Shares of Dr. Reddy’s Laboratories Ltd. fell nearly 2% on Thursday after Citi cut its target price to Rs 990 from Rs 1,040. The brokerage expressed caution on the growth outlook, particularly around the Canadian GLP-1 market and the highly anticipated launch of generic Semaglutide, while also highlighting significant upcoming earnings drag from the decline in gRevlimid sales and lower PLI incentives.

A key factor in Citi’s revised outlook is its analysis of the Canadian GLP-1 (glucagon-like peptide-1) market. Citi’s research suggests the market is already well-penetrated, with adoption levels estimated to be 60–80% higher than in the US for adult patients with type 2 diabetes and obesity.

This advanced penetration, combined with lower price points, implies limited room for aggressive future growth. Even under optimistic assumptions — such as 16% penetration by 2026 — Citi estimates the total Canadian GLP-1 market to reach around $1.9 billion, with Semaglutide accounting for $1.5–1.6 billion of that figure. This represents roughly 30% growth over 2024, significantly below street expectations that predict a doubling or tripling of the market.

Expectations surrounding generic Semaglutide also appear overinflated, according to Citi. The market is anticipating $150–300 million in sales for Dr. Reddy’s, but Citi sees several challenges. These include intense competition from firms with stronger peptide capabilities, Dr. Reddy’s lack of track record in peptides, the possibility of the innovator Novo Nordisk aggressively defending its market share, and Eli Lilly’s launch of Tirzepatide in 2025, which could further erode opportunities. Citi has forecast just $72 million in sales, assuming approval is granted in late 2025.

Another major headwind is the projected Ebitda impact from the waning contribution of gRevlimid and the tapering off of PLI incentives. Citi estimates a combined earnings drag of around $750–780 million over fiscal 2025–27, which it considers difficult to offset. While short-term performance may appear stronger due to residual gRevlimid supplies, this is already factored into current market forecasts.

Citi has added Dr. Reddy’s to its Pan-Asia Focus List but maintains a cautious outlook. Upside risks to its bearish thesis include successful cost-cutting, a surprise acquisition, or accelerated approvals in complex products.

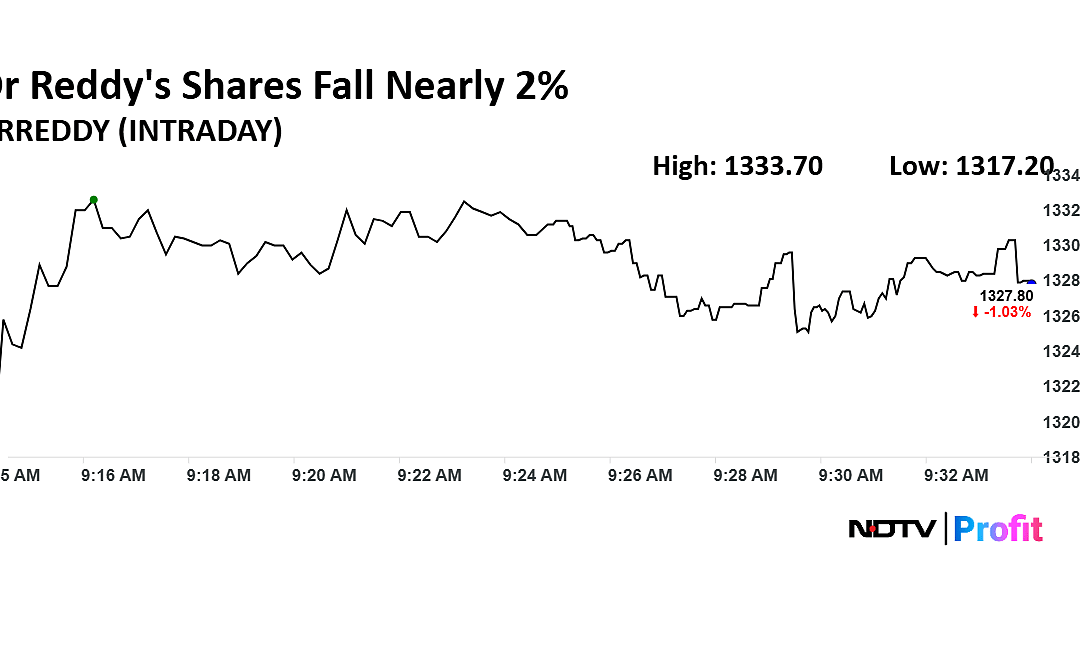

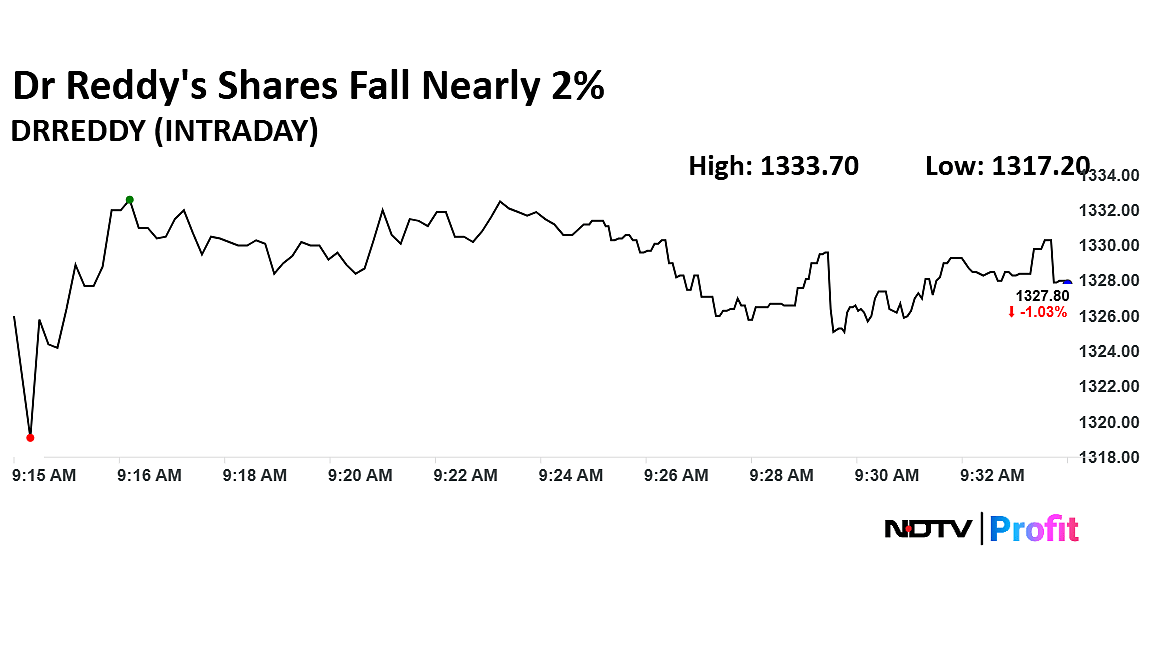

Dr. Reddy’s Share Price Today

Shares of Dr. Reddy’s fell as much as 1.82% to Rs 1,317.20 apiece, the lowest level since June 24. It pared losses to trade 0.72% lower at Rs 1,331.20 apiece, as of 9:25 a.m. This compares to a 0.36% advance in the NSE Nifty 50.

The stock has risen 9.65% in the last 12 months and fallen 4.11% year-to-date. Total traded volume so far in the day stood at 1.2 times its 30-day average. The relative strength index was at 65.02.

Out of 39 analysts tracking the company, 18 maintain a ‘buy’ rating, eight recommend a ‘hold’ and 13 suggest ‘sell’, according to Bloomberg data. The average 12-month consensus price target implies a downside of 4.2%.

. Read more on Markets by NDTV Profit.