Good morning!

Markets On Home Turf

The benchmark indices ended flat but closed below the crucial mark of 26,000. Nifty 50 ended 0.09% higher at 25,891.40 and Sensex closed 0.15% higher at 84,556.40 on Thursday. The Nifty rose over 0.91% during the day to 26,104.20, while the Sensex was up 1.02% to 85,290.06.

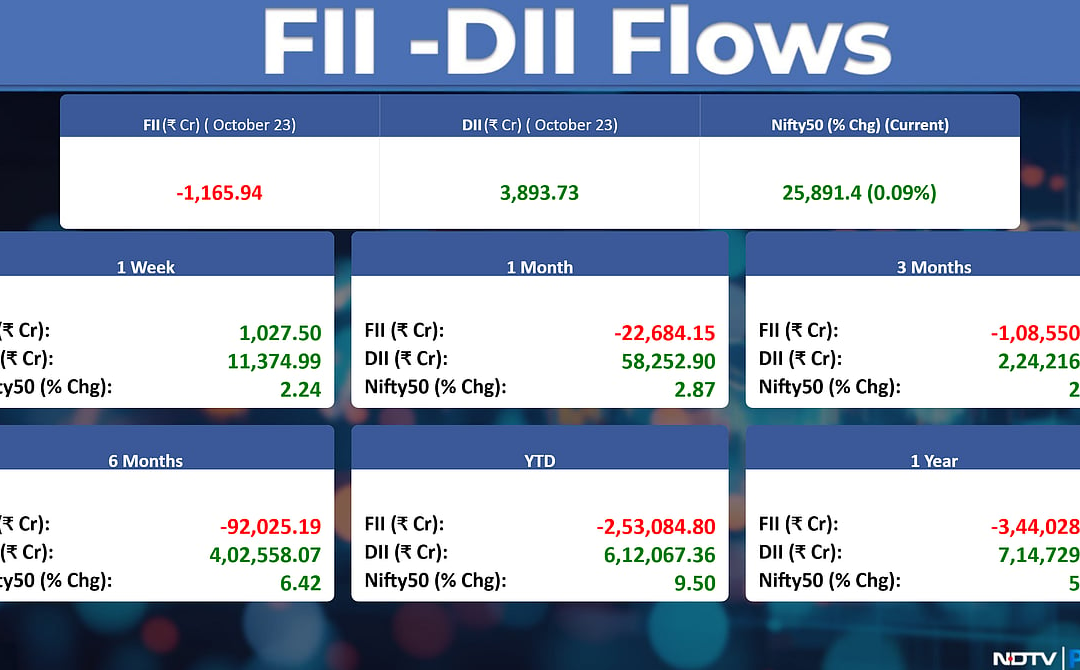

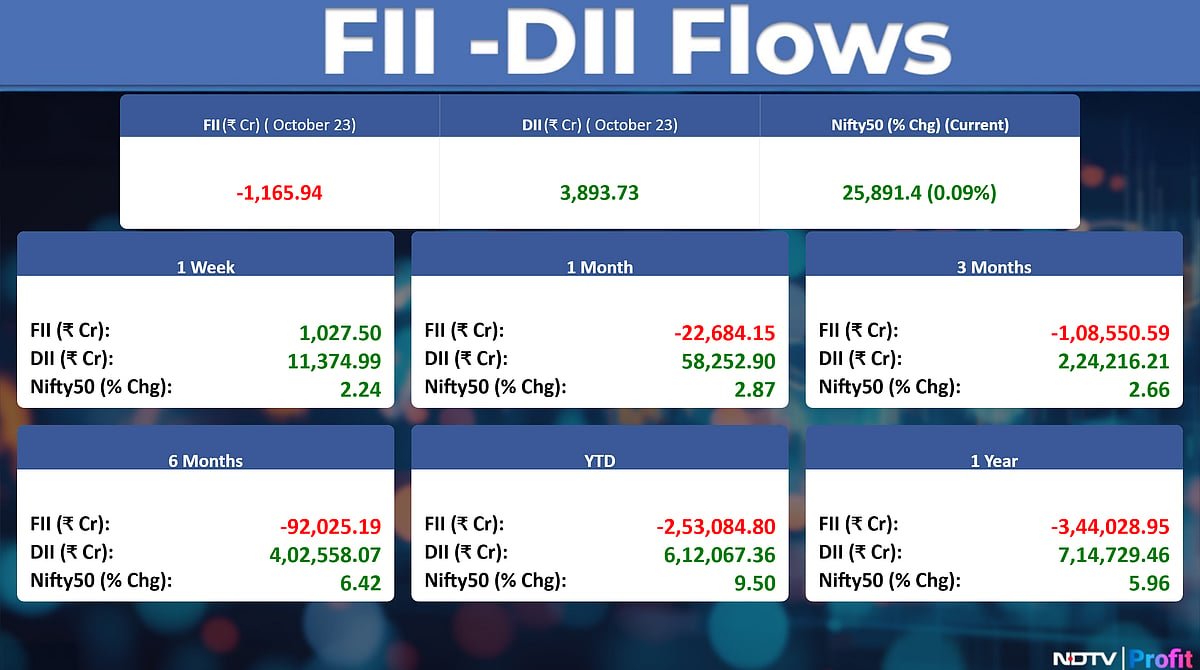

The foreign portfolio investors (FPIs) on Thursday turned net sellers of Indian shares after four sessions of selling. FPIs sold stocks worth approximately Rs 1,165.94 crore, according to provisional data from the National Stock Exchange (NSE). The domestic institutional investors that have stayed net buyers for over a month bought stake worth Rs 3,893.73 crore.

Earnings Post Market Hours

Colgate Palmolive Q2 Highlights (YoY)

-

Revenue down 6.2% to Rs 1,519.50 crore versus Rs 1,619.11 crore.

-

Ebitda down 6% to Rs 465.43 crore versus Rs 497.35 crore.

-

Margin at 30.6% versus 30.7%.

-

Net Profit down 17% to Rs 327.50 crore versus Rs 395.05 crore.

PTC India Financial Q2 Highlights (Cons, YoY)

-

Net Profit up 86.2% to Rs 88.1 crore versus Rs 47.3 crore.

-

Net Interest Income down 6% to Rs 72.3 crore versus Rs 77 crore.

Sagar Cements Q2 Highlights (Cons, YoY)

-

Revenue up 26.7% to Rs 602 crore versus Rs 475 crore.

-

Ebitda up to Rs 51.3 crore versus Rs 19.9 crore.

-

Margin at 8.5% versus 4.2%

-

Net Loss at Rs 42.3 crore versus loss of Rs 55.6 crore.

Earnings Today

Dr Reddys Labs, SBI Life, SBI Cards, Latent view Analytics, Supreme Petrochem, Coforge, Cigniti Tech, Aditya Birla AMC.

Business Update

Arihant Foundations

-

Total area sold up 44% at 1.18 lakh Sq Ft (YoY).

-

Total sale value up 13% at Rs.113 crore (YoY).

-

Collections stand at Rs.78.3 crore as on Sept 30, 2025.

Stocks In News

-

Cipla: The company enters into an agreement with Eli Lilly to distribute Tirzepatide in India under the brand name Yurpeak. The drug is used to treat Type-2 diabetes and obesity and will be priced the same as Eli Lilly’s Mounjaro.

-

Syrma SGS: The company enters into an agreement with Premier Energies to acquire KSolare Energy for Rs 170 crore.

-

Hero MotoCorp: The company expands into the UK market through a partnership with MotoGB. In addition the company has launched Euro 5+ range led by Hunk 440, expanding its global presence to 51 countries.

-

Tamilnad Mercantile Bank: The company opens a new branch in Tamil Nadu.

-

AGI Infra: The company’s board approves raising up to Rs 500 crore through equity instruments.

-

UGRO Capital: The company approves issuance of 5,000 NCDs worth Rs 50 crore, with an option to retain oversubscription up to Rs 150 crore.

-

Vodafone Idea: The company invests Rs 26,000 as the first tranche out of the total proposed investment of Rs 1.56 crore in the capital of ABRen SPV 3.

-

Kaynes Technology: The company’s subsidiary enters into an agreement with Frauscher Sensor Technology Group GmbH to acquire a 7% stake in Sensonic GmbH for 1 Euro.

-

Insolation Energy: The company to migrate its listing from BSE SME to BSE and NSE main boards. The board has approved borrowing limit up to Rs 5,000 crore.

-

Shipping Corporation of India: The company’s board grants consent for its long-term business plan.

-

Karnataka Bank: The company announces resignation of Ramachandra K. Gurumurthy as Head of Treasury.

-

ARSS Infra: The company secures multiple orders aggregating to Rs 164 crore from Shivam Condev.

-

Welspun Enterprises: The company receives a tax demand of Rs 18 crore, including penalty, from the Tamil Nadu Tax Authority.

-

Himatsingka Seide: The company approves fundraise of up to Rs 500 crore through permissible modes, including issuance of shares and other eligible securities.

-

NTPC Green Energy: The company’s subsidiary declares commercial operations of 9.9 MW out of its 92.4 MW wind project in Bhuj, raising NTPC Green Energy Group’s total installed capacity to 7,563.57 MW.

-

Oriental Hotels: The company to invest $1.76 million in its subsidiary, OHL International (HK).

-

Syngene International: The company confirms news on expansion of its Biologics facility with new ADC bioconjugation capability, stating the investment is part of its ordinary business.

Listing

-

Midwest: The company is engaged in the business of exploration, mining, of natural stones. The company’s shares will debut on the stock exchange on Friday. The public issue was subscribed to 87.89x on day 3. The bids were led by QIBs (139.87 times), NIIs (168.07 times) retail investors (24.26 times), Employee reserved (24.44 times).

Bulk & Block Deals

-

Cohance: BNP Paribas Financial Markets bought & Morgan Stanley Asia sold 1.12 lakh shares at Rs 890.75 apiece.

-

EPack Prefab Techn: Bofa Securities Europe bought 5.6 lakh shares at Rs 233.82 a piece.

-

Tourism Finance Corp: Unity Associates bought 24.06 lakh shares at Rs 71.08 a piece.

-

Shiltech: Alay Jitendra Shah sold 1 lakh shares at Rs. 4,373.09 a piece.

Corporate Actions

Interim Dividend

-

Kajaria Ceramics- Rs 8 Per Share

-

LTIMindtree- Rs 22 Per Share

-

Indian Railway Finance Corporation- Rs 1.05 Per Share

-

Waaree Energies- Rs 2 Per Share

-

Cyient- Rs 16 Per Share

-

Dalmia Bharat- Rs 4 Per Share

-

Thyrocare Technologies- Rs 7 Per Share

-

HDB Financial Services – Rs 2 Per Share

Shares to Exit anchor Lock-in

-

GK Energy (2%)

-

Saatvik Green Energy (2%)

-

VMS TMT (3%)

Board Meeting

-

Bharat Rasayan (Stock Split, Bonus)

-

eClerx Services (Buyback)

-

Federal Bank (Fundraising)

Trading Tweaks

-

List of securities shortlisted in Short – Term ASM Framework Stage – I : GK Energy, Tatva Chintan Pharma Chem

-

List of securities to be excluded from ASM Framework: Knowledge Marine & Engineering Works

-

Price Band change from 10% to 5%: GK ENERGY

F&O Cues

-

Nifty Oct futures is up 0.17% to 25,950 at a premium of 80.05 points.

-

Nifty Oct futures open interest down by -4.32%

-

Nifty Options Oct. 28 Expiry: Maximum Call open interest at 26,000 and Maximum Put open interest at 25,000.

Currency/Bond Market

The rupee appreciated by 5 paise to close at 87.88 against the US dollar on Thursday, supported by a positive trend in domestic equities and risk-on sentiments amid optimism about the US-India trade deal. The yield on the 10-year bond ended one point higher at 6.54%.

. Read more on Markets by NDTV Profit.