Wall Street is ending the week on a positive note, with stocks rising as traders parsed corporate results. Equities also gained after Bloomberg News reported that Washington and Moscow are aiming to reach a deal to halt the war in Ukraine. Oil whipsawed.

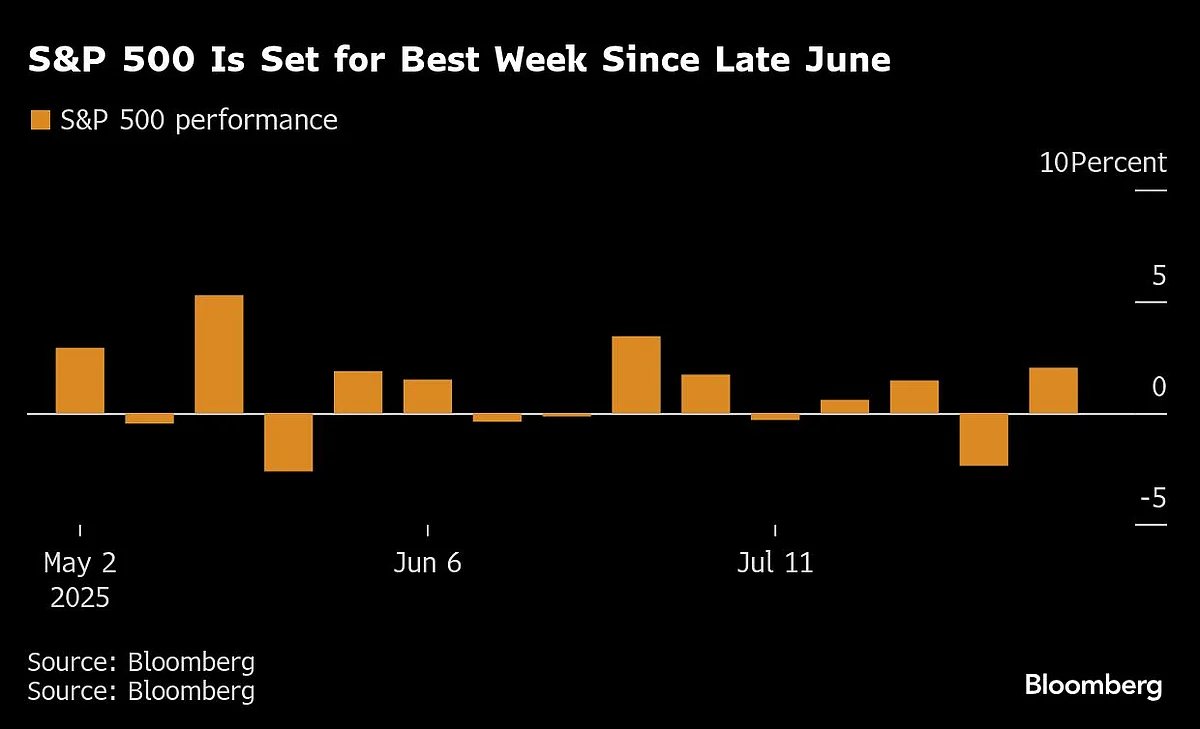

The S&P 500 headed toward its best week since June. A gauge of the “Magnificent Seven” megacaps was set for a record. Fannie Mae and Freddie Mac jumped as the Wall Street Journal reported the US is preparing to sell their shares in an offering that could start as early as this year.

S&P 500 sees weekly gain.

The yield on 10-year Treasuries rose three basis points to 4.28%. The dollar barely budged. Oil resumed gains after a brief slide. A US move to put tariffs on imports of gold bars unleashed turmoil in the bullion market. Gold futures in New York hit a record high before unwinding the move.

Bret Kenwell at eToro noted momentum has been strong in equities, and more than 80% of S&P 500 firms have beaten earnings expectations this quarter. The technicals and the fundamentals have been working in bulls’ favor, he said.

“While an unexpected risk could develop in the second half of 2025, earnings have been better-than-expected and the Fed is inching closer to lower interest rates,” Kenwell noted. “As long as the economy holds up, there are catalysts in play for stocks to continue higher.”

President Donald Trump said tariffs are “having a huge positive impact on the stock market.”

“Almost every day, new records are set,” he said. Hundreds of billions of dollars are “pouring into our country’s coffers.

“Markets rebounded strongly this week with a clear ‘buy on the dip’ mentality,” said Florian Ielpo at Lombard Odier Investment Managers. “While market sentiment appeared to be waning last week, with subdued reactions to earnings beats, this week clearly demonstrated a different trend.”

And that begs the question: are we close to a solid ceiling?

“Our risk appetite indicator shows improvement from last week but clearly has room to grow,” Ielpo said.

At Piper Sandler, Craig Johnson says that while historically, the summer doldrums often lead to modest pullbacks in August and September, investors who have doubted this rally are now forced to “buy the dips…and not sell the rips” to play catch-up.

Despite the solid rebound in the S&P 500, nearly $28 billion was redeemed from US stocks in the week through Aug. 6, while money market funds attracted about $107 billion, according to a Bank of America Corp. note from citing EPFR Global data.

On the macro front, BofA’s Michael Hartnett said a majority of the bank’s clients are betting on a “Goldilocks” outcome, which implies an economy that’s running neither too hot nor too cold. He said investors expect a scenario where lower rates would fuel a rally in equities.

Kenwell at eToro says that it would be a healthy price action for stocks to consolidate after a big rally — either by pulling back or digesting the move by trading sideways.

“This pullback would likely be viewed as an opportunity for investors to buy the dip rather than run for the hills,” Kenwell said.

“We believe stocks will stay supported amid solid fundamentals, but fresh headlines in the coming week may challenge investor sentiment that remains vulnerable to tariff, economic, and geopolitical risks,” said Ulrike Hoffmann-Burchardi at UBS Global Wealth Management.

Federal Reserve Bank of St. Louis President Alberto Musalem said he supported last week’s decision by policymakers to leave interest rates steady, adding the US central bank is still missing more on the inflation side of its mandate.

Money markets have boosted bets on rate cuts after last week’s weak jobs numbers report. Swaps currently assign a 95% chance of a Fed reduction in September and price at least one more

Traders will soon be looking ahead to next week’s release of US inflation numbers.

“We expect the July CPI report to show that core inflation gained additional momentum,” according to strategists at TD Securities. “We look for goods prices to gather further steam, as tariff passthrough continues to materialize.”

Corporate Highlights:

-

Meta Platforms Inc. has selected Pacific Investment Management Co. and Blue Owl Capital Inc. to lead a $29 billion financing for its data center expansion in rural Louisiana as the race for artificial intelligence infrastructure heats up, according to people with knowledge of the matter.

-

Tesla Inc. is disbanding its Dojo team and its leader will leave the company, according to people familiar with the matter, upending the automaker’s effort to build an in-house supercomputer for developing driverless-vehicle technology.

-

Intel Corp. Chief Executive Officer Lip-Bu Tan said he’s got the full backing of the company’s board, responding for the first time to US President Donald Trump’s call for his resignation over conflicts of interest.

-

SoftBank Group Corp. is the buyer taking ownership of Foxconn Technology Group’s electric vehicle plant in Ohio, a move aimed at kick-starting the Japanese company’s $500 billion Stargate data center project with OpenAI and Oracle Corp.

-

Taiwan Semiconductor Manufacturing Co. reported a 26% growth spurt in July, adding to evidence of accelerating spending on artificial intelligence.

-

Expedia Group Inc. raised its full-year sales target after reporting strong second-quarter bookings, fueled mainly by its enterprise business as well as improved demand from US consumers.

-

Pinterest Inc. reported second-quarter sales that beat analysts’ expectations, but earnings for the second quarter were less than Wall Street expected and user growth in the US and Canada, the company’s most lucrative market, was flat.

-

Under Armour Inc. forecast worse-than-expected sales and profit for the current quarter, stalling a turnaround plan that was taking hold.

-

Wendy’s Co. cut its full-year sales guidance after posting a bigger-than-expected quarterly decline, highlighting the economic pressures weighing on the chain’s US business.

-

Instacart posted its strongest order growth since 2022 for a second straight quarter and beat earnings estimates for the current period, a sign of resilience in its core delivery business after it rolled out initiatives to cater to price-conscious consumers.

-

Sweetgreen Inc. slashed its sales guidance after a second straight quarter of disappointing results, highlighting the salad chain’s struggles to sell $15 salads to budget-strained diners.

-

Gilead Sciences Inc. lifted its full-year outlook after strong HIV drug sales in the second quarter helped revenue and earnings modestly beat analyst expectations.

-

Trade Desk Inc. reported second-quarter results that spurred multiple downgrades. Firms note growing concerns about competition from Amazon.com Inc.

What Bloomberg Strategists say…

“An improving geopolitical backdrop has become a headwind for oil prices, especially as peace in Ukraine looks closer. Traders will now increasingly look past geopolitical hurdles, leaving the market uncomfortably exposed to uncertain demand and rising supply.”

—Michael Ball, Macro Strategist, Markets Live

Some of the main moves in markets:

Stocks

-

The S&P 500 rose 0.7% as of 12 p.m. New York time

-

The Nasdaq 100 rose 0.8%

-

The Dow Jones Industrial Average rose 0.4%

-

The Stoxx Europe 600 rose 0.2%

-

The MSCI World Index rose 0.6%

-

Bloomberg Magnificent 7 Total Return Index rose 1.3%

-

The Russell 2000 Index rose 0.2%

Currencies

-

The Bloomberg Dollar Spot Index was little changed

-

The euro was little changed at $1.1660

-

The British pound was little changed at $1.3443

-

The Japanese yen fell 0.4% to 147.70 per dollar

Cryptocurrencies

-

Bitcoin fell 0.9% to $116,216.73

-

Ether rose 2.1% to $3,956.44

Bonds

-

The yield on 10-year Treasuries advanced three basis points to 4.28%

-

Germany’s 10-year yield advanced six basis points to 2.69%

-

Britain’s 10-year yield advanced five basis points to 4.60%

-

The yield on 2-year Treasuries advanced three basis points to 3.76%

-

The yield on 30-year Treasuries advanced three basis points to 4.86%

Commodities

-

West Texas Intermediate crude rose 0.6% to $64.25 a barrel

-

Spot gold was little changed

. Read more on Markets by NDTV Profit.