Suzlon Energy Ltd.’s shares slid nearly 4% during trade so far despite the company posting a notable uptick in both profit and revenue.

The consolidated profit went up 7% in the first quarter of the current financial year. The renewable energy firm posted a net profit of Rs 324.32 crore for the June quarter as compared to Rs 302.29 crore in the year-ago period.

Brokerages like Investec and UBS also remained bullish on the counter maintaining their ‘Buy’ calls. Citing strong execution, healthy growth in order book figures, they noted that Suzlon is well-positioned to meet its financial year 2026 guidance, backed by stronger positioning and a supportive growth cycle.

They also cited rising protectionism, sector consolidation, and a resilient wind energy profile continue to benefit Suzlon across its key segments.

However, the earnings were slightly below Nuvama’s expectations. The brokerage revised its target price to Rs 67 from Rs 68.

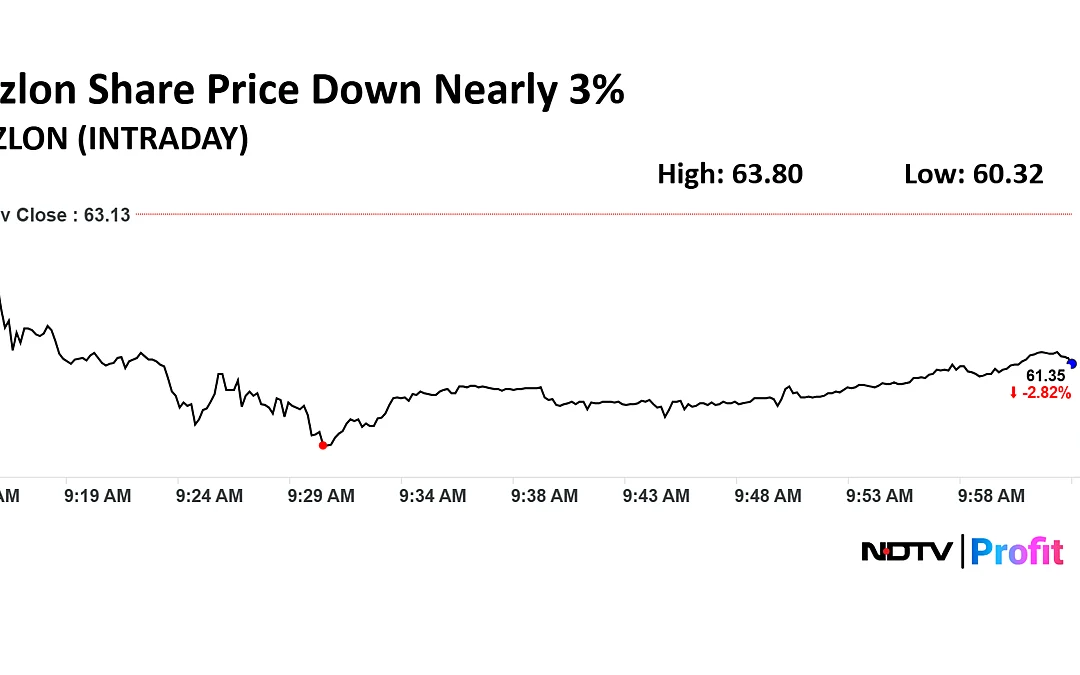

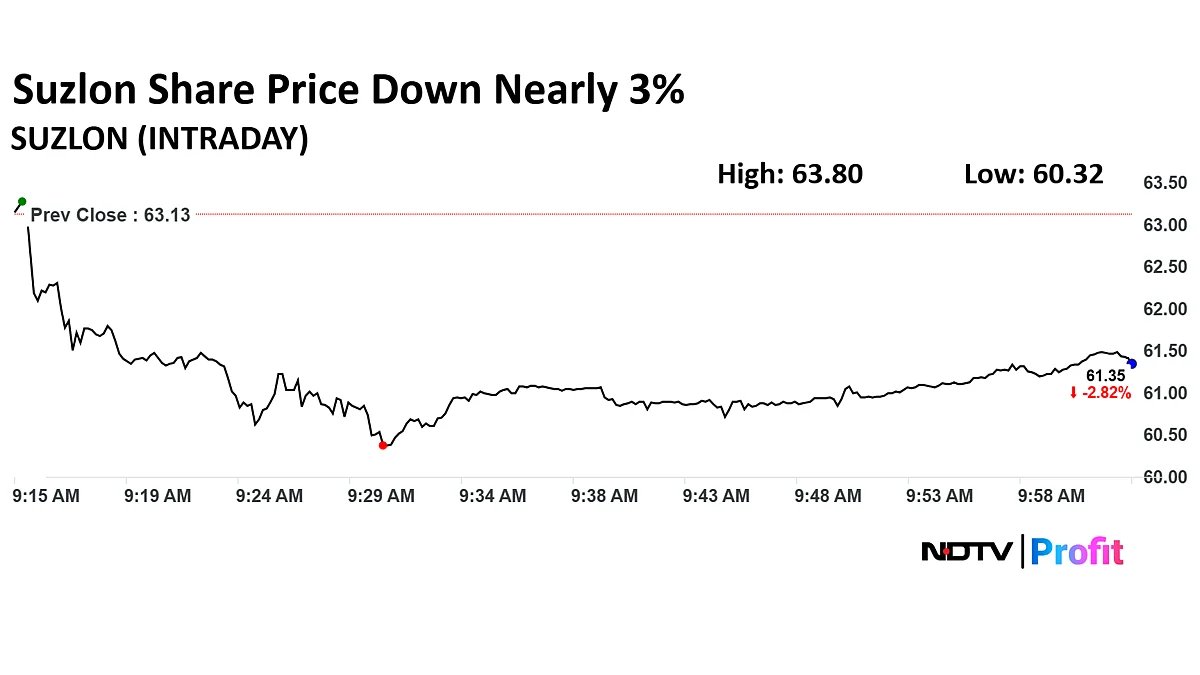

Suzlon Energy Share Price

Suzlon Energy stock fell as much as 4.45% during the day to Rs 60.3 apiece on the NSE. It was trading 3.53% lower at Rs 60.9 apiece, compared to a 0.42% advance in the benchmark Nifty 50 as of 10:12 a.m.

It had declined 24.25% in the last 12 months and 1.64% on a year-to-date basis. The total traded volume so far in the day stood at 5 times its 30-day average. The relative strength index was at 55.2.

Eight out of the nine analysts tracking the company have a ‘buy’ rating on the stock and one recommends a ‘hold’, according to Bloomberg data. The 12-month analysts’ consensus target price on the stock is Rs 76.4, implying an upside of 25%.

. Read more on Markets by NDTV Profit.