U.S. stock futures rose on Thursday following Wednesday’s decline. Futures of major benchmark indices were higher.

The Nasdaq Composite fell 1% on Wednesday as reports of a 25% tariff on select semiconductor imports overshadowed U.S. approval for exports to China. Meanwhile, tariff uncertainty persists as the Supreme Court again delayed its ruling on the framework’s legality.

Meanwhile, the 10-year Treasury bond yielded 4.15%, and the two-year bond was at 3.52%. The CME Group’s FedWatch tool‘s projections show markets pricing a 95% likelihood of the Federal Reserve leaving the current interest rates unchanged in January.

| Index | Performance (+/-) |

| Dow Jones | 0.11% |

| S&P 500 | 0.36% |

| Nasdaq 100 | 0.75% |

| Russell 2000 | 0.16% |

The SPDR S&P 500 ETF Trust (NYSE:SPY) and Invesco QQQ Trust ETF (NASDAQ:QQQ), which track the S&P 500 index and Nasdaq 100 index, respectively, were higher in premarket on Wednesday. The SPY was up 0.34% at $692.68, while the QQQ advanced 0.71% to $623.95.

Stocks In Focus

Goldman Sachs Group

- Goldman Sachs Group Inc. (NYSE:GS) was 0.44% lower in premarket on Thursday as analysts expect it to report quarterly earnings before the opening bell. Wall Street expects earnings of $11.65 per share on revenue of $13.79 billion.

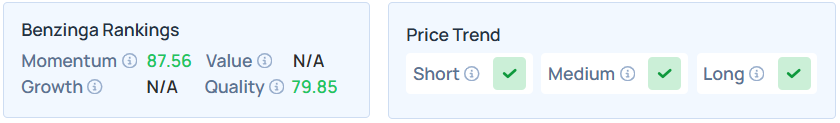

- Benzinga’s Edge Stock Rankings show that GS maintains a stronger price trend over the short, medium, and long term, with a solid quality ranking.