Synopsis:

Shakti Pumps allotted 31.87 lakh shares via QIP at ₹918 each, raising ₹292.6 crore, increasing paid-up capital to ₹123.39 crore.

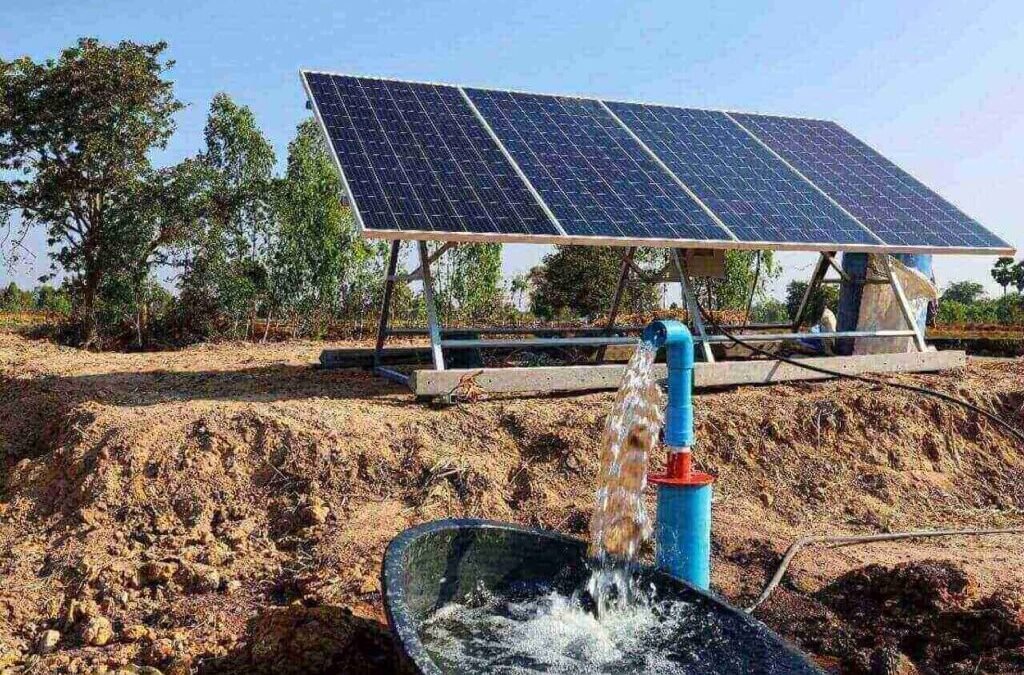

The shares of the Small-cap company, specializing in the manufacturing of various types of pumps and motors. It also offers advanced water pumping solutions for diverse applications, are in a focus on raising Rs. 292.6 crores via QIP (Qualified Institutions Placement).

With a market capitalization of Rs. 11,261.33 Crores on Monday, the shares of Shakti Pumps India Ltd rose by 0.9 percent after making a high of Rs. 945.75 compared to its previous closing price of Rs. 936.55. Over the last five years, the company has given a massive return of 2,978 percent.

Shakti Pumps India Ltd, engaged in the manufacturing of various types of pumps and motors, has announced the revised outcome of its Treasury Committee meeting held on July 5, 2025, where it approved the allotment of 31,87,365 equity shares with a face value of Rs. 10 each to qualified institutional buyers through a Qualified Institutions Placement (QIP).

The shares were issued at Rs. 918 per share (including a premium of Rs. 908), representing a 4.97% discount to the floor price of Rs. 965.96 per share, aggregating to approximately Rs. 292.6 Crores. The QIP opened on July 2, 2025, and closed on July 4, 2025.

Following this allotment, the company’s paid-up equity share capital increased from Rs. 1,202,106,000 (120,210,600 shares) to Rs. 1,233,979,650 (123,397,965 shares). The updated shareholding pattern will be submitted with the listing application as per SEBI regulations.

Financials & Others

The company’s revenue rose by 9.7 percent from Rs. 610.13 crore to Rs. 669.76 crore in Q4FY24-25. Meanwhile, the Net profit rose from Rs. 89.66 crore to Rs. 110.23 crore during the same period.

The company appears financially strong, with a P/E ratio of 27.57, which is much lower than the industry average of 67.04, indicating potential undervaluation. Its low PEG ratio of 0.15 and a low debt-to-equity ratio of 0.14 further highlight its strong fundamentals. Additionally, the company has delivered an impressive average net profit growth of 29.79% over the past three years.

As of May 9, 2025, the company’s total outstanding order book stands at approximately Rs. 1,654.6 crore. Major orders include Rs. 742.1 crore from the Magel Tyala Saur Urja Yojana in Maharashtra (Off-Grid SPWPS), Rs. 378.5 crore from the Department of Agriculture, Rs. 130 crore from the Haryana Renewable Energy Department (HAREDA), and Rs. 98 crore from various domestic and export projects, including Uganda.

Other significant clients are Maharashtra State Electricity Distribution Company Limited (MSEDCL), Maharashtra Energy Department Agency (MEDA), and agencies from Rajasthan, Jharkhand, and Uttarakhand.

Shakti Pumps is a leading integrated Indian manufacturer of solar and electric submersible pumps, exporting to over 100 countries. It is a major beneficiary of the PM KUSUM scheme, holding about 25% market share in this government initiative.

The company owns 15 patents and develops unique products through its in-house research, design, and development. With more than four decades of industry experience, Shakti Pumps is among the few companies capable of manufacturing both pumps and motors in-house.

In FY25, the company’s export revenue was mainly driven by the United States (14.7%), followed by the Middle East (24.8%), Africa (43.3%), Rest of the World (13.8%), and Asia (3.4%).

Written by Sridhar J

Disclaimer

The views and investment tips expressed by investment experts/broking houses/rating agencies on tradebrains.in are their own, and not that of the website or its management. Investing in equities poses a risk of financial losses. Investors must therefore exercise due caution while investing or trading in stocks. Trade Brains Technologies Private Limited or the author are not liable for any losses caused as a result of the decision based on this article. Please consult your investment advisor before investing.

The post Multibagger Solar pump stock jump after raising ₹292.6 Cr via QIP appeared first on Trade Brains.