IDBI Bank Ltd. share price was trading near a four-month high in Tuesday’s session after news reports indicated the Government will soon call for bids for the stake sales.

Inter-Ministerial Group will likely meet on Oct 31 to approve the bidding process. Secretaries of the Department of Investment and Public Asset Management and the Department of Financial Services, as per media reports are part of the IMG.

The new development followed DFS Secretary M Nagaraju expressing confidence to conclude the impending stake sale in financial year 2026 early October at the Global Fintech Festival, as per a PTI report.

The Government of India is planning to offload 60% stake in the Mumbai-headquartered private lender. As of now, the Centre owns over 45% stake while the state-run Life Insurance Corp owns over 49%.

Get live updates on Indian stock markets here.

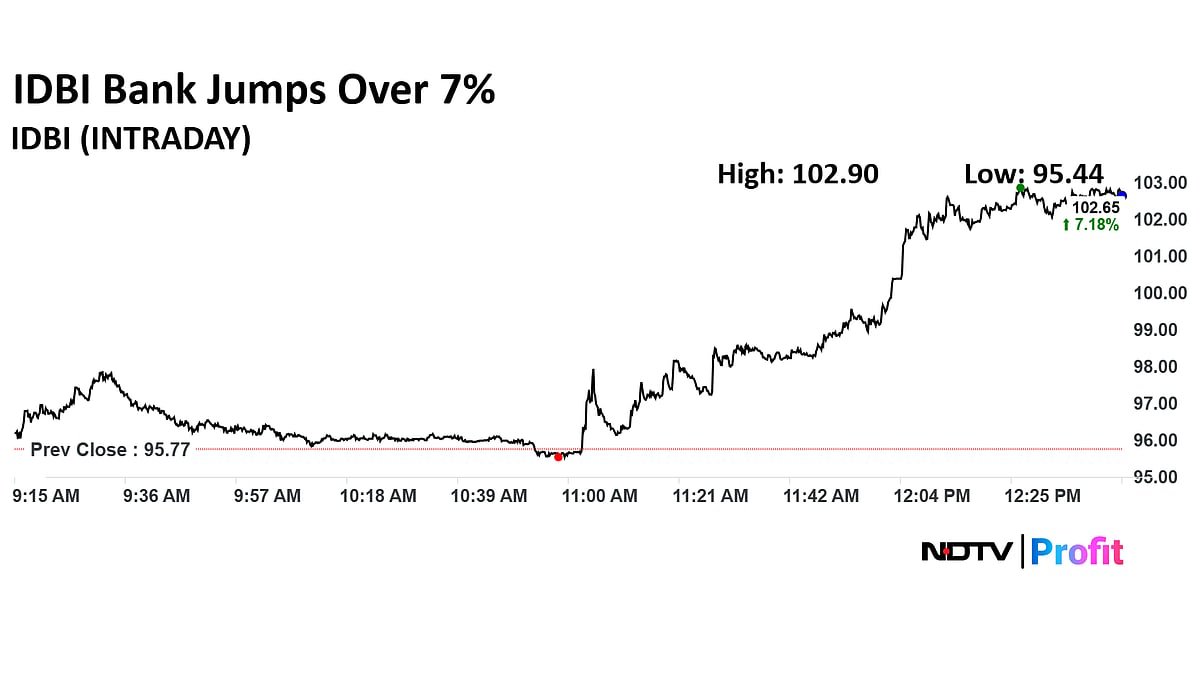

IDBI Bank share price rose 7.75% to Rs 102.90 apiece, the highest level since July 3. It has been rising for the second session in a row. The stock was trading 7.54% higher at Rs 102.90 apiece as of 1:02 p.m., as compared to 0.08% decline in the NSE Nifty 50 index.

The stock has gained 64.19% in 12 months, and 65.89% on year-to-date basis. On National Stock Exchange, the total traded volume so far in the day stood at 0.12 times its 30-day average. The relative strength index was at 75.66, which implied the stock is overbought.

IDBI Bank Q2 Results (Standalone, YoY)

-

Net Profit up 98% At Rs 3,627 crore versus Rs 1,836 crore

-

NII down 15% At Rs 3,285 crore versus Rs 3,875 crore

-

Operating Profit up 17% At Rs 3,523 crore versus Rs 3,006 crore

-

Gross NPA at 2.65% versus 2.93%

-

Net NPA flat at 0.21%

. Read more on Markets by NDTV Profit.