Good morning!

The GIFT Nifty traded half a percent higher at 24,959 as of 7:00 a.m., indicating a positive open for the benchmark Nifty 50 index.

US and European futures were trading marginally higher during early Asian trade.

-

S&P 500 futures up 0.13%

-

Euro Stoxx 50 futures up 0.15%

Key Events/Data To Watch

Prime Minister Narendra Modi and Prime Minister of Singapore Lawrence Wong will virtually inaugurate JN Port PSA Mumbai terminal.

Commerce Minister Piyush Goyal will speak at two events in New Delhi.

The two-day GST Council meeting will conclude in the national capital.

The RBI will conduct Rs 1.5 lakh crore, 8-day variable rate reverse repo auctions under Liquidity adjustment facility (LAF).

Markets At Home

The benchmark equity indices ended in the green on Wednesday on expectations of a GST rate reduction, which can help boost consumption.

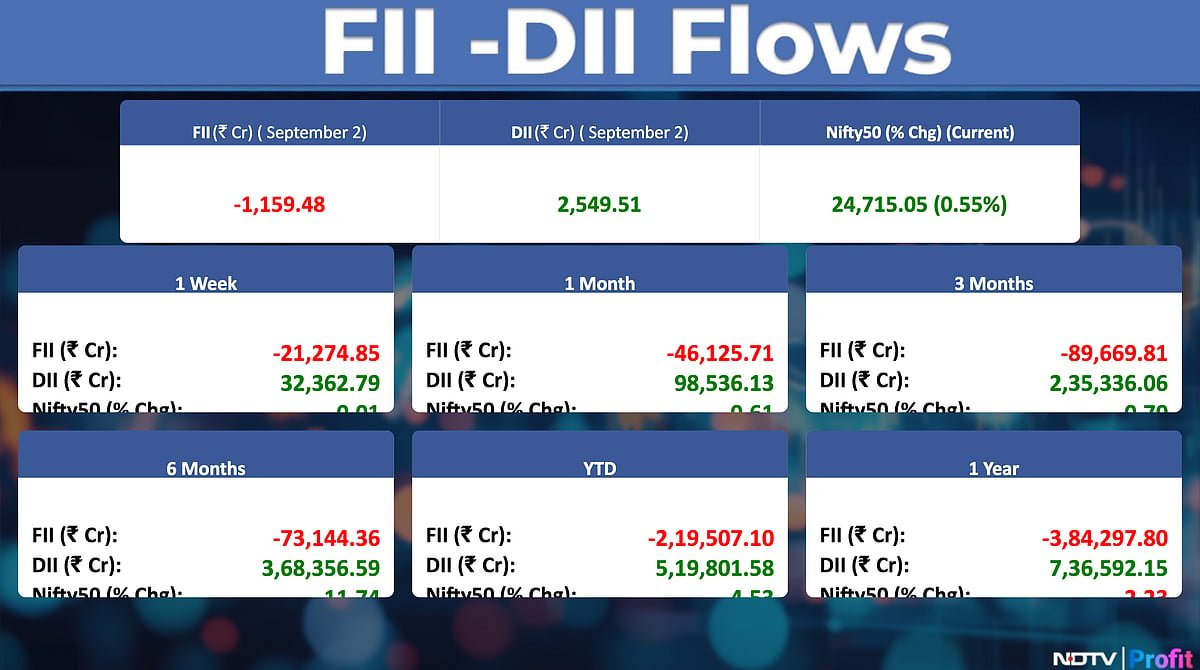

The NSE Nifty 50 settled 135.45 points or 0.55% higher at 24,715.05 and the BSE Sensex closed 409.83 points or 0.51% up at 80,567.71. The Nifty rose as much as 0.64% during the day to 24,737.05, while the Sensex was up 0.64% to 80,671.28.

Stocks In News

-

Muthoot Finance: The company approves the settlement of $600-million senior secured notes due 2030.

-

Muthoot Microfin: The company has approved raising up to $15 million through bonds and Rs 150 crore through non-convertible debentures.

-

Swiggy: The company increases platform fees on food delivery orders to Rs 15 from Rs 12.

-

Aptus Value Housing Finance: Westbridge may sell its entire 16.5% stake in the company comprising of 82.3 million shares, at a price of Rs 316 per share through a block deal, which represents a 5% discount to the current market price.

-

SPML Infra: The company appoints Abhinandan Sethi as Managing Director.

-

Ester Industries: The company’s joint venture has acquired land in Gujarat to build India’s first Infinite Loop manufacturing facility.

-

Campus Activewear: The company acquired the land and building of Nainipanel Industries in Uttarakhand for a cash consideration of Rs 74.75 crore. This will enable the Company to expand its existing capacity for the manufacturing of semi-finished goods (Upper) and assembly of footwear.

-

Allied Blenders and Distillers: The company has received tax assessment orders from the Asst. Commissioner of State Tax, raising a demand of Rs 14.98 crore.

-

BHEL: The company has accepted a Letter of Intent worth Rs 2,600 crore from MB Power (Madhya Pradesh) Ltd. to supply equipment (Boiler, Turbine, Generator) for the 1×800 MW Anuppur Power Project.

-

Sundram Fasteners: The CRISIL Ratings has re-affirmed the rating of the company’s short-term debt and commercial paper at CRISIL A1 +.

-

Shoppers stop: The company’s arm has approved the transfer of its entire holding in Pahadi Goodness Pvt ltd for a consideration of not less than Rs 3 crore.

-

Bajaj Hindusthan : The company’s Trust has sold 3.11 crore equity shares for approximately Rs 67.84 crore to reduce the company’s loan from lenders.

-

Poly Medicure: The company, through its arm RisoR Holdings B.V. in the Netherlands, is acquiring a 90% stake in the PendraCare Group for Rs 188.5 crores. This acquisition will allow to expand its presence in the European medical devices market.

-

Epigral: Sanjay Surendra Jain has resigned as the Chief Financial Officer of Epigral, effective Sept. 30.

-

RailTel: The company has received a work order worth Rs 14.94 crore for the SITC of IP-based CCTV surveillance at the Ministry of Home Affairs.

-

Carraro India : The company received two show cause notices worth Rs 14.29 crore from the Customs Office for unpaid IGST, interest, and penalties.

-

Steel Exchange India: The company is expanding its business to include integrated logistics, and the company will indulge in acquisition , purchase, lease, pooling of land for the construction, development, and renovation of residential , commercial, and public infrastructure.

-

Asian Hotels : The company has appointed Arjun Raghavendra Murlidharan as the Chairman of its Board of Directors, effective Sept. 13, 2025.

-

UCO Bank : The bank has received approval from the Reserve Bank of India to establish an IFSC Banking Unit in GIFT City, Gandhinagar.

-

Religare Enterprises: The company received in-principal approval for a warrant issue of up to Rs 1,500 crore at a price of Rs 235 per warrant. The company will issue 6.3 crore warrants, which are convertible into an equal number of equity shares.

-

Prestige Estates: The company’s arm has received a show cause notice from the GST authority for a tax demand of Rs 160 crore. The notice alleges non-payment, short payment of GST, and non-reversal of input tax credit for the period from February 2020 to March 2024.

-

ITD Cementation: The company has announced that they are changing their name to “Cemindia Projects Ltd”.

-

Sammaan Capital: The company has approved resolutions to raise up to Rs 10,000 crore via bonds or ECBs and up to Rs 30,000 crore through bonds or NCDs.

-

Can Fin Homes: The company has approved the issuance of non-convertible debentures worth up to Rs 10,000 crore on a private placement basis.

-

IIFL Finance: The company has approved the issuance of non-convertible debentures worth up to Rs 250 crore on a private placement basis.

-

Suraj Estate: The company has approved a plan to raise up to Rs 500 crore by issuing shares or other securities.

-

Force Motors: The company’s, total sales saw a year-on-year increase of 4.5% to 2,403 units. This was primarily driven by a 6.6% growth in domestic sales, which reached 2,295 units. However, the company’s export sales declined by 26%, totalling 108 units.

-

SW Solar: The company received a Rs 40 crore tax demand in South Africa.

-

GHV INnfra: The company has received a Letter of Intent for Rs 120 crore for the integrated redevelopment of a railway station of the Southeastern Railway in Jharkhand.

-

Redington: The company has entered a new distribution agreement with CrowdStrike to accelerate cybersecurity transformation across India, making CrowdStrike’s AI-native Falcon platform available to Redington’s customers and partners.

-

Tata Motors, Mahindra & Mahindra: The Delhi High Court ordered to take immediate steps to disburse the subsidies promised to customers for buying electric vehicles and said procedural hurdles cannot be used as a pretext to delay payments.

-

Exide, Amara Raja, Gravita India: Cabinet approves Rs 1,500 crore incentive scheme for critical and rare earth minerals. The scheme will run for six years, from FY2025-26 to FY2030-31. It will cover recycling of e-waste, lithium-ion battery scrap, and other scrap such as catalytic converters from end-of-life vehicles.

IPO Offering

-

Amanta Healthcare: Amanta Healthcare is a pharmaceutical company that specializes in the development, manufacturing, and marketing of a diverse array of sterile liquid products. The company is also a manufacturer of medical devices. The price band is set from Rs 120 to Rs 126 per share. The Rs 126-crore IPO is entirely a fresh issue. The public issue was subscribed to 82.61 times on day 3. The bids were led by Qualified institutional investors (35.86 times), non-institutional investors (209.42 times), retail investors (54.98 times).

Bulk Deals

Aditya Vision: Promoter Yashovardhan Sinha sold 32.61 lakh shares(2.53% stake) at Rs 461.04, while Axis Mutual Fund bought 14 lakh shares (1.08% stake) at Rs 459.7 and IRAGE Broking Services LLP had a net buy of 5.29 lakh shares (0.41 % stake) and Motilal Oswal Mutual Fund bought 8.6 lakh shares (0.66%) at Rs 460 apiece.

Block Deal

-

Vertis Infrastructure: 360 One Prime Limited sold 91.75 lakh shares at Rs 98.25 and Galaxy Investments II PTE Ltd sold 37 lakh shares at Rs 98.04. Meanwhile, a group of buyers including Duroshox International Private Limited (18.25 lakh shares at Rs 98.25), ARA Investments (15.25 lakh shares at Rs 98.25), Adwait Holdings Private Limited (15.25 lakh shares at Rs 98.25), Sanjay Kumar Chadha (15.25 lakh shares at Rs 98.04), RB Diversified Private Limited (12.25 lakh shares at Rs 98.25), Axis Securities Limited (11 lakh shares at Rs 98.03), Spark Financial Holdings Private Limited (10.75 lakh shares at Rs 98.06), Tibrewala Electronics Limited (10.25 lakh shares at Rs 98.25), Ashra Family Trust (10.25 lakh shares at Rs 98.25), and Afshan Riyaz Peermohamed (10.25 lakh shares at Rs 98.25) collectively bought shares.

Trading Tweaks

-

Ex-Dividend : NIIT Limited, Nahar Spinning, AIA Engineering, Ruby Mills, Nahar Capital and Financial, Kopran, Finolex Industries, NTPC, Surya Roshni, Shipping Corporation Of India, Themis Medicare, and Finolex Cables.

-

Price band change from 20% to 10% : Ola Electric

-

Price band change from 10% to 5%: Astron Paper, Spacenet Enterprises, Zenith Exports

-

List of securities shortlisted in Short – Term ASM Framework: ANB Metal Cast, Bharat Seats Limited

-

List of securities shortlisted in Long – Term ASM Framework: Apollo microsystem , Cupid Ltd, Pritish Nandy Communications.

F&O Cues

-

Nifty September Futures up by 0.52% to 24,813 at a premium of 98 points.

-

Nifty September futures open interest up by 0.03%

-

Nifty Options 2 September Expiry: Maximum Call open interest at 25000 and Maximum Put open interest at 24,500.

-

Securities in Ban Period: RBL Bank.

Currency/Bond Update

The rupee recovered 9 paise from its all-time low level to settle at 88.06 (provisional) against US dollar on Wednesday, on positive domestic equities, softening of crude oil prices and weak US dollar index. The yield on the 10-year bond, went down three basis points to close at 6.54%.

. Read more on Markets by NDTV Profit.