Japan’s main bourse is seeking to capitalize on the growth of strategies that enhance yield.

Trades such as call overwriting — when investors who own shares sell bullish options to pocket the contracts’ premium — have become increasingly popular in Japan, and the Tokyo Stock Exchange now wants to enable listings of actively managed exchange-traded funds with over-the-counter derivatives.

The bourse is asking an advisory body for guidance to take on ETFs that use non-listed instruments such as swaps and options, according to Kei Okazaki and Ryutaro Someya, managers at the new listings department of the Tokyo Stock Exchange. While listed funds can use options on Osaka’s derivatives exchange, OTC products are currently prohibited.

The Tokyo exchange is seeking to get the Financial Services Agency’s nod to list such ETFs by next June, Okazaki and Someya said, adding that the change would help lower the cost of managing the funds. A representative for the FSA, which gives guidance for investment trusts and ETFs, declined to comment.

Call overwriting — also known as the covered call strategy — is common across the world and is especially appealing in Japan, where interest rates remain some of the lowest among developed markets even after the central bank ended its yearslong zero-rate policy. In the US, some actively managed ETFs with derivatives-driven strategies may also use OTC instruments.

“Banks and insurers are seeking yield as they have to pay more in interest rates to their clients,” Okazaki said in an interview in Tokyo, explaining that covered call strategies offer regular and stable income. He expects the market for listed covered call products to expand to more than ¥1 trillion ($6.8 billion) from the current ¥35 billion.

The bourse is also asking the regulator to allow ETFs that sell options to pay dividends with the premiums they receive, adding to investors’ returns, Okazaki also said.

Call overwriting may be one of the most popular volatility trades globally, according to Georges Debbas, head of equity-derivatives strategy for Europe at BNP Paribas SA. At large institutions, the strategy is fully automated and growing, and several active ETFs are also using it, he said.

The trade tends to do well in a falling or stable market but underperforms during strong rallies. In such cases, the sale of the contract caps equity gains, given that the buyer is likely to exercise the option, forcing the seller to part with the underlying shares.

Some market watchers say call overwriting may dampen equity volatility and form temporary price resistance levels if a large open interest builds up at a particular strike and maturity. But fund managers that do the strategy systematically tend to spread out their trades to avoid clustering on certain contracts and to limit the strategy’s impact, according to Geoff Kirk, a manager at Premier Miton in London.

“Asset managers doing systematic overwriting are very aware of market impact and pin risk,” Kirk said, referring to the uncertainty that comes when an option’s expiration price is close to its strike. “Banks also have quite strict risk limits so dealing desks will reject orders or just price to lose when they’re at capacity on a certain underlying.”

In a June note, JPMorgan Chase & Co. strategists said the trade performed well during the market selloff between February and April but lagged behind in the sharp rebound that followed, concluding that timing and selectivity are key.

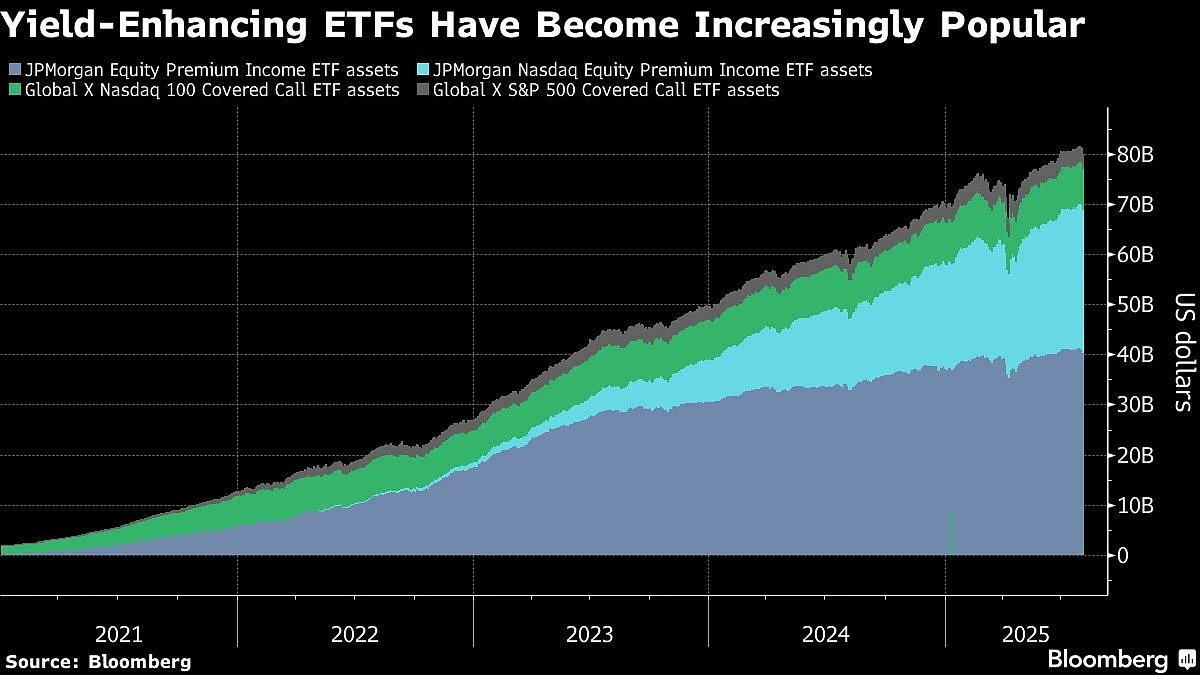

“The post-Covid growth in assets into covered-call ETFs that sell equity volatility for yield has continued a gradual ascent,” Tanvir Sandhu, Bloomberg Intelligence’s chief global derivatives strategist, wrote in a note last week. “The rationale for call overwriting is that selling call options can provide income, and on an expectation that the market rally is contained within the expiry time frame.”

. Read more on Markets by NDTV Profit.