Shares of Suzlon Energy Ltd. declined on Tuesday after it notified exchanges about order cancellations of 300 MW.

The first cancellation was a 99 MW order from Vibrant Energy, that the company had notified the street about on May 17, 2023.

The second order that was cancelled was a 100 MW order that the company received from a leading global utility firm on Dec. 15, 2023. Both the orders were cancelled as the companies decided not to proceed with the respective projects as a whole, Suzlon said.

Additionally, an order size of 201.6 MW, received on Aug. 25, 2023, has also been reduced by half, meaning the company will only be supplying turbines for a 100.80 MW project. The original order was from O2 Power Pvt., specifically through their subsidiary Teq Green Power XI Pvt. Moreover, Suzlon Energy will now execute the order in the name of Solalite Power Pvt., instead of Teq Green Power XI.

As of January 2025, Suzlon Energy’s pending orders totalled 5,523 MW. As per the company’s latest exchange filing, the company’s order book now stands at 5,622 MW. This includes the new orders won by the company since January, as well as the cancellations and order size reduction.

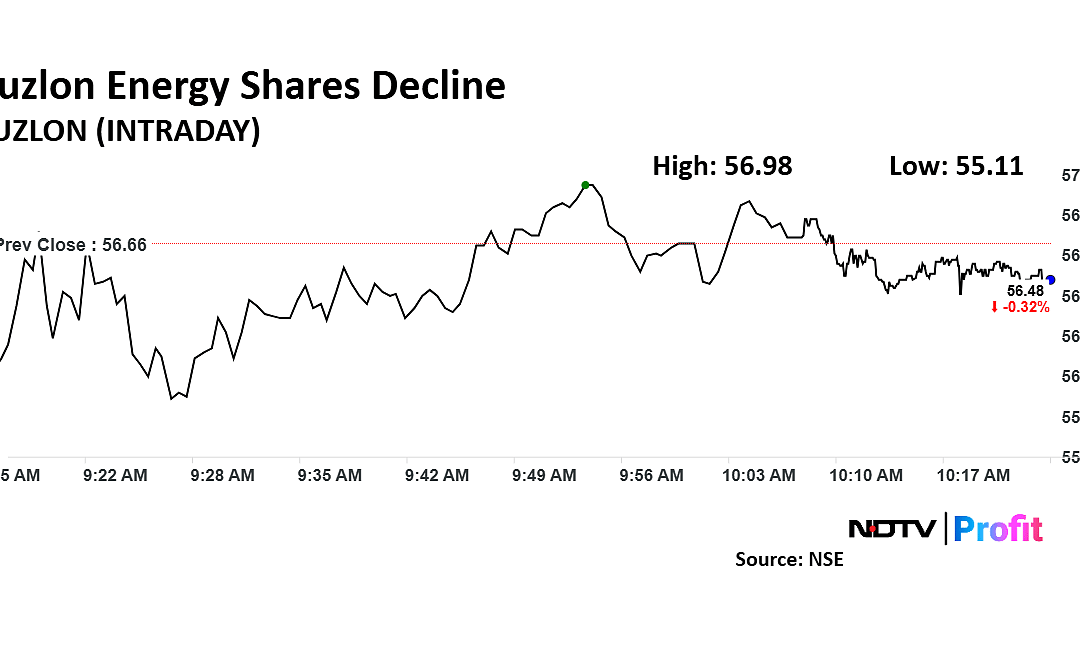

Suzlon Energy Share Price Decline

Shares of Suzlon Energy fell as much as 2.74% to Rs 55.11 apiece, the lowest level since March 18. It pared losses to trade 2.05% lower at Rs 55.50 apiece, as of 10:22 a.m. This compares to a 0.26% decline in the NSE Nifty 50. The shares extended their decline on Tuesday for the fifth consecutive session.

It has risen 36.69% in the last 12 months and fallen 13.52% year-to-date. The relative strength index was at 55.

Out of eight analysts tracking the company, seven maintain a ‘buy’ rating and one recommends a ‘hold’, according to Bloomberg data. The average 12-month analysts’ consensus price target implies a downside of 22.2%.

. Read more on Markets by NDTV Profit.