Austin, TX, USA, Aug. 13, 2025 (GLOBE NEWSWIRE) — Custom Market Insights has published a new research report titled “Stainless Steel Scrap Market Size, Trends and Insights By Scrap Type (Austenitic 300 series, Ferritic 400 series, Martensitic, Others), By End-Use Industry (Construction & Infrastructure, Automotive & Transportation, Machinery & Industrial Equipment, Consumer Goods, Others), and By Region – Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2025 – 2034“ in its research database.

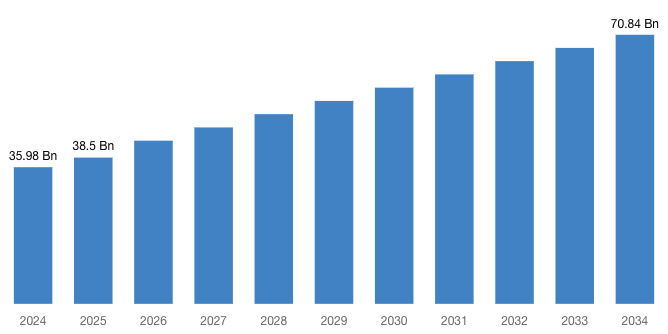

“According to the latest research study, the demand of the global Stainless Steel Scrap Market size & share was valued at approximately USD 35.98 Billion in 2024 and is expected to reach USD 38.50 Billion in 2025 and is expected to reach a value of around USD 70.84 Billion by 2034, at a compound annual growth rate (CAGR) of about 7.01% during the forecast period 2025 to 2034.”

Click Here to Access a Free Sample Report of the Global Stainless Steel Scrap Market @ https://www.custommarketinsights.com/request-for-free-sample/?reportid=72134

Overview

As per the industry experts at CMI, the primary growth driver of the stainless steel scrap market comes from the global whirl of circular economy practices and rising stress on decarbonized, resource-efficient metal production. Stainless steel scrap is a valuable secondary raw material from the perspective of new stainless steel production, saving great quantities of energy, carbon emissions, and use of primary alloying materials-Nickel, Chromium, etc. With industries adopting green procurement policies and tracking lifecycle emissions from construction, automotive, machinery, consumer goods, etc., stainless steel scrap has become a vital element for realizing any sustainability objective.

The high global demand for steel is reinforcing the use of scrap-based Electric Arc Furnace (EAF) technology, especially in light of environmental regulations, carbon border taxes, and efficiency standards in key markets. And then, changes in national recycling policies and technological developments in diffusion sorting of alloys, with the introduction of digital scrap trading platforms, improve traceability and quality control, which ultimately enhances scalability. Where scrap generation and stainless steel consumption are both high, in Europe and Asia-Pacific, the market is swiftly formalizing and remains a worthy investment. While the industry shifts towards low-carbon steelmaking, stainless steel scrap aims to serve as both an economic input and a strategic enabler of industrial green transformation.

Key Trends & Drivers

- Global Emphasis on Circular Economy and Decarbonization: This market of stainless steel scrap is rapidly evolving with the worldwide decline in circular economy principles and the demand for quick decarbonization of metal-intensive industries. Stainless steel can be recycled 100% without losing its quality, hence rendering stainless steel scrap highly sought after as a secondary raw material for steelmaking. Hence, as governments, corporations, and industry bodies set net-zero targets, scrap will play a crucial role in cutting carbon emissions that are involved in primary steelmaking, especially by the EAF (Electric Arc Furnace) route, wherein scrap is considered the major raw material. A cleaner form of production with scrap steel thus reduces the energy intensity and landfill build-up, and hence scrap becomes a strategic material for green manufacturing.

- Urbanization and industrialization are accelerating the production of more stainless steel scrap in bulk: As urban infrastructures, transportation, and consumer durables grow in these parts of the world, end-of-life stainless steel products, along with other materials, are being dumped into waste streams at an increasing rate, especially in Asia-Pacific, Latin America, and Africa. These might be discarded household appliances, kitchenware, automotive parts, pipelines, and construction materials. Dismantling and recovery operations are going up in places like India, Indonesia, and Brazil, often driven by increasing raw material prices and incentives coming from the scrap side. This rise in uptake of take-back programs and buy-back schemes for scrap across industrial sectors has ensured a very dynamic stainless steel recycling market.

- Policy and Regulation Support for Low-Carbon Materials: Government policies across high-ranking economies are promoting production methodologies that heavily rely on scrap. The EU is pushing scrap usage all the way to abate embedded emissions in steel through the implementation of CBAM and the Green Deal. Further, schemes such as India’s Steel Scrap Recycling Policy and moves from Japan for a circular metals economy seek to formalize scrap collection and improve traceability. Export tariffs seal the efforts, with China levying an incredible 40% on stainless scrap. These policy levers, in a way, promote the inclusion of inox scrap into value chains and create a compliance-driven market that favors recycled inputs over virgin ones.

Request a Customized Copy of the Stainless Steel Scrap Market Report @ https://www.custommarketinsights.com/request-for-customization/?reportid=72134

- Technological Betterments in Scrap Sorting and Processing: Recent advancements like sensor-based sorting, X-ray fluorescence (XRF), and AI-assisted alloy recognition are helping to improve the reputation of stainless steel scrap by enhancing processing efficiency and quality. These technologies can identify different grades of stainless steel scrap (like 300-series and 400-series), which helps reduce contamination and allows the scrap to be used in important applications such as aerospace and medical devices. Additionally, automation in scrap processing, robotics for handling scrap, and digital marketplaces for trading scrap are increasing transparency and traceability in the supply chain, addressing the long-standing issue of price discovery in this fragmented and informal industry. Such technologies identify stainless steel scrap by grade (i.e., 300-series, 400-series), and therefore, reduce contamination level so that stainless steel scrap can be supplied for critical higher-specification applications such as aerospace and medical devices. At the same time, automation for processing scrap, robotics for scrap handling, and digital scrap marketplaces for scrap trading are now providing much-needed transparency and traceability along the supply chain so that the absence of price discovery would be once-for-all all addressed to the benefit of what has been a highly fragmented and informal industry.

- Growing Demand Across End-Use Industries: Several downstream sectors utilize large quantities of stainless steel scrap. To begin with, construction and infrastructure stainless steel from scrap is used for rebars, beams, and cladding owing to the strength and corrosion-resistant properties. Stainless steel is used in automotive and transportation for structural and exhaust components to reduce vehicle weight and improve recyclability, with special emphasis on electric vehicle manufacturers. In industrial machinery, stainless steel scrap is turned back into shafts, valves, and fabrication components, whereas consumer goods form the market for recycled stainless steel in cutlery, kitchenware, and appliances. Such a vast pool of demand assures stable market growth even if raw material prices are volatile.

Report Scope

| Feature of the Report | Details |

| Market Size in 2025 | USD 38.50 Billion |

| Projected Market Size in 2034 | USD 70.84 Billion |

| Market Size in 2024 | USD 35.98 Billion |

| CAGR Growth Rate | 7.01% CAGR |

| Base Year | 2024 |

| Forecast Period | 2025-2034 |

| Key Segment | By Scrap Type, End-Use Industry and Region |

| Report Coverage | Revenue Estimation and Forecast, Company … |