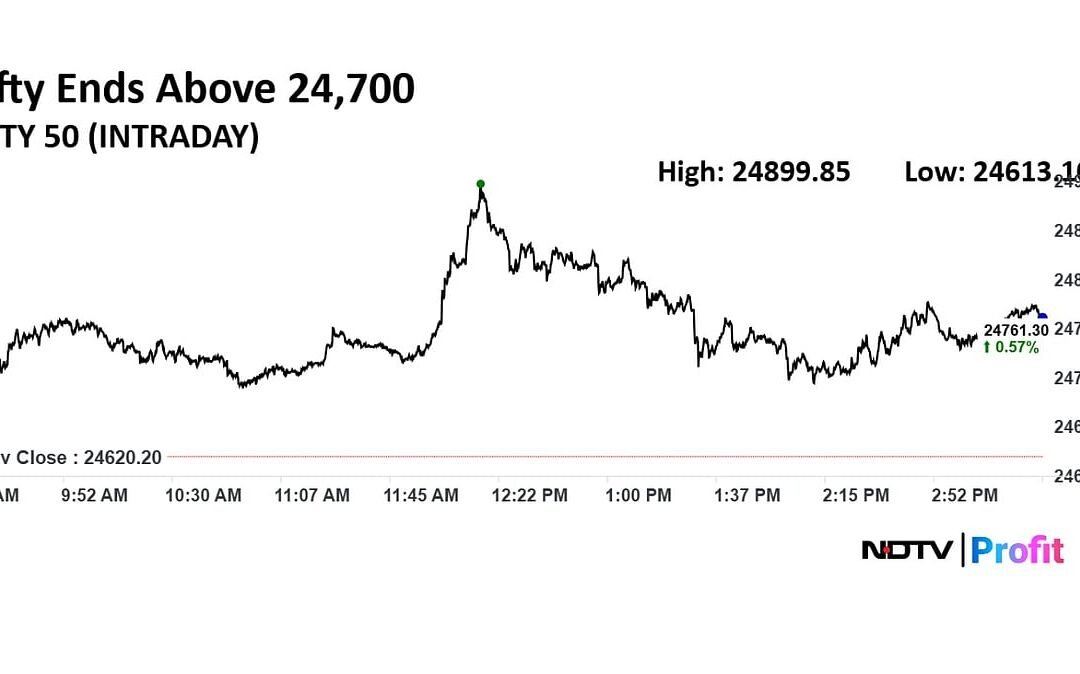

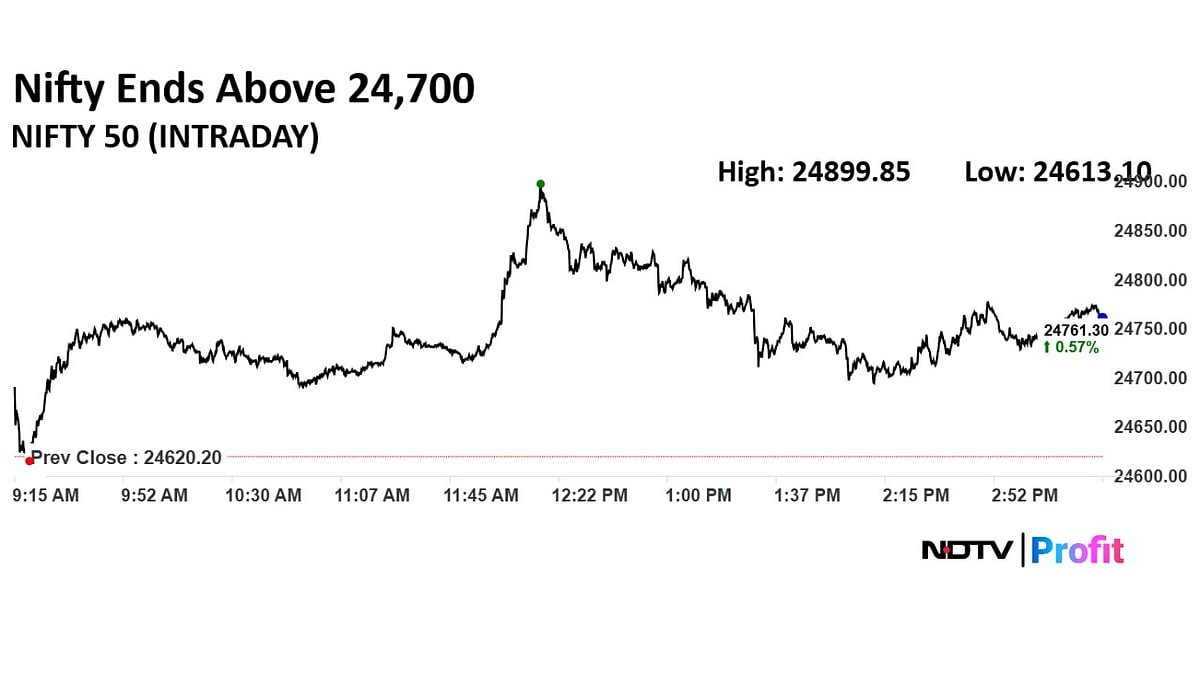

The NSE Nifty 50 ended on a strong note last week, forming a bullish engulfing candle on the weekly chart as buying demand surged from the lower band of the three-week consolidation range of 24,400–25,100.

The index settled near the upper band of this range on Friday, bolstered by the Reserve Bank of India’s surprise 50-basis-point rate cut and a 100-basis-point cut in the cash reserve ratio.

Bajaj Broking Research expects the index to challenge the upper band of 25,100 and head higher towards 25,250 and then 25,500 in the coming weeks. It said dips in the current week should be seen as buying opportunities, with short-term supports at 24,700 and 24,400 — key levels shaped by the previous breakout zone and three-week lows.

Devarsh Vakil, head of prime research at HDFC Securities, highlighted that Nifty was on the brink of surpassing its recent swing high of 25,116. A sustained move above this level could propel it to 25,307, marking the 78.6% Fibonacci retracement of the entire downtrend from 26,277 to 21,743. However, on the downside, he sees 24,845 as an immediate support level.

Amol Athawale of Kotak Securities pegs 24,800–24,816 as the crucial trend-decider zone. If Nifty holds above this level, the bullish momentum is expected to persist, with 25,100–25,600 as the near-term upside targets. Should the index breach below 24,800, sentiment could swiftly sour, and a retreat to 24,500 or even 24,350 cannot be ruled out.

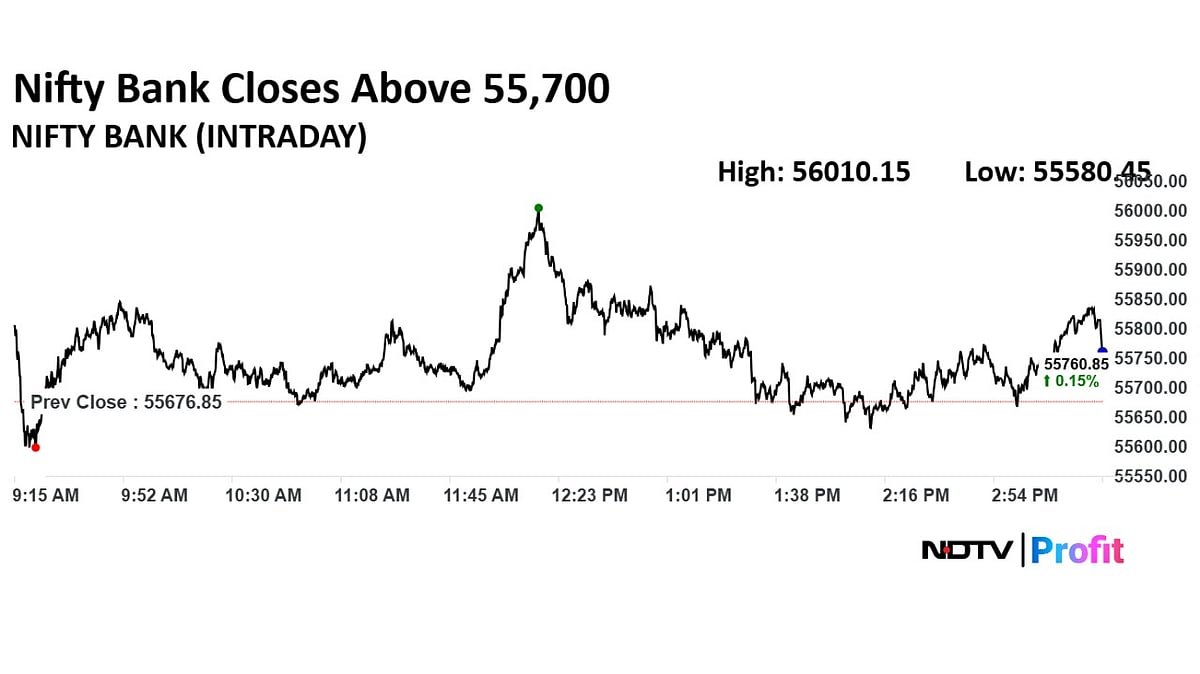

For the Bank Nifty, Kotak’s Athawale sees a potential for an extended uptrend as long as it holds above 55,500, with targets at 57,200–57,700. However, any slip below 55,500 would put the rally at risk.

Looking ahead, Monday’s action will hinge on the index’s ability to break decisively above 25,100 and sustain higher levels. If that happens, the door opens to 25,250–25,500 in the coming sessions. However, a failure to hold 24,800–24,816 could trigger a fresh round of selling, pulling the index back to test lower supports at 24,500 and 24,350.

With the RBI’s aggressive pro-growth policy stance already factored in by markets, traders will keep a sharp eye on these crucial support and resistance levels to gauge if the breakout is here to stay or if the Nifty is due for another round of back-and-forth action.

Market Recap

The benchmark equity indices closed higher for the third straight session on Friday, buoyed by the Reserve Bank of India Monetary Policy Committee’s move to slash the key lending rate by 50 basis points to 5.5%.

The NSE Nifty 50 gained 252.15 points or 1.02% to settle at 25,003.05, while the BSE Sensex closed 746.95 points or 0.92% higher at 82,188.99

Currency Update

The Indian rupee closed 16 paise stronger at 85.64 against the US dollar on Friday, compared with its previous close of 85.8 on Thursday.

. Read more on Markets by NDTV Profit.