The first five months of Donald Trump‘s presidency have coincided with one of the steepest collapses in the U.S. dollar in over three decades, as economic contraction, surging deficits and political friction with the Federal Reserve hammered investor confidence in the greenback.

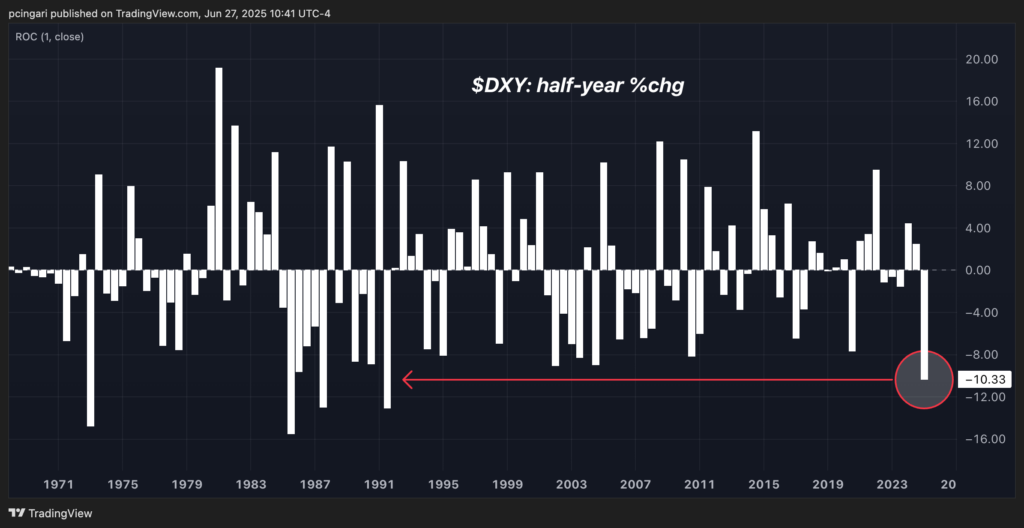

The Dollar’s Biggest Slump Since 1991

The U.S. Dollar Index, a benchmark that measures the greenback’s strength against a basket of major currencies, has dropped over 10% year-to-date, marking its worst half-year performance since the second half of 1991.

After staging a powerful rally between late 2024 and January 2025 — gaining in 13 of 14 weeks on optimism over Trump’s return and expected tax and tariff policies — the dollar turned sharply lower after Inauguration Day on Jan. 20.

What Triggered The Dollar Collapse?

Initial market expectations had priced in a stronger dollar under Trump, given his promises of tax cuts and protectionist trade policies. Yet, these measures backfired.

The tide began turning in March, when the euro surged after Germany’s coalition government launched a major fiscal expansion, abandoning the country’s long-held debt brake. Berlin approved a defense spending boost, while the European Union announced an €800 billion “ReArm Europe” program, sending capital flows into the eurozone.

April delivered a double blow …