Synopsis: Polycab outperformed KEI in Q3 FY26 with stronger revenue growth, higher margins and superior ROCE, while KEI delivered healthy profit growth and maintained a clean balance sheet, making both strong but differently positioned players.

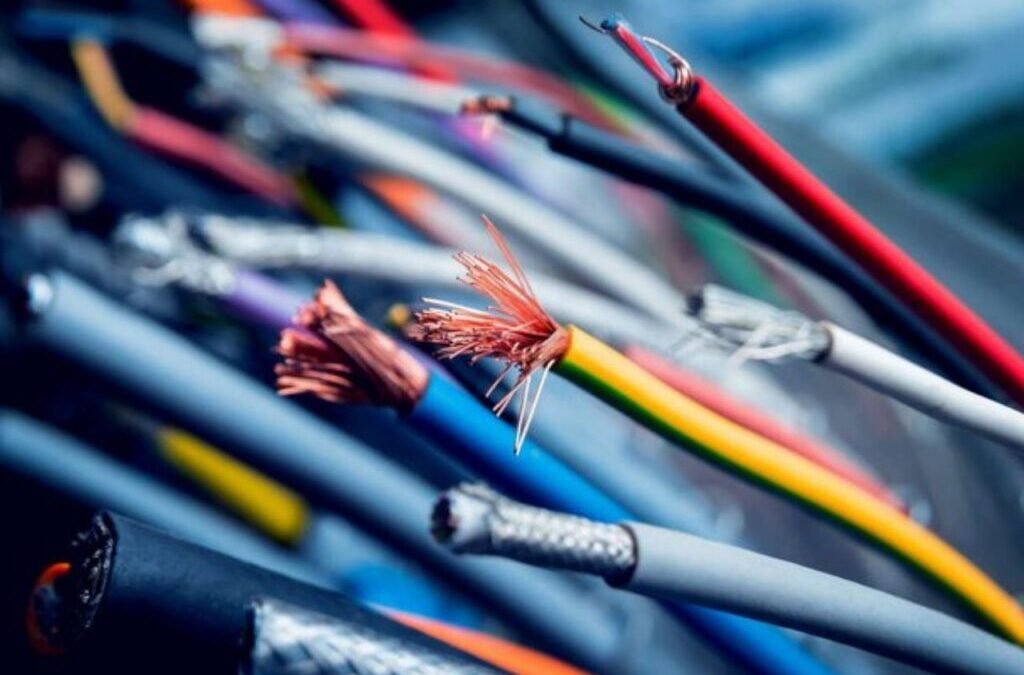

Polycab India and KEI Industries, two leading wire and cable manufacturers, reported robust Q3 FY26 results amid strong infrastructure and housing demand. While Polycab benefited from its diversified business model and brand-led growth, KEI continued to show steady performance as a focused cables player. This comparison highlights which company outshone the other across key financial and operational metrics.

Business Profile & Market Position

Polycab India is India’s largest wires and cables company with a strong presence across Wires & Cables (W&C), FMEG (fans, lighting, switches) and EPC, making it a diversified electricals player. It has a dominant domestic footprint and growing international presence.

KEI Industries is primarily focused on wires and cables, with limited exposure to EPC and stainless steel wires. Its business is more concentrated in institutional and dealer-distribution segments, making it a relatively pure-play W&C company.

Financials

Polycab reported Q3 FY26 revenue of ₹7,636 crore, registering a strong 46% YoY growth, driven mainly by exceptional performance in the domestic wires and cables segment.

Polycab posted a Q3 FY26 PAT of ₹630 crore, up 36% YoY, with an EBITDA margin of 12.7% and a PAT margin of 8.3%, reflecting strong operating leverage. KEI reported Q3 FY26 revenue of ₹2,955 crore, showing a healthy but lower 19.5% YoY growth, supported by growth in dealer distribution and institutional sales.

KEI reported a Q3 FY26 PAT of ₹235 crore, up 42.5% YoY, with an EBITDA margin of 11.98% and a PAT margin of 7.95%, indicating improving but slightly lower profitability compared to Polycab.

Segment Mix & Growth Drivers

Polycab’s growth is led by Wires & Cables (59% YoY domestic growth) and improving performance in FMEG, with solar products and brand investments driving future growth. KEI’s growth is driven by dealer distribution (29% YoY) and rising institutional cable demand, with EPC contributing a small portion (about 2–3%) of overall revenue.

Export Presence & International Exposure

Polycab has a strong and expanding international business, with exports contributing a meaningful share of revenues across the Middle East, Africa, Europe and the US. The company is actively scaling its overseas distribution network and sees exports as a long-term structural growth driver.

KEI also has an export presence, but it is relatively smaller and more limited in scale, with the company primarily focused on domestic demand. International sales exist but are not yet a major growth pillar compared to Polycab.

Brand Strength & Product Diversification

Polycab has built a strong consumer brand in electrical and FMEG products such as fans, lighting, switches and solar solutions, giving it direct exposure to retail demand and higher-margin branded products. This brand-led strategy reduces dependence on institutional orders.

KEI, in contrast, is more B2B and channel-driven, with its sales largely coming from dealers, contractors and infrastructure projects. While this provides volume stability, it offers less pricing power and brand premium compared to Polycab.

Conclusion

Overall, Polycab appears structurally stronger due to its larger scale, diversified product portfolio, higher margins, stronger ROCE and net cash position. KEI, however, offers a focused wires-and-cables play with consistent growth, improving profitability and a clean balance sheet. Polycab suits investors seeking market leadership and stability, while KEI fits those preferring a high-growth, niche electricals manufacturer.

Disclaimer: The views and investment tips expressed by investment experts/broking houses/rating agencies on tradebrains.in are their own, and not that of the website or its management. Investing in equities poses a risk of financial losses. Investors must therefore exercise due caution while investing or trading in stocks. Trade Brains Technologies Private Limited or the author are not liable for any losses caused as a result of the decision based on this article. Please consult your investment advisor before investing.

The post KEI Vs Polycab: Which wire and cable manufacturer performed better in Q3 FY26? appeared first on Trade Brains.