Disappointed would be a word to use for how the week ended. It began well, actually and then for the next two days, slid back some. Quite passively too.

The weekly expiry was seeming like it would turn into a dull drift down was playing out when, suddenly, out of the blue, a blitzkrieg of buying emerged and carried the index in a near vertical manner for the second half of the day. This raised visions of restoration of the uptrends and people looked at Friday with some anticipation for continuation.

But the weekend completely undid the good work of the bulls of Thursday, and the market finished near the bottom, erasing all the gains of the prior day. Chart 1 shows the moves unfolding through the week. You can note how different days would have stoked different kinds of sentiment about what is in store. Result? Utter confusion at the end of the week.

Event of the week was of course the finalisation of the tariffs on India. Not just that but the additional slam that we got. It is to the credit of the trend that it didn’t cave in as much as might have been feared. Ideally, that should have led the market higher from where it has been churning for the past few days.

Like we discussed in last week’s letter, the slide from the June 30 rally high, the prices had dropped into the consolidation support zone near 24,500 across a month. It seemed like we were holding on to the support — it still does — but repeated attacks on the base and an inability to carry higher is indicating weakness of bulls and some renewed determination of bears here.

The FIIs have been culprits so far, creating the largest selling pool, while the DIIs have been making valiant attempts to absorb those selling. The latter have little choice though, given that the SIP from the public continues (as per June data).

But the FIIs seem to be quite relentless in their selling and their overall holdings in Indian equity has, apparently now come down to around 15% or so. That is a far cry from the nearly 19-20% that they held a while ago. All those continually expecting revival of FII buying should take note of this consistency in exit.

I have been mentioning also about the consistent buildup of Index shorts. Many of us are still looking at that as a source of bullish news, considering that covering that large position will produce a large recovery. It can, but as and when it shows up.

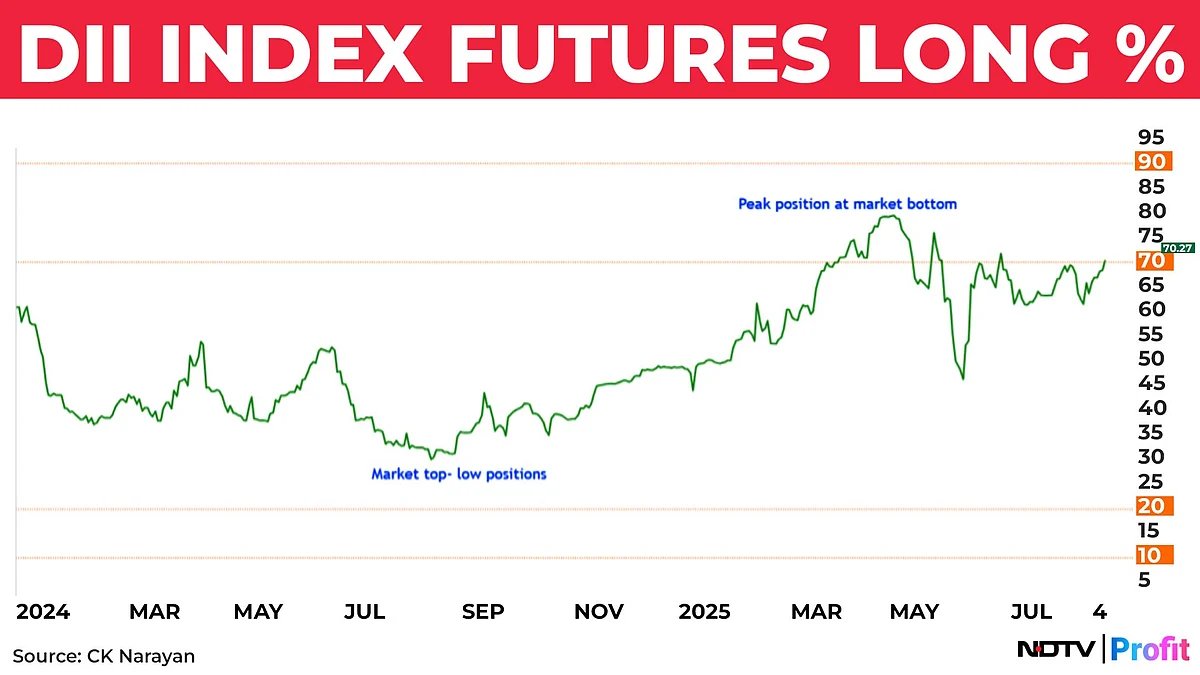

I would see it this way right now. If the FIIs have decided to exit and know that the liquidity may be a factor for their exit may have decided to secure the trend down with Index shorts. We can conclude this because this is what the DIIs are doing but in reverse. Given that the SIP inflow is continuing, and they need to invest and cannot afford the market running away from them, a lot of the money went into hedging against a rise by going long index futures. Chart 2 shows the situation.

While the market rallied from the April 25 bottom, the DIIs shed their long futures and even now, they are about 70% long in Index futures. I believe that so long as the SIP inflow continues, they will hedge themselves first through long Index positions and then unwind them gradually as they are able parley their funds into equities and other assets.

In direct contrast to this is the situation with the FIIs. Their holdings have been slipping ever since 2016! Did we never notice? Perhaps not, because the markets were in such a gloriously strong trend. Their peak holdings in Indian equities was the highest around 21% back in 2015 and ever since, it has been on a slide. Their peak holding of long Index future positions was back in 2016 and ever since it has been skidding.

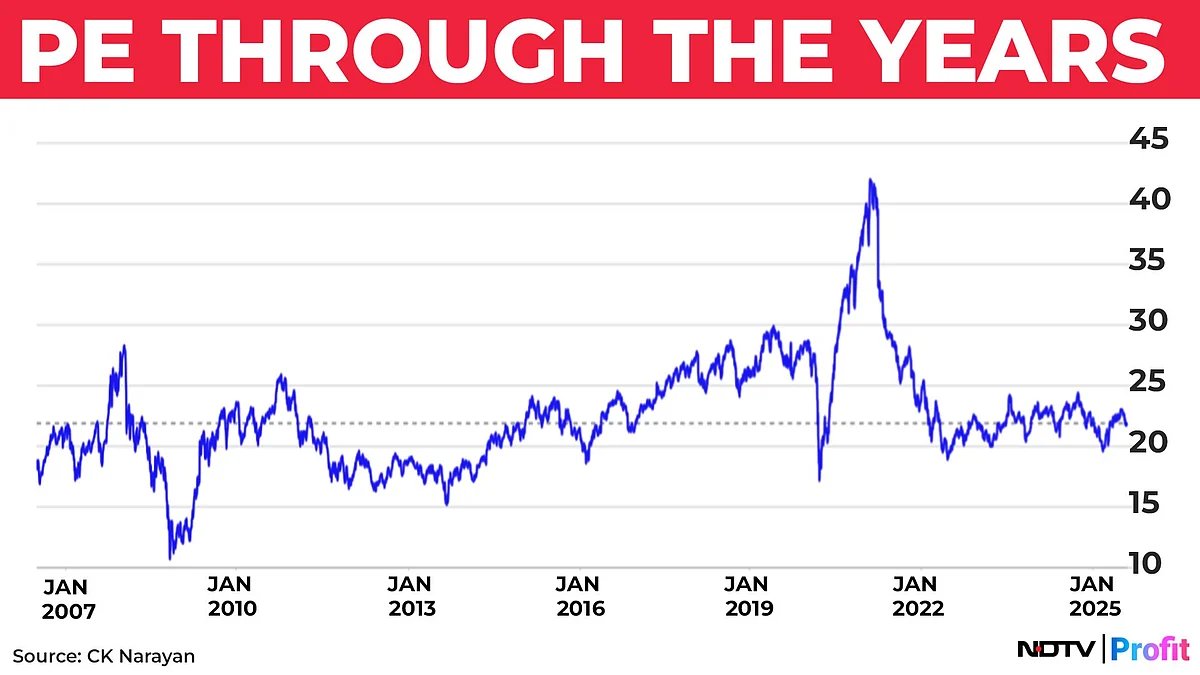

All through, some Mark or a Chris or Jim or a John has been talking bullish about India and its prospects. But the numbers don’t back up their talk. In the last 10 years, India seems to have lost its mojo as far as the foreign investor is concerned. Maybe they were not happy with the valuations? Chart 3 shows PE through the years.

By 2018, our markets had crossed prior PE peaks of 25x and traded higher. After the trough of 2020, the changes in the market character drove prices to dizzying levels to create a PE high of 41x in 2021. The selling which resumed in 2021 after a brief hiatus before that has not stopped till today, despite the fact that the Nifty is now back at a median PE level of 21x.

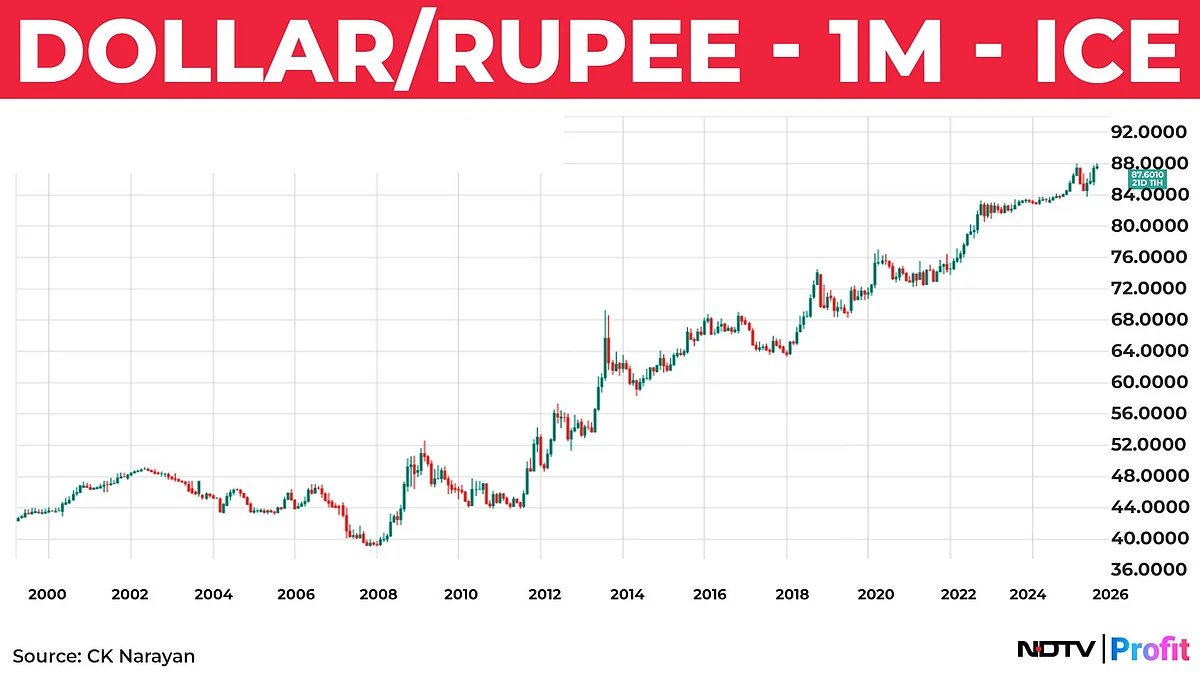

We can’t also just lay the blame at the door of the currency getting weaker, for, it has been weakening ever since 2008 up until today. Chart 4 shows the progress of the USD-INR pair. Perhaps the pace of weakening of the INR has been a source of worry?

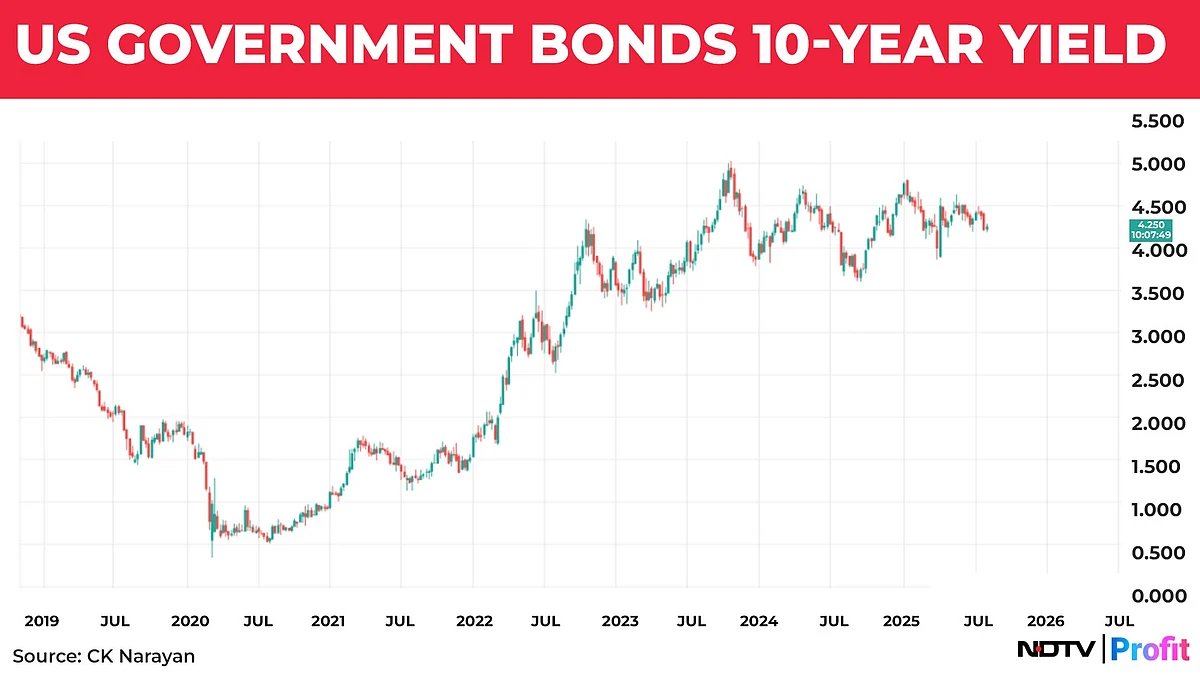

Perhaps, it is the long-awaited reversal in US 10-year bond yields that created the flight back home? Chart 5 shows the 10-year yield chart after the bottom in 2020. It is to be noted that bond yields had been falling ever since 1981 till then! Probably the single biggest reason for flight of funds back home.

Since America itself is in a bit of an upheaval and Trump’s policies and their long-term impact on global economies are unclear, it is possible that the 10-year yields may not drop much, and neither will the dollar lose its preeminent position in a hurry. Maybe these events shall happen well into the future and there shall be a new world order altogether, but I don’t think anyone quite knows how that is going to pan out.

The long and short of all these ranting is to say that we should not be looking at FII numbers to turn positive any time soon. They were a great positive factor in making our markets what they are today but it seems like domestic funds and investors have now picked up the baton and are running with it and it is their activity that we should now be tracking. This is not to mean that FIIs will be gone but just that they may now play a more subdued role in the markets.

So, what do we focus on then, moving forward? For one, technology changes are leading to shortening market cycles. Executions are getting speeded up. These two are combining to produce a faster moving market in either direction, thereby making volatility a firmer feature of the market. This demands a change from the long held concept of buy and hold and a shift to buy and sell with some greater frequency.

Next, there is now a great deal of interest in Algo trading even from the Retail space. SEBI is easing the pathway for them and shall continue to do so. Service providers are springing up faster than mushrooms can bloom.

Transaction costs continue to remain low. Government action is focused on reducing the cost of funds. All these should now combine to make way for a new breed of investors and traders who will make the shift to technology-oriented approach.

The tried and tested methods may not work with the kind of efficiency of the past as they may get overrun by the increased volatility. So all the old dogs will have learned new tricks!

Why all these outpourings, one may well ask? Well, sometimes you have to pause to take a look at the larger picture, the context in which everything is happening. When that context is undergoing a change (for better or for the worse, we know not), we have to do a rethink of what we believe to be correct and the best and maybe set out to learn new ones.

Harking back into the present, the down drift carries on and is now threatening to turn into an intermediate decline. This shall be confirmed if the Nifty breaks last week low and remains lower. Same is the situation with the Bank Nifty. This would mean that we may have to continue with a sell the rally approach in the index even as one tries to find some diamonds in the rough of quarterly numbers for investing. It will require a move past 24,900/56,150 (on spot) for the down drift to get arrested.

Disclaimer: The views expressed here are those of the author and do not necessarily represent the views of NDTV Profit or its editorial team.

. Read more on Opinion by NDTV Profit.