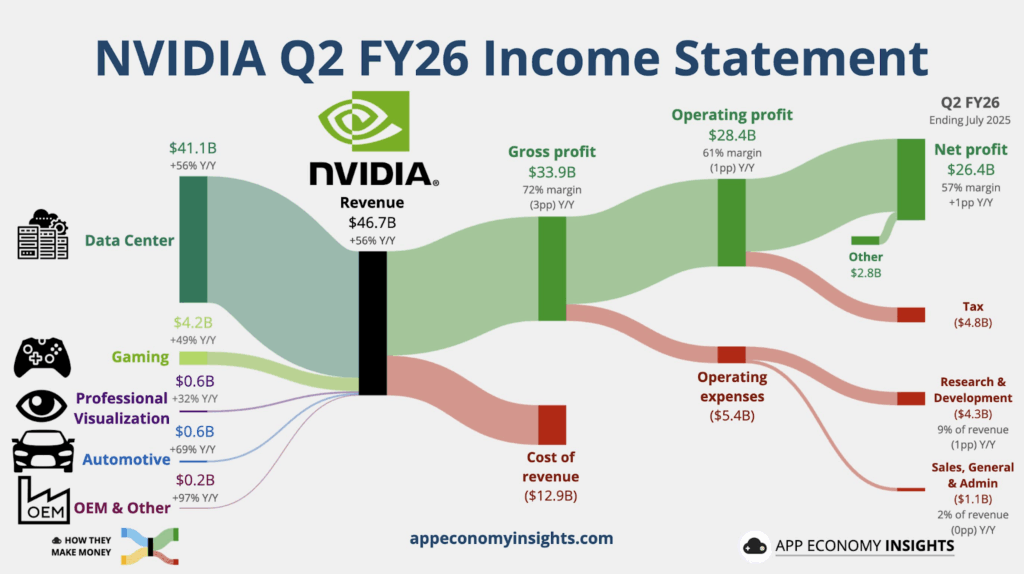

Nvidia turned in another huge quarter, proving the AI cycle is still delivering extraordinary revenue, margins, and cash. The company reported revenue of $46.67 billion, up 56% year over year, with a gross profit of $33.9 billion, an operating profit of $28.44 billion, and net income of $26.4 billion, implying roughly a 57% net margin and very strong operating leverage.

Despite a slightly jittery stock reaction tied to data centre revenue modestly undershooting aggressive expectations, the broader growth narrative remains intact.

Headline numbers and margin picture

- Revenue: $46.67 billion, +56% YoY; sequential growth remains healthy given the company’s scale.

- Profitability: $33.9 billion in gross profit and $28.44 billion in operating profit highlight exceptional pricing power and mix, unusual for a hardware-centric business at this scale.

- Net income: $26.4 billion implies Nvidia is keeping roughly 57% of revenue as profit this quarter, an extraordinary outcome even among megacaps.

Segment mix and the surprise

- Data centres are now the business: the AI compute segment dwarfs gaming, a sharp shift from earlier years when gaming dominated.

- Data centre nuance: reported around $41.1 billion versus an expected “$41.4”, implying a -0.5% decline from consensus, barely a miss, but enough to cool sentiment given the market’s expectation of continuous beat‑and‑raise.

- Gaming upside: gaming outperformed internal and Street expectations, with most of the upside due to Nintendo’s “Switch 2” demand for Nvidia’s graphics chip, even before a deep games slate takes hold.

Concentration risk in hyperscalers

Roughly 39% of revenue is tied to two “mystery” customers, with them most likely implying Meta and Microsoft, and adding Amazon, Google, and Tesla to push the revenue concentration to about 50%.

The implication is that any capex moderation by even one top platform could dent Nvidia’s growth cadence, raising the stakes on sustained hyperscaler AI infrastructure spending.

Nvidia’s capital returns and investment balance came into sharp focus with a newly authorised share repurchase of $60 billion, one of the largest on record, signalling management’s conviction in the durability of future cash generation even as valuations remain elevated and AI demand is running hot.

The timing shows confidence but also intensifies scrutiny of how much cash is being returned relative to reinvestment needs for equipment capacity and sustained R&D at the current breakneck pace, a tradeoff that is central for AI incumbents scaling infrastructure and innovation simultaneously.

China: constraints, smuggling routes, and political blowback

Historical China contribution to revenue is around 10–15%, but direct sales have been increasingly restricted by U.S. export controls on advanced accelerators. A sharp increase in shipments to Singapore (from near zero to ~18.1% share) is flagged as a proxy for trans‑shipment into China; efforts are underway to curb diversions using embedded trackers in AI chip logistics.

H20 “water chip”: Nvidia designed a reduced‑capability H20 for China after top‑end devices were banned, but controversial remarks by the U.S. commerce secretary (framing China’s allocation as “fourth‑best” and an “addiction to the stack”) triggered Chinese regulators to push firms away from H20, effectively shutting down that route.

Nvidia is reportedly halting H20 and exploring a new compliant product for China but faces four hurdles: designing a new chip, securing U.S. approval, securing China’s willingness to buy, and navigating a requested 15% payment tied to sales by Trump, for which no formal mechanism exists.

Domestic substitution in China

Cambricon’s market surge as Chinese AI firms, including DeepSeek, aim to optimise for domestic accelerators amid U.S. restrictions. Cambricon’s rally enough to temporarily make it the most valuable on the Shanghai market by price reflects investor conviction that constrained Nvidia supply could accelerate adoption of local silicon, even if performance parity remains a work in progress. Cambricon itself warned investors about potential overvaluation after a rapid run‑up, underlining froth risks around localised AI‑chip narratives.

What to watch next

The quarter’s numbers are outstanding by any historical benchmark: revenue growth near 60% at this size, net margins above 50%, and multi‑tens‑of‑billions in quarterly profit are rare. Comparison of figures in a stock screener stands as proof of this.

The small data centre shortfall versus lofty expectations, buyer concentration, and a more hostile China channel add realism to the forward risk set, but none of it erases Nvidia’s core advantage: a complete AI stack with unmatched performance, ecosystem pull, and operational execution. The growth story remains very much alive; the challenge from here is managing concentration and geopolitics without breaking the compounding engine.

Written By Fazal Ul Vahab C H

The post Why China Is a Growing Problem for Nvidia and What It Means for the Global markets appeared first on Trade Brains.