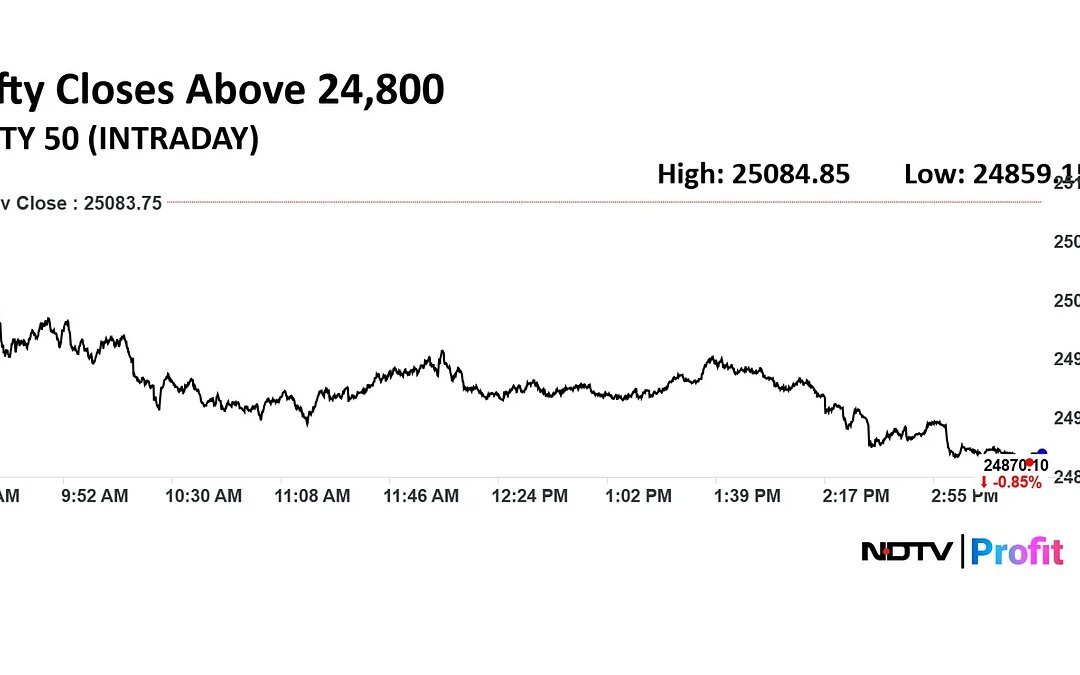

The NSE Nifty 50 still has a short-term positive outlook despite breaking a six-session winning streak in the last trading day, according to analysts.

“Support is seen at 24,800. Sustaining above this level should maintain the uptrend, with potential to move towards 25,000–25,250,” stated Bajaj Broking Research.

The Nifty formed a large bearish candle but continues to trade above key moving averages. Following a steady rally, the index paused on Friday, hinting at a brief consolidation before resuming its upward move, the brokerage added. “It remains well above the 50 EMA, reinforcing the short-term positive outlook.”

Rupak De, senior technical analyst at LKP Securities, also echoed this view reiterating key support levels at 24,800.

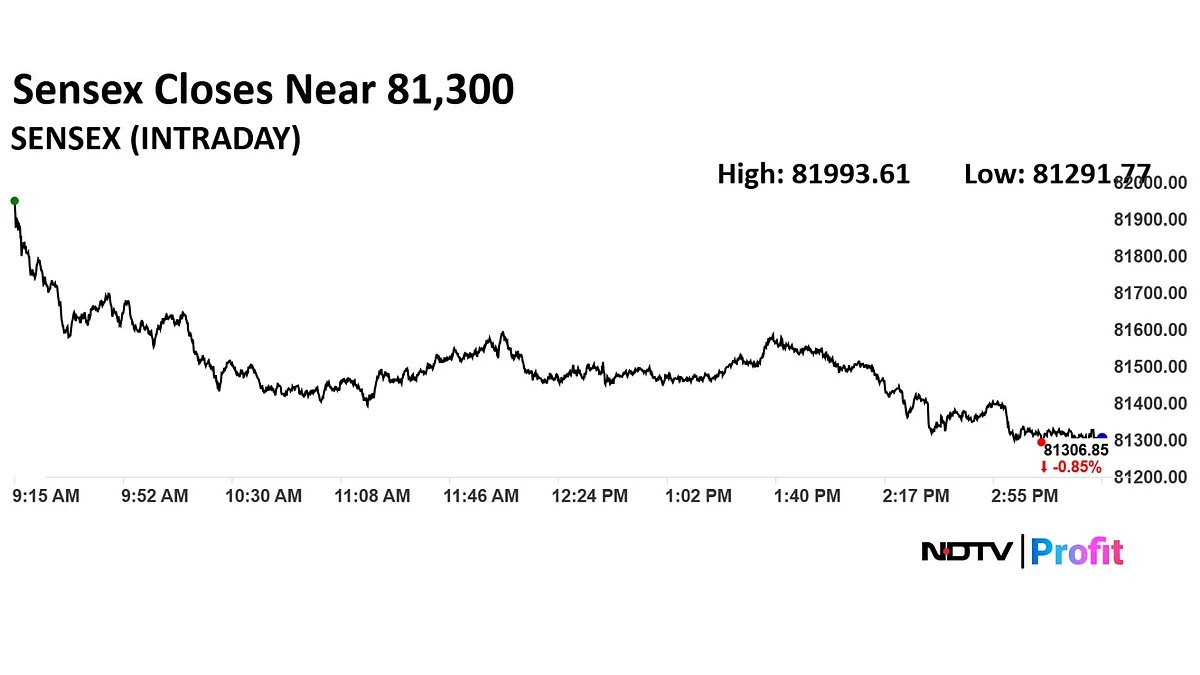

Whereas for Bank Nifty, the charts see short term weakness to persist.

The immediate bias remains corrective, with the index likely to drift toward the 55,000–54,900 zone, which coincides with a key consolidation and strong support area. A sustained move below this zone could open the gates for further downside toward 54,000 in the near term, according to Bajaj Broking.

The Bank Nifty must close above 55,715–55,720 levels to break out of the negative trend, it added.

Market Recap

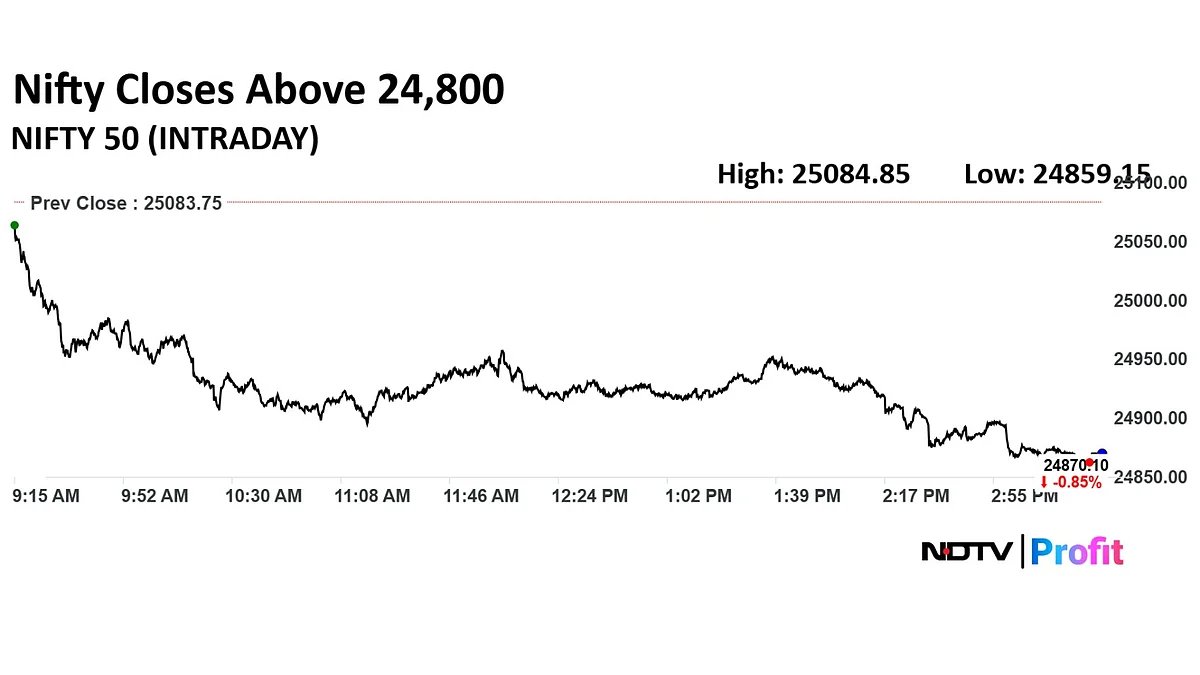

At close, the Sensex was down 693.86 points or 0.85% at 81,306.85, and the Nifty was down 213.65 points or 0.85% at 24,870.10.

Currency Update

The Indian rupee closed 27 paise weaker at 87.53 a dollar on Friday.

. Read more on Markets by NDTV Profit.