Gold Vs SIP: What Rs 5,000 Per Month Investment Can Grow Into In 15 Years?

Wealth accumulation with consistent savings requires long-term financial planning. With so many investment options available in the market, choosing the appropriate savings instruments could be confusing. However, gold, mutual funds and fixed deposits, among others, are some of the most popular savings options among investors across all income groups.

Learn more here.

Stock Market Live: PB Fintech Earnings Call Highlights

-

Core business is growing for over 40% last 7 quarters.

-

Focus is entirely on growth than on Profit.

-

Focus is on growth; profit will automatically come.

-

Will be focus on growing secured part in Paisabazaar.

-

We are not in market share gain ;we are in market scale game.

-

In savings, we are at 2% market share from 0.4% share during IPO.

-

Pension is very big opportunity going forward.

-

Our no of customer is growing faster than the premium growth.

-

Customers are seeing value in our products which led to growth.

New initiatives

-

UAE business has become profitable.

-

PSOPs have been improving in margins.

-

ESOP compensation is based on the performance of share price.

-

ULIP is more efficient as equity is more efficient solution in long term.

-

Percentage of business we are doing with smaller business is growing very fast.

-

Paisa is not big revenue driver right now.

-

In lending, focusing on quality of book.

-

There will little bit drag in cashflows till September due to 1/n…

-

Sticking with long term profitability guidance.

-

On savings side seeing good growth in pensions.

-

Negative credit business has been problem.

-

Negative credit business led to shrink in contribution margin.

-

Seeing uptrend in renewal take rates.

-

Health segment is going good in renewal.

-

Renewal rates in health are quite high.

-

82% percent are new customers.

-

Q3 will be quarter will see things improving.

-

Expecting healthy growth from Q3.

Stock Market Live Update: Suzlon Energy Shares Rise 6% After Winning 381 MW Order From Zelestra

Suzlon Energy Ltd. shares rose over 6% during early trade on Friday after it announced a new order of 381 MW from Zelestra India and its affiliates.

“The 381 MW project, involving 127 of Suzlon’s S144 turbines, will be spread across Maharashtra (180 MW), Madhya Pradesh (180 MW), and Tamil Nadu (21 MW),” the company said in a press release.

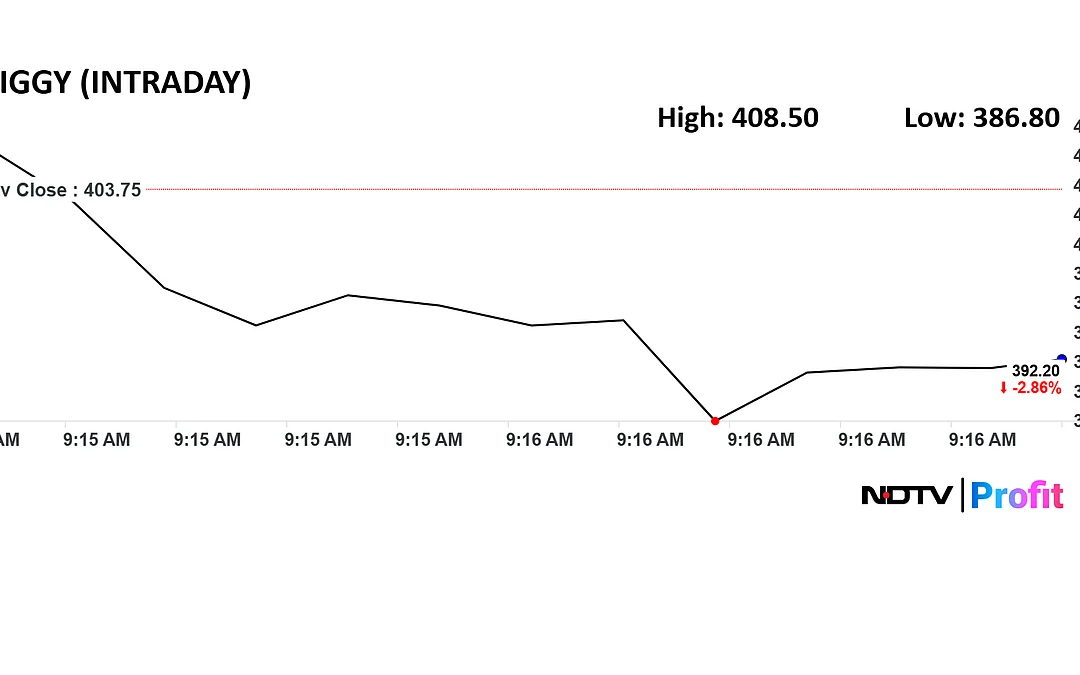

Stock Market Live: Swiggy Share Price Falls 4% After Q1 Loss Widens

Swiggy Ltd. shares fell during early trade on Friday after the delivery company’s first-quarter net loss widened despite revenue growth beating estimates.

Swiggy’s net loss widened to Rs 1,197 crore in the June quarter, compared to Rs 1,081 crore in the previous quarter. Revenue from operations rose 12.5% sequentially to Rs 4,961 crore in the June quarter, higher than the Bloomberg consensus estimate of Rs 4,878 crore.

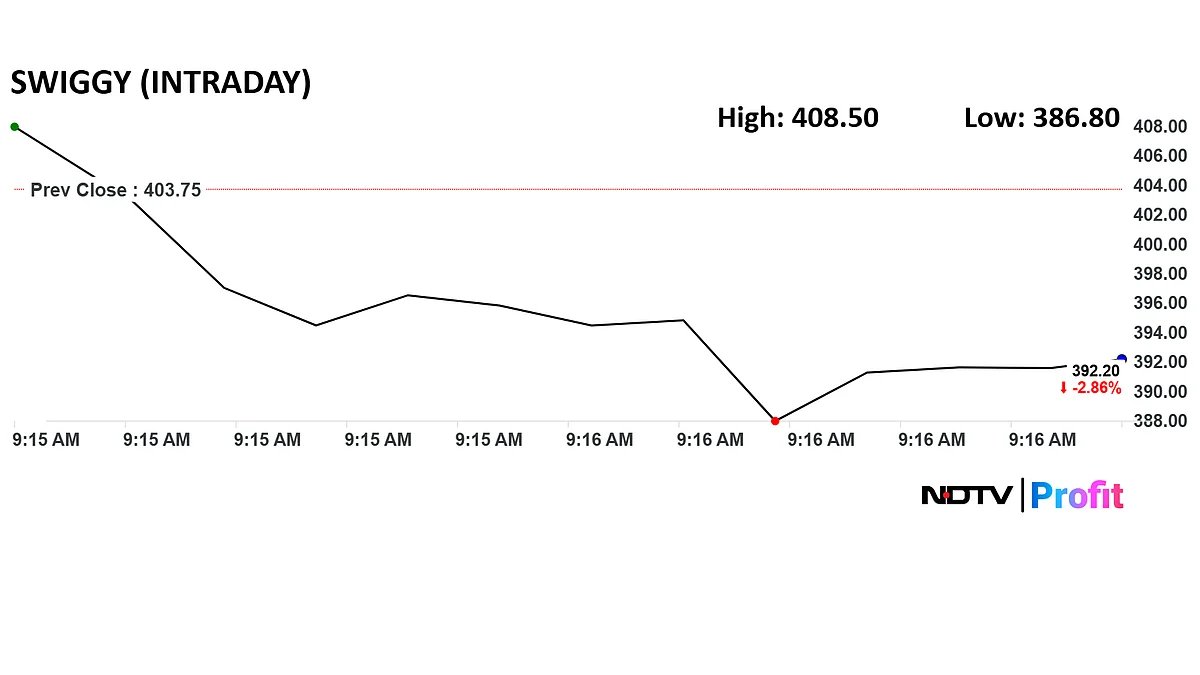

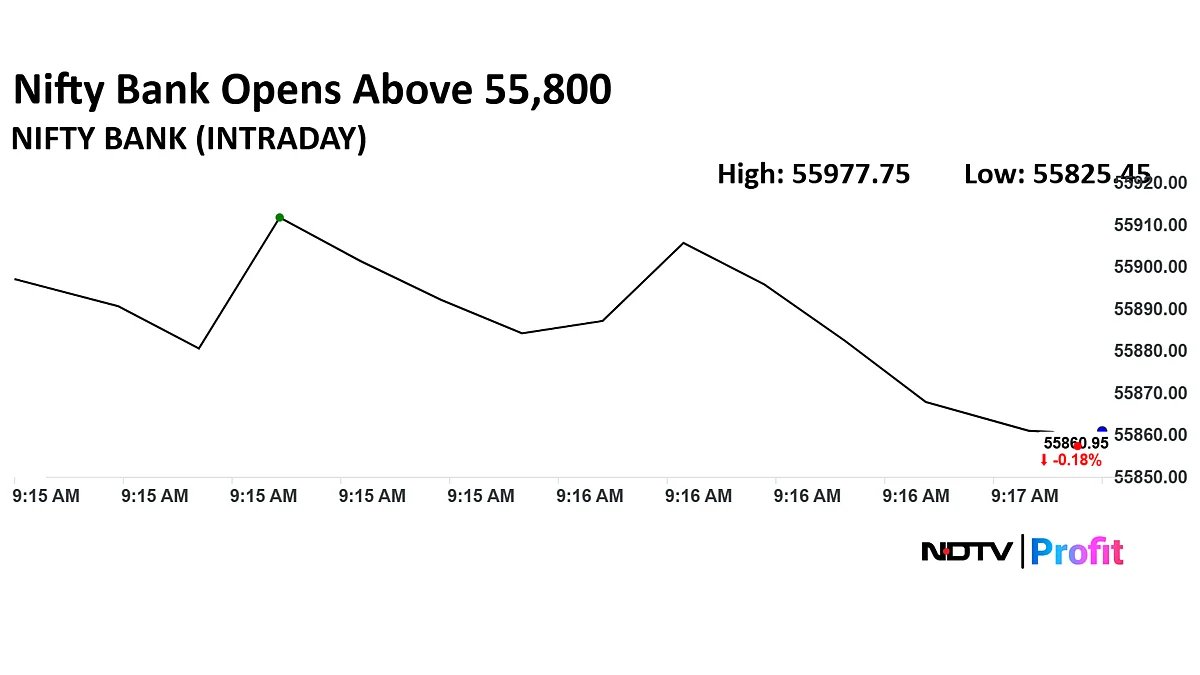

Sectoral Performance At Open: Nifty FMCG Outperforms

On National Stock Exchange Ltd., six sectoral indices advanced, nine sectoral indices declined out of 15. The NSE Nifty FMCG rose the most, while the NSE Nifty Pharma declined the most.

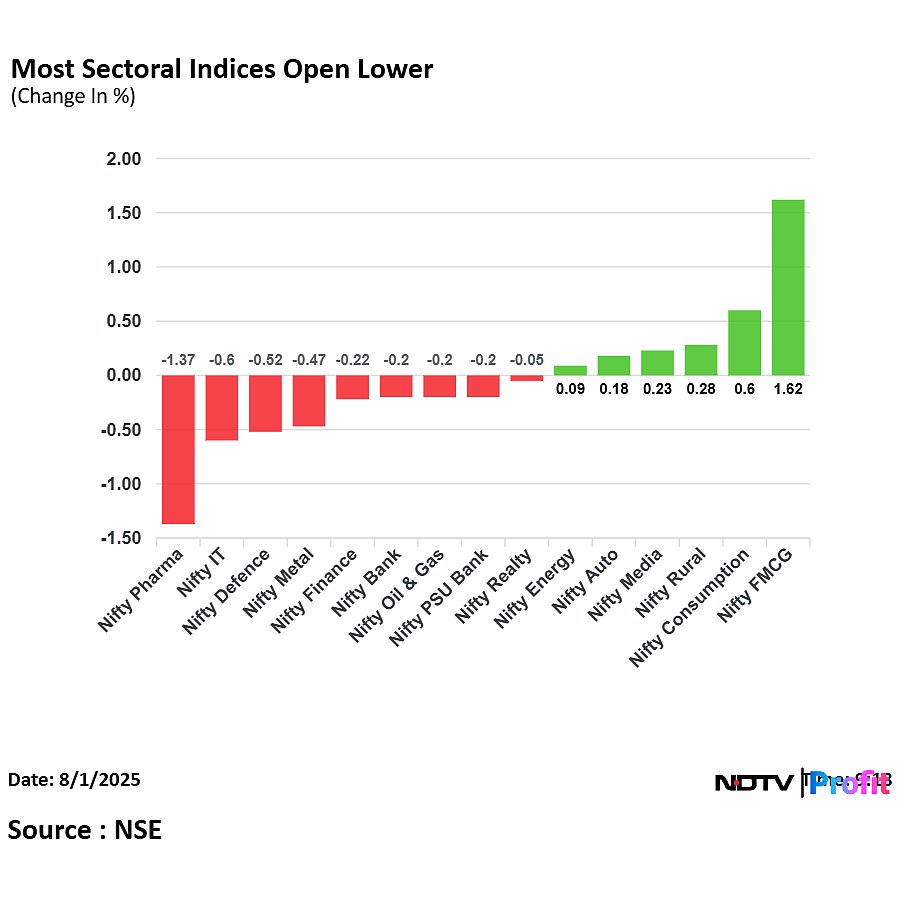

Nifty Contributors: HUL, Maruti Suzuki Limit Losses

Hindustan Unilever Ltd., Maruti Suzuki India Ltd., Eicher Motors Ltd., ITC Ltd., and HDFC Bank Ltd. limited losses in the NSE Nifty 50 index.

Sun Pharmaceutical Industries Ltd., Infosys Ltd., ICICI Bank Ltd., Larsen & Toubro Ltd., and Mahindra & Mahindra Ltd. weighed on the Nifty 50 index.

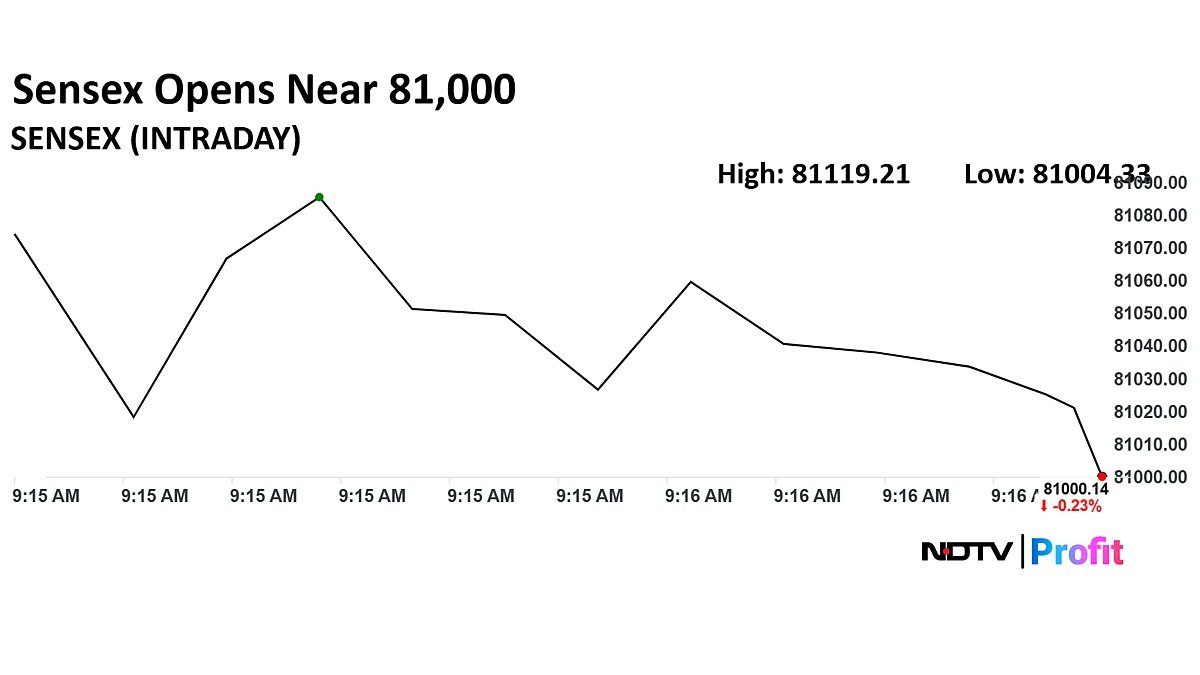

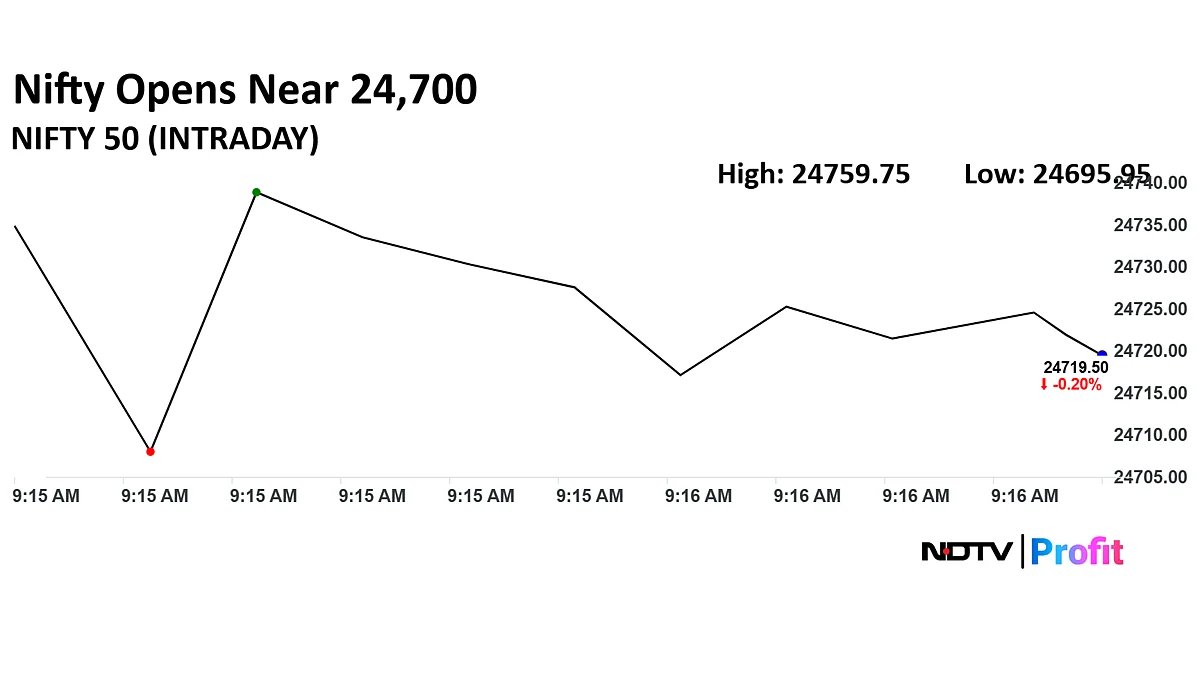

Stock Market Today: Nifty, Sensex Continue To Log Losses As Traders Assess Consequence Of New US Tariffs

The NSE Nifty 50 and BSE Sensex continued to log losses in Friday’s session as risk-off sentiment prevailed while traders assessed the consequence of new US tariffs and penalties. The Nifty 50 and Sensex were trading 0.17% and 0.18%, down respectively as of 9:22 a.m.

“Analysts expect a 0.1 to 0.4 percentage point drag on GDP growth, depending on whether a trade deal materialises by fall. This development could pressure the Sensex and Nifty in the near term, especially in export-oriented segments, and weigh on earnings visibility,” said Vineet Agrawal, Co-founder of Jiraaf. “Markets will remain highly sensitive to both geopolitical developments and the central bank’s response in the coming weeks.”

Stock Market Live: Suzlon Energy Secures Wind Power Project From Zelestra India

Suzlon Energy has secured a 381 MW wind power project from Zelestra India and affiliates. The project will span across Maharashtra, Madhya Pradesh, and Tamil Nadu.

Stock Market Today Live: Nifty, Sensex Extend Losses At Pre-Open

At pre-open, the NSE Nifty 50 was trading 0.14% down at 24,734.90, and the BSE Sensex was trading 0.14% down at 81,074.58.

Yield On The 10-Year Bond Opens Flat

-

The 10-year bond yield opened flat at 6.37%

Source: Cogencis

Rupee Opens Flat Against US Dollar

-

Rupee opened flat at 87.60 a dollar

Source: Cogencis

Stock Market Today Live Update: JPMorgan On Coal India

-

Maintain Neutral with a target price of Rs 415

-

First quarter was largely in-line results; volume recovery will remain key

-

Higher-than-expected e-auction premium of 50%; likely that Q2 premium will remain lower than last year

-

Don’t see any negatives from the print

-

Expect a slight positive revision to consensus estimates given the 5% beat on PAT

-

Coal India’s volume prints and the trajectory of the e-auction premium will be key

NDTV Profit Exclusive: Jane Street: Tax Dept Probes Treaty Shopping Via Mauritius Entity

-

Jane Street used Mauritius arm to trade in F&O, booked profits tax-free

-

Allegedly claimed India–Mauritius treaty benefit to avoid capital gains tax

-

Booked losses on equity investments in Indian cos, paid zero tax

-

Shifted F&O profits to Mauritius entity to claim treaty benefit

-

Officials are of the view that Nuvama, being sole clearing agent, is liable to withhold tax under Indian tax laws

Alert: I-T Dept surveyed Nuvama’s headquarters in Mumbai on Thursday

Source: People In The Know

Oil Prices Fall In Asia Session

Oil prices fell over 1% in Asia session Friday as market participants became concerned about the demand amid new tariff rates.

The October future contract was trading 0.06% at $71.00 a barrel as of 7:38 a.m.

Asia Market Live Update: KOSPI Declines Over 3%

South Korea’s benchmark index KOSPI was trading over 3% down early morning Friday as market participants analysed the probable consequences of US President Donald Trump’s latest tariff.

The KOSPI was trading 3.02% down, and the Nikkei 225 fell 0.36% down as of 7:22 a.m.

The Hang Seng and CSI 300 were trading higher bucking the trend in Asia.

US Market Live Update: S&P 500 And Dow Jones Futures Decline On Tariff Concerns

The S&P 500, Dow Jones Industrial Average, and Nasdaq 100 futures declined in Asia session as uncertainty over tariffs weighed. US President Donald Trump said that the country will maintain a minimum tariff of 10% and countries with trade surplus will face 15% tariff.

The S&P 500 and Dow Jones Industrial Average were trading 0.08% down. The S&P 500 and Nasdaq 100 futures declined 0.13% and 0.18%, respectively as of 7:19 a.m.

GIFT Nifty Implies Positive Open; Coal India, Swiggy, Tata Steel Shares In Focus

The GIFT Nifty was trading 0.06% or 14.50 points higher at 24,721.00 as of 6:35 a.m., which implied a positive open for the benchmark Nifty 50 index.

Traders will monitor Coal India Ltd., Swiggy Ltd., Tata Steel Ltd., ITC Ltd., and Godrej Properties share prices.

Indian stock markets snapped a four-month rally to end July in losses as simmering trade tensions with the US triggered a risk-off sentiment and caused a flight of foreign capital. Both the Nifty 50 and BSE Sensex shed 2.9% this month.

The Nifty settled 86.7 points or 0.35% lower at 24,768.35 on Thursday, when monthly futures contracts expired. The BSE Sensex lost 296.28 points or 0.36% to close at 81,185.58.

. Read more on Markets by NDTV Profit.