Austin, TX, USA, Aug. 21, 2025 (GLOBE NEWSWIRE) — Custom Market Insights has published a new research report titled “Biologics and Biosimilars Market Size, Trends and Insights By Product Type (Monoclonal Antibodies, Insulin, Recombinant Hormones, Fusion Proteins, Other Product Types), By Therapeutic Application (Oncology, Autoimmune Diseases, Diabetes, Blood Disorders, Other Therapeutic Applications), By End User (Hospitals, Clinics, Homecare Settings, Retail Pharmacies, Other End Users), and By Region – Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2025 – 2034“ in its research database.

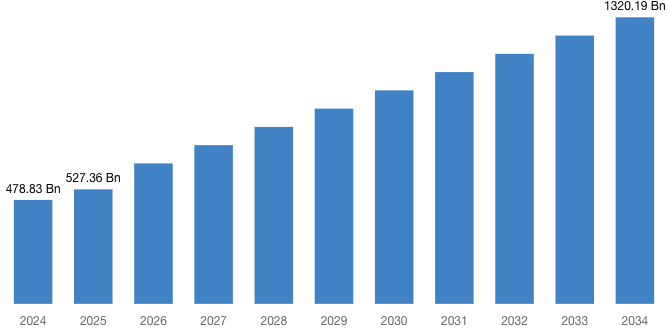

“According to the latest research study, the demand of the global Biologics and Biosimilars Market size & share was valued at approximately USD 478.83 Billion in 2024 and is expected to reach USD 527.36 Billion in 2025 and is expected to reach a value of around USD 1,320.19 Billion by 2034, at a compound annual growth rate (CAGR) of about 10.42% during the forecast period 2025 to 2034.”

Click Here to Access a Free Sample Report of the Global Biologics and Biosimilars Market @ https://www.custommarketinsights.com/request-for-free-sample/?reportid=72402

Overview

According to industry analysts at CMI, the Genetics and biosimilars markets remain buoyed by aging incidences of chronic diseases such as cancer, diabetes, and autoimmune disorders requiring long-term and targeted treatments. The newer cutting-edge biomanufacturing technologies like cell line engineering and expression systems have provided the production with more efficiency. The expiration of patent rights of several blockbuster biologics has allowed biosimilars to enter the market and commercialize themselves as relatively inexpensive alternatives.

Increasing governmental interest in healthcare cost containment, coupled with a favorable regulatory framework, has accelerated the views on biosimilars. This acceptance and adoption of biosimilars is also being encouraged by rising awareness among physicians and patients and by reimbursement policies in both developed and emerging markets.

Key Trends & Drivers

- Patent Expiry on Biologics: With the expiry of patents of important molecules, many such drugs and their costlier counterparts are entering the market. Biosimilar makers have come in with less expensive versions of in-demand therapies that include those in oncology and autoimmune diseases. This is leading to a change in competitive dynamics in the market and allowing for greater access and lower healthcare costs. Pharmaceutical companies are inclined to work on biosimilar pipelines as a means of capturing opportunities created by the expiry of patents. Accordingly, payers and governments attempt to stimulate the uptake of biosimilars to create effective treatment pathways. The patent cliff in major markets is expected to foster biosimilar launches in the next decade, especially in high-volume therapeutic areas.

- Rising Chronic Disease Burden: The increasing global demand for biologics and biosimilars is sustained by the increasing prevalence of chronic conditions such as cancer, diabetes, and rheumatoid arthritis. Biologics treat complex conditions by targeted intervention, keeping DM in long-term management, hence becoming an integral part of the treatment of today. With the aging population and changing lifestyle variables, there has been an increasing chronic disease burden worldwide. This gives an opportunity for a healthcare system to adopt innovative biologics as well as biosimilars that are cost-effective in meeting increased demand without compromising the quality of care provided. The increase in diagnoses and screening programs is further improving patient access and initiation of therapies to reinforce biologics for long-term disease control.

Request a Customized Copy of the Biologics and Biosimilars Market Report @ https://www.custommarketinsights.com/request-for-customization/?reportid=72402

- Regulatory Advancements: Product development and approval cycles have been the beneficiary of biosimilars-specific regulation in the main markets. The FDA, EMA, and PMDA have built their evaluation structures for biosimilars around science, including checks for analytical comparability, the extrapolation of indications, and interchangeability. Such advances in regulation have lowered the barriers to entry into the marketplace and made it more predictable for the manufacturers. As a result, an increased number of companies are investing in biosimilars portfolios. At the same time, regional regulatory harmonization efforts are improving market access in the regions of Asia and Latin America. With efficient approvals and increasing regulatory certainty, biosimilars are being launched faster, with acceptance building among physicians and patients all over the world.

- Innovation vs. Cost Pressure: The biologics market is shaped by an uneasy relationship between high-tech therapies and ever-escalating cost pressures. On one hand, pharmaceutical companies invest in new and advanced biologic drugs such as monoclonals for unmet clinical needs or gene therapies. On the other hand, payers and governments exert maximum cost pressure through the uptake of various biosimilars. These conflicting forces create very interesting dynamics in the market, with innovators attempting to maintain exclusivity via litigation and life-cycle management and biosimilar companies competing on price and access. This interplay will continue into strategies on pricing and shifts in market share, while investment decisions will be influenced by this process in global healthcare systems.

- Varying Adoption Across Regions: Europe leads the list of integrating biosimilars, as its early regulatory perspective and tender-based pricing supported it. In contrast, the U.S. has seen slow uptake, largely due to barriers associated with interchangeability and payer rebate agreements. Emerging markets such as India, Brazil, and South Korea are undergoing rapid development fueled by initiatives to ensure affordability and by local production capacities. Such regional variations determine strategies for market entry, pricing models, and competitive positioning. Customized education, policy alignment, and engagement with stakeholders would still be pivotal for the harmonization of the adoption trend worldwide.

- Mutating Prescriber and Patient Perception: Prescriber and patient confidence is paramount for an expanding market for biosimilars. To begin with, uptake was discouraged by concerns of efficacy, safety, and switching. But now, with real-world evidence being accumulated alongside post-marketing surveillance and clinical guidelines supporting the trust, physician education programs encourage substitution and switching, alongside payment incentives acting similarly. Patient advocacy and outreach have also provided a backdrop for building familiarity with biosimilars, especially in the treatment of chronic conditions where continuous care is required. As perceptions change, resistance at the market level decreases, thereby easing biosimilars into protocol treatments. Continuous engagement and transparent communication will therefore always be necessary to diminish behavioral and clinical inertia.

Report Scope

| Feature of the Report | Details |

| Market Size in 2025 | USD 527.36 Billion |

| Projected Market Size in 2034 | USD 1,320.19 Billion |

| Market Size in 2024 | USD 478.83 Billion |

| CAGR Growth Rate | 10.42% CAGR |

| Base Year | 2024 |

| Forecast Period | 2025-2034 |

| Key Segment | By Product Type, Therapeutic Application, End User and Region |

| Report Coverage | Revenue Estimation and Forecast, Company Profile, Competitive Landscape, Growth Factors and Recent Trends |

| Regional Scope | North America, Europe, Asia Pacific, Middle East & Africa, and South & Central America |

| Buying Options | Request tailored purchasing options to fulfil your requirements for research. |

(A free sample of the Biologics and …