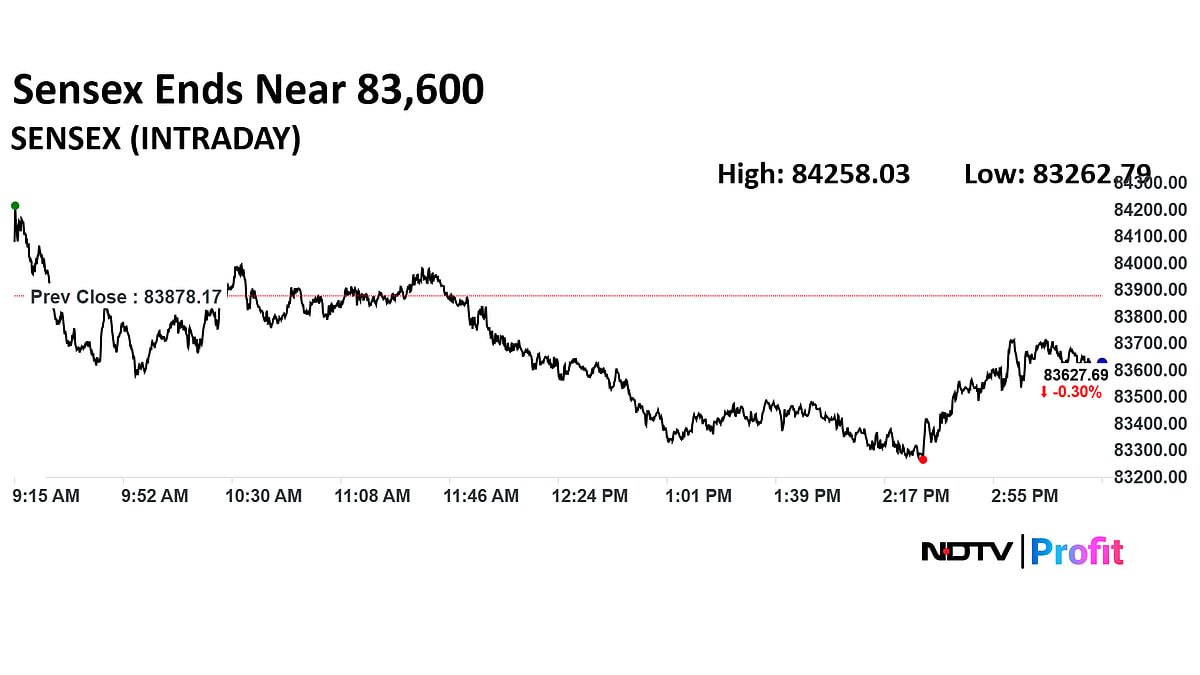

Stock Market Today: Nifty Ends Near 25,700, Sensex Down 250 Points On Expiry Day

-

Nifty recovers from lows in last hour of trade

-

Nifty falls after gaining in previous session

-

Nifty falls 6 times in last 7 sessions

-

L&T and Trent fall over 3% in Nifty; emerges as the top losers in Nifty

-

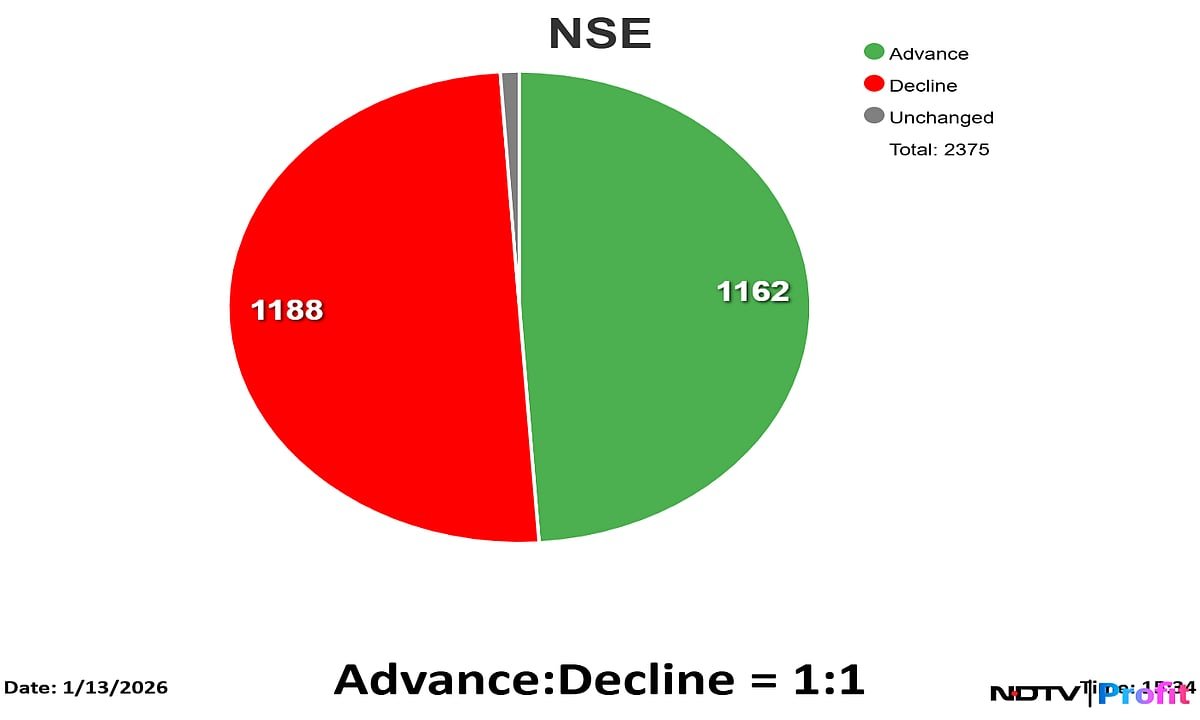

Nifty Smallcap 250 outperformed Benchmark Indices

-

Dixon Tech and Vodafone Idea fall the most in Nifty Midcap 150

-

Nifty Smallcap 250 snaps 3-day losing streak

-

Chemplast Sanmar and Balaji Amines are the top gainers in Nifty smallcap 250

-

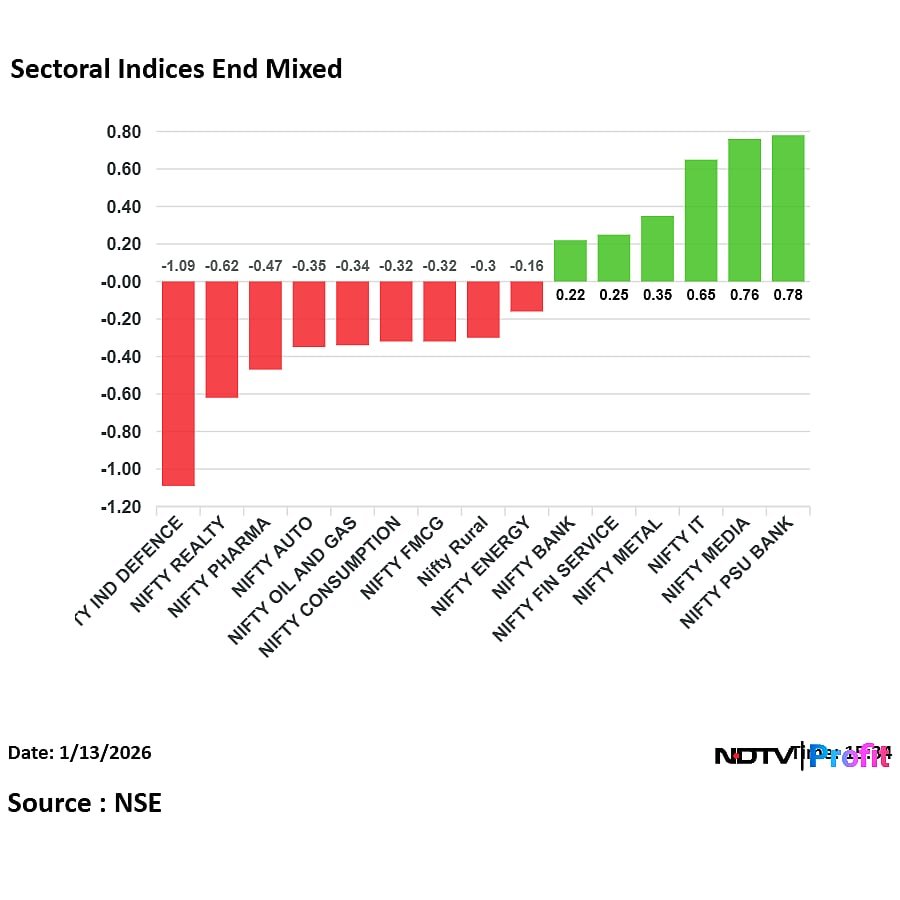

All sectoral indices close on a mixed note

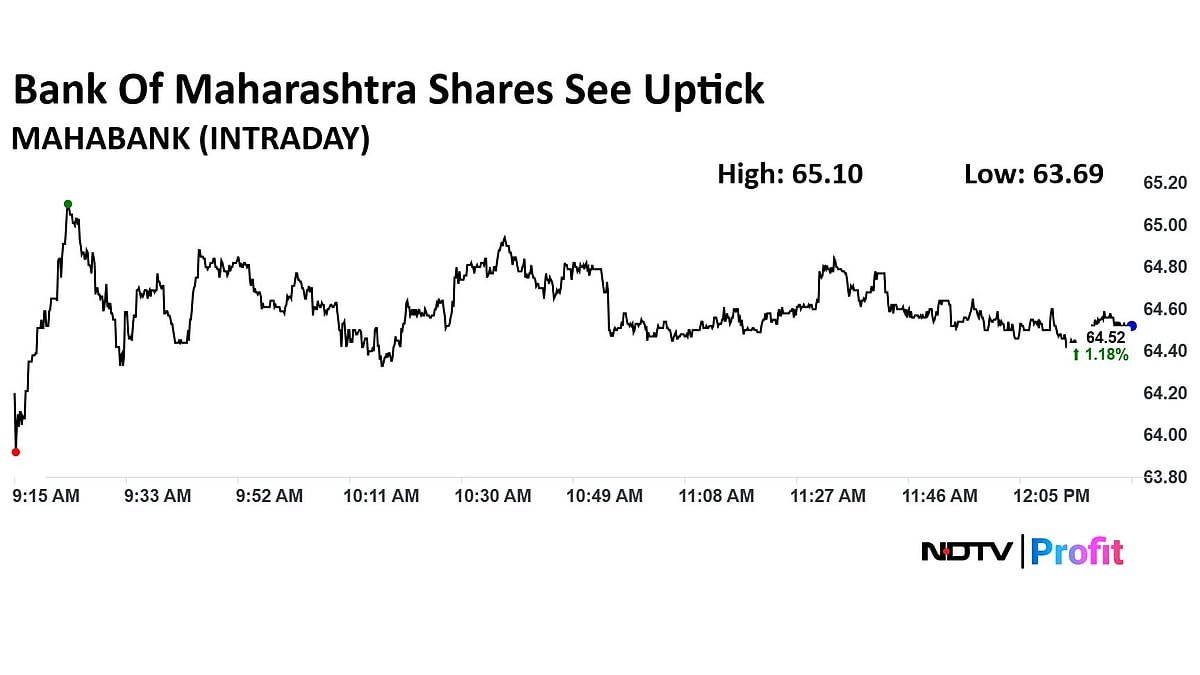

Q3 Results LIVE: Bank Of Maharashtra Profit Sees Uptick

Bank Of Maharashtra Q3 Highlights (Standalone, YoY)

-

Net profit up 26.5% at Rs 1,779 crore versus Rs 1,406 crore

-

Operating profit up 18.8% at Rs 2,736 crore versus Rs 2,303 crore

-

NII up 16.2% at Rs 3,422 crore versus Rs 2,943 crore

-

Provisions down 13.4% at Rs 728 crore versus Rs 841 crore

-

Net NPA at 0.15% versus 0.18% (QoQ)

-

Gross NPA at 1.60% versus 1.72% (QoQ)

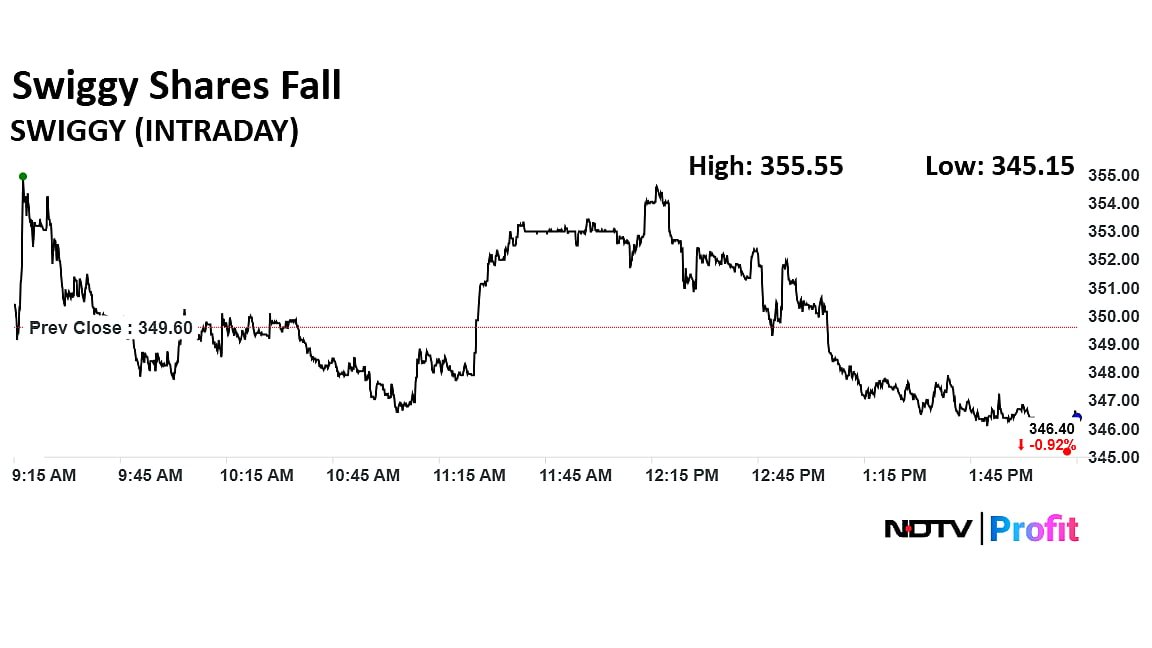

Swiggy Shares Fall As Labour Ministry Intervenes

The Labour ministry on Tuesday has directed quick-commerce companies like Zomato, Swiggy, Blinkit and Zepto to remove the 10-minute delivery time limit. After the announcement Swiggy shares fell over 1%.

Labour Ministry has asked Blinkit, Zepto and Swiggy to remove the delivery time limit, reported NDTV.

Sensex, Nifty Today: Stock Market Watch 2 PM

-

Indian equities were trading lower on Tuesday after snapping its five day declining streak.

-

Intraday, both Nifty and Sensex fell nearly 0.60%.

-

Nifty fell 0.47% at 25,671.30 as of 2 p.m.

-

Sensex was down 0.50% to 83,457.41.

-

Broader indices were trading mixed. Nifty Midcap 150 fell 0.43%; Nifty Smallcap 250 was trading 0.31% higher.

-

Most sectoral indices fell, led by Nifty Defence and Nifty Realty. Nifty Media and Nifty PSU Bank were in the green.

-

Nifty Bank fell 0.03%, Nifty IT was up 0.14%.

-

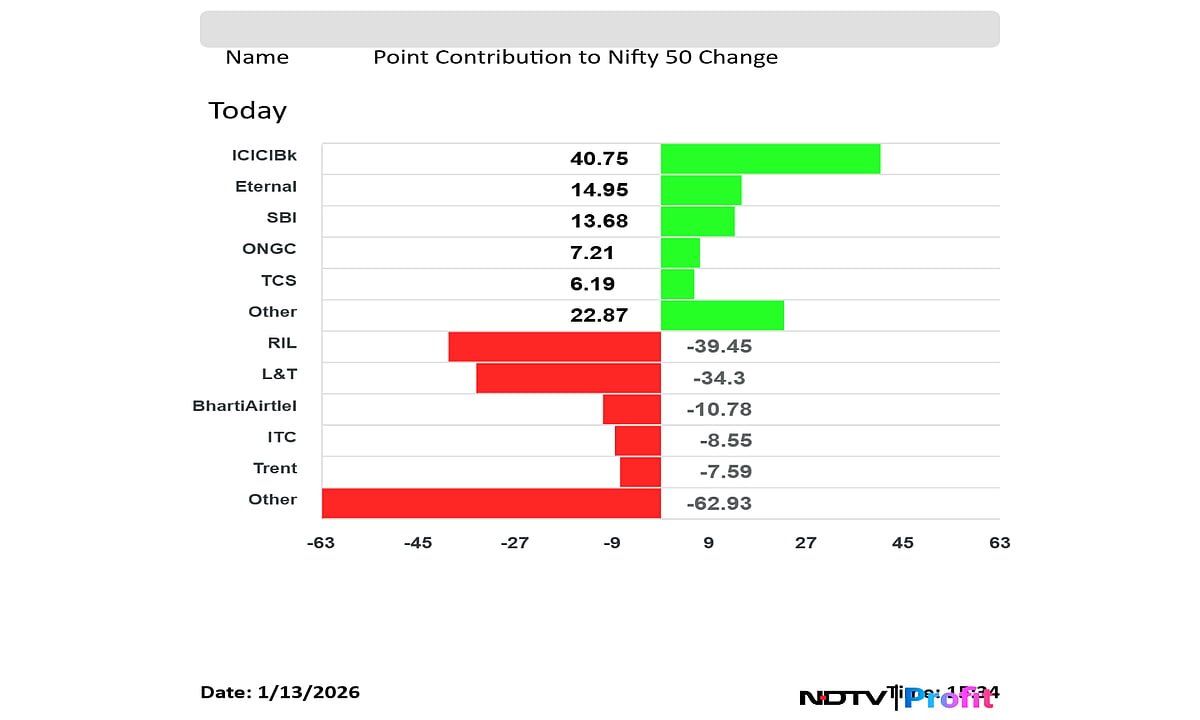

ICICI Bank, Eternal, SBI, ONGC and TCS were top Nifty gainers.

-

RIL, L&T, Bharti Airtel, ITC and Axis Bank were top Nifty losers.

ICICI Prudential Life Q3 Results Live: Profit Rises 19%

ICICI Prudential Life Q3 Result Highlights (Cons, YoY)

-

Net Profit rises 19% at Rs 387 crore versus Rs 325 crore.

-

Net Premium Income falls 3.7% to Rs 11,809 crore.

-

61st Month Persistency Ratio At 58.6% versus 62.6%.

-

13th Month Persistency Ratio At 81% Vs 85.6%.

ICICI Prudential Life Q3 Result Highlights (Cons, QoQ)

-

Solvency Ratio at 214.8% versus 213.2%.

-

61st Month Persistency Ratio At 58.6% versus 59.5%.

-

13th Month Persistency Ratio At 81% versus 81.4%.

-

Expenses of management ratio at 19.3% versus 17.5%.

OpenAI Acquires Torch For $100 Million To Boost ChatGPT’s Medical Capabilities

OpenAI on Tuesday announced the acquisition of Torch, a year-old health-technology startup reportedly valued at approximately $100 million.

This acquisition will see the startup’s technology and its four-person founding team integrated into the recently launched ‘ChatGPT Health’ division.

In a post on X (formerly Twitter), Ilya Abyzov, confirmed the news and write, “OpenAI has acquired Torch. The Torch team and I are joining OAI to help build ChatGPT Health into the best AI tool in the world for health and wellness.”

Kotak Mahindra Bank Q3 Results Live: Check Result Date

Kotak Mahindra Bank is set to announce its third quarter earnings on Jan. 24.

Bank Of Maharashtra Shares Rise Ahead Of Q3 Results

Shares of Bank of Maharashtra advanced over 2% in intraday trade on Tuesday, ahead of their Q3 results.

Q3 Results LIVE: ICICI Lombard, ICICI Prudential, Tata Elxsi In Focus

After the IT majors have kicked off the earnings season on Monday, ICICI Lombard, ICICI Prudential and Tata Elxsi will be announcing their results today.

You can track the live updates here.

Coal India Share Price Update: Large Trade In Stock

Over 2.2 million shares of Coal India were traded via a block deal on Tuesday. The share of Coal India fell as much as 0.6% to Rs 429.45 apiece.

Stop Building Business Plans Around A Possible US-India Trade Deal, Says Deepak Shenoy — Here’s Why

Capitalmind AMC CEO Deepak Shenoy has cautioned against building market or business assumptions around the possibility of a US trade deal, saying exporters should plan as if no agreement will materialise.

Shenoy said this was the “17,500th time” there has been talk about a trade deal, and while he acknowledged there is a chance it could happen, he stressed that the default assumption should be that it will not.

India’s Basmati Rice Trade Hit By Iran Unrest & Trump’s Tariffs; Exporters Flag Payment Risks

Indian basmati rice exporters are flagging fresh pressure on prices and payments as political unrest in Iran disrupts trade flows and raises new risks for Indian shipments. According to exporters, basmati rice prices have declined by Rs 5-8 per kg across key varieties over the past few weeks as Iranian buyers struggle with payments amid domestic instability.

Iran is one of India’s largest basmati markets, and exporters say importers there have conveyed their inability to honour existing remittance commitments.

Stock Market Live Updates: BSE F&O Snapshot

As the volatility continues in Tuesday’s session, her is what is happening in the futures and options market today.

BSE F&O Snapshot: @Sharad9Dubey breaks down the action in futures and options market today. @BSEIndia pic.twitter.com/tSypJ03cTO

— NDTV Profit (@NDTVProfitIndia) January 13, 2026

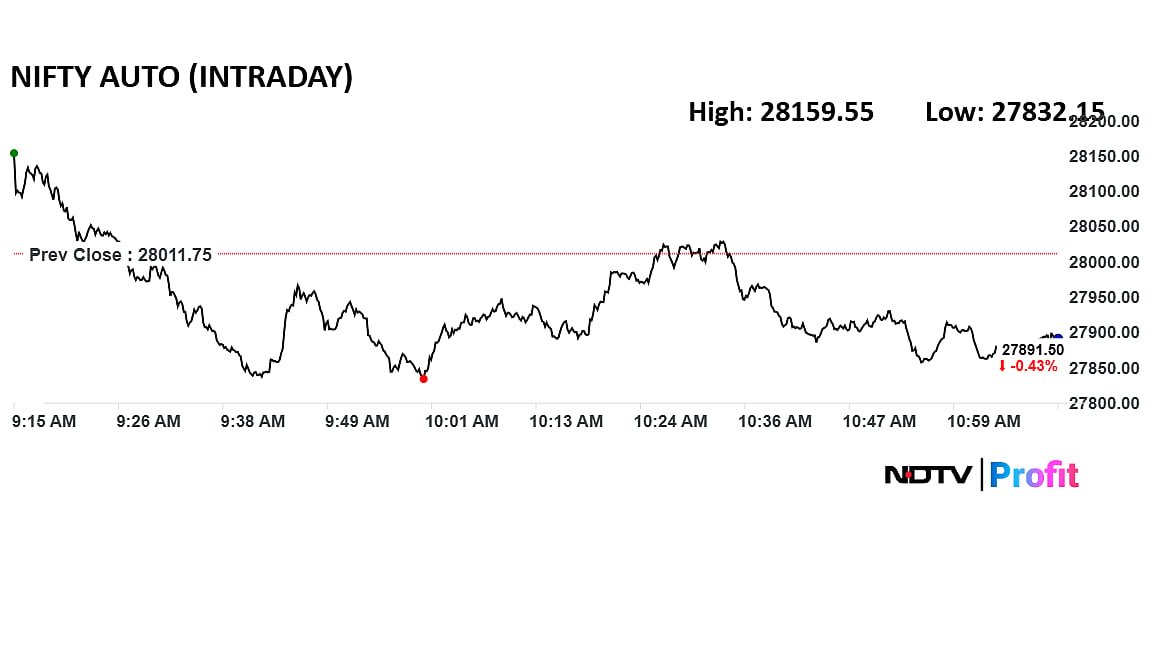

Nifty Auto In Focus As Passenger Vehicle Posts Highest Ever Sales In Q3

-

Nifty Auto was in focus on Tuesday after the release of SIAM data. Passenger Vehicle segment posted its highest ever sales of Q3.

-

The segment also clocked its highest ever sales of a calendar year of 44.90 Lakh units during Jan – Dec 2025

-

In Q3 of 2025–26, Two-Wheelers posted their highest ever Q3 sales of 5.70 million units,

-

Two wheeler sales crossed the 5 million mark for the first time

-

For the Jan-Dec 2025 period, the Two-Wheeler segment crossed the 20-million-mark sales

-

2W sales still below the peak it had achieved in 2018

SIAM Data For December: Overall Domestic Sales Rises 17.6%

Overall domestic sales for the industry registered a 17.6% jump year-on-year, 74.77 lakh units against 63.60 lakh units.

Passenger vehicle sales registered a 20.6% jump, 12,76,073 units vs 10,58,145 units.

Two-wheeler sales registered a 16.9% jump, 56,96,238 units vs 48,74,590 units.

CV sales registered a 21.6% jump, 1,10,289 units vs 90,667 units.

Three wheeler sales registered a 14.0% jump, 2,15,211 units vs 1,88,853 units.

Godrej Properties Shares In Focus: Stock Hits Two-Year Low

Godrej Properties shares extended decline for the fourth day and hit a two-month low. The scrip fell as much as 2.62% to Rs 1,880.30 apiece on Tuesday, lowest level since Dec. 21, 2023. It pared losses to trade 1.81% lower at Rs 1,895.40 apiece, as of 10:52 a.m. This compares to a 0.02% advance in the NSE Nifty 50 Index.

It has fallen 15.87% in the last 12 months and 5.61% year-to-date. Total traded volume so far in the day stood at 1.46 times its 30-day average. The relative strength index was at 45.14.

Stock Market Live Updates: L&T to Nuvama

-

Current order book from Kuwait in minimal

-

About $4-5 billion of order prospects from Kuwait, where L&T is already L1

-

Despite being L1, the quoted price is more than budgeted amount

-

Hence there are some negotiations going on between the Kuwait authorities and the bidders

Bharat Coking Coal IPO Live

The Bharat Coking Coal IPO has been subscribed 34.37 times so far on Tuesday.

-

Qualified Institutional Buyers (QIBs): 1.44 times

-

Non-Institutional Investors (NIIS): 97.62 times

-

Retail Individual Investors: 27.83 times

-

Employee reserved: 2.72 times

-

Reservation for shareholders: 44.96 times

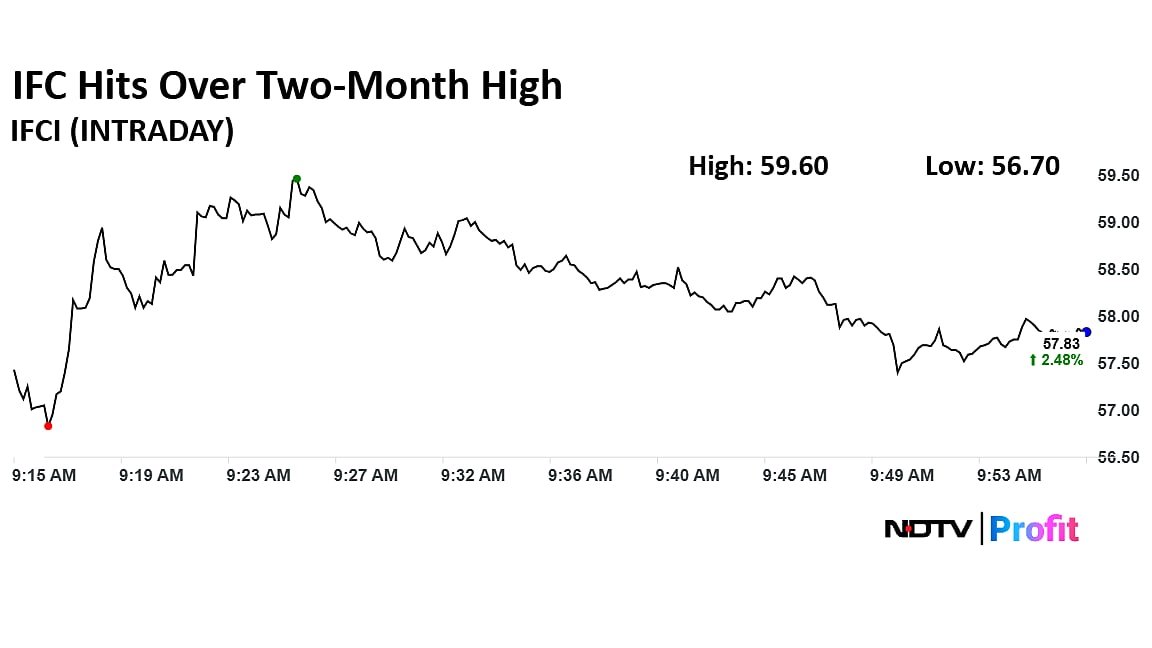

IFCI Share Price Today: Stock Hits Over Two-Month High

IFCI shares hit over one-month high on Tuesday extending advance for the second consecutive session. The scrip rose as much as 5.62% to Rs 59.60 apiece on Tuesday, highest level since Oct. 31. It pared losses to trade 2.68% higher at Rs 57.97 apiece, as of 9:56:23 a.m. This compares to a 0.25% decline in the NSE Nifty 50 Index.

It has risen 12.51% in the last 12 months and 0.43% year-to-date. Total traded volume so far in the day stood at 5.03 times its 30-day average. The relative strength index was at 66.10.

HDFC Bank Share Price Update: Large Trade In Stock

Over 1 million shares of HDFC Bank were traded via another block deal on Tuesday. The share of HDFC Bank fell as much as 1.15% to Rs 947.70 apiece.

Bharti Airtel Share Price Update: Large Trade In Stock

Over 1.99 million shares of Bharti Airtel were traded via a block deal on Tuesday. The share of Bharti Airtel fell as much as 1.03% to Rs 2,023 apiece.

Eternal Shares In Focus Today

Here is why Eternal shares are in focus on Tuesday.

-

Released its latest shareholding pattern yesterday evening.

-

Foreign Room Increase Likely to Drive Full MSCI Weight in Feb Review

-

Currently, the stock carries half weight in the MSCI index due to low foreign headroom

-

Based on the latest shareholding data, foreign room has increased and is now above 25%

-

This should make the stock eligible for full MSCI weight

-

This change is expected to be reflected in the February MSCI review

-

Potentially resulting in passive inflows of $390 million

HDFC Bank Share Price Update: Large Trade In Stock

Over 1.63 million shares of HDFC Bank were traded via a block deal on Tuesday. The share of HDFC Bank rose as much as 1.15% to Rs 947.70 apiece.

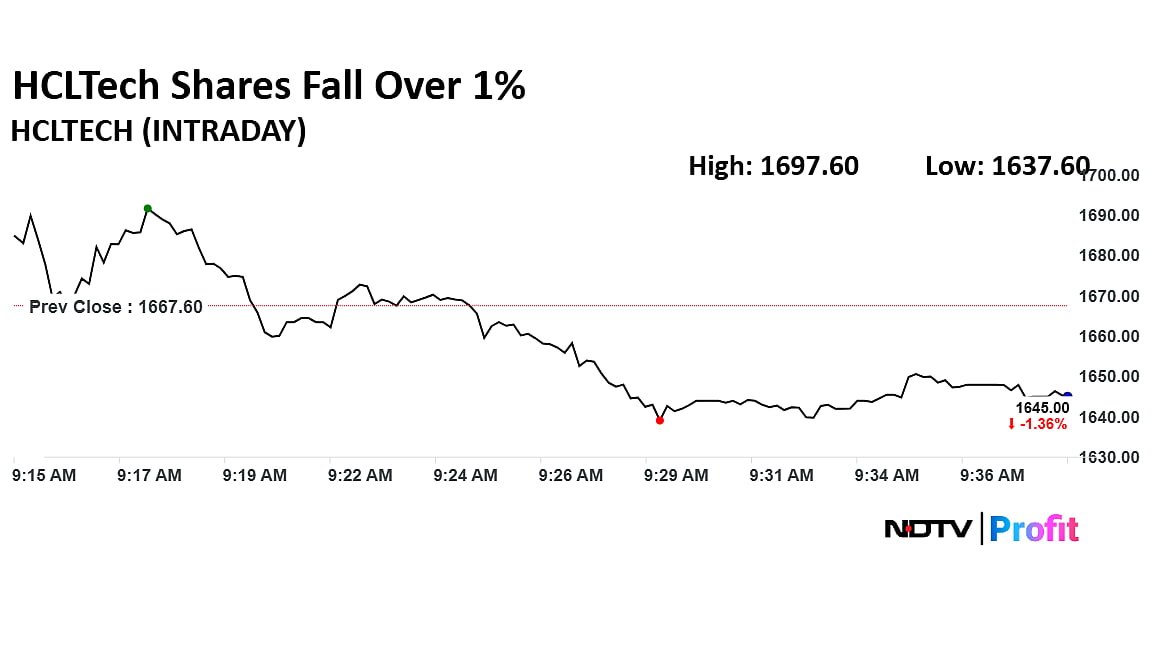

HCLTech Shares In Focus After Q3 Results

HCLTech that opened in positive was trading 1.8% lower at Rs 1,637.60 per share as of 9:37 a.m. This comes after the company posted its third-quarter earnings for the financial year ending March 2026.

The IT giant reported a consolidated bottom-line of Rs 4,076 crore in the October-December period, compared to Rs 4,235 crore in the preceding quarter, according to an exchange filing on Monday.

Analysts’ consensus estimate compiled by Bloomberg projected the profit to grow by 11% to Rs 4,702 crore.

Stock Market Live Updates: Nifty, Sensex Give Up Opening Gains

The Nifty 50 opened 0.42% higher at 25,897.35 and Sensex opened 0.24% up at 84,079.32. However, it gave up the opening gains to trade in red. Both Nifty and Sensex were trading nearly 0.19% lower.

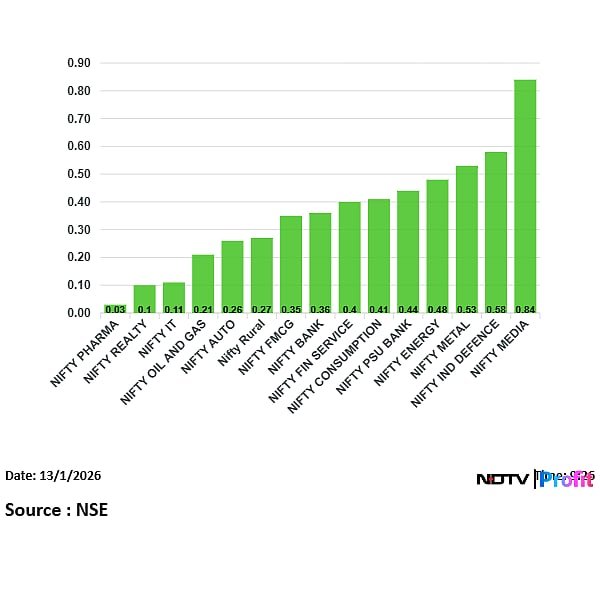

Nifty, Sensex Live Updates: Media, Defence Stocks Lead Gain

On NSE, all 15 sectors were in the green. Nifty Media and Nifty Defence lead the gains.

Broader markets were also in the green, with the NSE Midcap 150 trading 0.46% higher and NSE Smallcap was trading 0.46% higher.

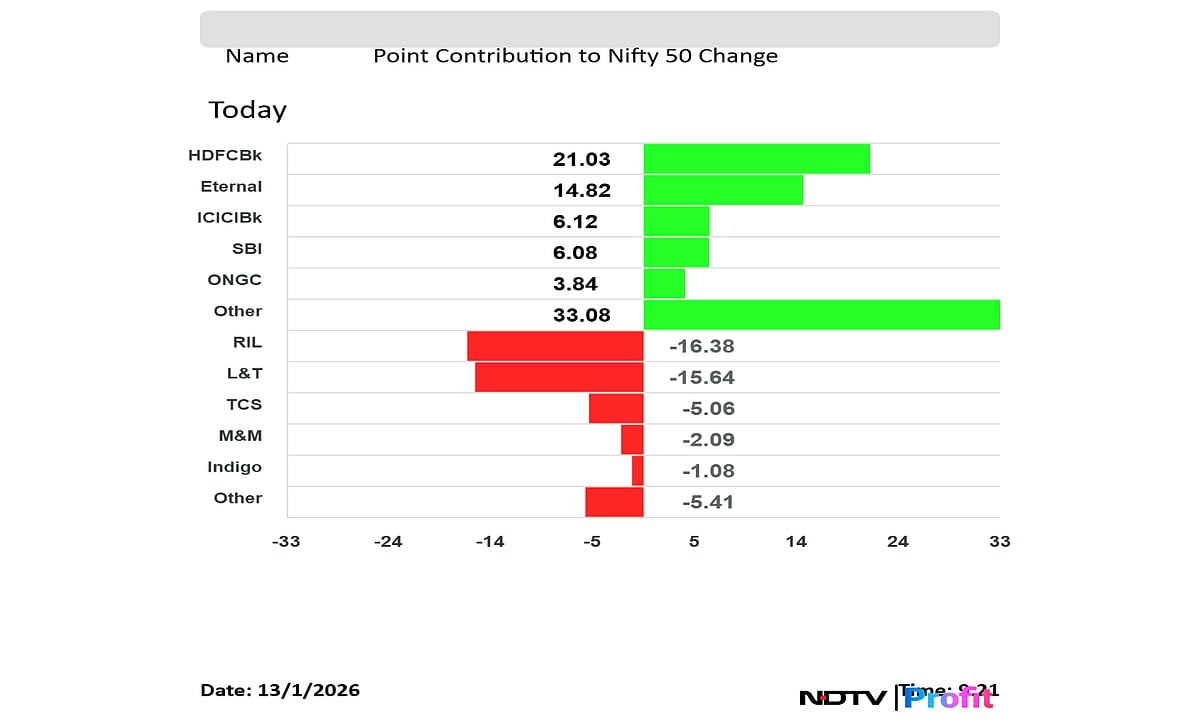

Nifty 50 Live Today: HDFC Bank, Eternal Lead Gains

RIL, L&T, TCS, M&M and Indigo weighed on the Nifty 50 index.

HDFC Bank, Eternal, ICICI Bank, SBI and ONGC added to the Nifty 50 index.

Stock Market Live Updates: Nifty Opens Near 25,900, Sensex Gains Over 200 Points

The NSE Nifty 50 and BSE Sensex opened higher on Tuesday extending gains for the second day. The Nifty 50 opened 0.42% higher at 25,897.35 and Sensex opened 0.24% up at 84,079.32. However, minutes after open the Nifty was trading below 25,850 and Sensex was also trading nearly 200 points higher.

Stock Market Live Update: Nifty, Sensex Advance In Pre-Open

At pre-open, the NSE Nifty 50 was trading 107.10 points or 0.42% higher at 25,897.35. The BSE Sensex was up 193.39 points at 84,071.56.

TCS: What Brokerages Say

Citi

Citi on the other hand, maintained its Sell rating on TCS, trimming its target price marginally to Rs 3,020. The brokerage termed December quarter as an inline quarter but highlighted that muted international business growth is likely to disappoint investors, especially after management’s relatively positive tone post second quarter.

It pointed out that equipment and software contributed nearly half of the sequential growth, raising questions about the sustainability of core services momentum.

Citi remains cautious on the sector, citing high competitive intensity, AI-led productivity risks and the rise of global capability centres. Despite management’s confidence, Citi believes the business outlook remains challenged and continues to prefer peers like Infosys and HCLTech within large-cap IT.

TCS: What Brokerages Say

Tata Consultancy Services Ltd.’s third quarter performance drew a mixed response from brokerages, with the Street broadly agreeing that while the quarter was largely in line on headline numbers, underlying trends in international markets remain soft.

Morgan Stanley

Morgan Stanley maintained an Overweight rating on TCS and raised its target price to Rs 3,540 from Rs 3,430. While it noted that underlying trends were softer than expected — especially in international business growth — the brokerage highlighted management commentary pointing to momentum holding up into calendar year 2026.

Stable margins near 25%, with management expressing confidence of moving towards 26%, and expectations of fiscal 2026 exiting at a better growth rate than last year were seen as key positives supporting FY27 assumptions.

The brokerage also sees early silver linings in the company’s AI journey, with proof-of-concept projects moving into production and AI revenues scaling up, even though the sector remains in a transition phase. It modestly nudged up financial year 2027–28 estimates and sees potential catalysts from data-center-related developments over the medium term.

HCLTech: What Brokerages Say

-

Citi maintains a Neutral rating and raises the target price to Rs 1,700 from Rs 1,670.

-

Q3 performance and deal TCV were better than expected.

-

Forward-looking indicators remain stronger than peers.

-

Management is focused on identifying and tapping new spending areas.

-

Citi has raised FY27 and FY28 earnings estimates by 2% each.

-

The brokerage maintains a cautious stance on the IT services sector.

HCLTech: What Brokerages Say

Kotak Securities on HCLTech

-

Kotak Securities maintains a Reduce rating and raises the target price to Rs 1,680 from Rs 1,500.

-

The quarter was solid overall, driven by the products segment.

-

Services performance was moderately better than expected.

-

Net-new bookings were strong, supported by a large deal win.

-

The brokerage sees limited scope for meaningful EBIT margin expansion.

-

A cost takeout-led demand environment continues to cap margin upside.

-

Valuations remain rich, with the stock trading at a premium to peers.

HCLTech: What Brokerages Say

In the wake of HCLTech’s Q3 earnings, a slew of brokerages came out with a positive note on the IT giant, with the likes of Morgan Stanley, Citi and Kotak Securities hiking target price on the counter.

Morgan Stanley on HCLTech

-

Morgan Stanley maintains an Equal-weight rating and raises the target price to Rs 1,760 from Rs 1,680.

-

Q3 performance surprised positively, prompting an upgrade to the full-year outlook.

-

Growth visibility into FY27 appears slightly better than earlier.

-

Margins are expected to normalise around an 18% base next year.

-

Consensus estimates are likely to move higher.

-

Strong recent performance is already reflected in premium valuations.

-

The brokerage sees limited upside from current levels.

Pricing Pressure To Cap Agri-Chemicals Growth Despite Volume Growth Says Jefferies — Check Stock Picks

Jefferies says crop protection innovators are heading into another year of muted growth in 2026, with pricing pressure persisting despite improving volumes, while refrigerant gas exports remain a rare bright spot for Indian chemical companies.

The brokerage notes that innovators are guiding for 0–2% revenue growth in 2026, as mid-single-digit volume growth is offset by continued pricing pressure led by aggressive Chinese supplies. Chinese crop-protection export volumes are up 16%, with prices still near nine-year lows.

Trade Setup For Jan 13: Nifty 50 At Crucial Turning Point

From a technical standpoint, the 50-Double Exponential Moving Average at 25,900 is expected to serve as an intermediate hurdle, followed by a strong resistance level at the 26,000 mark, which coincides with the 20-DEMA, Osho Krishan, chief manager of technical and derivative research at Angel One, said.

A decisive breakthrough above these levels could only reignite bullish sentiment in the upcoming session.

On the downside, 25,650 and 25,600 would act as key support zones, while 25,900-25,950 could serve as immediate resistance areas for the bulls, said Shrikant Chouhan, head of equity research at Kotak Securities.

Nifty Today: What F&O Cues Indicate

-

Nifty January futures up by 0.36% to 25,880 at a premium of 90 points.

-

Nifty January futures open interest up by 1.7%.

-

Nifty Options on Jan 13: Maximum Call open interest at 26,000 and Maximum Put open interest at 25,500.

-

Securities in ban period: SAIL, Samman Capital

Dollar Check

-

The US Dollar index is up 0.05% at 98.700.

-

Euro was down 0.08% at 1.1658.

-

Pound was up 0.02% at 1.3468.

-

Yen was up 0.22% at 158.47.

Stock Market News Live: Global Check

Asian shares are trading near record highs, driven by optimism over earnings and regional economic growth. Investors are increasingly looking beyond US markets, with the MSCI Asia Pacific Index rising 0.9% for the second consecutive day. This growth has allowed Asian shares to outpace the S&P 500, despite the US benchmark reaching a record high with a 0.2% increase.

The S&P 500’s performance has been strong, but Asian markets are gaining attention due to their growth potential. Equity-index futures for US stocks slightly declined by 0.2% in early Asian trading.

Japan’s stock market saw significant gains after the holiday, contributing to the region’s positive momentum. The yen also strengthened, gaining up to 0.2% to 157.90 per dollar, reports Bloomberg.

Stock Market Live Updates: GIFT Nifty Hints At Positive Opening

Good morning readers.

The GIFT Nifty was trading near 25,920 early on Tuesday. The futures contract based on the benchmark Nifty 50 rose 0.24% at 25,920 as of 6:50 a.m. indicating a positive start for the Indian markets. This comes as India-US trade talks are set to resume today.

In the previous session on Monday, the benchmark snapped its five days fall to end in positive. The NSE Nifty 50 ended 106.95 points or 0.42% higher at 25,790.25, while the BSE Sensex closed 301.93 points or 0.36% higher at 83,878.17.

. Read more on Markets by NDTV Profit.