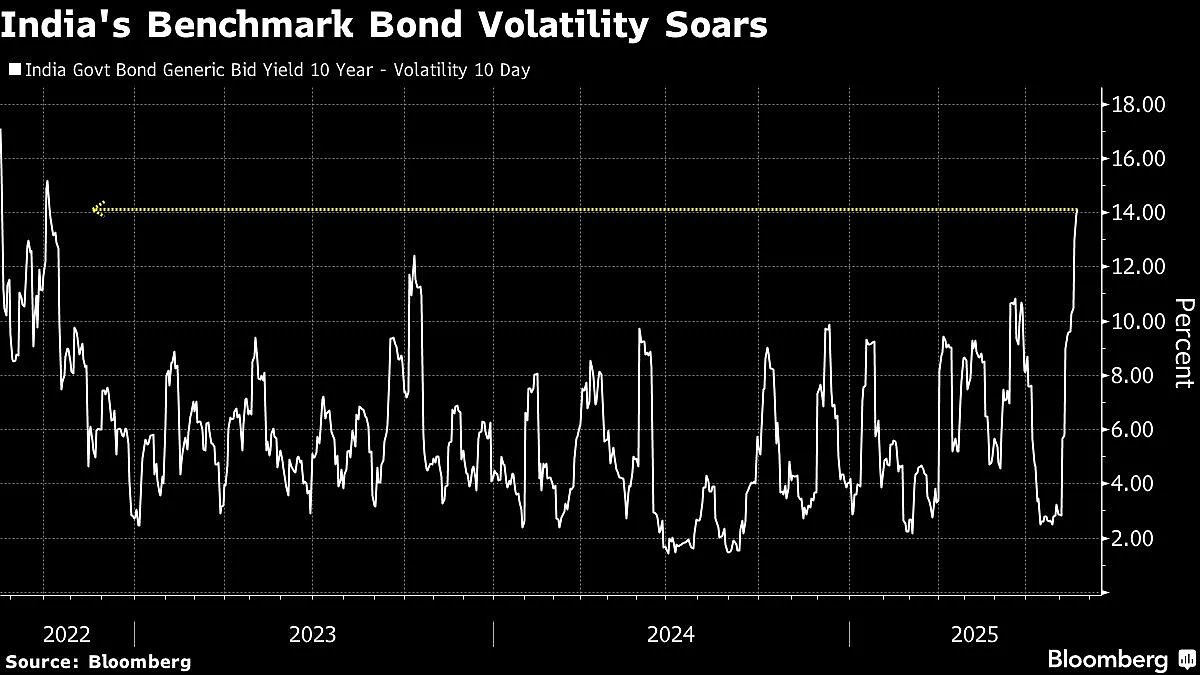

Volatility in benchmark Indian bonds jumped to a three-year high, as a plan to cut consumption taxes stoked concerns that the government may sell more debt to make up for any revenue shortfall.

A Bloomberg gauge of swings in India’s 10-year bonds reached the highest since October 2022 on Tuesday, after recent ructions in the nation’s debt. Benchmark bonds suffered the biggest selloff in almost two years this week, reversing a rally Thursday that was triggered by a rare sovereign rating upgrade.

The planned tax revamp has led to worries about absorbing greater bond supply this year. The volatility may persist amid the uncertainty over the extent of a possible hit to the government’s revenue. HSBC Holdings Plc estimates the proposed tax changes will cost the exchequer around 1.4 trillion rupees ($16 billion) or 0.4% of India’s gross domestic product.

The benchmark yield could still decline by about 10 basis points to near the 6.40% mark if the administration signals that it would stick to its budgeted deficit for the current fiscal year, said VRC Reddy, treasury head at Karur Vysya Bank.

The 10-year yield closed at 6.51% on Tuesday, after rising as much as five basis points earlier in the session.

The turbulence in bonds has broader implications for India’s economy, which faces one of the steepest US tariff rates, following President Donald Trump’s broadsides against the South Asian country for its purchases of Russian oil. The abrupt spike in sovereign yields has pushed up borrowing costs in the corporate bond market too, likely posing a risk to fundraising in a slowing economy.

Further, the central bank has struck a wary stance by predicting higher inflation next year, leaving bond traders all but convinced that fresh easing may not be in the offing anytime soon.

“The sharp rise in volatility is a typical feature of a change in the market’s rate view and that is playing out right now,” said Sagar Shah, head of domestic markets at RBL Bank. “There’s a concern that the fiscal consolidation that has been a feature of the last few years may now bottom out.”

. Read more on Markets by NDTV Profit.