Semiconductor stocks extended their rally in 2026, with the PHLX Semiconductor Sector (NASDAQ:SOX) index up 10.14% year-to-date, and reinforcing Cantor Fitzgerald’s view that the sector remains a must-own.

Cantor’s Semiconductor analyst C.J. Muse evaluates the outlook for the top chip stocks, Advanced Micro Devices (NASDAQ:AMD), Qualcomm (NASDAQ:QCOM), and Microchip Technology (NASDAQ:MCHP) ahead of their results this week.

AMD Poised to Beat Q4, Raise Outlook

AMD is expected to slightly beat December-quarter results and raise March-quarter guidance, benefiting from Intel Corp‘s (NASDAQ:INTC) wafer transition issues. Strength should come from data center CPUs and GPUs, driven by agentic AI, server demand, and upcoming MI 400-series launches. While client unit volumes may be constrained by supply, higher average selling prices in both client and server segments should support performance, Muse noted.

AMD will report quarterly earnings on Tuesday, with analysts expecting EPS of $1.24. Last quarter, AMD beat EPS estimates by $0.11, driving a 2.51% rise in shares the following day.

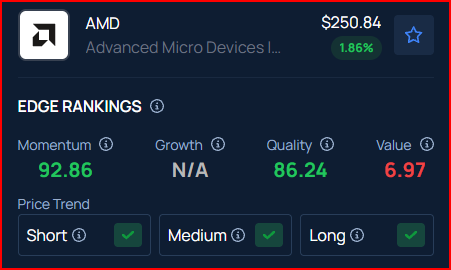

Benzinga’s Edge Rankings place AMD in the 92nd percentile for momentum and the 86th percentile for quality, reflecting its strong performance. Benzinga’s screener allows you to compare AMD’s performance with its peers.

Price Action: Over the past …