Lemon Tree Hotels Ltd. share price touched fresh high for two session in a row. The stock has been rising three sessions in a row. Investors preferred the stock in the backdrop of recently announced GST reforms as they hope that appetite for discretionary spends on hotels and resorts among urban population will increase.

In recent development, the hotel informed the exchanges that its subsidiary has managed to own a letter of award for land parcel in Nehru Place, New Delhi. Fleur Hotels has own the letter of award from Delhi Development Authority to develop and operate a five-star hotel, Lemon Tree Hotel said on Aug 14. The hotel will be named Aurika Nehru Place.

Aurika Nehru Place will be the debut for Lemon Tree in upper upscale brand in National Capital Region, the company said in the exchange filing.

The letter of award is for 12 months from the date of its issuance. The land parcel measures to 2.256 acres. Lemon Tree Hotels did not mentioned the cost of developing the five-star hotel in the exchange filing.

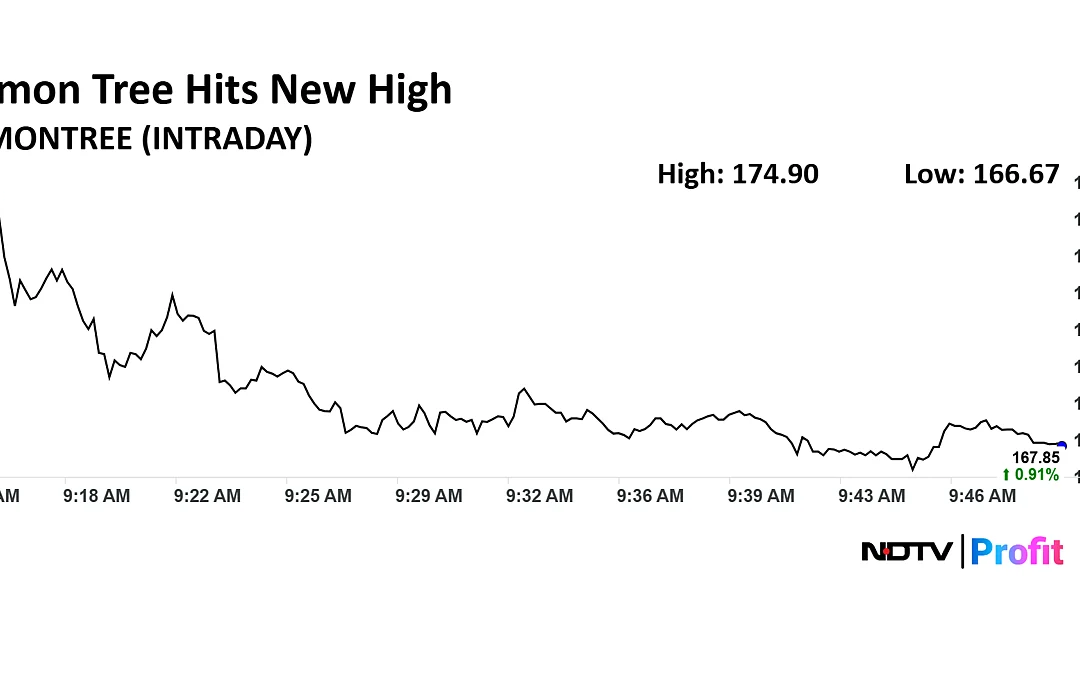

In last three session, Lemon Tree Hotels increased 11.79%. The stock advanced 5.15% to a record high of Rs 174.90 apiece. It was trading 0.34% higher at Rs 166.91 apiece as of 10:07 a.m., which implied 0.47% decline in the NSE Nifty 50 index.

Lemon Tree Hotels advanced 24.96% in 12 months, and 9.15% on year-to-date basis. Total traded volume so far in the day stood at 11 times its 30-day average. The relative strength index was at 71.27, which implied the stock is slightly overbought.

Out of 23 analysts tracking the company, 21 maintains a ‘buy’ rating, one recommends a ‘hold’ and one suggests to ‘sell’, according to Bloomberg data. The average 12-month consensus price target implies an upside of 5.2%.

. Read more on Markets by NDTV Profit.