U.S. stock futures fluctuated on Tuesday following Friday’s mixed close. Futures of major benchmark indices were mixed at the beginning of the holiday-shortened week as the markets were closed on Monday for Presidents’ Day.

Weekly losses hit all major indices last week, with the S&P 500 dropping 1.4% and the Dow slipping 1.2%. The Nasdaq recorded a 2.1% weekly decline.

Meanwhile, Congressional Democrats and the administration of President Donald Trump failed to agree on a funding deal through September, triggering a partial government shutdown that commenced Saturday.

Investors will be looking out for earnings releases from Walmart Inc. (NASDAQ:WMT), DoorDash Inc. (NASDAQ:DASH), and Molson Coors Beverage Co. (NYSE:TAP) through the week.

The 10-year Treasury bond yielded 4.02%, and the two-year bond was at 3.39%. The CME Group’s FedWatch tool‘s projections show markets pricing a 90.2% likelihood of the Federal Reserve leaving the current interest rates unchanged in March.

| Index | Performance (+/-) |

| Dow Jones | 0.02% |

| S&P 500 | -0.14% |

| Nasdaq 100 | -0.47% |

| Russell 2000 | -0.21% |

The SPDR S&P 500 ETF Trust (NYSE:SPY) and Invesco QQQ Trust ETF (NASDAQ:QQQ), which track the S&P 500 index and Nasdaq 100 index, respectively, were lower in premarket on Tuesday. The SPY was down 0.16% at $680.65, while the QQQ declined 0.49% to $598.97.

Stocks In Focus

Ocular Therapeutix

- Ocular Therapeutix Inc. (NASDAQ:OCUL) soared 33.56% as it is set to announce topline data for SOL-1 Phase 3 superiority trial in wet AMD on Tuesday.

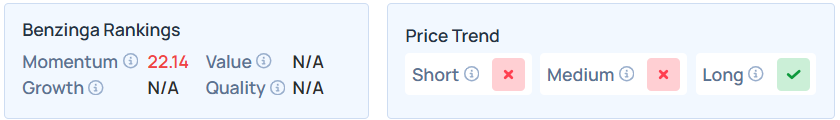

- OCUL maintains a stronger price trend over the long term but a weak trend in the short and medium terms, as per Benzinga’s Edge Stock Rankings.

Sonoco Products

- Sonoco Products Co. (NYSE:SON) gained 2.38% after posting upbeat results for the fourth quarter. The company reported quarterly earnings of $1.05 per share, which beat the analyst consensus estimate of $1.00 per share.

- SON maintains a stronger price trend over the short, medium, and long terms, with a poor growth ranking, as per Benzinga’s Edge Stock Rankings.