The Nifty 50 ended last week with a sharp cut, sliding below the key 24,500 mark on Friday amid a fresh round of geopolitical jitters, before recovering to close near the day’s high at 24,718.60.

According to Rajesh Bhosale, equity technical analyst at Angel One, Nifty started the week strong but remained stuck below the 25,200 mark before slipping sharply on the weekly expiry and gapping down Friday. Despite the weak open, the index held its support zone and bounced back.

“Friday’s candle is an open-low Marubozu, which in isolation is bullish, but given the volatile backdrop, a cautious stance is warranted. The 24,400–24,450 band, aligning with the 50-day exponential moving average, remains the key support zone, while 24,825 and 25,000 are upside hurdles,” he said, adding that traders should avoid chasing momentum and look to buy on dips.

Bajaj Broking said the index formed a sizeable bearish candle on the weekly chart, signalling profit booking near the 78.6% retracement zone of 25,200.

“A breakdown below 24,400 could accelerate the correction. The broader consolidation range of 24,400–25,200 remains intact for now, with 25,000 acting as a key near-term barrier,” the brokerage said.

Nagaraj Shetti, senior technical research analyst at HDFC Securities, said the Nifty has entered a broader high-low range of 24,500–25,100 again.

“The short-term trend remains negative with a top reversal at 25,222. A sustained breach below 24,500 may lead to further selloff, while any bounce could take the index back to 25,100,” he said.

Market Recap

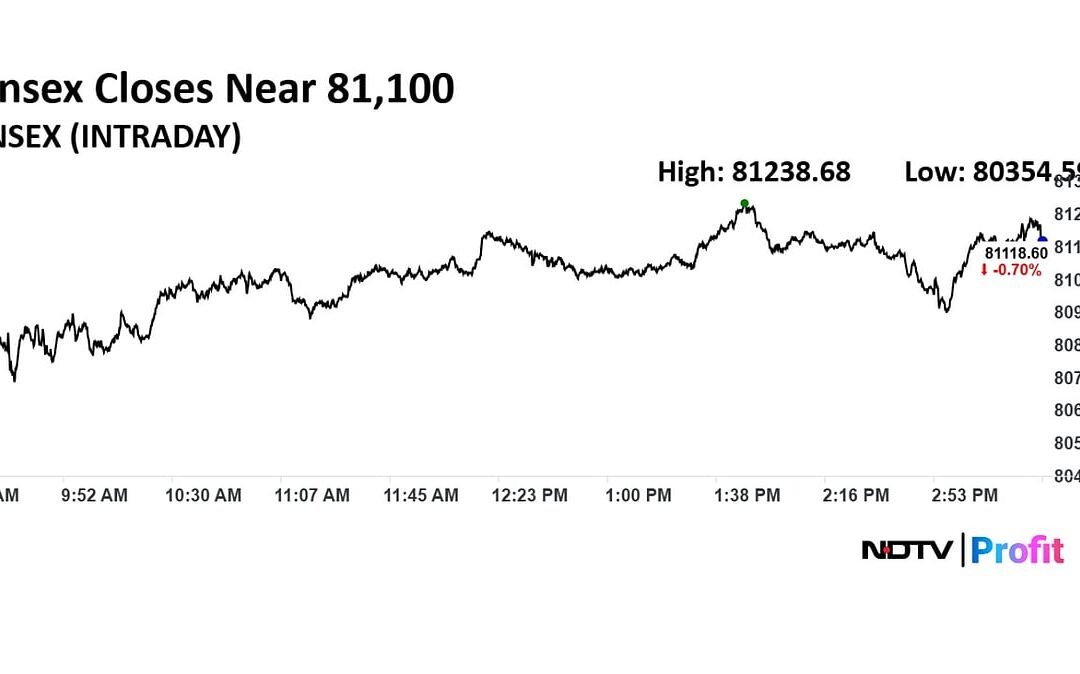

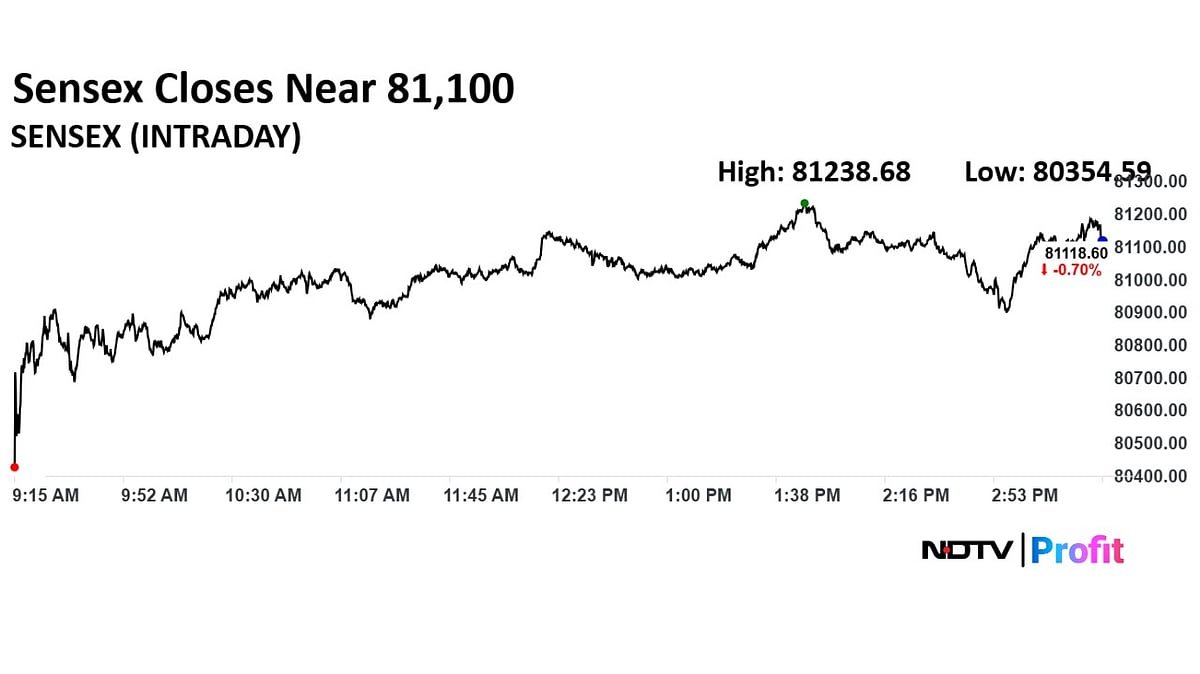

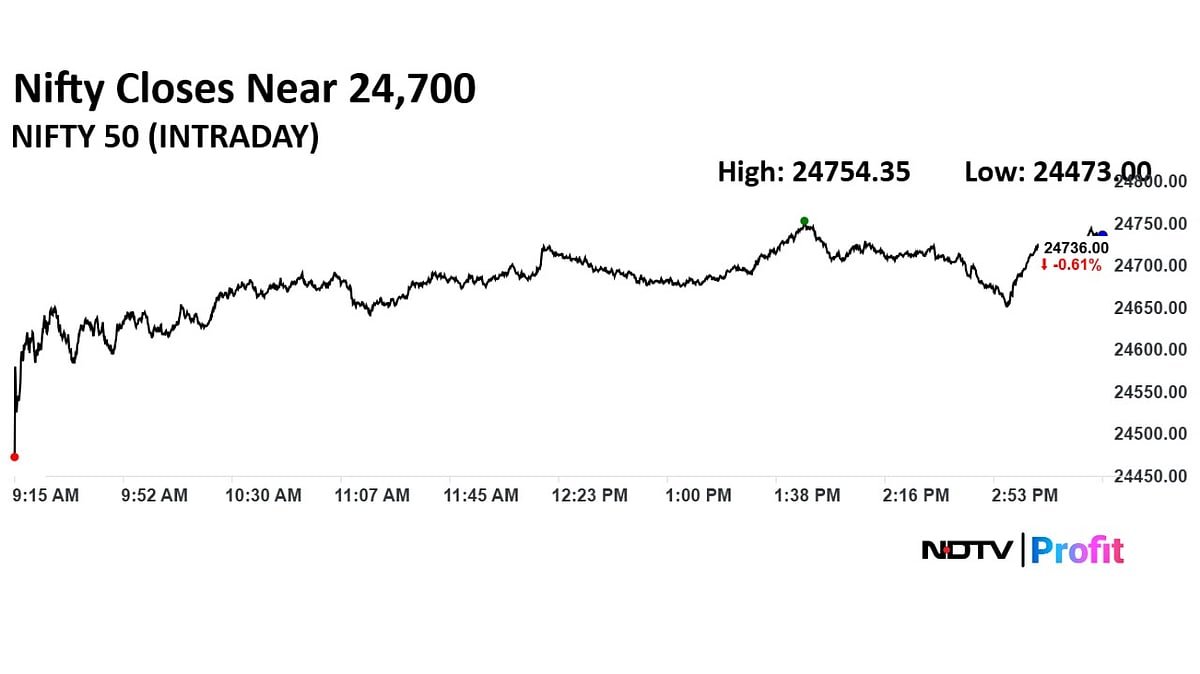

Benchmark indices ended lower for a second straight session on Friday, closing the week in the red amid heightened volatility.

The NSE Nifty 50 fell 169 points, or 0.68%, to end at 24,718.60, while the BSE Sensex dropped 573 points, or 0.70%, to settle at 81,118. During the session, Nifty slipped as much as 1.67% to 24,473, and Sensex fell 1.64% to hit an intraday low of 80,354.59.

For the week, both indices declined over 1%, with Nifty dropping nearly 500 points from its weekly high, snapping a two-day winning streak.

Currency Update

The Indian rupee closed 49 paise lower at 86.09 against the US dollar on Friday, compared to 85.60 in the previous session.

The currency opened 55 paise weaker at 86.15, marking its lowest level since April 11, amid pressure from global and domestic macroeconomic factors.

. Read more on Markets by NDTV Profit.