Axis Bank Q2 Results LIVE: On Crop Loan Discontinuation

Puneet Sharma, CFO, Axis Bank

-

Bank had been offering two crop loan variants

-

Bank has now discontinued these products

-

Have not changed any customer conditions for loans already disbursed

-

Bank has been asked to maintain standard asset provisions against these loans

Source: Con Call

Axis Bank Q2 Results LIVE: No Divergence In Asset Quality

Puneet Sharma, CFO, Axis Bank

-

Following RBI advisory, bank has made one time standard asset provision of Rs 1,231 crore

-

Provisioning will be written back once loans are settled

-

No divergence in asset quality or provision in FY25

-

Not expecting any material rise in credit costs from the crop loans

-

To the best of our understanding, this RBI direction was specific to Axis Bank

Source: Con Call

Q2 Results LIVE: Oberoi Realty Profit Up 30%

Oberoi Realty Q2 Highlights (Consolidated, YoY)

-

Revenue up 34.8% to Rs 1,779.04 crore versus Rs 1,319.89 crore

-

Net Profit up 29% to Rs 760.26 crore versus Rs 589.44 crore

-

Ebitda up 25% to Rs 1,020.29 crore versus Rs 813.78 crore

-

Margin at 57.4% versus 61.7%

Axis Bank Q2 Results LIVE: Premiumisation Of Business Continues

Amitabh Chaudhry, MD & CEO, Axis Bank:

-

Retail unsecured book seeing stablisation on asset quality

-

Deposits to grow faster than industry in medium to long term

-

Bank has made focussed interventions to ensure better relationship with salary account customers

-

Premiumisation of business continues

-

First half of fiscal year unfolded in a dynamic global situation

-

Remain confident of opportunities that lie ahead

Source: Con Call

Q2 Results LIVE: Huhtamaki India Profit Triples

Huhtamaki India Q2 Highlights (YoY)

-

Revenue down 4.2% to Rs 625 crore versus Rs 652.50 crore

-

Net Profit up 214.5% to Rs 36.80 crore versus Rs 11.70 crore

-

Ebitda up 19.8% to Rs 55.5 crore versus 18.1 crore

-

Margin at 8.9 % versus 2.8%

Q2 Results LIVE: KEI Industries Profit Jumps

KEI Industries Q2 Highlights (Consolidated, YoY)

-

Revenue up 19.4% to Rs 2726.34 crore versus Rs 2,284 crore

-

Net Profit up 31.5% to Rs 204 crore versus Rs 155 crore

-

Ebitda up 19.8% to Rs 269 crore versus 225 crore

-

Margin at 9.9% versus 9.8%

Q2 Results LIVE: HDB Financial Profit Down (YoY)

-

Net Profit down 1.6% to Rs 581.4 crore versus Rs 591 crore

-

NII 19.6% to Rs 2,193 crore versus Rs 1,823 crore.

-

Board approves interim dividend of Rs 2 per equity share

Q2 Results LIVE: Kewal Kiran Profit Down

Kewal Kiran Clothing Q2 Highlights (Consolidated, YoY)

-

Revenue up 14.9% to Rs 354 crore versus Rs 308 crore

-

Net Profit down 31.5% to Rs 44.9 crore versus Rs 65.5 crore

-

Ebitda up 11% to Rs 71 crore versus Rs 64 crore

-

Margin at 20% versus 20.7%

Axis Bank Q2 Results LIVE: Small Business Loans Up 14%

-

Corporate loan growth boosted advances in Q2

-

Corporate loans rise 20% YoY to Rs 3.5 lakh crore

-

Retail loans rise just 6% YoY to Rs 6.35 lakh crore

-

Home loan book contracts 1% from last year

-

LAP portfolio rises 22% YoY

-

Small business loans up 14% YoY to Rs 70,663 crore

Q2 Earnings Update LIVE: Axis Bank Advances And Deposits

-

Net Advances up 12% at Rs 11.16 lakh crore (YoY)

-

Net Deposits up 11% at Rs 12.03 lakh crore (YoY)

-

Gross Slippage Ratio down 102 basis points at 2.11% (QoQ)

-

Gross Slippage Ratio down 128 basis points at 1.05% (QoQ)

Q2 Earnings Update LIVE: Axis Bank Profit Down 26%

Axis Bank Q2FY26 Highlights

-

Net Profit down 26.4% at Rs 5,090 crore versus Rs 6,918 crore

-

Net interest income up 2% at Rs 13,744 crore versus Rs 13,483 crore

-

Provisions up 61% at Rs 3,547 crore versus Rs 2,204 crore (YoY)

-

Provisions down 10.1% at Rs 3,547 crore versus Rs 3,948 Cr (QoQ)

-

Gross NPA at 1.46% versus 1.57% (QoQ)

-

Net NPA at 0.44% versus 0.45% (QoQ)

-

One-time standard asset provisioning at Rs 1,230 crore

-

NIM at 3.73%

Q2 Earnings Update LIVE: HDFC Life Profit Up 3%

HDFC Life Q2 Highlights (Consolidated, YoY)

-

Net Profit up 3% to Rs 448 crore versus Rs 435 crore

-

Net premium income up 13.6% to Rs 18,871.00 crore versus Rs 16,613.70 crore

-

Annual Premium Equivalent grew by 9% to Rs 4,188 crore

-

Value of new business grew by 8% to Rs 1,009 crore

-

VNB margin at 24.1% versus 25.1% (QoQ)

Q2 Earnings Update LIVE: Heritage Foods Profit Rises

Heritage Foods Q2 Highlights (Consolidated, YoY)

-

Revenue up 9.1% to Rs 1,112.50 crore versus Rs 1,019.50 crore

-

Net Profit up 5% to Rs 51.00 crore versus Rs 48.60 crore

-

Ebitda down 7% to Rs 77.20 crore versus Rs 83.20 crore

-

Margin at 6.9% versus 8.2%

Q2 Earnings Update LIVE: HDFC AMC Profit Dips

HDFC Asset Management Co Q2 Highlights (Cons, QoQ)

-

Total income down 6.4% at Rs 1,124 crore versus Rs 1,201 crore.

-

Net profit down 4% at Rs 718 crore versus Rs 747 crore.

-

Board approves bonus issue in the ratio of 1:1

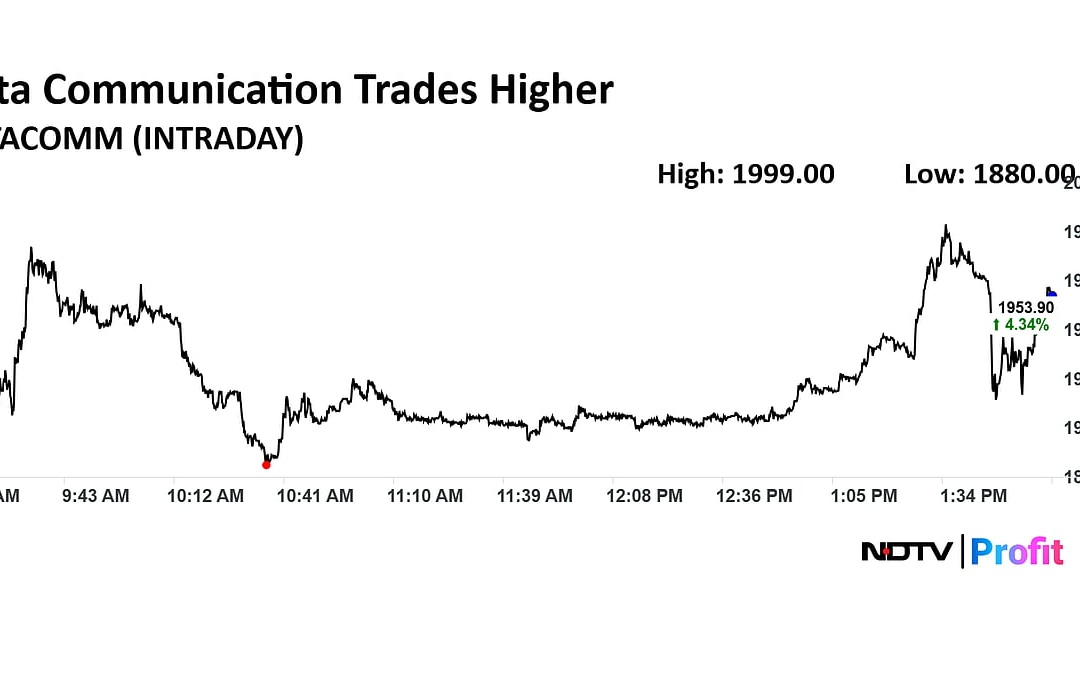

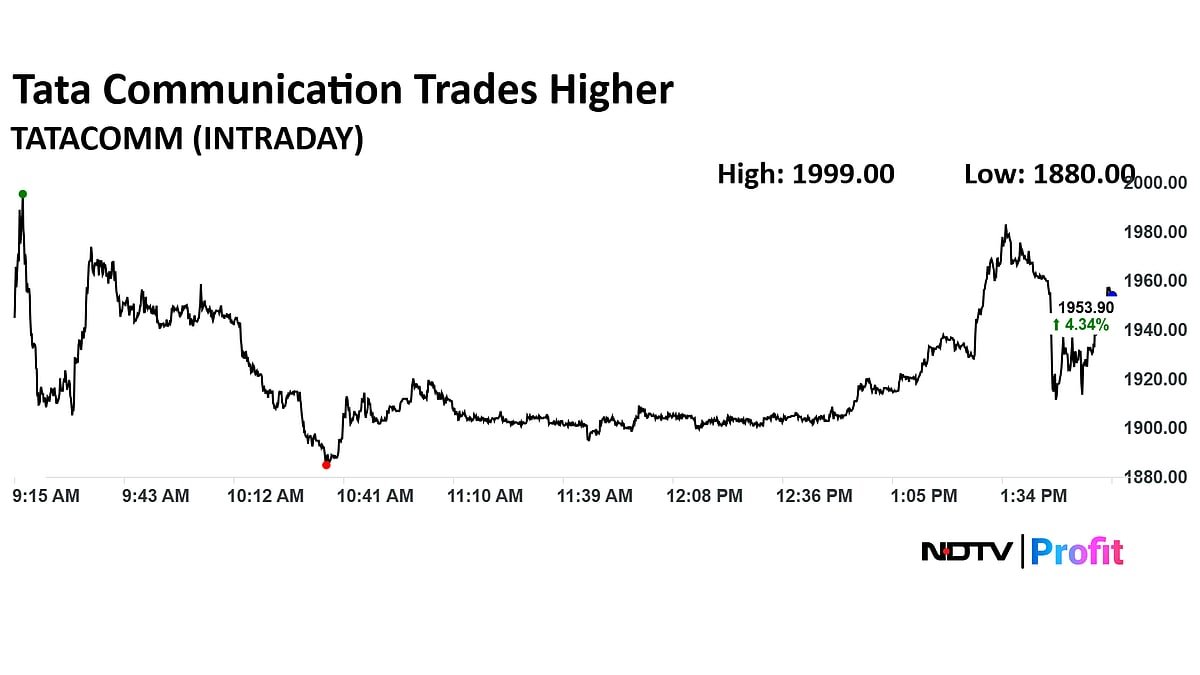

Q2 Earnings Update LIVE: Tata Communication Falls After Net Profit Declines

Q2 Results Live: Tata Communications Revenue Rises 6.5%

Tata Communications Q2 Highlights

-

Revenue up 6.5% at Rs 6,100.00 crore versus Rs 5,728.00 crore.

-

Ebitda up 3.9% at Rs 1,174.00 crore versus Rs 1,129.00 crore.

-

Margin at 19.2% versus 19.7%.

-

Net Profit down 19.4% at Rs 183.00 crore versus Rs 227.00 crore.

Q2 Results Live: IRFC Total Income Declines 7.7%

IRFC Q2 Highlights

Total Income down 7.7% at Rs 6,372 crore versus Rs 6,900 crore.

Declares Interim Dividend of Rs 1.05 per share.

Net Profit up 10.2% at Rs 1,777 crore versus Rs 1,613 crore.

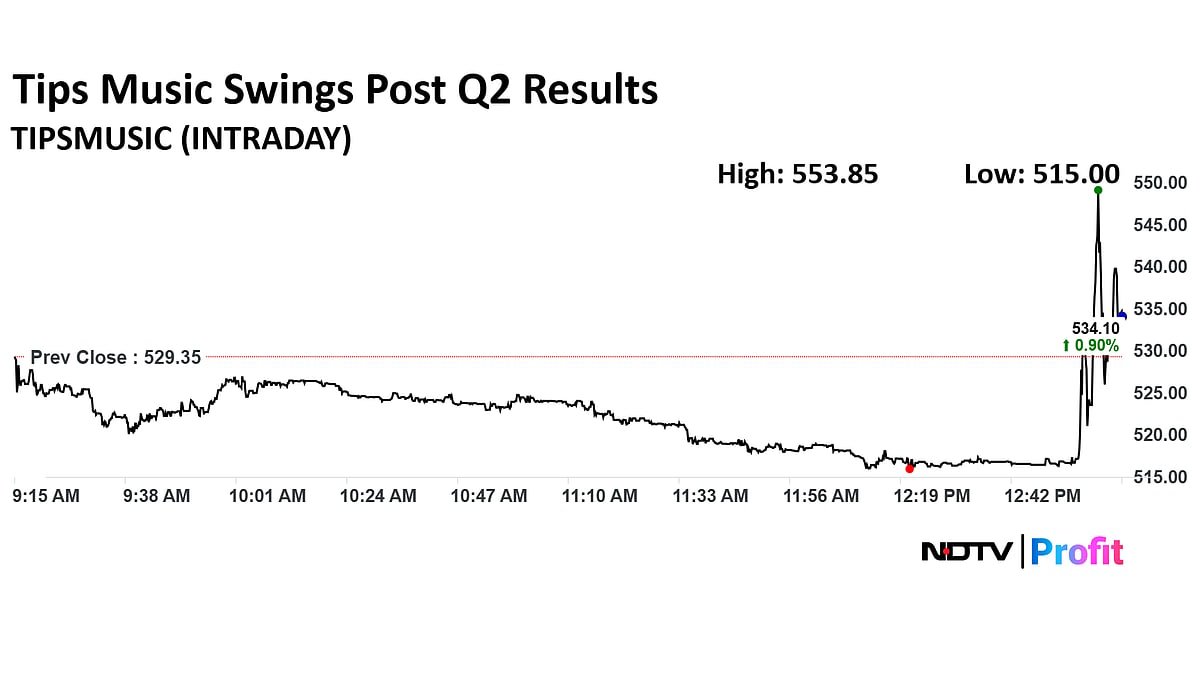

Q2 Earnings LIVE: Tips Music Share Price Swings Post Results

Track live update on Q2 earnings here.

Q2 Results Live: Tips Music Revenue Rises 10.7%

Tips Music Q2 Highlights

Revenue up 10.7% at Rs 89.20 crore versus Rs 80.60 crore.

Ebitda up 13.9% at Rs 67.70 crore versus Rs 59.50 crore.

Margin at 75.9% versus 73.8%.

Net Profit up 10.4% at Rs 53.20 crore versus Rs 48.20 crore.

Q2 Results Live: Axis Bank Earnings Expecations

Profitability may stay under pressure as net interest margins moderate to 3.6% from 3.8% in the June quarter.

Analysts said credit costs are likely to remain elevated even as slippages ease. Meanwhile the loan growth is expected to rise 9% on a yearly basis, according to Kotak Securities.

Q2 Results Live: Axis Bank Earnings Estimates

Axis Bank Ltd. will also be reporting its results for the quarter on Wednesday. The company is likely to report a net profit of Rs 19,669 crore and revenue of Rs 5,880 crore, according to estimates.

Q2 Results Live: Angel One Earnings Estimates

Angel One Ltd. is likely to clock a 17.8% rise in net profit at Rs 215 crore and a revenue of Rs 1,208.4 crore for the quarter ended September, according to a survey of analysts’ estimates done by Bloomberg.

Q2 Results Live: Axis Bank, HDB Financial, Angel One

Hello and welcome to NDTV Profit‘s live coverage of the first-quarter earnings season. The financial landscape is buzzing today, as various players are set to announce their performance for the second quarter.

Names like Angel One Ltd., Axis Bank Ltd. and HDFC Life Insurance Co. and more are in focus today as they post their results.

This is your front-row seat to the earnings action, so stay with us for real-time updates, analysis of the numbers, and all the key details that companies will be putting out through the day!

. Read more on Earnings by NDTV Profit.