TORONTO, Feb. 12, 2026 /CNW/ – H&R Real Estate Investment Trust (“H&R” or “the REIT”) (TSX:HR) is pleased to announce its financial results for the three months and year ended December 31, 2025.

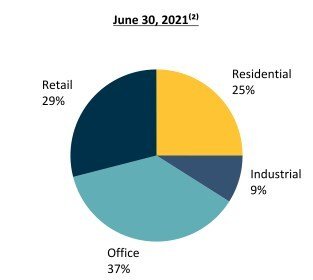

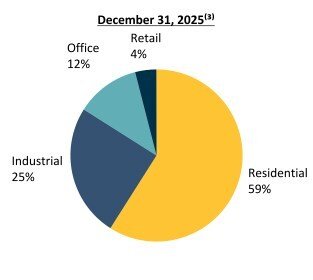

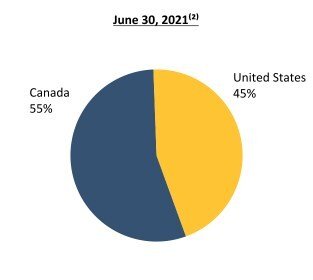

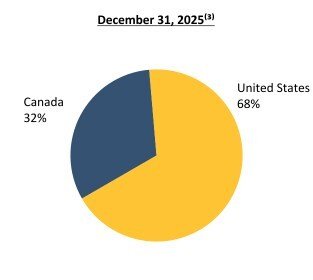

Tom Hofstedter, Executive Chair and Chief Executive Officer said “We continue to successfully execute our strategic plan to reposition H&R to be a more simplified growth and income-oriented REIT focused on residential and industrial properties. From the announcement of this plan to December 31, 2025, H&R completed the spin-off of the REIT’s 27 enclosed shopping centres and sold ownership interests in 69 properties totaling approximately $5.4 billion. In addition, properties sold and under contract to be sold in 2026 total approximately $1.6 billion. As a result of these sales and properties under contract to be sold, H&R’s residential and industrial real estate assets combined will grow from 34% of the total portfolio to 84% and geographically, our real estate assets in the United States will grow from 45% of the total portfolio to 68%.”

|

(1) |

At the REIT’s proportionate share, excluding assets classified as held for sale. Refer to the “Non-GAAP Measures” section of this news release. |

|

(2) |

June 30, 2021 has been used as a benchmark since H&R’s strategic repositioning plan was announced prior to the release of H&R’s Q3 2021 results. |

|

(3) |

Excludes the Bow and 100 Wynford, which were legally sold in October 2021 and August 2022, respectively. |

STRATEGIC REPOSITIONING HIGHLIGHTS SINCE JUNE 30, 2021(1)

- H&R completed a spin off, on a tax-free basis, of 27 properties including all of the REIT’s enclosed shopping centres to a new publicly-traded REIT, Primaris REIT, which properties were valued at approximately $2.4 billion at the time of the spin off;

- H&R sold 69 real estate assets totalling approximately $3.0 billion through December 31, 2025, including the Bow and 100 Wynford;

- H&R has sold $1.1 billion and contracted to sell a further $0.4 billion of assets in 2026;

- H&R increased its percentage of residential and industrial real estate assets at the REIT’s proportionate share(2) excluding assets classified as held for sale, from 34% as at June 30, 2021 to 84% as at December 31, 2025;

- H&R increased its percentage of real estate assets held in the United States at the REIT’s proportionate share(2) excluding assets classified as held for sale, from 45% as at June 30, 2021 to 68% as at December 31, 2025 (excluding the Bow and 100 Wynford);

- H&R reduced its office portfolio at the REIT’s proportionate share(2) excluding assets classified as held for sale, from approximately $5.0 billion as at June 30, 2021 to approximately $0.9 billion as at December 31, 2025 (excluding the Bow and 100 Wynford);

- H&R reduced its retail portfolio at the REIT’s proportionate share(2) excluding assets classified as held for sale, from approximately $4.0 billion as at June 30, 2021 to approximately $0.3 billion as at December 31, 2025;

- H&R completed five single-tenant industrial developments in the Greater Toronto Area (“GTA”) totalling 641,920 square feet and two residential developments in Dallas, TX, totalling 763 residential rental units;

- H&R increased average contractual rent for U.S. residential properties from U.S. $21.16 per square foot as at June 30, 2021 to U.S. $27.18 per square foot as at December 31, 2025;

- H&R increased average contractual rent for Canadian industrial properties from $7.17 per square foot as at June 30, 2021 to $10.05 per square foot as at December 31, 2025;

- H&R reduced debt per the REIT’s Financial Statements(3) from approximately $6.1 billion as at June 30, 2021 to approximately $3.5 billion as at December 31, 2025;

- H&R improved debt to total assets at the REIT’s proportionate share(3)(4) from 50.0% as at June 30, 2021 to 49.8% as at December 31, 2025;

- H&R improved its unencumbered asset to unsecured debt coverage ratio(5) from 1.65x as at June 30, 2021 to 1.92x as at December 31, 2025;

- H&R improved debt to Adjusted EBITDA (based on trailing 12 months) at the REIT’s proportionate share(3)(4)(6) from 10.4x as at June 30, 2021 to 9.3x as at December 31, 2025.

|

(1) |

June 30, 2021 has been used as a benchmark as H&R’s Strategic Repositioning Plan was announced prior to the release of Q3 2021 results. |

|

(2) |

These are non-GAAP measures. Refer to the “Non-GAAP Measures” section of this news release. |

|

(3) |

Debt includes mortgages payable, debentures payable, unsecured term loans and lines of credit. |

|

(4) |

These are non-GAAP ratios. Refer to the “Non-GAAP Measures” section of this news release. |

|

(5) |

Unencumbered assets are investment properties and properties under development without encumbrances for mortgages or lines of credit. Unsecured debt includes debentures payable, unsecured term loans and unsecured lines of credit. |

|

(6) |

Adjusted earnings before interest, taxes, depreciation and amortization (“Adjusted EBITDA”) is defined in the “Non-GAAP Measures” section of this news release. |

FINANCIAL HIGHLIGHTS

|

December 31 |

December 31 |

|

|

2025 |

2024 |

|

|

Total assets (in thousands) |

$9,108,286 |

$10,620,487 |

|

Debt to total assets per the REIT’s Financial Statements(1) |

38.4 % |

33.4 % |

|

Debt to total assets at the REIT’s proportionate share(1)(2) |

49.8 % |

43.7 % |

|

Debt to Adjusted EBITDA at the REIT’s proportionate share(1)(2)(3) |

9.3x |

9.4x |

|

Unitholders’ equity (in thousands) |

$4,135,718 |

$5,278,743 |

|

Units outstanding (in thousands) |

264,558 |

262,016 |

|

Exchangeable units outstanding (in thousands) |

15,442 |

17,974 |

|

Unitholders’ equity per Unit |

$15.63 |

$20.15 |

|

Net Asset Value (“NAV”) per Unit(2)(4) |

$16.09 |

$20.92 |

|

Three months ended December 31 |

Year ended December 31 |

|||

|

(in thousands except for per Unit amounts) |

2025 |

2024 |

2025 |

2024 |

|

Rentals from investment properties |

$203,750 |

$202,350 |

$815,128 |

$816,990 |

|

Net operating income |

$143,107 |

$141,149 |

$509,083 |

$519,918 |

|

Same-Property net operating income (cash basis)(5) |

$123,148 |

$122,651 |

$489,739 |

$481,813 |

|

Net income (loss) from equity accounted investments |

($241,748) |

$82,308 |

($271,064) |

$2,477 |

|

Fair value adjustment on real estate assets |

($216,378) |

($53,265) |

($969,275) |

($425,884) |

|

Net income (loss) |

($250,308) |

$130,882 |

($791,564) |

($119,714) |

|

Funds from Operations (“FFO”)(5) |

$87,278 |

$83,417 |

$339,278 |

$334,427 |

|

Adjusted Funds from Operations (“AFFO”)(5) |

$72,936 |

$61,594 |

$278,585 |

$266,962 |

|

Weighted average number of Units and exchangeable units |

279,993 |

279,990 |

279,990 |

279,933 |

|

FFO per basic and diluted Unit(2) |

$0.312 |

$0.298 |

$1.212 |

$1.195 |

|

AFFO per basic and diluted Unit(2) |

$0.260 |

$0.220 |

$0.995 |

$0.954 |

|

Cash distributions per Unit |

$0.150 |

$0.150 |

$0.600 |

$0.600 |

|

Special December cash distribution per Unit |

$— |

$0.120 |

$— |

$0.120 |

|

Payout ratio as a % of FFO(2) |

48.1 % |

90.6 % |

49.5 % |

60.3 % |

|

Payout ratio as a % of AFFO(2) |

57.7 % |

122.7 % |

60.3 % |

75.5 % |

|

(1) |

Debt includes mortgages payable, debentures payable, unsecured term loans, lines of credit and liabilities classified as held for sale. |

|

(2) |

These are non-GAAP ratios. Refer to the “Non-GAAP Measures” section of this news release. |

|

(3) |

Adjusted EBITDA is based on the trailing 12 months and is calculated on page 9 of this news release. |

|

(4) |

See page 12 of this news release for a detailed calculation of NAV per Unit. |

|

(5) |

These are non-GAAP measures. Refer to the “Non-GAAP Measures” section of this news release. |

SUMMARY OF SIGNIFICANT 2025 ACTIVITY

Net Operating Income Highlights:

|

Three months ended December 31 |

Year ended December 31 |

|||||

|

(in thousands of Canadian dollars) |

2025 |

2024 |

% Change |

2025 |

2024 |

% Change |

|

Operating Segment: |

||||||

|

Same-Property net operating income (cash basis) – Residential(1) |

$44,033 |

$43,559 |

1.1 % |

$170,394 |

$168,417 |

1.2 % |

|

Same-Property net operating income (cash basis) – Industrial(1) |

15,831 |

17,396 |

(9.0 %) |

65,343 |

67,851 |

(3.7 %) |

|

Same-Property net operating income (cash basis) – Office(1) |

38,553 |

37,998 |

1.5 % |

154,682 |

152,448 |

1.5 % |

|

Same-Property net operating income (cash basis) – Retail(1) |

24,731 |

23,698 |

4.4 % |

99,320 |

93,097 |

6.7 % |

|

Same-Property net operating income (cash basis)(1) |

123,148 |

122,651 |

0.4 % |

489,739 |

481,813 |

1.6 % |

|

Net operating income (cash basis) from Transactions at the REIT’s proportionate share(1)(2) |

32,873 |

31,073 |

5.8 % |

126,390 |

134,486 |

(6.0 %) |

|

Realty taxes in accordance with IFRIC 21 at the REIT’s proportionate share(1)(3) |

15,781 |

14,686 |

7.5 % |

— |

— |

— % |

|

Straight-lining of contractual rent at the REIT’s proportionate share(1) |

3,284 |

3,527 |

(6.9 %) |

13,898 |

18,256 |

(23.9 %) |

|

Net operating income from equity accounted investments(1) |

(31,979) |

(30,788) |

3.9 % |

(120,944) |

(114,637) |

5.5 % |

|

Net operating income per the REIT’s Financial Statements |

$143,107 |

$141,149 |

1.4 % |

$509,083 |

$519,918 |

(2.1 %) |

|

(1) |

These are non-GAAP measures. Refer to the “Non-GAAP Measures” section of this news release. |

|

(2) |

Transactions includes acquisitions, dispositions, and transfers of investment properties to or from properties under development during the two-year period ended December 31, 2025. |

|

(3) |

Realty taxes in accordance with IFRS Interpretations Committee Interpretation 21, Levies (“IFRIC 21”) relates to the timing of the liability recognition for U.S. realty taxes. By excluding the impact of IFRIC 21, U.S. realty tax expenses are evenly matched with realty tax recoveries received from tenants throughout the period. |

|

Fair Value Adjustment on Real Estate Assets |

Three months ended December 31 |

Year ended December 31 |

||||

|

(in thousands of Canadian dollars) |

2025 |

2024 |

Change |

2025 |

2024 |

Change |

|

Operating Segment: |

||||||

|

Residential |

($302,175) |

$56,099 |

($358,274) |

($361,874) |

($39,312) |

($322,562) |

|

Industrial |

(16,975) |

5,225 |

(22,200) |

(85,971) |

(24,872) |

(61,099) |

|

Office |

(126,531) |

(36,869) |

(89,662) |

(563,130) |

(275,732) |

(287,398) |

|

Retail |

(11,845) |

(14,385) |

2,540 |

(96,660) |

(114,684) |

18,024 |

|

Land and properties under development |

(18,437) |

485 |

(18,922) |

(198,588) |

(27,178) |

(171,410) |

|

Fair value adjustment on real estate assets per the REIT’s proportionate share(1) |

(475,963) |

10,555 |

(486,518) |

(1,306,223) |

(481,778) |

(824,445) |

|

Less: equity accounted investments |

259,585 |

(63,820) |

323,405 |

336,948 |

55,894 |

281,054 |

|

Fair value adjustment on real estate assets per the REIT’s Financial Statements |

($216,378) |

($53,265) |

($163,113) |

($969,275) |

($425,884) |

($543,391) |

|

(1) |

The REIT’s proportionate share is a non-GAAP measure defined in the “Non-GAAP Measures” section of this news release. |

During the three months and year ended December 31, 2025, the fair value adjustments on real estate assets were primarily due to one office property …