Primoris Services (NASDAQ:PRIM) will release its quarterly earnings report on Monday, 2025-08-04. Here’s a brief overview for investors ahead of the announcement.

Analysts anticipate Primoris Services to report an earnings per share (EPS) of $1.06.

The market awaits Primoris Services’s announcement, with hopes high for news of surpassing estimates and providing upbeat guidance for the next quarter.

It’s important for new investors to understand that guidance can be a significant driver of stock prices.

Earnings Track Record

Last quarter the company beat EPS by $0.32, which was followed by a 2.94% drop in the share price the next day.

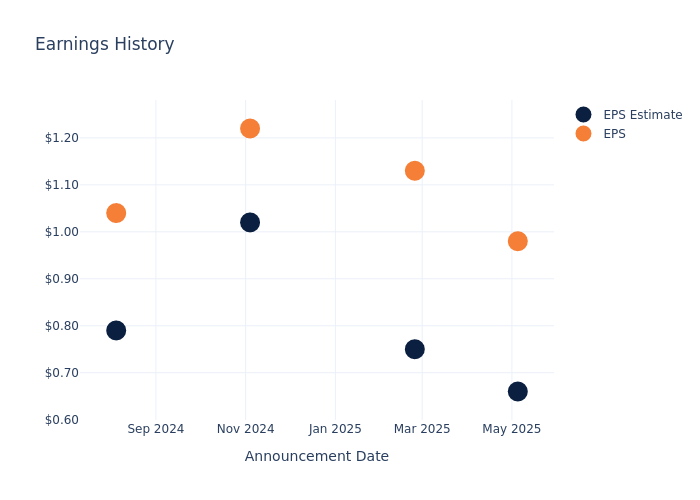

Here’s a look at Primoris Services’s past performance and the resulting price change:

| Quarter | Q1 2025 | Q4 2024 | Q3 2024 | Q2 2024 |

|---|---|---|---|---|

| EPS Estimate | 0.66 | 0.75 | 1.02 | 0.79 |

| EPS Actual | 0.98 | 1.13 | 1.22 | 1.04 |

| Price Change % | -3.0% | 10.0% | 15.0% | 6.0% |

Stock Performance

Shares of Primoris Services were trading at $94.17 as of July 31. Over the last 52-week period, shares are up 90.71%. Given that these returns are generally positive, long-term shareholders are likely bullish going into this earnings release.

Analysts’ Take on Primoris Services

Understanding market sentiments and expectations within the industry is crucial for investors. This analysis delves into the latest insights on Primoris Services.

A total of 6 analyst ratings have been received for Primoris Services, with the consensus rating being Outperform. The average one-year price target stands at $93.67, suggesting a potential 0.53% downside.

Peer Ratings Comparison

In this analysis, we delve into the analyst ratings …