Synopsis:

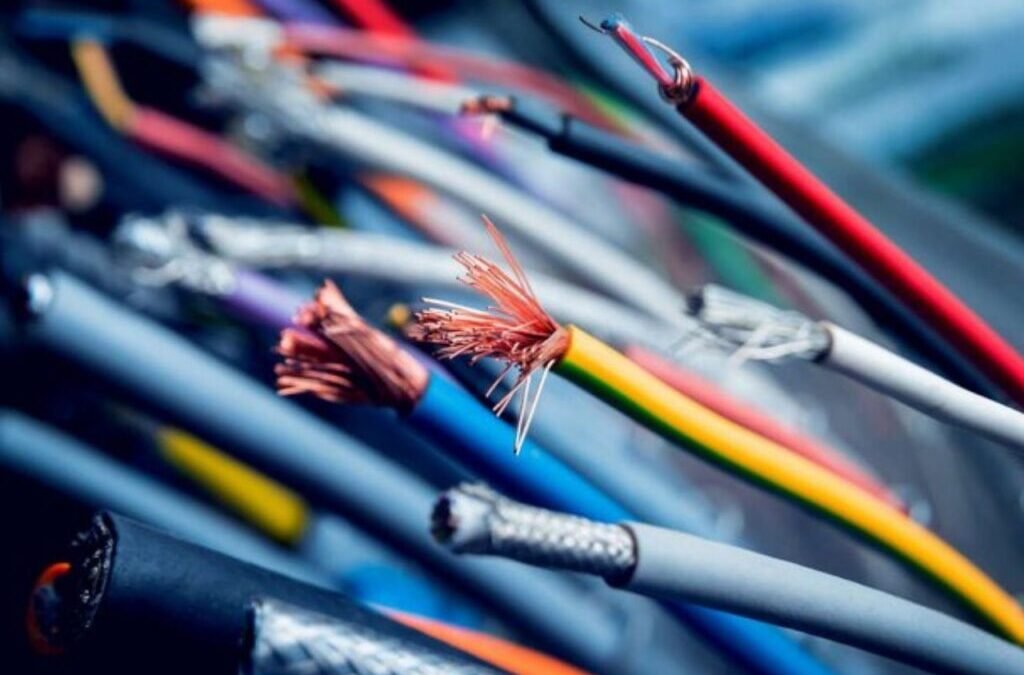

Bhadora Industries jumped sharply after grabbing two major low-voltage cable deals worth Rs 115.85 crore from a prestigious infrastructure company in Tamil Nadu. The agreements entail the supply of both armored and unarmored copper and aluminum cables.

The shares one of the leading industrial cable manufacturers for electricity transmission and distribution are in focus after securing a significant order value, which is almost 64 percent of its market capitalization. In this article, we will dive more into the details.

With a market capitalization of Rs 181 crore, the shares of Bhadora Industries Ltd reached a day high of Rs 105.30 per share, up by 16 percent from its previous day closing price of Rs 90.50 per share. Post its debut on the stock exchange in August 2025, the stock has corrected by over 10 percent.

About the order

Bhadora Industries, through a stock exchange filing, announced that it has secured two new orders from a reputed construction and infrastructure company based in Tamil Nadu.

These orders are part of the company’s regular business operations and involve the supply of various types of low-voltage (LV) cables, including both armored and unarmoured types made from copper and aluminum conductors. The contracts specify different cable sizes and technical specifications to meet the customer’s project requirements.

The total value of the two orders stands at around Rs 115.85 crore, which involves Rs 13.26 crore for the first order and Rs 102.58 crore for the second. The delivery for both orders is scheduled between October 2025 and December 2026.

These fresh contracts highlight Bhadora Industries’ growing presence in the electrical cable segment and strengthen its business relationship with reputed infrastructure players in the country.

Also Read: Realty stock in focus after promoter plans to sell 3.63% stake worth ₹251 Cr via OFS

Financial Highlights

The company reported a revenue growth of 36 percent to Rs 110 crore in FY25 as compared to Rs 81 crore in FY24. Regarding its profitability, the company reported a net profit growth of 120 percent to Rs 11 crore in FY25 as compared to Rs 5 crore in FY24.

The stock has delivered a robust ROE and ROCE of 69.41 percent and ROCE of 57.48 percent respectively, and is currently trading at a low P/E of 16.74x as compared to its industry P/E of 23x.

Bhadora Industries, established in 1986, manufactures industrial cables under the brand “Vidhut Cables,” such as PVC, low-voltage, and XLPE cables that are utilized for efficient power transmission. The firm is quality and safety certified and markets its products throughout India to government electricity boards, contractors, and industries.

Written by Satyajeet Mukherjee

Disclaimer

The views and investment tips expressed by investment experts/broking houses/rating agencies on tradebrains.in are their own, and not that of the website or its management. Investing in equities poses a risk of financial losses. Investors must therefore exercise due caution while investing or trading in stocks. Trade Brains Technologies Private Limited or the author are not liable for any losses caused as a result of the decision based on this article. Please consult your investment advisor before investing.

The post Stock under ₹100 skyrockets 16% after receiving ₹115 Cr order to supply low-voltage cables appeared first on Trade Brains.