Shares of Indian Energy Exchange (IEX) surged to their near six-month high before retreating almost 6% on Friday as the Electricity Appellate Tribunal (APTEL) resumed hearings in the high-profile market coupling case.

IEX, in its submission to APTEL, highlighted that CERC had issued a corrigendum converting the market coupling “order” into a “direction.” The company termed this retrospective change unusual, given that the case is still pending. IEX argued that the CERC order is arbitrary, violates principles of natural justice, and would erode market share without delivering any tangible benefits. It also pointed out the lack of clarity from CERC on withdrawing the coupling order.

On its part, CERC’s lawyer requested more time to respond on the withdrawal of the July 23, 2025 order. The regulator clarified through the corrigendum that the term “order” in its July 23, 2025 publication should be read as “directions.”

During the hearing, APTEL observed that the Central Electricity Regulatory Commission (CERC) must function independently and remain above suspicion. The tribunal noted that it would conduct an inquiry if any irregularities were found within CERC and emphasised the need for the regulator to show urgency in putting its house in order.

The hearing had previously been postponed after CERC indicated its willingness to accept directions regarding withdrawal of the contentious order, which had sparked strong reactions in the market.

What Is Market Coupling?

Market coupling is a framework where buy and sell bids from all power exchanges—such as IEX, PXIL, and HPX—are to be aggregated and cleared under a single market clearing price (MCP). This contrasts with the current setup where each exchange sets its own prices.

If approved, it will be a major regulatory shift in the Day-Ahead Market (DAM) mechanism, aimed at centralising electricity price discovery across India’s multiple power exchanges.

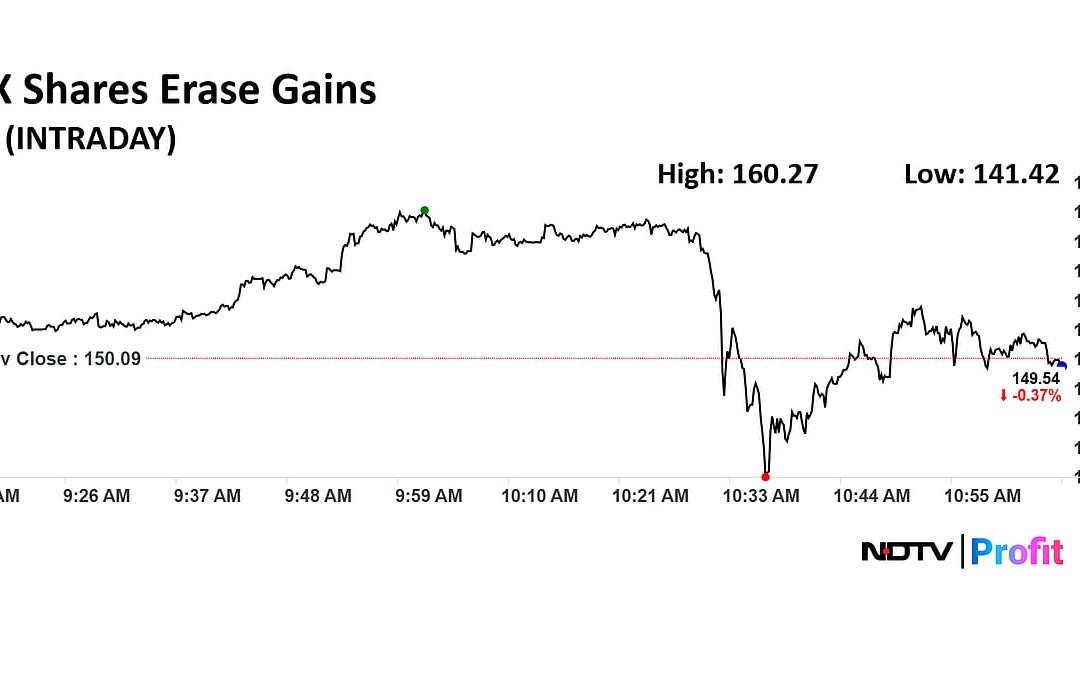

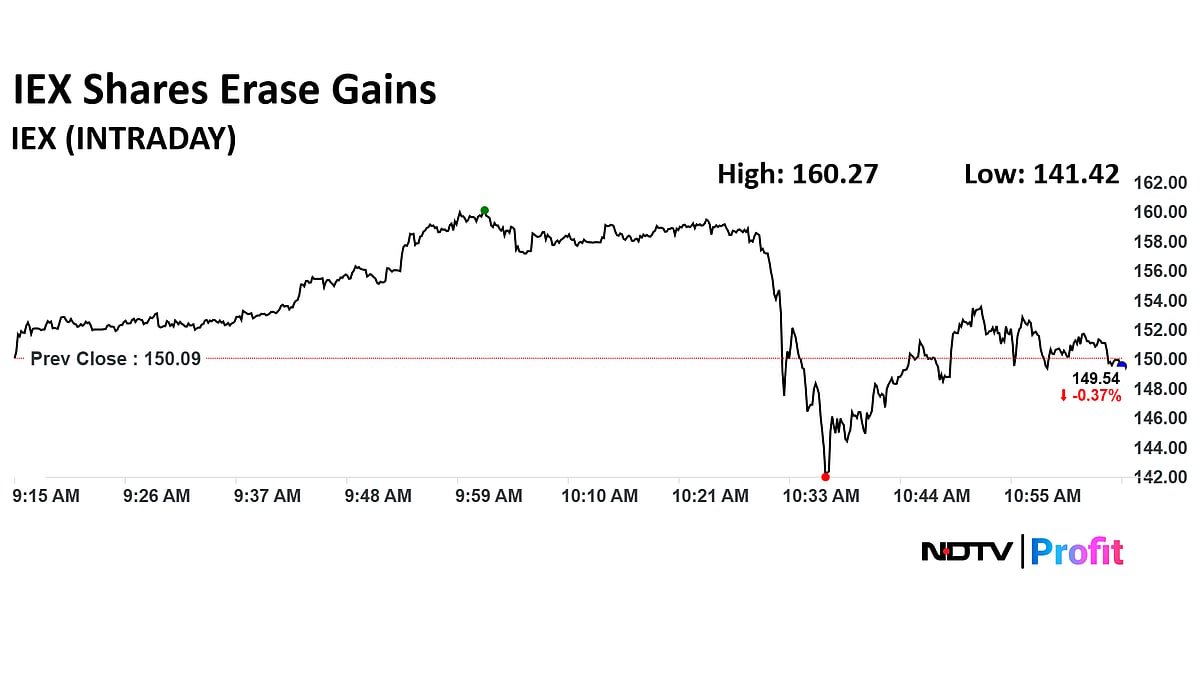

IEX Share Price Data

The scrip rose as much as 6.78% to Rs 160.27 apiece, the highest level since July 24, 2025. It pared gains to trade 0.32% lower at Rs 149.61 apiece, as of 11:07 a.m. This compares to a 0.23% decline in the NSE Nifty 50 Index.

It has fallen 13.64% on a year-to-date basis. The relative strength index was at 62.20.

Out of 13 analysts tracking the company, four maintain a ‘buy’ rating, three recommend a ‘hold,’ and six suggest ‘sell,’ according to Bloomberg data. The average 12-month consensus price target implies a downside of 1.1%.

. Read more on Markets by NDTV Profit.