U.S. stock futures rose on Wednesday following Tuesday’s declines. Futures of major benchmark indices were higher.

Shares of Oracle Corp. (NASDAQ:ORCL) fell 2.5% on Tuesday, dragging other tech stocks after the company said that it faced financial struggles related to renting out Nvidia Corp. (NASDAQ:NVDA) chips.

Meanwhile, following his meeting with Prime Minister Mark Carney, President Donald Trump hinted at potential progress in trade negotiations with Canada but gave no concrete assurances as tariffs continue to strain the neighboring economy.

The 10-year Treasury bond yielded 4.11% and the two-year bond was at 3.56%. The CME Group’s FedWatch tool‘s projections show markets pricing a 95.1% likelihood of the Federal Reserve cutting the current interest rates in its October meeting.

| Futures | Change (+/-) |

| Dow Jones | 0.18% |

| S&P 500 | 0.16% |

| Nasdaq 100 | 0.21% |

| Russell 2000 | 0.37% |

The SPDR S&P 500 ETF Trust (NYSE:SPY) and Invesco QQQ Trust ETF (NASDAQ:QQQ), which track the S&P 500 index and Nasdaq 100 index, respectively, rose in premarket on Wednesday. The SPY was up 0.14% at $670.09, while the QQQ advanced 0.19% to $670.09, according to Benzinga Pro data.

Stocks In Focus

Trilogy Metals

- Trilogy Metals Inc. (NYSE:TMQ) jumped 8% in premarket on Wednesday, continuing its move fueled by the Trump administration’s investments in the metals sector, sparking interest in rare earths and battery metals.

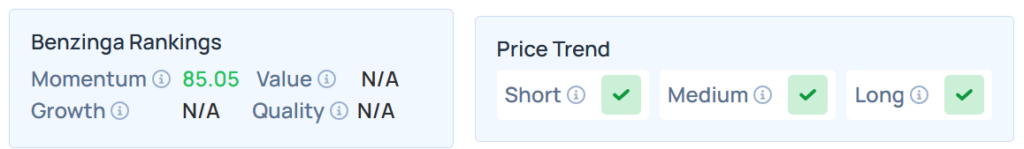

- TMQ maintained a stronger price trend over the short, medium, and long terms, as per Benzinga’s Edge Stock Rankings. Additional performance details are available here.

Nuburu

- Nuburu Inc. (NYSE:BURU) surged 34.84% after the announcement of its defense subsidiary’s acquisition of Orbit S.r.l., an Italian software firm. This strategic move marks Nuburu’s expansion into defense software, enhancing its mission assurance capabilities.

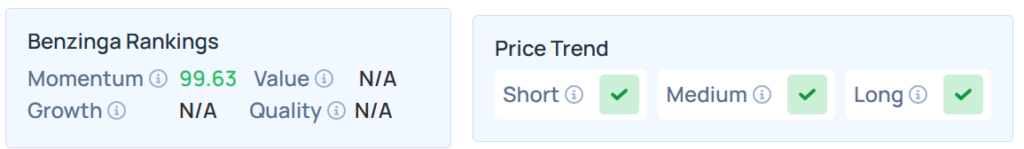

- Benzinga’s Edge Stock Rankings indicate that BURU maintains a stronger price trend in the short, medium, and long terms. Additional performance details are available here.