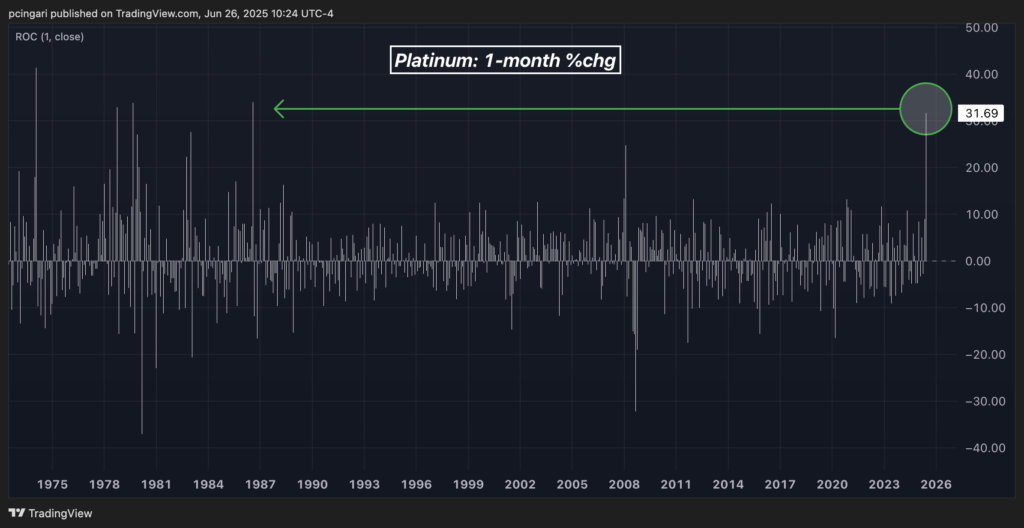

Platinum is staging a spectacular rally this year, rising more than 30% in June alone and hitting $1,390 per ounce—its highest level since September 2014—putting it on track for its best monthly performance since 1986.

The precious metal, closely tracked by the GraniteShares Platinum Shares ETF (NYSE:PLTM), has gained over 50% year-to-date, more than doubling the returns seen in gold, which is up 25%, and silver, which is up 24%, as investors chase platinum amid expectations of continued structural deficits.

Elevated platinum prices are poised to deliver windfall profits for key mining companies with heavy exposure to the metal, many of which have already begun a bull market.

Chart: Platinum Is On Track For Best-Performing Month Since 1986

What’s Fueling The Platinum Rally?

According to the World Platinum Investment Council, the rally is underpinned by long-standing supply shortages.

The group projects that platinum market deficits will persist through 2029, averaging 727,000 ounces annually from 2025 to 2029, equivalent to approximately 9% of average demand.

“The platinum investment case remains compelling,” the council said, highlighting ongoing shortfalls …