This month’s geopolitical tension focused on the Middle East is re-establishing the dollar’s traditional inverse relationship with risk assets, according to Goldman Sachs Group Inc.

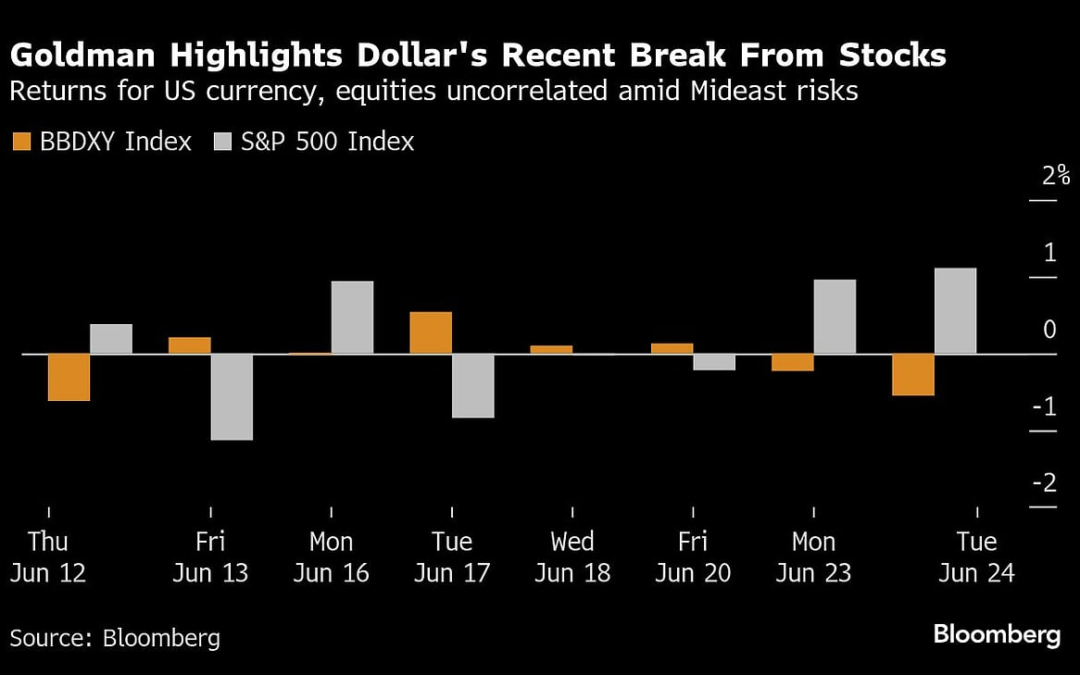

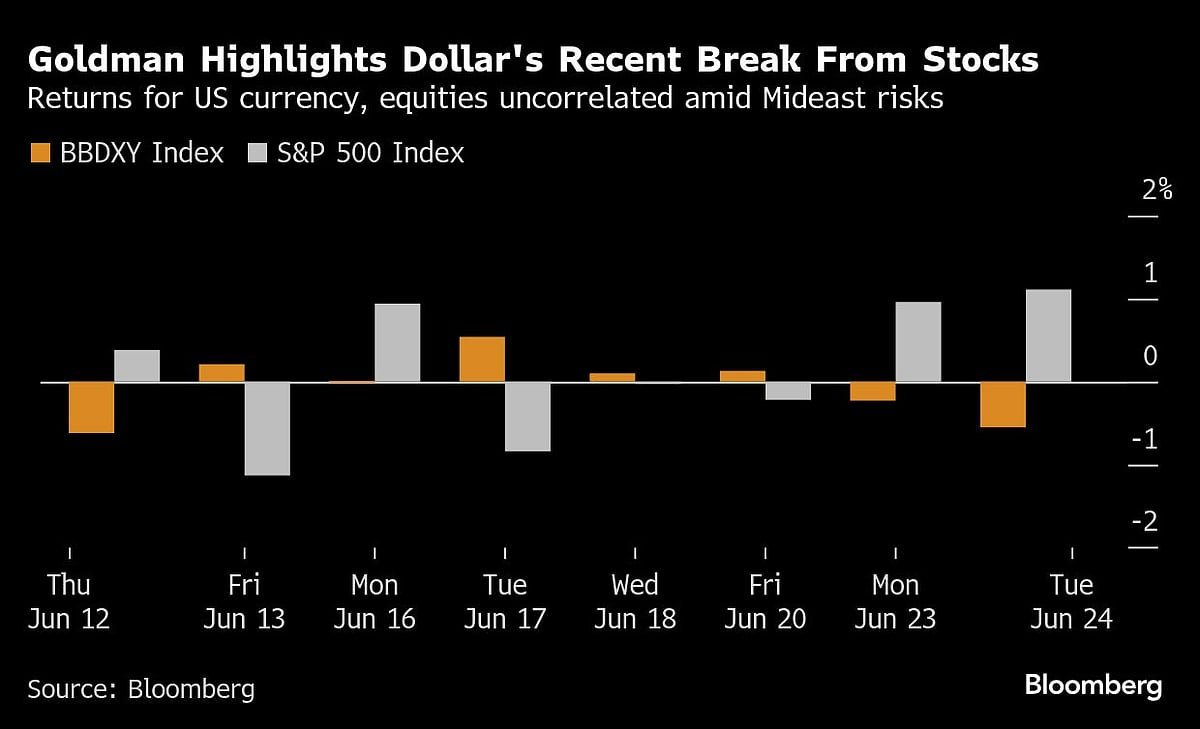

The last eight trading sessions saw the greenback move in the opposite direction of the S&P 500 Index, in contrast to the positive link to risky assets seen amid the broader selling of US holdings after President Donald Trump launched his trade war earlier this year, Goldman strategists including Stuart Jenkins, Teresa Alves and Isabella Rosenberg wrote in a note Wednesday.

“We think this partially reflects a recent shift in the source of global growth and risk shocks away from the US, and toward rest of world (in this case mostly geopolitical developments in the Middle East),” the note said.

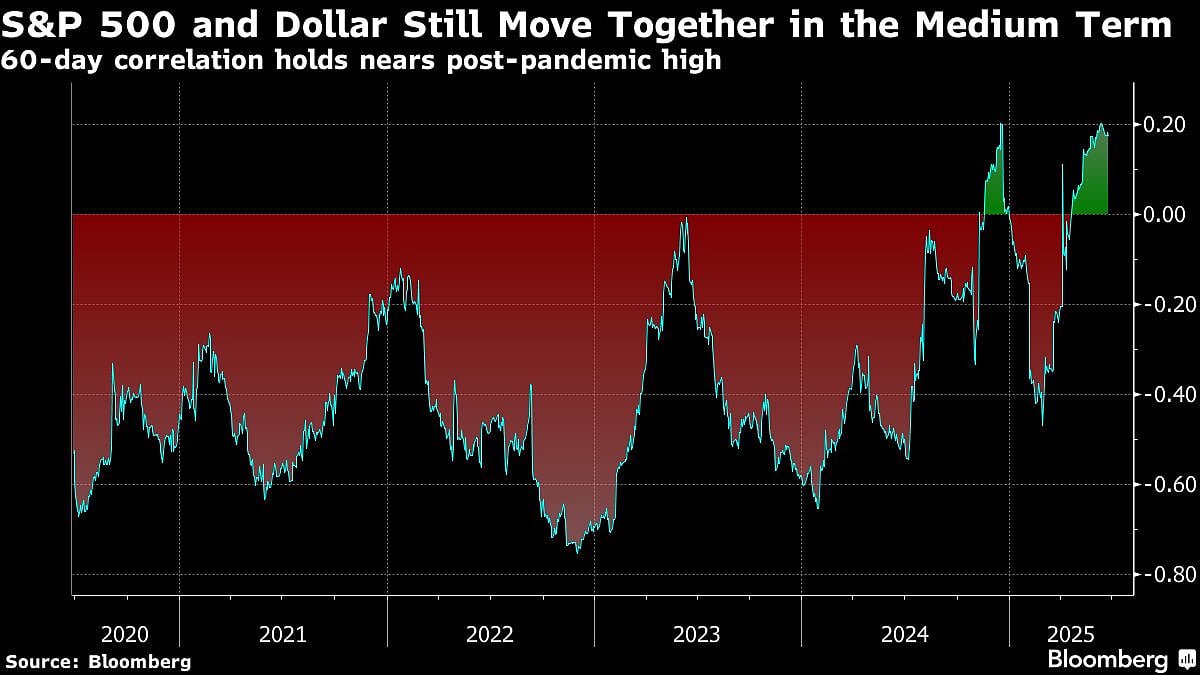

Still, on a lengthier timeframe, of roughly two months, the dollar remains positively correlated to US stocks. That means the greenback has tended to rally as global risk sentiment improves, and vice versa — a big shift from the greenback’s typical role as a haven currency of choice for global investors.

Goldman Sachs also sees the dollar’s year-to-date decline — a Bloomberg gauge is down more than 8% in 2025 — deepening in the months ahead. Richard Chambers, global head of repo trading at Goldman Sachs, said Tuesday that foreign investors raising their currency hedges against the dollar will further weigh on the greenback.

. Read more on Business by NDTV Profit.