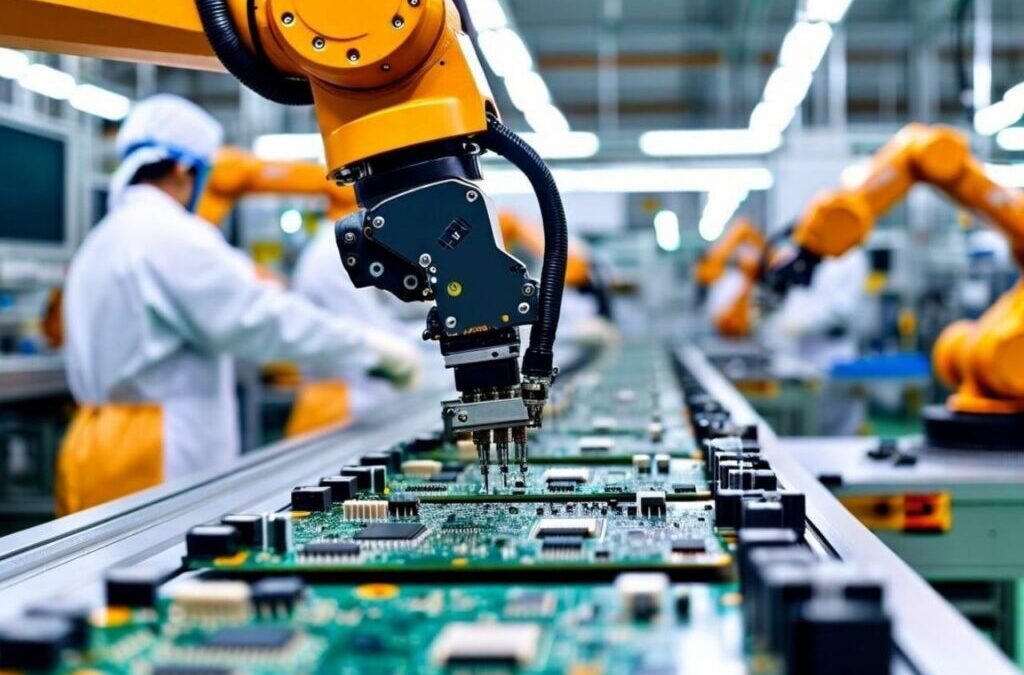

The Indian government has approved a few companies under the Electronics Component Manufacturing Scheme (ECMS), marking a major step toward strengthening India’s electronics manufacturing ecosystem.

The total proposed investment from these companies stands at Rs. 5,532 crore, with a combined production target of Rs. 44,406 crore. The move aims to boost domestic manufacturing, reduce import dependence, and enhance India’s position in the global electronics supply chain.

The approved companies include Kaynes Circuits (a subsidiary of Kaynes Technology), Syrma Strategic Electronics (a subsidiary of Syrma SGS), SRF Ltd, and Ascent Circuits of the Amber Group. Union Minister Ashwini Vaishnaw stated that the initiative is expected to help India save imports worth Rs. 20,000 crore. These companies will manufacture a range of essential components such as printed circuit boards (PCBs), high-density and multi-layer PCBs, copper laminates, camera modules, and capacitor films.

Kaynes is investing Rs. 3,280 crore in four major projects. These include making multi-layer printed circuit boards (PCBs) worth Rs. 4,300 crore, camera module sub-assemblies worth Rs. 12,630 crore, and high-density interconnect (HDI) PCBs worth Rs. 6,875 crore. These projects aim to strengthen the electronics manufacturing sector and increase production capacity in India.

Apart from Kaynes, other companies are also making big investments. Ascent Circuits plans to invest Rs. 991 crore to produce multi-layer PCBs worth Rs. 7,847 crore. Syrma Strategic Electronics will invest Rs. 765 crore for multi-layer PCBs worth Rs. 6,933 crore. SRF Limited is investing Rs. 496 crore to produce polypropylene film worth Rs. 1,311 crore.

According to the government, these companies are projected to meet 20 percent of India’s demand for multi-layer PCBs, 100 percent for copper laminates, and 15 percent for camera modules. The ECMS, launched with an outlay of Rs. 22,805 crore, aims to build a strong local electronics component base and encourage self-reliance in this sector.

So far, the scheme has attracted 249 applications across sectors, with proposed production valued at Rs. 10.34 lakh crore, well above the initial target of Rs. 4.6 lakh crore. The government had aimed to create around 91,600 jobs, but applications received are expected to generate over 1.41 lakh jobs, highlighting the scheme’s growing success and investor confidence in India’s electronics industry.

Here are a few listed electronics component stocks that the government approved Rs. 5,532 Crore ECMS Boost

Kaynes Technology India Limited

With a market capitalization of Rs. 45,857.07 crore, the shares of Kaynes Technology India Limited closed at Rs. 6,840.80 per equity share, rising nearly 1.53 percent from its previous day’s close price of Rs. 6,737.65.

Kaynes Technology India Limited is engaged in end-to-end electronics manufacturing and IoT solutions. It provides design, assembly, testing, and manufacturing services across automotive, industrial, aerospace, defence, medical, and telecommunication sectors. It focuses on innovation, quality, and customer satisfaction with advanced manufacturing facilities in India.

Coming into financial highlights, Kaynes Technology India Limited’s revenue has increased from Rs. 504 crore in Q1 FY25 to Rs. 673 crore in Q1 FY26, which has grown by 33.63 percent. The net profit has also grown by 47 percent from Rs. 51 crore in Q1 FY25 to Rs. 75 crore in Q1 FY26.

Syrma SGS Technology Limited

With a market capitalization of Rs. 15,444.29 crore, the shares of Syrma SGS Technology Limited closed at Rs. 802.45 per equity share, rising nearly 6.22 percent from its previous day’s close price of Rs. 755.45.

Syrma SGS Technology Limited is engaged in electronics manufacturing services, offering product design, PCB assembly, and RFID solutions. The company serves automotive, healthcare, industrial, and consumer electronics sectors with integrated manufacturing and innovative technology services.

Coming into financial highlights, Syrma SGS Technology Limited’s revenue has decreased from Rs. 1,160 crore in Q1 FY25 to Rs. 944 crore in Q1 FY26, which is a drop of 18.62 percent. The net profit has also grown by 150 percent from Rs. 20 crore in Q1 FY25 to Rs. 50 crore in Q1 FY26.

SRF Limited

With a market capitalization of Rs. 89,898.24 crore, the shares of SRF Limited closed at Rs. 3,032.75 per equity share, rising nearly 0.40 percent from its previous day’s close price of Rs. 3,020.55.

SRF Limited was established in 1970 and is engaged in manufacturing industrial and specialty intermediates with products in technical textiles, specialty chemicals, fluorochemicals, and packaging films. The company serves diverse industries globally, focusing on innovation, quality, and sustainability.

Coming into financial highlights, SRF Limited’s revenue has increased from Rs. 3,464 crore in Q1 FY25 to Rs. 3,819 crore in Q1 FY26, which has grown by 10.25 percent. The net profit has also grown by 71.43 percent from Rs. 252 crore in Q1 FY25 to Rs. 432 crore in Q1 FY26.

Written By – Nikhil Naik

Disclaimer

The views and investment tips expressed by investment experts/broking houses/rating agencies on tradebrains.in are their own, and not that of the website or its management. Investing in equities poses a risk of financial losses. Investors must therefore exercise due caution while investing or trading in stocks. Trade Brains Technologies Private Limited or the author are not liable for any losses caused as a result of the decision based on this article. Please consult your investment advisor before investing.

The post EMS stocks in focus after Govt approves ₹5,532 Cr investment under Electronics Component Manufacturing Scheme appeared first on Trade Brains.