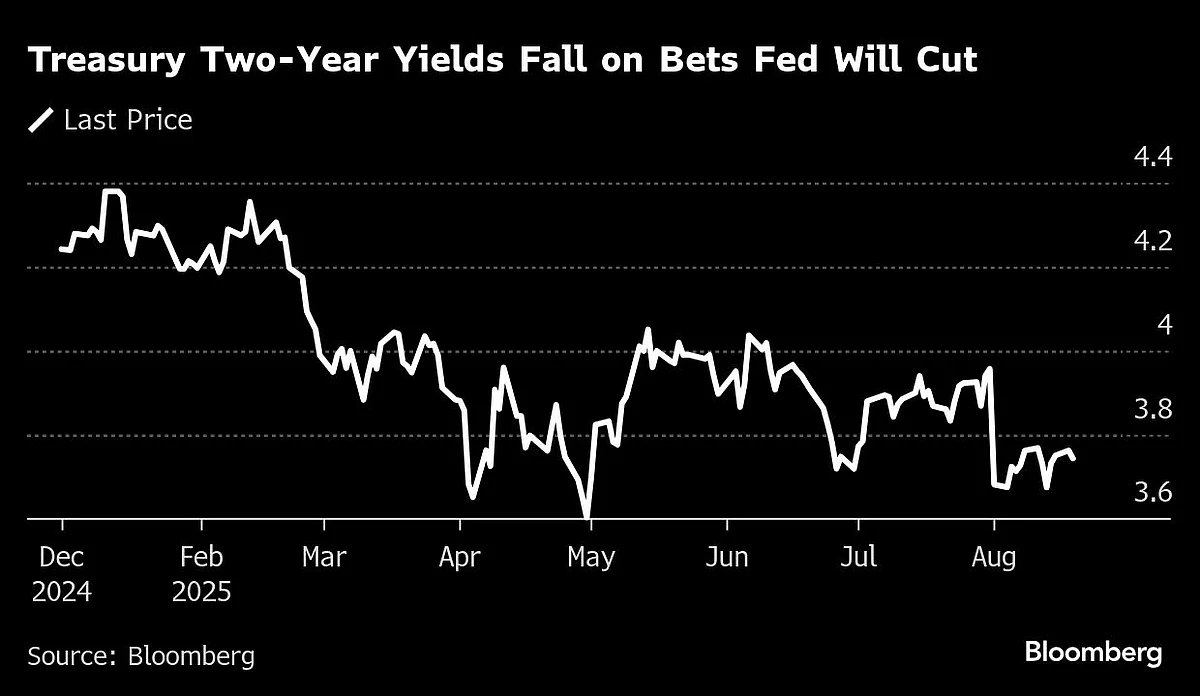

A slide in the world’s largest technology companies weighed on stocks, while big-box retailers got a boost from Home Depot Inc.’s results. Bond yields fell ahead of Jerome Powell’s speech later this week as traders continued to price in high chances of a September rate cut.

The Nasdaq 100 fell about 1.5%, with Nvidia Corp. leading losses in megacaps. Intel Corp. rallied as Commerce Secretary Howard Lutnick told CNBC the US is seeking a stake without governance rights and SoftBank Group Corp. agreed to buy $2 billion of the chipmaker shares. Transportation firms climbed as Lutnick said he’d support consolidation to make freight rail more efficient.

Tech stocks swoon.

Treasuries rose, driving 10-year yields down three basis points to 4.30%. The Bloomberg Dollar Spot Index was little changed.

Positioning across US equity markets remains at elevated levels following a strong second-quarter reporting season, according to Citigroup Inc. strategists including Chris Montagu. Individual investors are likely to slow their torrid pace of stock buying in September before resuming later this year, according to Scott Rubner at Citadel Securities.

“It is always easier when the markets are going up,” said Nicholas Bohnsack at Strategas. “It is difficult to poke holes in the bull case; the path of least resistance is likely higher, but we find ourselves increasingly worried that traditional risk assets (stocks and bonds) appear priced to perfection.”

The technology sector reclaimed its spot as the S&P 500’s top performer last quarter, helping indexes rise to all-time highs, noted Bret Kenwell at eToro. While valuations appear stretched, elevated growth expectations help justify prices, while AI enthusiasm and momentum can help keep tech in the driver seat, he said.

“Whether money continues to flow into the ‘Magnificent Seven’ leaders or rotate within the group, investors will likely look for tech’s continued leadership in the second half of 2025,” he noted.

Traders are gearing up for Powell’s speech on Friday in Jackson Hole, Wyoming, with the Treasury market seeing a quarter-point rate cut next month as virtually a lock and at least one more by year-end.

“As the market readies for Powell’s speech at Jackson Hole, we’ll argue that the biggest risk for Treasuries is if the Fed chief chooses to throw cold water on the widely anticipated September rate cut,” said Ian Lyngen at BMO Capital Markets.

While this is not Lyngen’s base-case scenario, he says the front-end of the curve is vulnerable to a correction if Powell doesn’t deliver on the degree of dovishness currently anticipated.

Investors are waiting to see if Powell affirms the market pricing — or pushes back with a reminder that new data arriving before the next policy gathering could change the picture. They’re also looking for clues about the longer-run trajectory of Fed cuts into next year.

“The market is all but pricing in a certainty for rate cuts in September and we agree with the market’s expectations,” said Stephen Schwartz at Pioneer Financial. “Rate cuts are warranted as financial conditions are too tight right now given the softening of the inflation data and the cracks we are starting to see in the labor market.”

A couple of weeks ago, when the latest jobs report revealed a slump in hiring, the case for lower rates appeared all but closed. Then came the sharpest spike in US wholesale prices in three years – fuel for the concern about tariff-led inflation that’s kept Fed officials on hold so far this year.

While the recent inflation data has been volatile with some conflicting signals, Schwartz says there’s a market perception that the inflation surge from 2022 is behind us.

“While we expect some near-term volatility, we believe markets will continue to move past the inflation situation, and that the economy and the US consumer are strong enough to continue growing,” he said.

At Bank of America Corp., strategists including Mark Cabana and Meghan Swiber say they don’t think Powell will sound as dovish as the market expects.

“Powell’s reaction function to recent stagflationary data will be key,” they noted. “Will he be spooked by jobs revisions or lean into the labor supply slowdown?

In an interview with Bloomberg Television, Fed Governor Michelle Bowman deflected when asked if she would be interested in leading the central bank as chair.

Meantime, S&P Global Ratings said revenues from tariffs will help soften the blow to the US’s fiscal health from the tax cuts, enabling it to maintain its current credit grade. S&P affirmed its AA+ rating for the US — a score it’s given since 2011.

Tariff revenue reached a fresh monthly record in July, with customs duties climbing to $28 billion.

On the geopolitical front, President Donald Trump urged Russia’s Vladimir Putin and Ukraine’s Volodymyr Zelenskiy to show some “flexibility” as the US president accelerates his efforts to end the war in Ukraine and encourages the two leaders to hold a bilateral summit.

“While there’s a sense that the path to peace is at least slightly clearer, traders remain wary,” said Fawad Razaqzada at City Index and Forex.com. “And rightly so – the toughest conversations, namely over territory, still lie ahead.”

Corporate Highlights:

-

Palo Alto Networks Inc. gave a stronger-than-expected annual forecast, as the company seeks to provide customers with a bundle of AI-enabled cybersecurity products to fend off attacks.

-

Apple Inc. is expanding iPhone production in India at five factories, including a pair of recently opened plants, as it seeks to lessen its reliance on China for US-bound models.

-

Tesla Inc. priced its new six-seat Model Y sport utility vehicle in the same range as local rival Li Auto Inc.’s extended-range L8 model to win over middle-class families in China’s hyper-competitive market.

-

Ford Motor Co. and South Korea’s SK On are seeking buyers for excess battery supply produced at their new joint-venture Kentucky factory, underscoring the waning demand for electric vehicles in the US.

-

Viking Therapeutics Inc.’s experimental obesity pill disappointed in a mid-stage study, marking another weaker-than-expected result for an oral alternative to popular weight-loss injections.

-

Starbucks Corp. will give all salaried employees in North America a 2% raise this year as the coffee chain looks to pull off a high-stakes turnaround and manage expenses.

-

Anglo American Plc suffered a major setback to its restructuring plans after Peabody Energy Corp. decided to walk away from a $3.8 billion deal to buy its steelmaking coal business following a fire at an Australian mine.

-

US power and natural gas utilities Black Hills Corp. and NorthWestern Energy Group agreed to merge in a $3.6 billion deal that underscores the boom for electricity demand that’s being unleashed by data centers.

-

Nexstar Media Group Inc. has agreed to buy TV station operator Tegna Inc. for $3.5 billion in a cash deal that stands to dramatically expand Nexstar’s reach to 80% of US households and test the Trump administration’s appetite for consolidation.

-

Medtronic Plc will expand its board after Elliott Investment Management became one of its biggest investors. The medical devices maker also reported profit that beat estimates and lifted full-year earnings guidance.

-

Air Canada will restart flights Tuesday evening after reaching a deal with flight attendants to end a three-day walkout that led to mass cancellations during the busy summer season and upended the carrier’s financial outlook.

-

BHP Group’s full-year underlying profit fell by more than a quarter to its lowest level since the pandemic, broadly in line with market expectations, as prices of its key earners — iron ore and coking coal — came under pressure from softer Chinese demand.

-

Shein Group Ltd. has considered moving its base back to China in the hopes that it would help sway Beijing authorities to sign off on the fast-fashion retailer’s plans to go public in Hong Kong, according to people familiar with the matter.

Some of the main moves in markets:

Stocks

-

The S&P 500 fell 0.7% as of 1:09 p.m. New York time

-

The Nasdaq 100 fell 1.4%

-

The Dow Jones Industrial Average was little changed

-

The MSCI World Index fell 0.5%

-

Bloomberg Magnificent 7 Total Return Index fell 1.7%

-

The Russell 2000 Index fell 0.9%

Currencies

-

The Bloomberg Dollar Spot Index rose 0.1%

-

The euro was little changed at $1.1657

-

The British pound fell 0.1% to $1.3487

-

The Japanese yen rose 0.2% to 147.56 per dollar

Cryptocurrencies

-

Bitcoin fell 2.7% to $113,325.87

-

Ether fell 4.4% to $4,144.7

Bonds

-

The yield on 10-year Treasuries declined three basis points to 4.30%

-

Germany’s 10-year yield declined one basis point to 2.75%

-

Britain’s 10-year yield was little changed at 4.74%

-

The yield on 2-year Treasuries declined two basis points to 3.75%

-

The yield on 30-year Treasuries declined three basis points to 4.90%

Commodities

-

West Texas Intermediate crude fell 1.5% to $62.44 a barrel

-

Spot gold fell 0.4% to $3,318.43 an ounce

. Read more on Markets by NDTV Profit.