Nifty Live Today: NMDC Shares In Focus

-

Revises Baila Fines Iron Ore price to Rs 3,900/Tn.

-

Revises Baila Lump Iron Ore price to Rs 4,600/Tn.

-

Revises Iron Ore prices effective today.

Source: Exchange Filing

IEX Shares In Focus

Kapil Sibal for IEX

-

CERC has powers to make regulation, no one can stop them

-

Grid India had raised concern on timelines for doing shadow pilot on market coupling

-

Grid India submitted a report on 16th January 2025

-

Grid India highlighted all the challenges

-

Grid India on 30th June submitted the final report

-

Grid India filed the report on 4 months historical data instead of 29 months

-

Nothing was shared with us

Ola Electric Shares In Focus

-

Softbank Fund Sells 2.15% Stake From Sept 2025 to Jan 2026

-

Softbank Fund’s stake in co now at 13.53%

After this the shares of Ola Electric shares have fallen over 2%.

Bharat Coking Coal IPO GMP

As the Bharat Coking Coal IPO gets fully subscribed on Friday, its latest grey market premium rose to Rs 9.4, according to Investorsgain website. The GMP indicates a listing price of Rs 32.4 apiece, which means upon listing, ICICI Prudential AMC may offer 40.87% additional gains to investors.

Note: GMP does not represent official data and is based on speculation.

AMFI Data: SIP Inflows In December Rose To Record High

SIP inflows in December rose to record high of Rs 31,002 crore.

Elecon Engineering Shares In Focus

Shares of Elecon Engineering Co Ltd. plunged over 13% with the stock hitting a nine-month low on Friday as the markets opened. The stock is currently trading at Rs 440.20.

Elecon Engineering posted its weakest revenue growth in six quarters, with margins under pressure. The company reported a sharp contraction of 720 basis points in EBIT margin, impacted by flat revenue, higher employee costs, and an unfavourable product mix.

Overseas operations were hit by geopolitical challenges, while gear segment revenue remained flat due to delayed order inflows.

IEX Shares In Focus As Hearing Continues

While the IEX hearing continues lets understand what is Market Coupling?

Market coupling is a framework where buy and sell bids from all power exchanges—such as IEX, PXIL, and HPX—are to be aggregated and cleared under a single market clearing price (MCP). This contrasts with the current setup where each exchange sets its own prices.

If approved, it will be a major regulatory shift in the Day-Ahead Market (DAM) mechanism, aimed at centralising electricity price discovery across India’s multiple power exchanges.

AMFI Data: Net Outflow At Rs 66,591 Crore

-

MF Industry net outflow at Rs 66,591 crore versus inflow of Rs 32,755 crore in November.

-

MF Industry net AUM at Rs 80.2 lakh crore versus Rs 80.8lakh crore (MoM).

-

Active Equity Fund Inflow at Rs 28,054 crore versus Rs 29,911 crore inflow in November.

-

Mid-Cap inflows at Rs 4,176 crore versus Rs 4,487 crore.

-

Small-Cap Inflows at Rs 3,824 crore versus Rs 4,407 crore.

-

Large-Cap Inflows at Rs 1,567 crore versus Rs 1,640 crore.

-

Flexi-Cap Inflows at Rs 10,019 crore versus Rs 8,135 crore.

-

Sectoral/Thematic Inflows at Rs 946 crore versus Rs 1,865 crore.

-

Gold ETF Inflow at Rs 11,647 crore versus Rs 3,742 crore.

-

NFO Inflows at Rs 4,074 crore versus Rs 3,126 crore.

IEX Share Price Live: CERC Seeks Time To Reply By Monday

CERC seeks time to reply by Monday as the APTEL bench begins hearing. The shares of IEX gained over 1% after it slumped over 5%.

IEX Share Price Live: Shares Recover After Slump

The shares of IEX saw recovery after CERC announcement on the market coupling case. The CERC will be passing an directive instead of an order, making this a benefit for the company.

IEX Shares In Focus

IEX shares are in focus on Friday as they fall over 5% as the Electricity Apellate Tribunal (APTEL) is set to hear the market coupling case today.

Bharat Coking Coal IPO Fully Subscribed On Day 1

-

Gets Fully Subscribed On Day 1, NIIs In Lead

-

Day 1: NII Subscription At 1.9x As Of 10:24 AM

-

Day 1: Retail Subscription At 1.4x As Of 10:24 AM

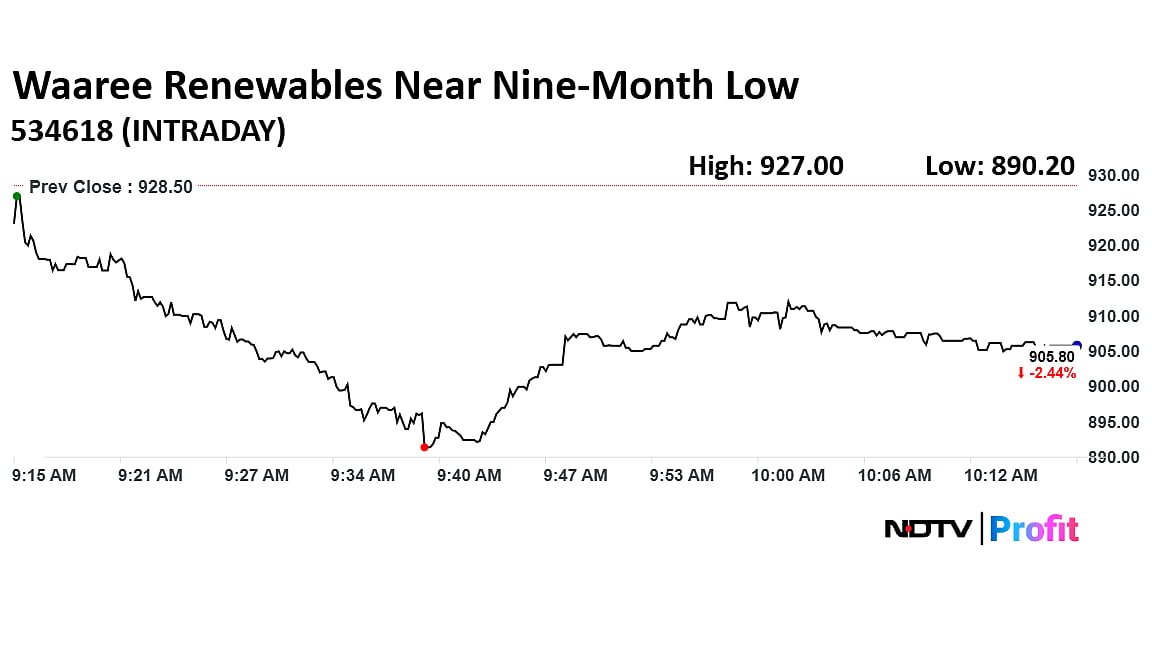

Waaree Renewable Shares In Focus

Waaree Renewables shares have fallen over 4% on Friday after it receive a revised letter of award, reducing the project value of Rs 213 crore. The scrip fell as much as 4.12% to Rs 889.29 apiece on Friday, lowest level since April 11. It pared gains to trade 2.33% lower at Rs 906.30 apiece, as of 10:17 a.m. This compares to a 0.08% decline in the NSE Nifty 50 Index.

It has fallen 27.61% in the last 12 months and 6.33% year-to-date. Total traded volume so far in the day stood at 0.54 times its 30-day average. The relative strength index was at 34.49.

HDFC Bank Shares In Focus

HDFC Bank shares were in focus on Friday after 1.55 million shares were traded in block deal. The shares extended decline for the fifth consecutive session dragging the Nifty index.

The scrip fell as much as 0.57% to Rs 941.35 apiece on Friday, highest level since Sept. 29. It pared gains to trade 0.37% lower at Rs 943.20 apiece, as of 9:59 a.m. This compares to a 0.05% advance in the NSE Nifty 50 Index.

It has fallen 43.44% in the last 12 months and 4.83% year-to-date. Total traded volume so far in the day stood at 2.15 times its 30-day average. The relative strength index was at 45.07.

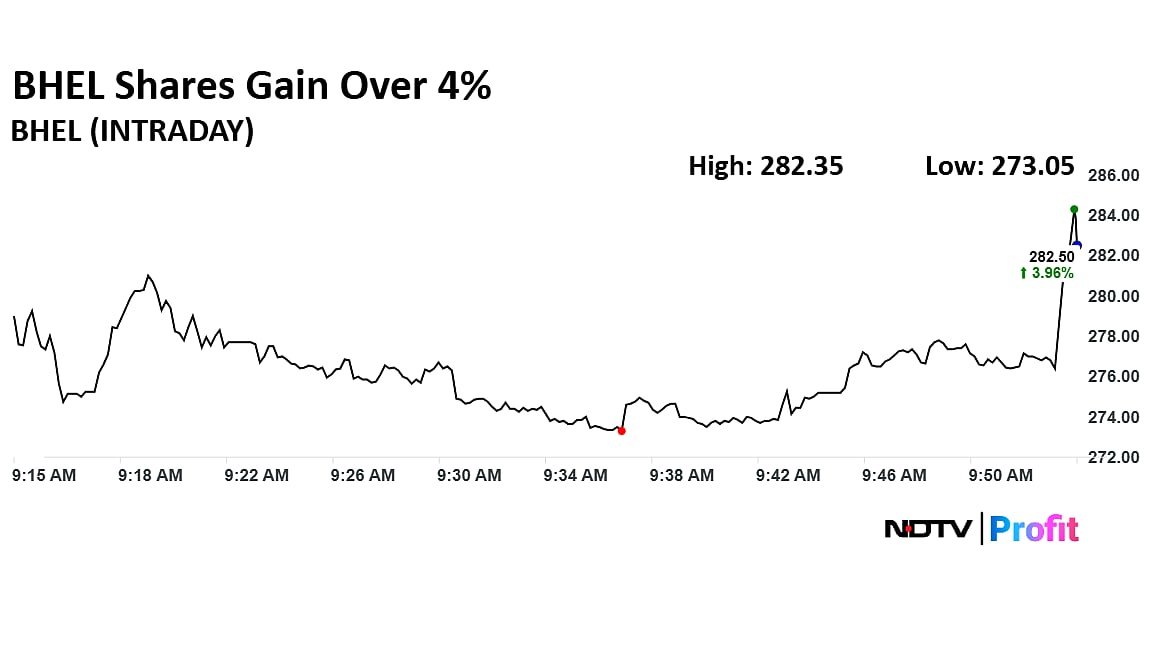

BHEL Shares In Focus

BHEL shares were in focus on Friday after brokerages are turning cautious on India’s power capital goods space as reports suggest the government may scrap the five-year-old curbs on Chinese companies bidding for government contracts. However, the company reversed its previous losses.

The scrip rose as much as 4.84% to Rs 284.90 apiece on Friday, highest level since Jan. 8. It pared gains to trade 4.25% higher at Rs 283.95 apiece, as of 9:51 a.m. This compares to a 0.03% decline in the NSE Nifty 50 Index.

It has risen 27.7% in the last 12 months and fallen 3.84% year-to-date. Total traded volume so far in the day stood at 2.15 times its 30-day average. The relative strength index was at 26.81, indicating it was oversold.

Eternal Share Price Update: Large Trade In Stock

Over 5.3 million shares of Eternal were traded via a block deal on Thursday. The share of Eternal rose as much as 3.05% to Rs 292.20 apiece.

Amid 500% Tariff Fears Important To See What Gets Included

MK Surana, Former CMD HPCL in an interview with

-

Even if the 500% tariff gets implemented, it will be necessary to see what items are getting included and excluded

-

Even with 50% tariffs, exports are increasing

-

The oil market continues to remain oversupplied

-

Expect crude prices to continue to hover around $60-65/bbl

-

Some PSU refineries can process the oil from Venezuela

Nifty, Sensex Live Updates Today: Markets Decline After Brief Gains

The markets fell after a brief period of gains. The Nifty 50 was trading 0.13% lower at 25,844.45 after it rose as much as 0.25% in the last trading session of this week. Sensex was also trading 0.13% lower as of 9:30 a.m. after it rose 0.27% in the volatile trading session. The 25,800 mark becomes crucial for the index, as it has not closed below that level since Dec. 10.

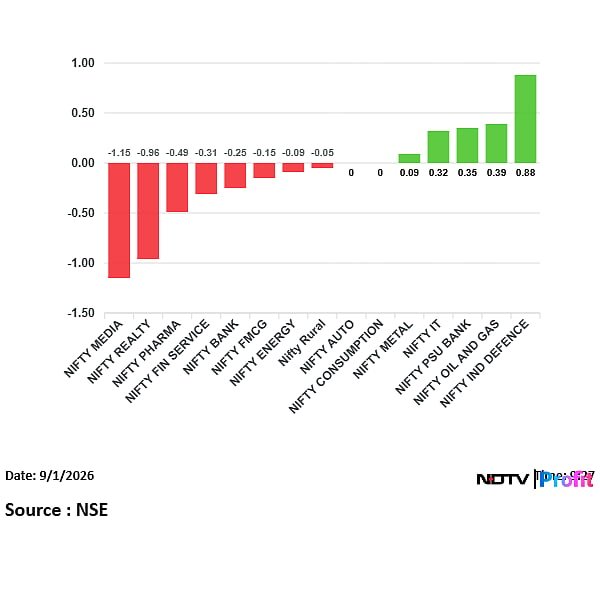

Nifty, Sensex Live Updates: Nifty Media, Nifty Realty Lead Decline

On NSE, eight out of 15 sectors were in the red. Nifty Media and Nifty Realty lead the decline, while Nifty Defence and Nifty Oil and Gas were among the sectors in green.

However, broader markets were in the red, with the NSE Midcap 150 trading 0.33% lower and NSE Smallcap was trading 0.87% lower.

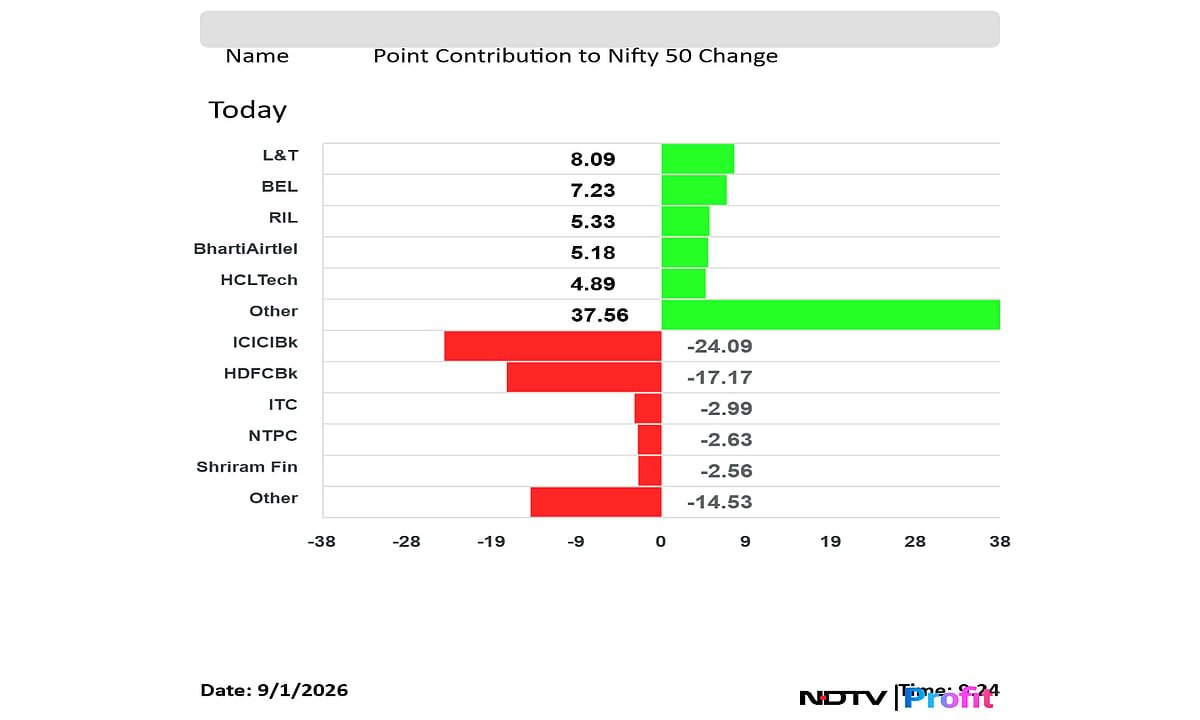

Nifty 50 Live Today: L&T, BEL Lead Gains, While ICICI Bank, HDFC Bank Drag

ICICI Bank, HDFC Bank, ITC, NTPC and Shriram Finance weighed on the Nifty 50 index.

L&T, BEL, RIL, Bharti Airtel and HCLTech added to the Nifty 50 index.

Stock Market Live Updates: Nifty Above 25,900, Sensex Gains 200 Points

The NSE Nifty 50 and BSE Sensex opened lower on Thursday extending decline for the fifth day. The Nifty 50 opened 0.14% lower at 25,840.40 and Sensex opened 0.19% down at 84,022.09. However, minutes after open the Nifty rose below 25,900 to recover and trade 0.23% higher, Sensex was also trading over 200 points higher.

Stock Market Live Updates: Nifty, Sensex Decline In Pre-Open

At pre-open, the NSE Nifty 50 was trading 36.45 points or 0.14% lower at 25,840.40. The BSE Sensex was down 158.87 points at 84,022.09.

Nifty May Touch 28,500 By Year End, Says Citi

Citi expects operating income growth of around 11% across its coverage universe in the third quarter of fiscal 2025, driven by a mixed but improving recovery in consumption, accelerating loan growth in financials, benefits of rupee depreciation for IT services, steady momentum in capital goods and reasonable growth in the typically volatile commodities space as per its latest note.

The brokerage has set a Nifty December 2026 target of 28,500, valuing the index at 20x one-year forward P/E.

Check the brokerage’s sectoral picks here.

Vodafone Idea Receives Communication On AGR Dues

Vodafone Idea receives DoT communication on AGR dues; payments capped at Rs 124 crore annually for six years, with staggered repayment plan through 2041.

Source: Exchange Filing

BHEL Most At Risk If Curbs On Chinese Power Equipment Suppliers Ease, Say Brokerages

Brokerages are turning cautious on India’s power capital goods space as reports suggest the government may scrap the five-year-old curbs on Chinese companies bidding for government contracts. Stocks such as BHEL, L&T and Siemens are seen at the centre of this debate, as easing restrictions could reshape competition, pricing and execution timelines across power generation and transmission projects.

For investors, brokerages agree that while easing restrictions could pressure certain domestic equipment players like BHEL, it could also lower costs, accelerate execution and support India’s long-term power capacity goals.

Read what brokerages have to say here.

Gold Price Check

Gold prices dropped across major Indian cities on Friday, Jan. 9, 2026, Gold pressured by a strong US dollar and reduced safe-haven demand.

Today, the yellow metal is trading at Rs 137,930 while the white metal is at Rs 2,42,940, according to Bullions website.

Bullion was near $4,465 an ounce, having risen 3.4% in the week through Thursday, and was facing some downward pressure after US initial jobless claims came in slightly lower than expected for the week ending Jan. 3.

Stock Market News Live: Global Cues To Watch

-

Dow Jones continue momentum, as Nasdaq slips

-

Rotation seen from tech stocks to other sectors

-

Mixed cues from Asian markets

-

Trump orders US government to buy $200bn in mortgage bonds

-

US trade gap lowest since June 2009

-

Dollar Index hits highest level since Dec 10

-

Oil futures extend gain to $62/bbl-Trump threat to Iran

-

Silver, Gold, Copper-continue sell-off

-

Rio Tintoi in talks to buy Glencore to create world’s largest mining

Nifty Today: What F&O Cues Indicate

-

Nifty January futures down by 1.03% to 25985 at a premium of 108 points.

-

Nifty January futures open interest up by 15.55%.

-

Nifty Options on Jan 13: Maximum Call open interest at 16200 and Maximum Put open interest at 25500.

-

Securities in ban period: SAIL and Sammaan Capital.

Dollar Check

-

The US Dollar index is up 0.09% at 98.712.

-

Euro was down 0.08% at 1.1649.

-

Pound was down 0.03% at 1.3430.

-

Yen was up 0.20% at 157.09.

Stock Market News Live: Global Check

Asian stocks opened slightly higher after their first two-day decline of the year, as investors awaited Friday’s US payrolls data and a potential Supreme Court decision on President Donald Trump’s tariff policies. Equities rose in Japan and Australia, while South Korea underperformed.

-

S&P 500 futures were unchanged as of 10:07 a.m. Tokyo time

-

Japan’s Topix rose 0.3%

-

Australia’s S&P/ASX 200 rose 0.3%

-

Euro Stoxx 50 futures fell 0.4%

Stock Market Live Update: GIFT Nifty Hints At Positive Opening

Good morning readers.

The GIFT Nifty was trading near 26,017 early on Thursday. The futures contract based on the benchmark Nifty 50 rose 0.12% at 26,000 as of 6:47 a.m. indicating a positive start for the Indian markets. This comes as the Asian markets gained modestly at the open.

In the previous session on Thursday, the benchmark ended lower for the fourth consecutive session. The NSE Nifty 50 ended 263.90 points or 1.01% lower at 25,876.85, while the BSE Sensex closed 780.18 points or 0.92% lower at 84,180.96.

. Read more on Markets by NDTV Profit.