Karur Vysya Bank Ltd.’s total business grew in the first quarter of fiscal 2025, aided by a rise in deposits and advances.

The Karur-based lender’s total business rose 15.3% year-on-year to Rs 1.96 lakh crore in the quarter ended June 30, 2025, according to an exchange filing.

During the same period, total current account saving account, or CASA, rose 4.5% year-on-year to Rs 29,306 crore.

The lender’s total deposits grew 15% to Rs 1.06 lakh crore, while advances rose 15% to Rs 89,370 crore, compared to the same period last year.

Karur Vysya Bank Q4 Results

Karur Vysya Bank’s standalone net profit during the quarter ended March rose 13% to Rs 513 crore, according to an exchange filing on Monday.

The net interest income—the difference of interest earned and interest paid—rose 9% to Rs 1,089 crore, the private sector bank said.

Operating profit fell 3.7% to Rs 835 crore in comparison to Rs 867 crore. Gross NPA for quarter ended March was at 0.76%, while net NPA was flat at 0.2%. Provisions for the quarter under review also fell 45% to Rs 161 crore.

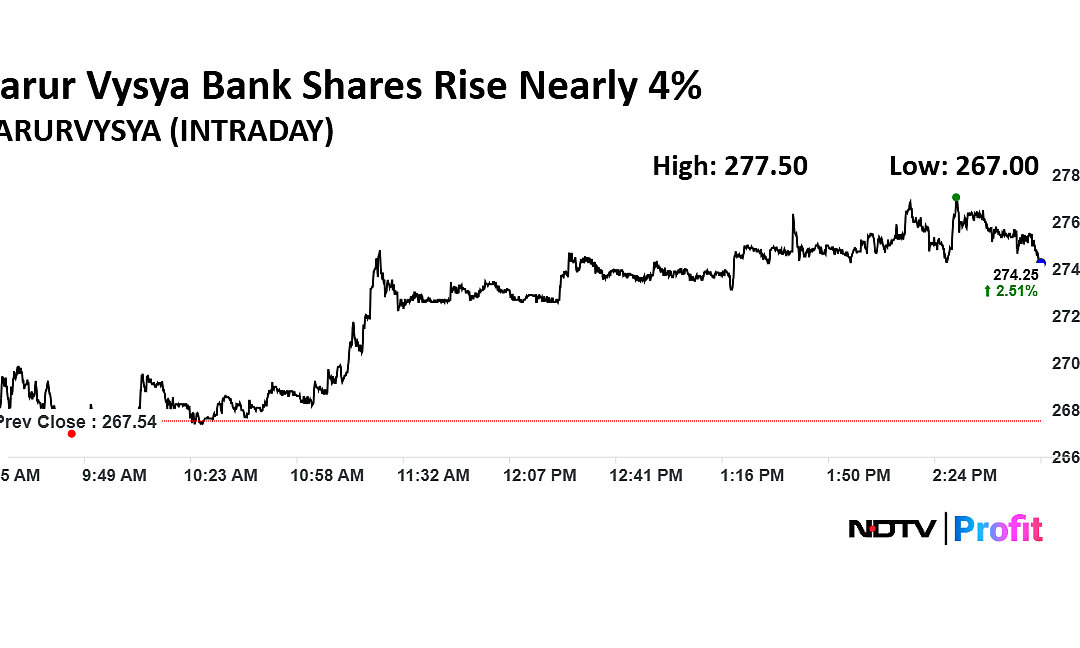

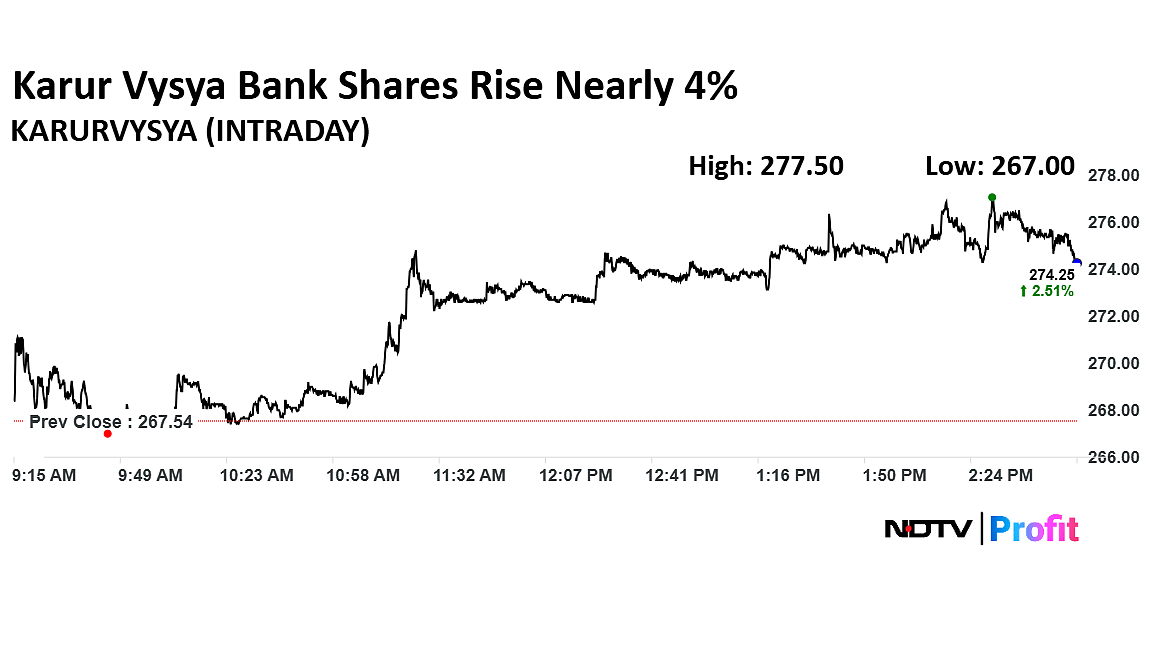

Karur Vysya Bank Share Price Today

Shares of Karur Vysya Bank rose as much as 3.72%, before paring gains to trade 2.92% higher at Rs 275.35 apiece, compared to a 0.05% advance in the benchmark Nifty 50 as of 2:50 p.m.

The stock has risen 33.06% in the last 12 months and 26.95% year-to-date. The relative strength index was at 65.71.

Out of 18 analysts tracking the bank, 17 have a ‘buy’ rating on the stock and one recommends ‘hold’ rating, according to Bloomberg data. The average of 12-month analysts’ price targets implies a potential upside of 0.2%.

. Read more on Business by NDTV Profit.