A mixed batch of economic data failed to stop the S&P 500 from pushing within a striking distance of a record high, with Treasury yields falling alongside the dollar amid growing bets on Federal Reserve rate cuts.

The US equity benchmark hovered near 6,130 and is now just a few points away from its Feb. 19 closing peak of 6,144.15. Banks led gains on Thursday as a veteran industry analyst said said that as long as there’s no recession, it’s “game on” for the stocks. Micron Technology Inc. gave an upbeat forecast, but the chipmaker shares faded as some investors expected more.

S&P 500 near record.

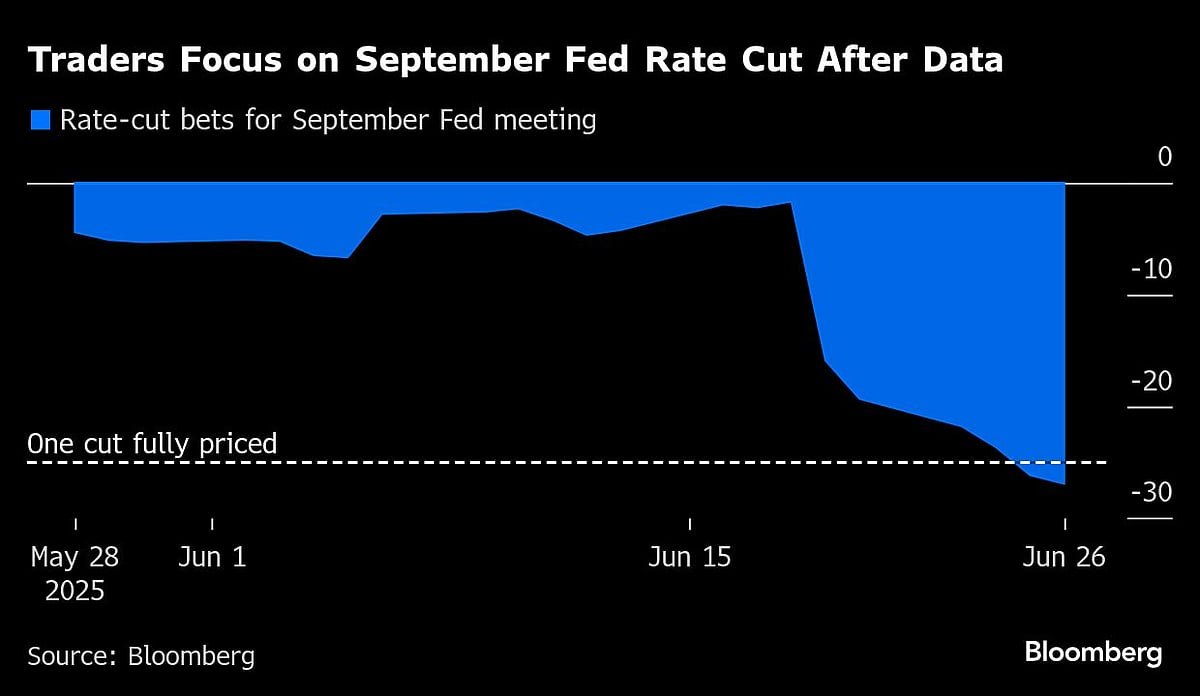

A rally in short-dated Treasuries gathered pace as a raft of economic data on balance favored wagers on as many as three Fed cuts this year. Traders continued to expect officials to slash rates in September – with two cuts fully priced in by year-end. A third cut is about half priced in. The greenback hit the lowest since 2022.

US consumer spending grew in the first quarter at the weakest pace since the onset of the pandemic. As a result, gross domestic product declined at a downwardly revised 0.5% annualized rate. Recurring applications for unemployment benefits rose to the highest since November 2021 – but initial claims decreased.

“The economy is slowing, but remains resilient,” said Chris Larkin at E*Trade from Morgan Stanley. “While the numbers as a whole don’t necessarily make a compelling case for bulls or bears, for the time being, the market appears fixated on tech strength and the S&P 500’s potential return to record levels.”

Indeed, Wall Street’s renewed push to record highs reflects confidence in artificial intelligence-fueled corporate expansion and economic resilience, with investors setting aside recent geopolitical fears.

While it’s very encouraging to see stocks back near record highs, there are plenty of questions on the next catalyst needed to propel stocks further from here, according to Paul Stanley at Granite Bay Wealth Management.

“In mid-July, earnings season begins, and that will act as a more concrete gauge on how companies have grappled with tariff uncertainty during the months of April and May, which were months with extreme headline risk,” he said. “The biggest risk right now isn’t missing out — it’s overreacting to short-term news, which could cause harmful investing mistakes.”

To Bret Kenwell at eToro, investors want to see two things come out of the second quarter: Better-than-expected earnings growth and a rebound to positive annualized GDP growth.

“If the latter is achieved, the US will avoid the technical definition of a recession,” Kenwell said. “Further, if management tells a good story about the consumer and current business trends, it should give investors further reassurance.”

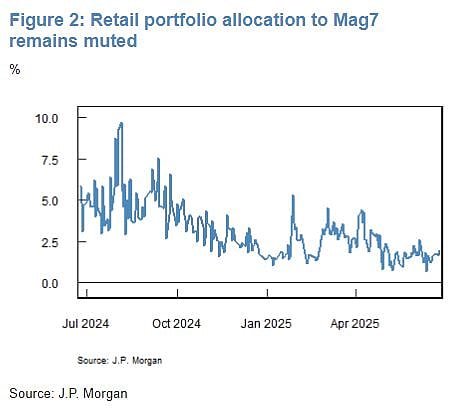

As the US stock market nears a fresh all-time high, retail investors are piling into equities.

The group purchased a net $3.2 billion of stocks in the five-day period through Wednesday’s close, according to data compiled by JPMorgan Chase & Co. quantitative and derivative strategist Emma Wu. That marks a sharp reversal from the lull over the prior week, she said in a report.

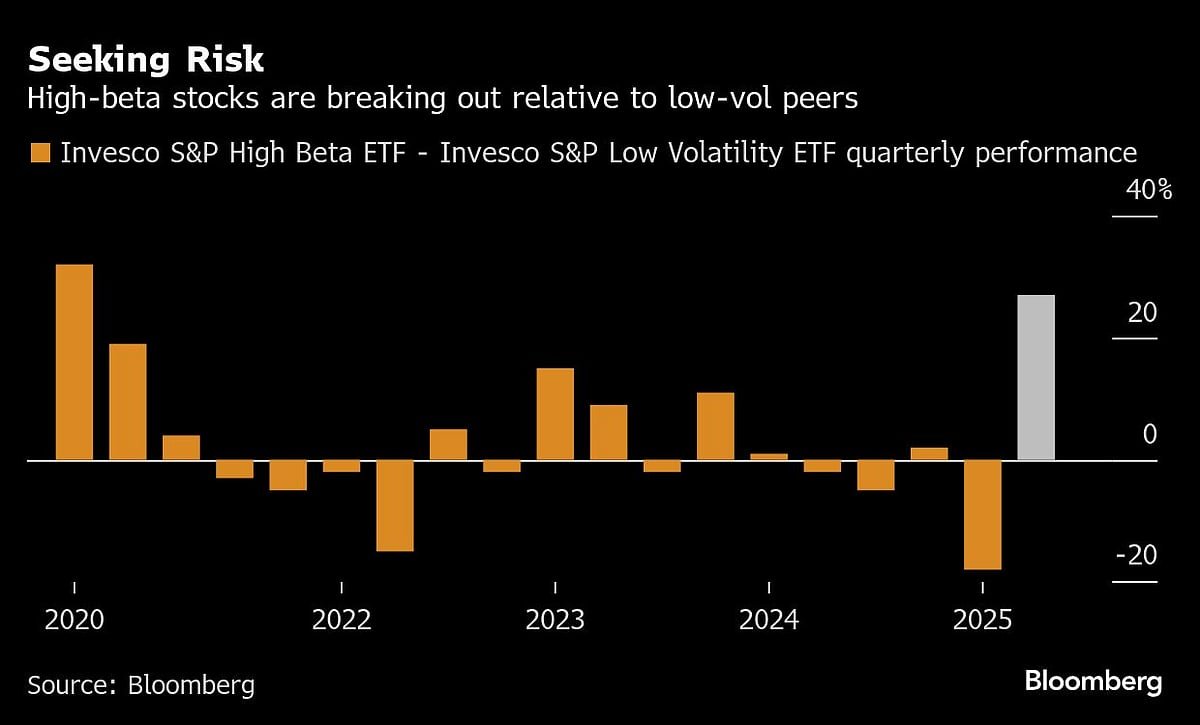

Another aspect of the rally to all-time highs is that investors are rushing into speculative and volatile edges of the stock market. The Invesco S&P 500 High Beta ETF, which tracks highly volatile stocks, is on track for its best quarter since 2020 relative to the Invesco S&P 500 Low Volatility ETF. A Goldman Sachs gauge of stocks with weak balance sheets is set for the best month relative to the S&P 500 since September.

“This is the very beginning of a period of FOMO that happens in the late stages of every structural bull market — every single one,” said Julian Emanuel at Evercore ISI. “What we are surprised by is the speed at which speculation has been embraced given the record bearishness just a little over two months ago and also in light of what continues to be significant economic and policy uncertainty.”

With tech stocks powering major US indexes toward record highs, technical analysts see the makings of a pullback in the coming months unless more sectors join the rally. The equal-weighted version of the S&P 500, which is often seen as a better reflection of market participation, is about 4% below its record touched in November.

“The markets are very overbought on a short-term basis and leadership is concentrated heavily toward S&P 500 and Nasdaq 100,” said Dan Wantrobski at Janney Montgomery Scott. “If breadth does not follow the breakouts in S&P and Nasdaq, then we will be on the watch for a correction.”

Another aspect of the rally to all-time highs is that investors are rushing into speculative and volatile edges of the stock market. The Invesco S&P 500 High Beta ETF, which tracks highly volatile stocks, is on track for its best quarter since 2020 relative to the Invesco S&P 500 Low Volatility ETF. A Goldman Sachs gauge of stocks with weak balance sheets is set for the best month relative to the S&P 500 since September.

“This is the very beginning of a period of FOMO that happens in the late stages of every structural bull market — every single one,” said Julian Emanuel at Evercore ISI. “What we are surprised by is the speed at which speculation has been embraced given the record bearishness just a little over two months ago and also in light of what continues to be significant economic and policy uncertainty.”

With tech stocks powering major US indexes toward record highs, technical analysts see the makings of a pullback in the coming months unless more sectors join the rally. The equal-weighted version of the S&P 500, which is often seen as a better reflection of market participation, is about 4% below its record touched in November.

“The markets are very overbought on a short-term basis and leadership is concentrated heavily toward S&P 500 and Nasdaq 100,” said Dan Wantrobski at Janney Montgomery Scott. “If breadth does not follow the breakouts in S&P and Nasdaq, then we will be on the watch for a correction.”

A flurry of Fed officials this week made clear they’ll need a few more months to gain confidence that tariff-driven price hikes won’t raise inflation in a persistent way.

In an interview Thursday on Bloomberg Surveillance, San Francisco Fed chief Mary Daly acknowledged she’s seeing increasing evidence that tariffs may not lead to a large or sustained inflation surge. But that merely made her open to a rate cut “in the fall.”

Richmond Fed President Tom Barkin said he expects tariffs will put upward pressure on prices. With so much remaining uncertain, he added, the central bank should wait for more clarity before adjusting rates.

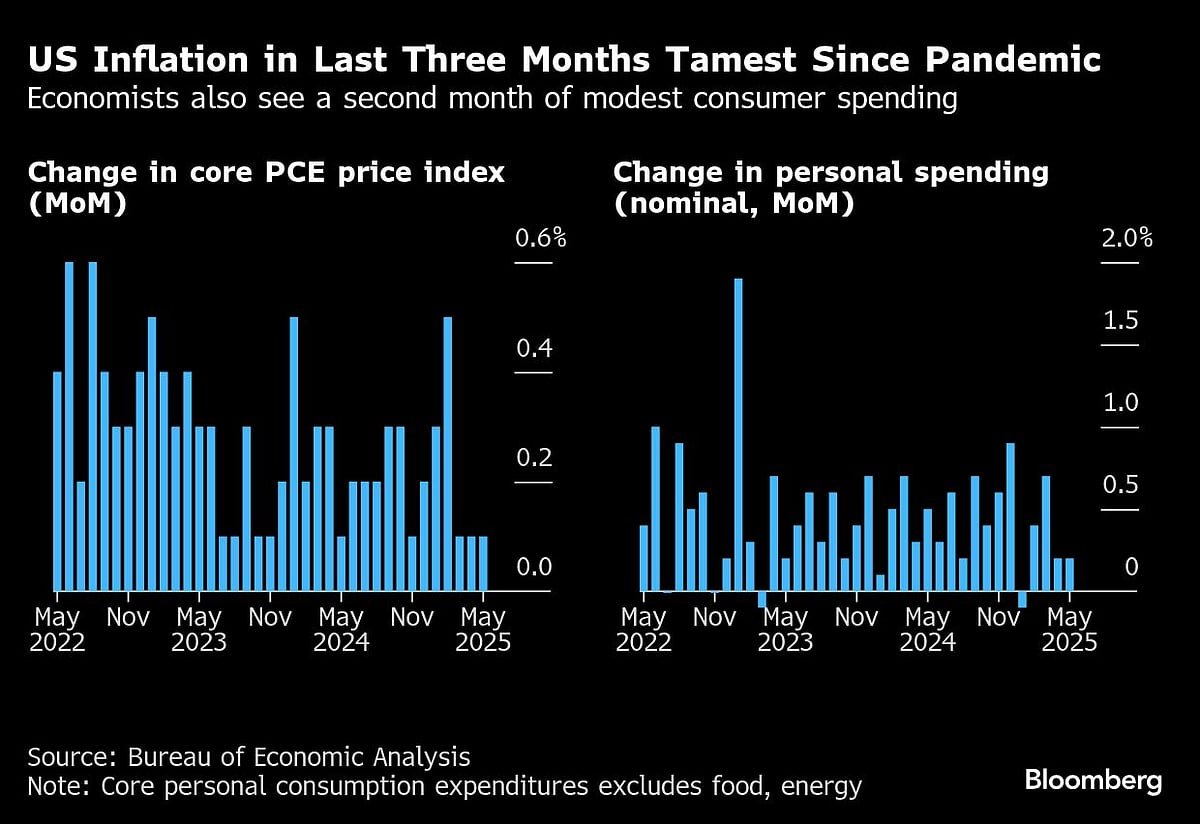

US inflation probably inched higher in May, offering scant evidence of extensive tariff-related repercussions that the Fed expects to become more apparent later in the year.

Economists see the personal consumption expenditures price index excluding food and energy — the Fed’s preferred gauge of underlying inflation — rising 0.1% in May for a third month. That would mark the tamest three-month stretch since the pandemic five years ago.

“Friday’s PCE data will help to confirm whether or not the past few months of soft inflation data has staying power,” said Stanley at Granite Bay Wealth Management. “The market is anxious for validation that inflation is truly easing. A cooler PCE could give the hope that the Fed will still cut later this year.”

Meantime, a report that President Donald Trump is considering naming Fed Chair Jerome Powell’s successor well before the end of his term also drew investor attention The Wall Street Journal said Trump may reveal his pick to run the central bank by September or October.

“Messaging from a dovish incoming Chair could potentially overshadow the hawkish skew to Powell’s wait-and-see signals,” said Ian Lyngen and Vail Hartman at BMO Capital Markets. “That certainly appears to be how the market is interpreting the risks as evidenced by the grinding bid for Treasuries.”

The Fed is an institution that will continue carrying out its tasks, but if its independence were in question, then the financial markets will quickly protest, Russell Brownback, a portfolio manager at BlackRock Inc., said on Bloomberg Television Thursday.

“I don’t think the independence of the Fed is in jeopardy,” he said. “I think the markets would protest any kind of degradation of that independence very quickly.”

Corporate Highlights:

-

Walgreens Boots Alliance Inc. reported quarterly profit that beat Wall Street’s expectations, a hopeful sign as the pharmacy giant prepares to transform into a private company after its market value plummeted due to retail competition and lower prescription drug payments from insurance companies.

-

Apple Inc. had its price target cut at JPMorgan Chase & Co. to $230 from $240 on the iPhone 17’s incremental lineup launch.

-

Salesforce Inc. Chief Executive Officer Marc Benioff said his company has automated a significant chunk of work with AI, another example of a firm touting labor-replacing potential of the emerging technology.

-

JetBlue Airways Corp.’s second-largest shareholder is calling on the US carrier to shrink its board to five people from the current 13 as part of efforts to slash spending and return to profits.

-

Jefferies Financial Group Inc.’s second-quarter earnings declined on a slump in the firm’s investment-banking and capital-markets businesses, with activity muted by economic and geopolitical turmoil.

-

Impossible Foods Inc. is set to add its plant-based burgers to European menus this year, ending a six-year quest to enter the world’s biggest market for meat alternatives.

-

Shares in Carrefour SA tumbled to their lowest level since 1993 after analysts at JPMorgan Chase & Co. said the French grocer’s first-half results next month may trigger further declines.

-

Shell Plc said it has no intention of making a takeover offer for BP Plc, refuting an earlier report that two of Europe’s biggest companies were in active merger talks.

-

Short sellers raised their wagers against Worldline SA’s bonds and shares in the days leading up to news reports that the French firm allegedly covered up fraud by some of its customers.

Some of the main moves in markets:

Stocks

-

The S&P 500 rose 0.7% as of 12:04 p.m. New York time

-

The Nasdaq 100 rose 0.8%

-

The Dow Jones Industrial Average rose 0.7%

-

The Stoxx Europe 600 was little changed

-

The MSCI World Index rose 0.8%

-

Bloomberg Magnificent 7 Total Return Index rose 0.9%

-

The Russell 2000 Index rose 0.9%

-

KBW Bank Index rose 1.2%

Currencies

-

The Bloomberg Dollar Spot Index fell 0.5%

-

The euro rose 0.5% to $1.1716

-

The British pound rose 0.6% to $1.3750

-

The Japanese yen rose 0.6% to 144.36 per dollar

Cryptocurrencies

-

Bitcoin fell 0.4% to $107,389.33

-

Ether fell 0.2% to $2,434.71

Bonds

-

The yield on 10-year Treasuries declined one basis point to 4.28%

-

Germany’s 10-year yield was little changed at 2.57%

-

Britain’s 10-year yield was little changed at 4.47%

Commodities

-

West Texas Intermediate crude rose 1.5% to $65.89 a barrel

-

Spot gold fell 0.2% to $3,324.77 an ounce

. Read more on Markets by NDTV Profit.