Q2 Results Live: Earnings In Focus Tomorrow

With this, we end today’s coverage of September quarter results. Big names in focus tomorrow include Reliance Industries, 360 One WAM, JSW Steel, Hindustan Zinc, PVR Inox, Tata Technologies and more.

(This live blog has ended).

Q2 Results Live: Waaree Energies Profit More Than Doubles

Waaree Energies Q2FY26 Highlights (Consolidated, YoY)

-

Revenue up 69.7% to Rs 6,065.64 crore versus Rs 3,574.38 crore

-

Net Profit at Rs 842.55 crore versus Rs 361.65 crore

-

Ebitda at Rs 1,406.40 crore versus Rs 524.85 crore

-

Margin at 23.2% versus 14.7%

Q2 Results Live: Sunteck Realty Profit Up 41%

Sunteck Realty Q2FY26 Highlights (Consolidated, YoY)

-

Revenue up 49.3% at Rs 252 crore versus Rs 169 crore.

-

Ebitda at Rs 77.8 crore versus Rs 37.4 crore.

-

Ebitda margin at 30.8% versus 22.1%

-

Net profit up 41.4% at Rs 49 crore versus Rs 34.6 crore.

Wipro Q2 Results Live: BFSI Sees Momentum

-

Deals wins in H1 are starting to ramp up

-

BFSI sees momentum, clients focus on cost optimisation & AI

-

Growth in BFSI was led by Europe & Asian markets

Source: Con Call

Infosys Q2 Results Live: Communications Sees Headwinds

-

Co sees continued traction in Agentic AI

-

FS continues to see growth & demand for AI

-

Retail clients continues to remain cautious on back of tariff uncertainty

-

Communication continues to see headwinds

-

Revenue guidance does not include addition from recent acquisitions

-

Revenue guidance does not include addition from recent acquisitions

-

Lower end of guidance has elevated uncertainty baked in

Source: Con Call

Q2 Results Live: Rallis India Margin Unchanged

Rallis India Q2FY26 Highlights (Consolidated, YoY)

-

Revenue up 7.2% at Rs 861 crore versus Rs 928 crore.

-

Ebitda down 7.2% at Rs 154 crore versus Rs 166 crore.

-

Ebitda margin flat at 17.9%

-

Net profit up 4.1% at Rs 102 crore versus Rs 98 crore.

Q2 Results Live: JSW Infra Profit Slips

JSW Infrastructure Q2FY26 Highlights (Consolidated, YoY)

-

Revenue up 26.37% at Rs 1,265 crore versus Rs 1,001 crore

-

Ebitda up 16.81% at Rs 608.59 crore versus Rs 521 crore

-

Ebitda margin down 393 bps at 48.1% versus 52.04%

-

Net profit down 2.69% at Rs 361 crore versus Rs 371 crore

Q2 Results Live: Punjab Sind Bank Profit Rises

Punjab Sind Bank Q2FY26 Highlights (YoY)

-

Net Profit up 22.9% at Rs 295 crore versus Rs 240 crore

-

NII up 8.8% at Rs 950 crore versus Rs 873 crore

-

Operating profit up 10.3% at Rs 505 crore versus Rs 458 crore

-

Provisions down 2% at Rs 148 crore versus Rs 151 crore

-

Margin at 15% versus 15.5%

-

Gross NPA at 2.9% versus 3.3% (QoQ)

-

Net NPA at 0.8% versus 0.9% (QoQ)

Q2 Results Live: CIE Automotive Profit Rises

CIE Automotive Q2FY26 Highlights (Consolidated, YoY)

-

Net Profit up 9.6% at Rs 214 crore versus Rs 195 crore

-

Revenue up 11.1% at Rs 2,372 crore versus Rs 2,135 crore

-

Ebitda up 7.6% at Rs 356 crore versus Rs 331 crore

-

Margin at 15% versus 15.5%

Q2 Results Live: Metro Brands Profit Slips

Metro Brands Q2FY26 Highlights (Consolidated, YoY)

-

Net Profit down 2.7% at Rs 67.7 crore versus Rs 69.6 crore

-

Revenue up 11.2% at Rs 651 crore versus Rs 586 crore

-

Ebitda up 10.3% at Rs 171 crore versus Rs 155 crore

-

Margin at 26.2% versus 26.4%

Q2 Results Live: Jio Finance Profit Marginally Up

Jio Financial Services Q2FY26 Highlights (Consolidated, YoY)

-

Net Profit up 0.9% at Rs 695 crore versus Rs 689 crore

-

Total Income up 44.5% at Rs 1,002 crore versus Rs 694 crore

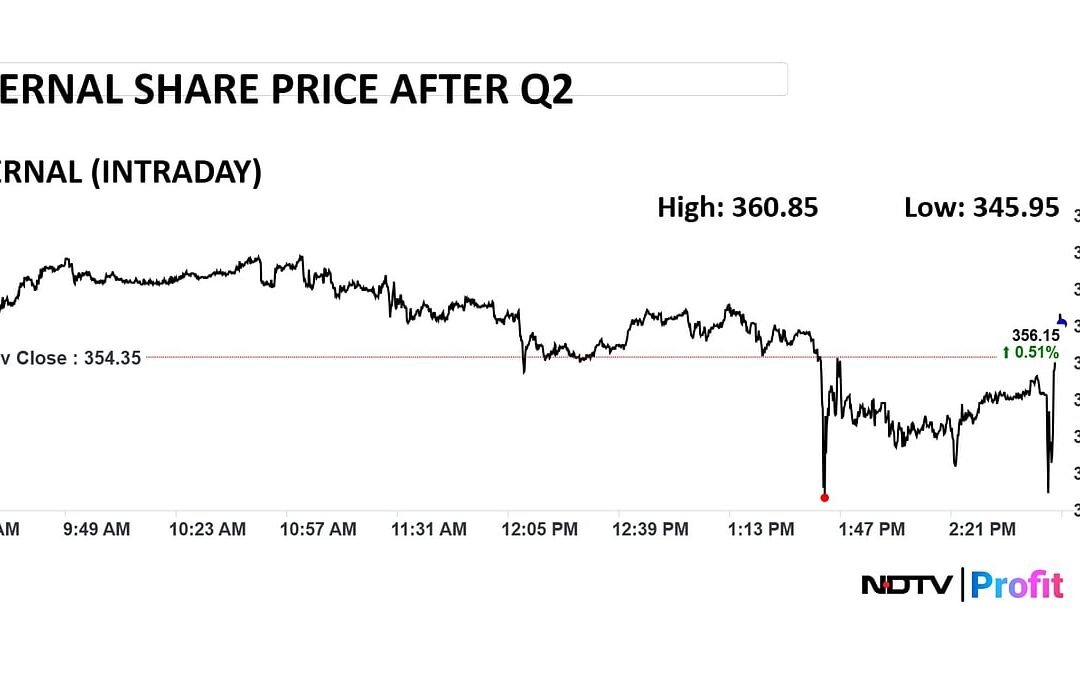

Eternal Q2 Results Live: Not Prioritising Blinkit Ebitda Breakdown

-

Will continue to invest in marketing till customer acquisition cost is healthy

-

Achieving EBITDA breakeven for Blinkit is not what we are aiming for right now

-

Customer acquisition cost in new geographies is similar to already existing market where we are expanding

Source: Con Call

Wipro Q2 Results Live: H1-B Impact Limited

CHRO Saurabh Govli:

-

Co on board 2,900 freshers in the Q2

-

No wage hikes announced on the back of macro uncertainties

-

Co has been focusing on localising

-

80% of US employees are local hires

-

Business impact from the change in H1B is very limited

Wipro Q2 Results Live: AI Platform Introduced

-

Co introduced its new AI platform Wipro Intelligence

-

In technology and communication the focus is on accelerating AI adoption

-

AI is creating consulting opportunities for the company in terms of AI advisory, data advisory

Wipro Q2 Results Live: Tariff Uncertainty Prevails

-

Tariff uncertainty continues to impact consumer, energy and manufacturing sector

-

Health care in US is under going structural changes

-

Health care remains a strong sector for the co

-

Co signs two mega deals in Q2 in health care & BFSI each

Infosys Q2 Results Live: Confident On Meeting Hiring Guidance

CFO Jayesh Sanghrajka:

-

Co has hired 12,000+ freshers in first half

-

Co remains confident meeting its annual hiring guidance

-

Project maximus continues to deliver

-

Co was able to expand margins on back of better cost management

Q2 Results Live: LTIMindtree Profit Up 12%

LTIMindtree Q2FY26 Highlights (Consolidated, QoQ)

-

Revenue up 5.6% to Rs 10,394.30 crore versus Rs 9,840.60 crore (Estimate: Rs 10,264.50 crore)

-

Net Profit up 12% to Rs 1,401.10 crore versus Rs 1,254.10 crore (Estimate: Rs 1,282.70 crore)

-

Ebit up 17% to Rs 1,648.10 crore versus Rs 1,406.50 crore (Estimate: Rs 1,532 crore)

-

Margin at 15.9% versus 14.3% (Estimate: 14.9%)

Q2 Results Live: Cyient Revenue Grows

Cyient Q2FY26 Highlights (Consolidated, QoQ)

-

Revenue up 4.0% to Rs 1,781.00 crore versus Rs 1,711.80 crore

-

Net Profit down 17% to Rs 127.50 crore versus Rs 153.80 crore

-

Ebit down 10% to Rs 146.60 crore versus Rs 162.70 crore

-

Margin at 8.2% versus 9.5%

-

To pay dividend of Rs 16 per share

Infosys Q2 Results Live: Huge Opportunity In AI Space

CEO Salil Parikh:

-

Employees with H1B requirement is limited

-

Co to have no disruption in services by H1B impact

-

Majority of US staff does not require H1B visa

-

There is huge opportunity in enterprise AI space

Source: Presser

Infosys Q2 Results Live: On H1-B Visa

-

US DOJ conducting investigation regarding how co classified certain H-1B visa-recipient employees

-

Engaged in discussions with the DoJ regarding its ongoing investigation

Wipro Q2 Results Live: Key Parameters Remain Strong

CFO Aparna Iyer:

-

Gradually returning to growth trajectory with three of our four SMUs growing sequentially in Q2

-

All key financial parameters continue to remain strong

-

Our large deal bookings in first two quarters have surpassed large deal booking for FY25

-

Cash flow conversion continues to remain strong

-

Operating cash flow at 104% of net income for the quarter

Wipro Q2 Results Live: Revenue Momentum Strengthening

MD & CEO Srinivas Pallia:

-

Revenue momentum strengthening, with Europe & APMEA returning to growth

-

Operating margins holding steady within narrow bands

-

Bookings surpassed $9.5 billion for H1FY26

-

Strategy is clear: remain resilient, adapt to global shifts, and lead with AI

Wipro Q2 Results Live: Guidance For Next Quarter

-

Expect revenue from IT services business to be in the range of $2.59-2.64 billion

-

Sequential guidance for IT services revenue at -0.5% to 1.5% in constant currency terms

Q2 Results Live: Infosys Declares Dividend

-

To pay dividend of Rs 23 per share

-

Last 12 Months attrition at 14.3% versus 14.4% (QoQ)

-

Large deal total contract value At $3.1 billion

-

Revenue growth in CC terms at 2.2% QoQ

Q2 Results Live: Infosys Profit Beats Estimates

Infosys Q2FY26 Highlights (Consolidated, QoQ)

-

Revenue up 5.2% to Rs 44,490.00 crore versus Rs 42,279.00 crore (Estimate: Rs 44,008 crore)

-

Net Profit up 6% to Rs 7,364.00 crore versus Rs 6,921.00 crore (Estimate: Rs 7,222 crore)

-

Ebit up 6% to Rs 9,353.00 crore versus Rs 8,803.00 crore (Estimate: Rs 9,338 crore)

-

Margin at 21.0% versus 20.8% (Estimate: 21.21%)

Wipro Q2 Results Live: Attrition At 14.9%

-

Attrition at 14.9% vs 15.1% (QoQ)

-

Attrition at 14.9% vs 14.5% (YoY)

-

Large deal booking at $2.9 billion, grew 90.5% YoY

-

Overall deal bookings at $4.7 billion

Q2 Results Live: Wipro Profit Down 3%

Wipro Q2FY26 Highlights (Consolidated, QoQ)

-

Revenue up 2.5% to Rs 22,697.30 crore versus Rs 22,134.60 crore

-

Net Profit down 3% to Rs 3,246.20 crore versus Rs 3,330.40 crore

-

Ebit up 4% to Rs 3,680.70 crore versus Rs 3,547.60 crore

-

Margin at 16.2% versus 16.0%

Zomato Q2 Results Live: Impact Of GST Rationalisation

-

GST rate cuts brought down the average GST on Blinkit’s typical basket by around 3%, points should drive more demand.

-

Expect a positive rub-off on demand due to this from Q3FY26 onwards

-

In Q2 , saw a negative impact on both growth and margins customers went into wait and watch mode

Q2 Results Live: Zomato On Competition

Zomato on Toing (Swiggy) and Ownly (Rapido)

-

These apps specifically target budget-conscious customers

-

Zomato app should be able to solve for such use cases without needing a new app

-

Zomato lowered minimum order value for free delivery from Rs 199 to Rs 99 for Gold members

-

Launching another food delivery app to differentiate between target

-

audiences should be carefully thought-out decision

-

Launching new app significantly increases organisational complexity

-

Will wait and watch, and are okay being the last mover

-

Will launch new app if it becomes clear that this is the right long-term approach

Source: Shareholder Letter

Q2 Results Live: Highlights From Zomato’s Shareholders

-

Q-comm net order value up 137% YoY, highest in ever 10 quarters

-

Q-comm losses shrank 4% QoQ to Rs 156 crore

-

Food delivery growth rate bottomed out and is on recovery path

-

Transition to inventory ownership model in q-comm almost complete

-

About 80% of net order value in Q2 was on own inventory model

Q2 Results Live: Highlights From Zomato’s Shareholders

-

Adjusted EBITDA loss was just INR 5 crore in the quarter (vs Rs 18 crore loss in Q1FY26).

-

Quick commerce NOV growth accelerated to 137% YoY (27% QoQ).

-

Food delivery growth rate bottomed out and is on a recovery path with 14% YoY NOV growth.

-

Food delivery profitability improved QoQ to an all time high of 5.3% of NOV.

-

GST rate cuts should drive more demand for Blinkit from Q3FY26 onwards.

-

18% GST is now applicable on the delivery charge paid by customers on food delivery orders.

-

The transition to inventory ownership in quick commerce is almost complete (80% of NOV in Q2FY26).

-

Hyperpure’s core restaurant business is expected to continue growing at 40% YoY.

-

Hyperpure restaurant business is expected to become profitable over the next two quarters.

-

The company is defending GST demands on delivery charges amounting to Rs 441 crore (Rs 420 crore+ Rs 21 crore).

Q2 Results Live: Zomato Segment Highlights

-

Food ordering and delivery revenue up 23.5% YoY at 2,485 crore

-

Quick Commerce revenue up 8.5x at 9,891 crore

-

Hyperpure supplies revenue down 30.5% at 1,023 crore

Q2 Results Live: Zomato Shares Wobble

Q2 Results Live: Zomato Revenue Beats Estimates

Eternal Q2FY26 (Consolidated, YoY)

-

Revenue at Rs 13,590 crore versus Rs 4,799 crore (Bloomberg estimate: Rs 8,665 crore)

-

EBITDA up 5.8% at Rs 239 crore versus Rs 226 crore (Estimate: Rs 236 crore)

-

Margin at 1.8% versus 4.7% (Estimate: 2.7%)

-

Profit down 63% at Rs 65 crore versus Rs 176 crore (Estimate: Rs 108 crore)

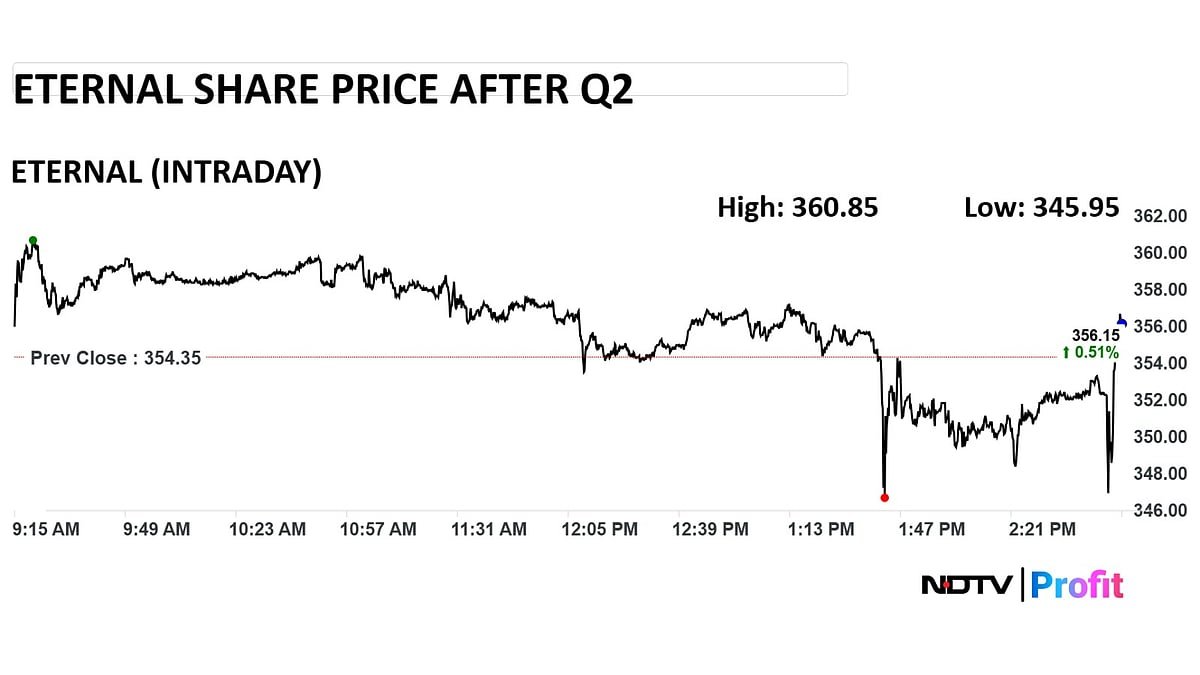

Q2 Results Live: South Indian Bank NII Falls

South Indian Bank Q2FY26 (Standalone, YoY)

-

Net Interest Income down 8.3% at Rs 809 crore versus Rs 882 crore

-

Net Profit up 8.2% at Rs 351 crore versus Rs 325 crore

-

Operating Profit down 2.7% at Rs 536 crore versus Rs 550 crore

-

Provisions down 42.5% at Rs 63.3 crore versus Rs 110 crore

-

Provisions down 73.5% at Rs 63.3 crore versus Rs 239 crore (QoQ)

-

Gross NPA at 2.93% versus 3.95% (QoQ)

-

Net NPA at 0.56% versus 0.68% (QoQ)

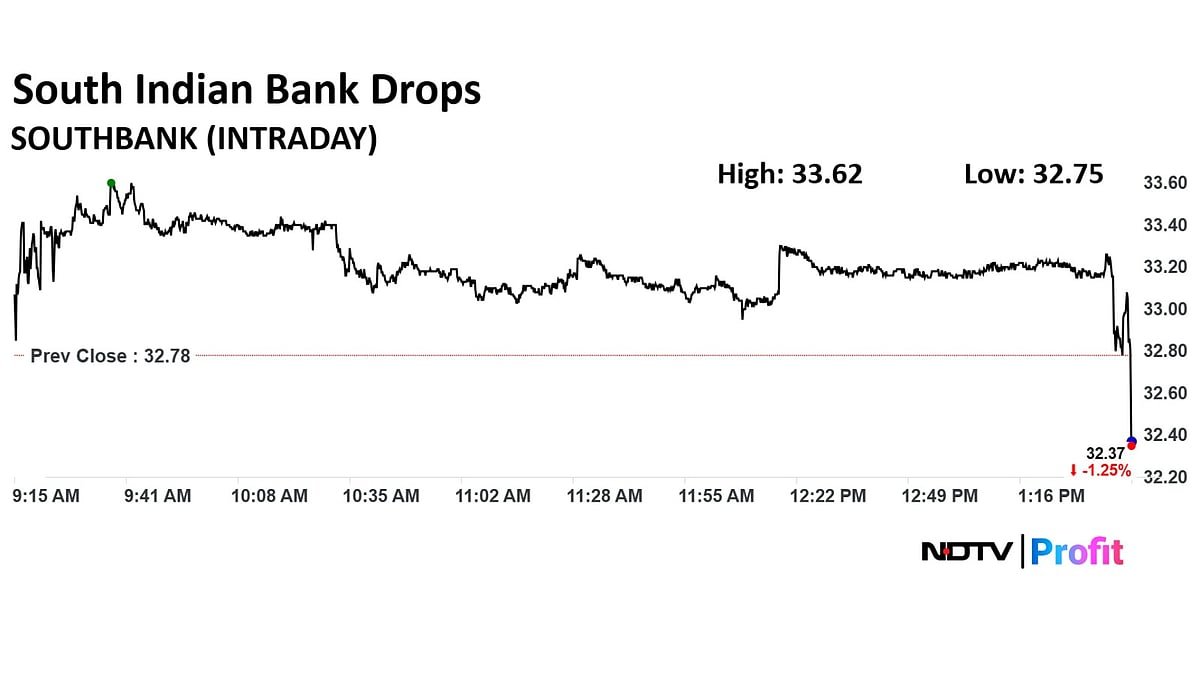

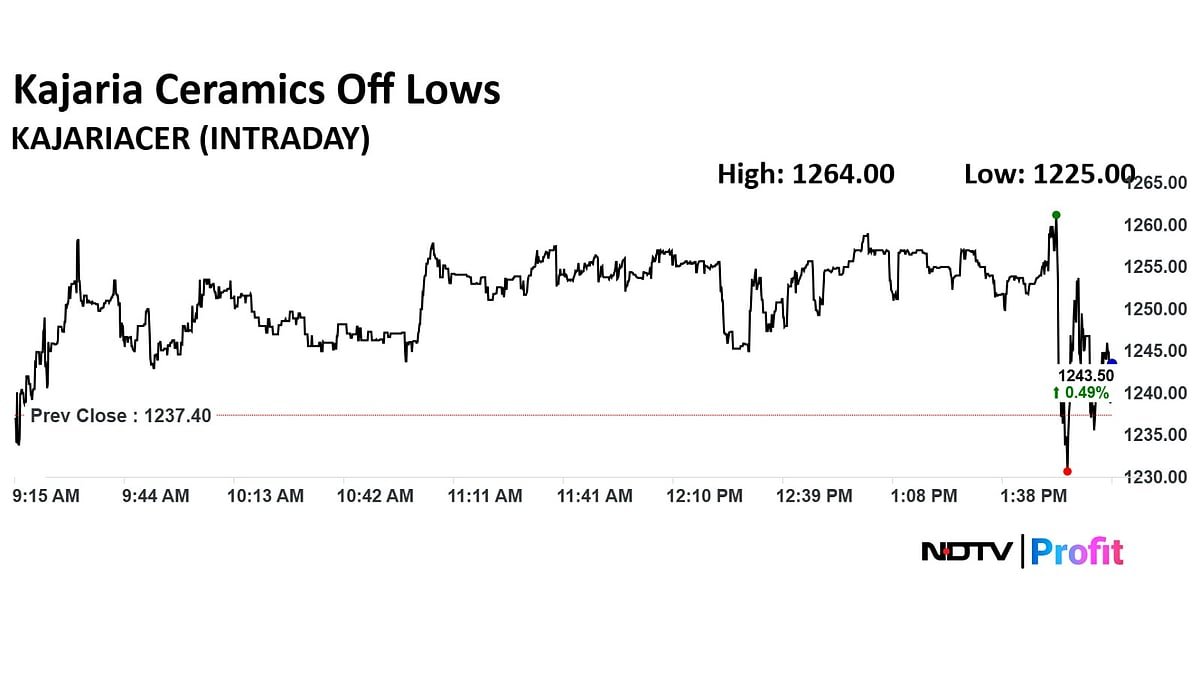

Q2 Results Live: Kajaria Ceramics Dividend

Kajaria Ceramics to pay interim dividend of Rs 8 per share.

Q2 Results Live: Kajaria Ceramics Profit Soars Over 50%

Kajaria Ceramics Q2FY26 (Consolidated, YoY)

-

Revenue up 2.1% at Rs 1,186 crore versus Rs 1,162 crore

-

EBITDA up 30.5% at Rs 214 crore versus Rs 164 crore

-

Margin at 18% versus 14.1%

-

Net Profit up 56.7% at Rs 134 crore versus Rs 85.5 crore

Q2 Results Live: Swaraj Engines Profit, Revenue Rise

Swaraj Engines Q2FY26 (YoY)

-

Revenue up 8.6% at Rs 504 crore versus Rs 464 crore

-

EBITDA up 8.3% at Rs 68 crore versus Rs 62.8 crore

-

Margin flat at 13.5%

-

Net Profit up 9.4% at Rs 49.7 crore versus Rs 45.4 crore

Q2 Results Live: Mastek Profit, Margin Grows

Mastek Q2FY26 (Consolidated, QoQ)

-

Revenue up 2.8% at Rs 940 crore versus Rs 915 crore

-

EBIT up 7.4% at Rs 128 crore versus Rs 119 crore

-

Margin at 13.6% versus 13%

-

Net Profit up 5.9% at Rs 97.5 crore versus Rs 92 crore

Q2 Results Live: Indian Bank Profit Up, Provisions Down

Indian Bank Q2FY26 (Standalone, YoY)

-

Net Profit up 11.5% at Rs 3,018 crore versus Rs 2,706 crore

-

Net Interest Income 5.8% at Rs 6,551 crore versus Rs 6,194 crore

-

Operating Profit up 2.3% at Rs 4,837 crore versus Rs 4,729 crore

-

Provisions down 32.8% at Rs 739 crore versus Rs 1,099 crore

-

Provisions up 7% at Rs 739 crore versus Rs 691 crore (QoQ)

-

Gross NPA at 2.6% versus 3% (QoQ)

-

Net NPA at 0.16% versus 0.18% (QoQ)

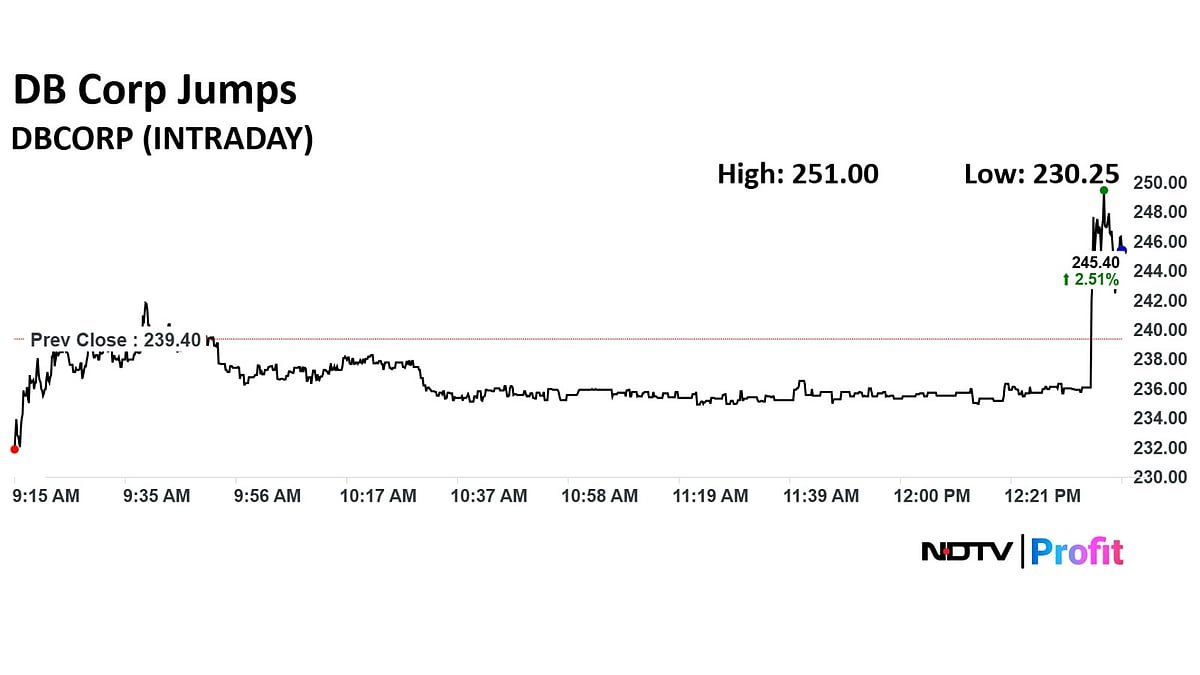

Q2 Results Live: DB Corp Profit Up

DB Corp Highlights Q2FY26 (Consolidated, YoY)

-

Revenue up 9.9% at Rs 614 crore versus Rs 559 crore

-

Ebitda up 14.6% at Rs 138 crore versus Rs 121 crore

-

Margin at 22.5% versus 21.6%

-

Net Profit 13.2% at Rs 93.4 crore versus Rs 82.5 crore

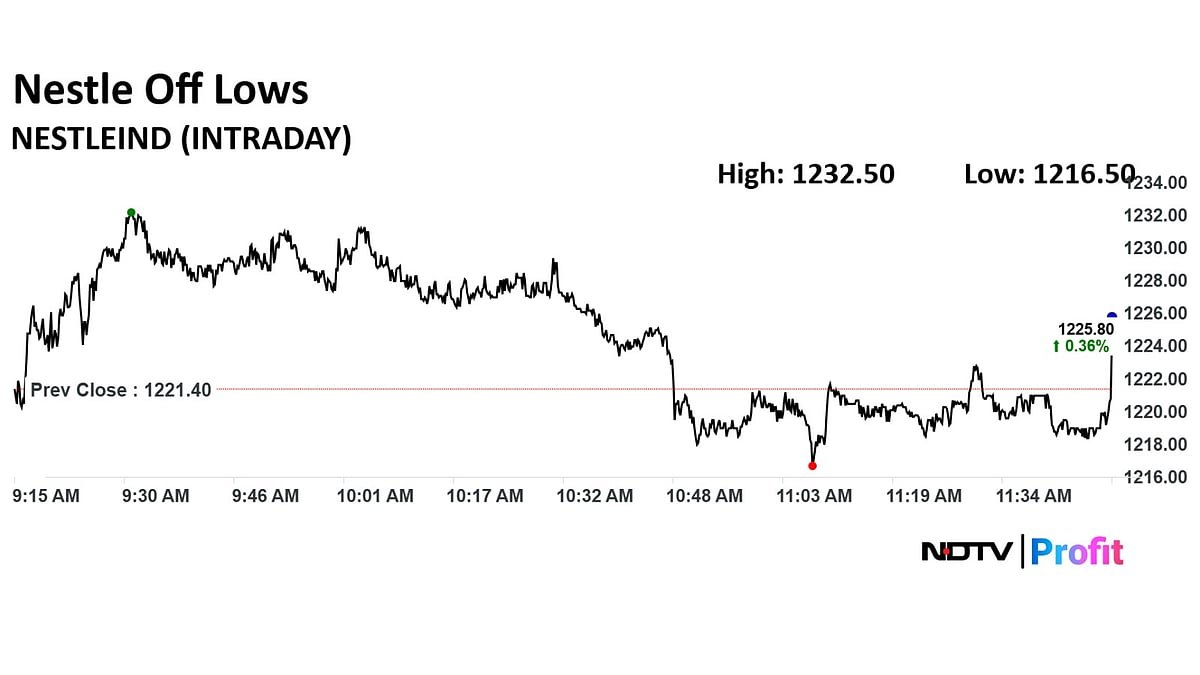

Q2 Results Live: Analyst Commentary On Nestle India

CLSA

-

Strong result with better-than-expected profitability.

-

Stong numbers despite trade disruption for other FMCG incumbents due to GST change.

Morgan Stanley

-

Good surprise on top line and in-line margins.

-

Both domestic sales and exports were ahead of estimates.

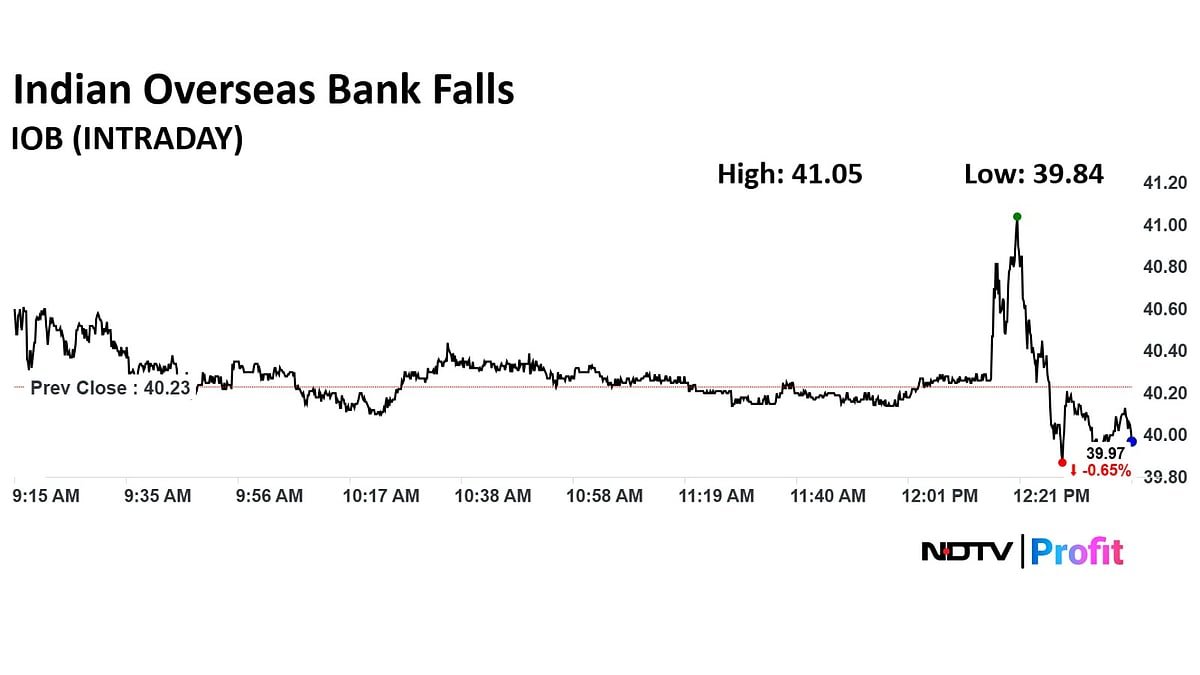

Q2 Results Live: Indian Overseas Bank Shares Down

Q2 Results Live: Indian Overseas Bank Profit Jumps

Indian Overseas Bank Q2FY26 (Standalone, YoY)

-

Net Profit up 57.8% at Rs 1,226 crore versus Rs 777 crore

-

Net Interest Income up 20.6% at Rs 3,059 crore versus Rs 2,537 crore

-

Operating Profit up 12.8% at Rs 2,400 crore versus Rs 2,128 crore

-

Provisions down 41.3% at Rs 672 crore versus Rs 1,146 crore

-

Provisions down 20.3% at Rs 672 crore versus Rs 844 crore (QoQ)

-

Gross NPA at 1.83% versus 1.97% (QoQ)

-

Net NPA at 0.28% versus 0.32% (QoQ)

Q2 Results Live: Nestle India On GST Cut Impact

“The recent amendments in the Goods and Services Tax (GST) rates announced by the Government of India is a positive step for consumers. It is expected to stimulate consumption, drive affordability and contribute to the overall growth of the FMCG sector and the economy. We have been working closely with our partners, distributors, wholesalers, and retailers, to pass on the benefits of the revised GST rates, across our product groups to our consumers.”

Source: Nestle Q2 statement

Q2 Results Live: Nestle India’s Commodity Outlook

-

Milk prices are expected to soften after the festive season, coinciding with the onset of the flush season.

-

Coffee prices are anticipated to stabilize and may decrease as the upcoming crops in Vietnam and India appear to be normal.

-

The global supply and demand for cocoa are projected to balance, primarily due to a correction in demand over the past two years.

-

Edible oil prices are expected to remain firm and may rise further due to a tight supply and demand at the global level.

Q2 Results Live: Nestle India Business Performance

-

Total sales and domestic sales for the quarter increased by 10.9% and 10.8% year-on-year, respectively.

-

Three out of four product groups delivered strong volume, leading to double-digit income growth.

-

Domestic sales reached Rs 5,411 crore, the highest ever recorded in any quarter.

-

The Confectionery, Powdered and Liquid Beverages, Prepared Dishes and Cooking Aids product groups grew at a strong double-digit rate, driven by significant underlying volume growth.

Q2 Results Live: Nestle India Share Price Rises

Q2 Results Live: Nestle India Revenue Beats Estimates

Nestle India Q2FY26 Highlights (Standalone, YoY)

-

Revenue up 10.5% at Rs 5,643 crore versus Rs 5,104 crore (Bloomberg estimate: Rs 5,350 crore)

-

Net profit down 23.7% at Rs 753 crore versus Rs 986 crore (Bloomberg estimate: Rs 762 crore)

-

Ebitda up 6% at Rs 1,237 crore versus Rs 1,168 crore (Bloomberg estimate: Rs 1,191 crore)

-

Margin at 21.9% versus 22.9% (Bloomberg estimate: 23.4%)

-

Note: Exceptional gain of Rs 91 crore in Q2 FY25 on slump sale of two businesses.

Zomato Q2 Results Preview: Margin Likely To Expand

Eternal Ltd., formerly known as Zomato, will report its results for the second quarter of financial year 2026 on Thursday.

Brokerages remain upbeat on Eternal ahead of its September quarter results, citing sustained strength in both food delivery and quick commerce. Most expect the company to post mid-to-high teens growth in food delivery GOV and over 130–140% year-on-year growth in Blinkit’s GOV, driven by continued store expansion, festive demand, and rising user acquisition.

Citi, Kotak Institutional Equities, and Morgan Stanley highlight Blinkit’s strong momentum and improving contribution margins, aided by the shift to the 1P model. JPMorgan and Nuvama forecast steady food delivery margins, with contribution margins expanding by 20 basis points sequentially.

Read full story below:

Nestle India Q2 Results Live: Demand Recovery In Sight, Check Preview

Nestle India Ltd. is set to announce its second quarter results amid a period of steady but moderating growth momentum, with analysts anticipating a mixed performance across key segments.

While demand trends are showing gradual improvement as the urban consumption slowdown eases, margin pressures are likely to persist due to elevated input costs, particularly in coffee and palm oil.

Brokerage estimates suggest modest top-line growth supported by price hikes in premium categories and benefits from recent GST rate cuts, though temporary destocking by trade partners ahead of the tax change may weigh on near-term volumes.

Read full story below:

Infosys Q2 Results Live: Investors Eye Guidance Update

Infosys Ltd. is expected to post a 4% rise in consolidated profit to Rs 7,222 crore for the July–September quarter, according to Bloomberg estimates. Revenue is projected to grow 4% sequentially to Rs 44,008 crore, while Ebit is seen up 6% to Rs 9,338 crore.

Analysts expect a steady quarter with moderate revenue growth and sequential margin expansion, led by stable demand in financial services and large deal ramp-ups. The focus will be on management commentary on FY26 guidance, client budgets, and discretionary spending trends.

Infosys’ results will be closely tracked for its FY26 growth guidance and commentary on discretionary technology spending, especially in financial services and European markets. Analysts expect margins to remain within the guided band, supported by operational discipline and deal execution.

Read full story below:

Wipro Q2 Results Live: Margin Seen Steady; Check Preview

Wipro is expected to report modest sequential revenue growth for the July–September quarter, with margins remaining largely steady as deal ramp-ups and cost factors offset each other.

Bloomberg consensus sees revenue at Rs 22,680 crore, up 2% from Rs 22,135 crore, while profit is seen down 2% at Rs 3,279 crore. Ebitda is expected to rise 5% to Rs 4,457 crore, with the margin near 19.65% versus 19.14% in the prior quarter. Analysts will focus on guidance for the next quarter and the impact of large deal ramps on near-term margin.

The quarter will test how recently won large deals affect operating profit as ramp costs feed through. Market attention will centre on Q3 guidance, consulting and Europe demand, and commentary on discretionary spend and any cost headwinds linked to deal ramps.

Read full story below:

Q2 FY26 Results Today Live : Infosys, Eternal, Jio Financial To Watch

In the ongoing earnings season, many big companies across sectors are scheduled to announce their results for the second quarter of the current financial year on Thursday. As many as 62 companies will declare their quarterly performance results for Q2FY26 on October 16.

Major companies announcing their second-quarter results include Wipro, Infosys, Eternal (formerly Zomato), Jio Financial Services, and Nestle India, among others.

Many companies are also expected to announce an interim dividend for shareholders. Several companies have also announced the schedule for their earnings call to discuss the Q2FY26 results.

. Read more on Earnings by NDTV Profit.