Vodafone Idea Ltd. shares hit the upper circuit on Tuesday after the government announced it would pick up more stake in the debt-laden telecom operator in lieu of spectrum auction dues. Indus Towers Ltd. shares also rose over 7% to hit an over one-month high.

Vodafone Idea has been directed to issue 3,695 crore equity shares of face value Rs 10 apiece at par within 30 days of regulatory approvals, according to an exchange filing on Sunday. The total amount to be converted into equity shares is Rs 36,950 crore.

VodaIdea’s capex continuity is expected to benefit Indus Towers in terms of growth and cash flow.

What Brokerages Have To Say

With the government picking more stake, Macquarie and Citi have presented contrasting views. While Macquarie maintains a ‘neutral’ stance with a target price of Rs 7, Citi retains a ‘buy’ rating (high risk) with a target price of Rs 12, highlighting potential short-term catalysts.

Macquarie views the development as a temporary relief, referring to it as a “bandage” rather than a permanent fix. Despite the reduction in net debt, the company’s gearing remains elevated at nearly 10 times net debt to trailing 12-month Ebitda, it said on Tuesday.

Macquarie also highlights Vodafone Idea’s inadequate free cash flow generation, which limits its ability to meet financial obligations organically. The firm reiterates concerns over additional equity dilution, which poses risks for minority shareholders.

Citi takes a more optimistic stance, adding Vodafone Idea to its 90-day Upside Catalyst Watch. It views the government’s decision as a significant step towards resolving Vodafone Idea’s financial woes. The conversion of Rs 36,950 crore of spectrum dues into equity at Rs 10 per share (a premium to the last closing price of Rs 6.8) increases the government’s stake from 22.6% to 49%.

Citi believes this move provides immediate cash flow relief and enhances the company’s ability to secure long-pending bank debt. The ongoing rollout of 5G services is expected to further boost sentiment and arrest subscriber losses, the brokerage said on Monday.

Citi in a note on Indus Towers said it expects the company to deliver a core Ebitda CAGR of 10%, underpinned by a tenancy CAGR of 8%. Additionally, it said the stock’s implied dividend yield of 5-7% presents a compelling investment opportunity.

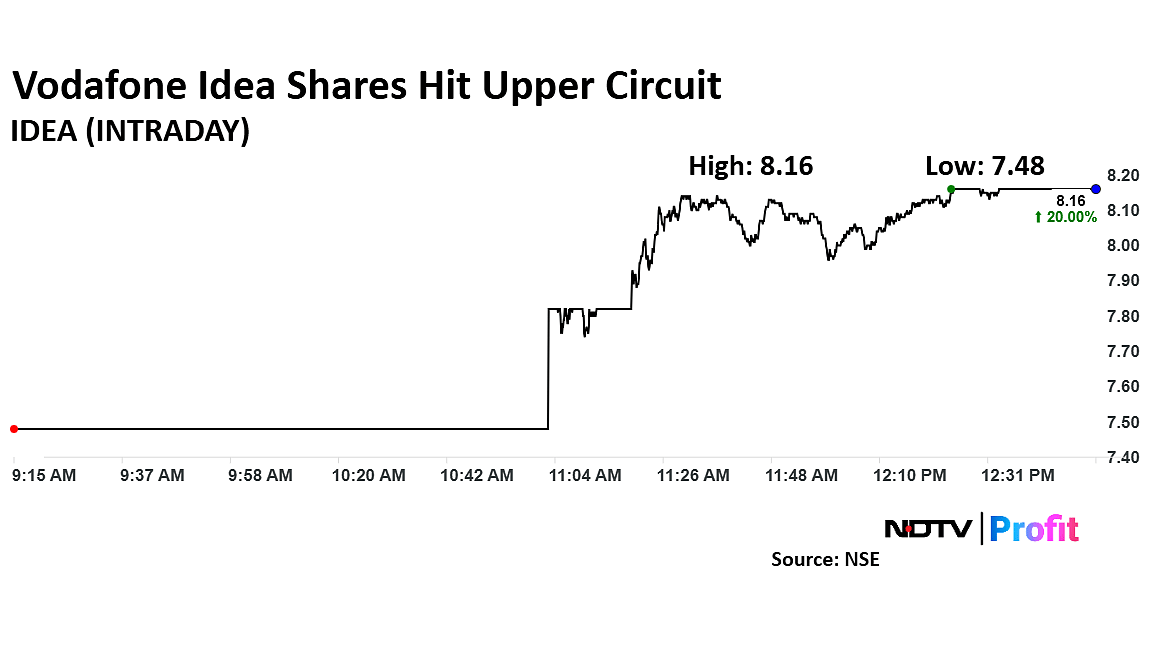

Vodafone Idea Share Price Rise

Shares of Vodafone Idea surged 20% to Rs 8.16 apiece to hit upper circuit. This is the highest level since Feb. 21. The upper circuit was revised to 20% from the earlier 10% on Tuesday, with the stocks hitting over one-month high.

The stock has fallen 41.71% in the last 12 months and 1.71% year-to-date. Relative strength index was at 50.

Out of 21 analysts tracking the company, five maintain a ‘buy’ rating, five recommend a ‘hold’ and 11 suggest ‘sell’, according to Bloomberg data. The average 12-month analysts’ consensus price target implies an upside of 2.8%.

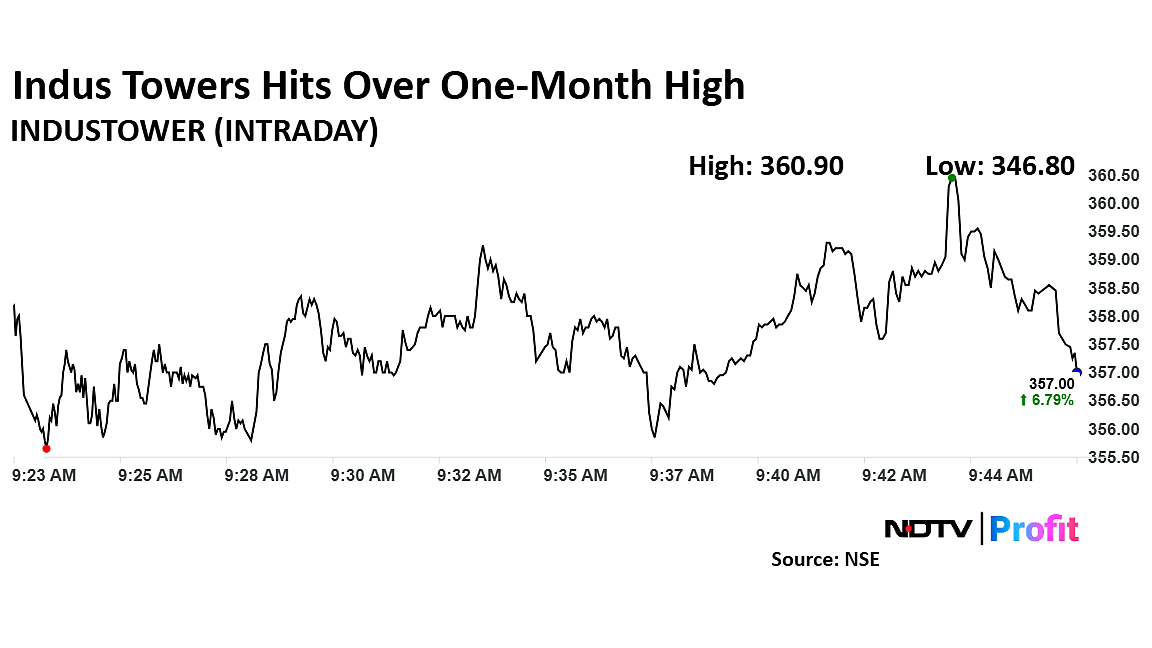

Indus Tower Share Price Rise

The scrip rose as much as 7.60% to Rs 359.70 apiece, the highest level since Feb. 10. It pared gains to trade 7.33% higher at Rs 358.80 apiece, as of 9:46 a.m. This compares to a 0.06% advance in the NSE Nifty 50.

It has risen 13.83% in the last 12 months and 4.27% year-to-date. Total traded volume so far in the day stood at 10 times its 30-day average. Relative strength index was at 62.

Out of 24 analysts tracking the company, 13 maintain a ‘buy’ rating, six recommend a ‘hold’ and five suggest ‘sell’, according to Bloomberg data. The average 12-month consensus price target implies an upside of 16.5%.

. Read more on Markets by NDTV Profit.