(All dollar amounts are in thousands of United States dollars unless otherwise indicated, except for shares, per ounce, and per share amounts)

VANCOUVER, BC, Aug. 14, 2025 /PRNewswire/ – Metalla Royalty & Streaming Ltd. (“Metalla” or the “Company“) (TSXV:MTA) (NYSE:MTA) announces its operating and financial results for the three and six months ended June 30, 2025. For complete details of the condensed interim consolidated financial statements and accompanying management’s discussion and analysis (“MD&A“) for the three and six months ended June 30, 2025, please see the Company’s filings on SEDAR+ (www.sedarplus.ca) or EDGAR (www.sec.gov). Shareholders are encouraged to visit the Company’s website at www.metallaroyalty.com.

Brett Heath, CEO of Metalla, commented, “The second quarter of 2025 marked another important milestone in Metalla’s growth, highlighted by the successful closing of our inaugural revolving credit facility and recommissioning of the Endeavor Mine. The facility lowers our cost of capital and materially enhances our financial flexibility to continue scaling our business. We are also pleased that, in its first month of production, the Endeavor Mine has achieved its operating costs targets while producing 5,398 dry metric tonnes of silver-lead concentrate in July. We anticipate our first cash flows in the third quarter. Further and subsequent to quarter end, we are delighted to see Hudbay’s joint venture announcement for a 30% interest in Copper World by Mitsubishi Corporation and Equinox Gold’s announcement that Castle Mountain has been accepted into the United States Federal Permitting Improvement Steering Council’s FAST-41 Program as we believe both updates are key to progressing these assets to a construction decision.”

COMPANY HIGHLIGHTS

Key Company highlights for the three months ended June 30, 2025, and subsequent period include:

- On June 24, 2025, the Company entered into an agreement with the Bank of Montreal and National Bank Financial for a revolving credit facility (“RCF“) of up to $40.0 million with an accordion feature for an additional $35.0 million in availability, subject to the satisfaction of certain conditions. Concurrent with entering into the RCF, the Company also fully repaid and retired a C$50.0 million convertible loan facility with Beedie Investments Ltd.;

- On June 26, 2025, the Company announced the release of its 2025 Asset Handbook outlining the Company’s gold, silver, and copper royalties and streams, as well as Mineral Reserve and Mineral Resource data for the underlying properties. The Asset Handbook is available on the Company’s website;

- On July 9, 2025, Polymetals Resources Ltd. (“Polymetals“) announced that it had successfully refurbished and commissioned the Endeavor mine (“Endeavor“) and processing plant with first concentrate shipment scheduled for July. On August 4, 2025, Polymetals announced that Endeavor was now meeting its operating costs after its first full month of production and had produced 5,398 dry metric tonnes of silver-lead concentrate during July and had received concentrate prepayments of A$11.6 million;

- On August 11, 2025, Equinox Gold Corp. (“Equinox“) announced that its Castle Mountain Mine Phase 2 Project (“Castle Mountain“) has been accepted into the FAST-41 program. FAST-41 is a federal permitting framework designed to streamline environmental reviews, improve interagency coordination, and increase transparency. Acceptance into the program is expected to enhance regulatory certainty through a defined permitting schedule that may reflect reduced permitting timelines. Based on the permitting timeline posted to the FAST-41 project dashboard on August 8, 2025, the federal permitting process should be completed in December 2026; and

- On August 13, 2025, Hudbay Minerals Inc. (“Hudbay“) announced a $600 million strategic investment from Mitsubishi Corporation (“Mitsubishi“) for a 30% joint venture interest in Copper World. The contribution from Mitsubishi will consist of $420 million upon closing and a $180 million matching contribution payable no later than 18 months following the closing. Mitsubishi will contribute 30% of the ongoing costs beginning August 31, 2025, and will participate in the funding of the definitive feasibility study as well as the final project design, project financing, and project construction for Copper World.

Key operating and financial metrics for the Company include:

|

Three months ended |

Six months ended |

|||||||

|

June 30, |

June 30, |

June 30, |

June 30, |

|||||

|

2025 |

2024 |

2025 |

2024 |

|||||

|

Revenue from royalty interests(1) |

$2,695 |

$875 |

$4,416 |

$2,130 |

||||

|

Net loss |

$(1,603) |

$(1,491) |

$(2,334) |

$(3,223) |

||||

|

Adjusted EBITDA(2) |

$1,485 |

$165 |

$2,351 |

$243 |

||||

|

Total attributable GEOs(2) |

840 |

401 |

1,468 |

1,025 |

||||

|

Average realized price per attributable GEO(2) |

$3,289 |

$2,332 |

$3,104 |

$2,173 |

||||

|

Average cash cost per attributable GEO(2) |

$8 |

$17 |

$10 |

$12 |

||||

|

Operating cash margin per attributable GEO(2) |

$3,281 |

$2,315 |

$3,094 |

$2,161 |

||||

|

(1) For the methodology used to calculate attributable Gold Equivalent Ounces (“GEOs“), see Non-IFRS Financial Measures. |

|

(2) Adjusted for the Company’s proportionate share of NLGM held by Silverback. |

ASSET UPDATES

Below are updates for the three months ended June 30, 2025, and subsequent period to certain of the Company’s assets, based on information publicly filed by the applicable project owner:

Tocantinzinho

On July 8, 2025, G Mining Ventures Corp. (“G Mining“) reported second quarter gold production of 42.6 Koz and that the processing plant reached nameplate capacity of 12,890 tonnes per day (“tpd“) over 30 consecutive days. G Mining also reaffirmed their 2025 production guidance of 175 to 200 Koz with 56% of output concentrated in the second half of the year as higher-grade ore becomes accessible deeper in the pit.

Metalla accrued 309 GEOs from Tocantinzinho for the second quarter of 2025.

Metalla holds a 0.75% Gross Value Return (“GVR“) royalty on Tocantinzinho.

Wharf

On August 6, 2025, Coeur Mining, Inc. (“Coeur“) reported second quarter gold production of 24.1 Koz. Gold production in the second quarter increased 18% quarter-over-quarter driven by higher gold grades. Exploration expenditures for the second quarter were $4 million with expansion and infill drilling programs at Wedge and North Foley completed during the quarter, results met expectations with both zones expected to contribute meaningfully to year-end reserve and resource estimates. Coeur indicated that exploration priorities in the third quarter include infill drilling at Juno, following up on 2024 expansion drilling, which extended mineralization approximately 500 feet to the northwest. Coeur reaffirmed its full year guidance for 2025 at Wharf of 90 – 100 Koz gold and announced it expects to spend $13 to $17 million on capital expenditures to materially extend the mine life as well as other investments which are expected to be required to convert the Juno and North Foley deposits into reserves.

Metalla accrued 279 GEOs from Wharf for the second quarter of 2025.

Metalla holds a 1.0% GVR royalty on the Wharf mine.

Aranzazu

On August 5, 2025, Aura Minerals Inc. (“Aura“) reported second quarter production from Aranzazu of 22,281 GEOs (as defined by Aura), marking a 9% increase over the first quarter of 2025. The increase was driven by higher grades and improved recoveries, attributed to greater stability in the grinding-flotation circuits and the introduction of more effective reagents. During the quarter, infill drilling at the Glory Hole zone focused on converting Inferred to Indicated Mineral Resources in deeper parts of the deposit. Drilling confirmed continuity of the mineralized skarn, with highlight intercepts of 5.86% copper, 1.3 g/t gold, and 62 g/t silver over 25.5 meters, and 0.95% copper, 0.33 g/t gold, and 10 g/t silver over 26 meters. At Esperanza, drilling continued to confirm mineralization continuity, with notable results including 2.3% copper, 0.88 g/t gold, and 20 g/t silver over 6.4 meters, and 0.72% copper, 0.27 g/t gold, and 5 g/t silver over 3.35 meters.

On May 5, 2025, Aura highlighted the release of an updated National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101“) technical report for Aranzazu on April 1, 2025, which confirmed a 10-year mine life and projected average annual production of 28.1 million pounds of copper, 25.2 Koz of gold, and 652 Koz of silver.

Metalla accrued 175 GEOs from Aranzazu for the second quarter of 2025.

Metalla holds a 1.0% Net Smelter Returns (“NSR“) royalty on Aranzazu.

La Guitarra

On July 31, 2025, Sierra Madre Gold & Silver Ltd. (“Sierra Madre“) announced closing of the final tranche of a C$19.5 million private placement, with net proceeds to be used to expand the capacity of the La Guitarra mine and conduct a detailed exploration program, including drilling in the East District of the La Guitarra property.

On April 29, 2025, Sierra Madre announced the commencement of underground mining at the Coloso mine, located within the Guitarra complex. The Coloso mine is located 4 kilometers from the Guitarra processing plant and was previously mined allowing Sierra Madre to restart operations with minimal pre-production expenditures and seven months ahead of schedule. Sierra Madre noted that the Coloso Mineral Resource grades are 1.7 times higher in silver and 1.2 times higher in gold than the Guitarra vein, which served as the initial mining front at La Guitarra.

Metalla accrued 30 GEOs from La Guitarra for the second quarter of 2025.

Metalla holds a 2.0% NSR Royalty on La Guitarra, subject to a 1.0% buyback for $2.0 million. The Company’s NSR royalty covers 100% of the Guitarra complex, including the Guitarra, Coloso, and Nazareno mines.

La Encantada

On July 8, 2025, First Majestic Silver Corp. reported production of 49 oz of gold from La Encantada in the second quarter of 2025. During the quarter, one underground rig completed 2,546 meters of drilling on the property.

Metalla accrued 26 GEOs from La Encantada for the second quarter of 2025.

Metalla holds a 100% GVR royalty on gold produced at the La Encantada mine limited to 1.0 Koz annually.

Endeavor

On August 4, 2025, Polymetals announced that Endeavor was now meeting its operating costs after its first full month of production. Endeavor produced 5,398 dry metric tonnes of silver-lead and zinc concentrates during July and has agreed to a second pre-payment with its offtake partner of A$11.6 million. Polymetals announced that zinc concentrate transports from site will commence mid-August with the first ocean shipment scheduled for early September. The operational ramp-up remains on track, with mining of the high-grade Upper North silver ore expected to begin in August.

On July 9, 2025, Polymetals announced that it had successfully refurbished and commissioned the Endeavor mine and processing plant. Mining and processing activities were ramping up to planned levels, with production of silver-lead-zinc concentrate well underway. Polymetals reported that first ore was treated on June 7, with a total of 36,066 dry metric tonnes of commissioning ore processed, grading 103 g/t silver, 3.72% zinc, and 2.31% lead. Site activities remain on track to process an average of 65,000 dry metric tonnes of ore per month during the second half of 2025. Exploration during the second quarter focused on the Carpark target and Endeavor South. At Endeavor South, drilling intersected encouraging alteration, veining, and visible sulphides, including elevated copper values, supporting the potential continuation of the mineral system south of the Endeavor main lode.

Metalla holds a 4.0% NSR royalty on lead, zinc and silver produced from Endeavor and expects its first cash flow in the third quarter of 2025 at which point it will be classified as producing.

Gurupi (formerly CentroGold)

On July 23, 2025, G Mining reported that a Brazilian federal court had nullified legacy environmental licenses granted in 2011 to a prior operator, resolving a longstanding legal dispute over the Gurupi Project and providing a clean regulatory path forward. The ruling allows G Mining to initiate a new environmental licensing process, including the preparation of a full environmental impact assessment and engagement with the National Institute for Colonization and Agrarian Reform. G Mining also announced a budget of $2 to $4 million has been allocated to Gurupi for 2025, with a larger budget to be mobilized in the second half of the year upon receipt of the necessary exploration permits.

Metalla holds a 1.0% NSR royalty on the first 500 koz of production, 2.0% NSR royalty on the next 1 Moz, and 1.0% NSR royalty thereafter on Gurupi.

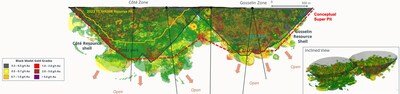

Côté-Gosselin

On August 7, 2025, IAMGOLD Corporation (“IAMGOLD“) reported in their second quarter MD&A that approximately 19,700 meters of drilling were completed at the Gosselin deposit during the quarter (31,700 meters year-to-date). The program was focused on increasing confidence in the existing resource and converting a significant portion of Inferred Resources to the Indicated category. IAMGOLD plans to drill a total of 45,000 meters at Gosselin in 2025, however this program could increase. In addition, 6,500 meters of the 20,000-meter infill drill program commenced in the second quarter of 2025 to improve resource confidence in the northeastern extension of the Côté deposit. According to IAMGOLD, the results of the Gosselin exploration program are expected to be included in an updated Mineral Reserve and Resource estimate next year and will inform the updated technical report which IAMGOLD announced will consider a larger scale Côté gold mine with a conceptual mine plan targeting both the Côté and Gosselin zones over life of mine. The updated technical report is expected to be completed by the end of 2026.

IAMGOLD also reported gold production at Côté gold mine in the second quarter was 96 Koz, as the mine continues to ramp up following the start of production in 2024. Mining activities continue to expand the pit and increase the volume of blasted ore in the pit to provide flexibility in supporting the planned mill feed with reduced handling. Production at Côté Gold in 2025 is expected to be in the 360 – 400 Koz range.

Metalla holds a 1.35% NSR royalty covering less than 10% of the Côté Mineral Reserves and Resources estimate in the northeastern portion of the pit design, as well as 100% of the Gosselin Mineral Resource estimate.

Castle Mountain

On August 11, 2025, Equinox reported that Castle Mountain has been accepted into the United States Federal Permitting Improvement Steering Council’s FAST-41 program. FAST-41 is a federal permitting framework designed to streamline environmental reviews, improve interagency coordination, and increase transparency. Acceptance into the program is expected to enhance regulatory certainty through a defined permitting schedule that may reflect reduced permitting timelines. Based on the permitting timeline posted to the FAST-41 project dashboard on August 8, 2025, the federal permitting process should be completed in December 2026. Equinox further stated that with FAST-41 permitting status in place, that it has initiated study updates …