ASX Release

Westgold is a leading, ASX200 Australian gold producer, with a clear purpose – to unearth enduring value for all our stakeholders.

Our vision is to become the leading Australian gold company, sustaining safe, responsible and profitable production.

Our operations comprise four mining hubs, with combined processing capacity of ~6Mtpa across the Murchison and Southern Goldfields, two of Western Australia’s most prolific gold-producing regions.

Financial values are reported in A$ unless otherwise specified.

This announcement is authorized for release to the ASX by the Board.

Underlying Quarterly Cash Build Doubled to a Record $365M

PERTH, Western Australia, Jan. 21, 2026 /CNW/ – Westgold Resources Limited (ASX: WGX) (TSX:WGX) (Westgold or the Company) is pleased to report results for the period ending 31 December 2025 (Q2 FY26), with record gold production, higher volume third-party ore purchase, and a record achieved gold price effectively doubling the underlying cash build compared to Q1 FY26.

HIGHLIGHTS

SAFETY

Total Recordable Injury Frequency Rate (TRIFR) increased to 9.32 / million hours worked

PRODUCTION

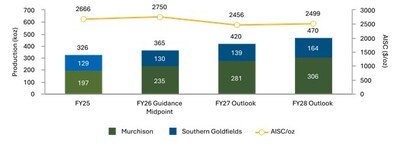

Record Group gold production of 111,418oz Au @ AISC of $3,500/oz – excluding ore purchases, Westgold produced 89,101oz at AISC of $2,945/oz

- 33% increase in gold produced quarter on quarter

- Reef mining recommenced at Great Fingall Mine

- Higher volume of HG oxide ore purchased from NMG

TREASURY

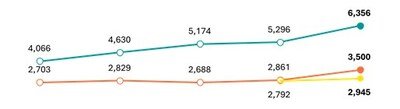

Gold sales of 115,200oz – at an average price of A$6,356/oz generating revenue of A$732M

Underlying cash build of $365M – before outflows of stamp duty on Karora transaction ($76M), debt repayments ($50M), investments in growth ($48M), dividends and buybacks ($29M) and exploration ($6M) and inflows from asset sales of $26M

$654M in closing cash, bullion, and liquid investments @ 31 December 2025 – a $182M increase Q on Q

Westgold is 100% debt free and remains unhedged

CORPORATE

Ongoing portfolio optimisation to unlock shareholder value:

- Mt Henry-Selene divested for $64.6M

- Reedy’s and Comet assets to demerge into a new ASX‑listed company, Valiant Gold Limited

FY25 dividends paid and FY26 share buyback continues

FY26 Guidance Maintained

Westgold Managing Director and CEO Wayne Bramwell commented:

“In Q2, FY26 Westgold delivered record quarterly cash build of $365M and production of 111,418 ounces.

Continued operational improvement from our assets continued and we had the opportunity to super charge our cash build by purchasing a higher volume of third-party ore. This third party ore delivered 22,317 ounces and monetising it further strengthened our balance sheet. These factors culminated in the Group closing the quarter with a treasury of $654M.

Costs this quarter, reflected deliberate choices made to maximise value.

Operational outputs continued to improve in the Murchison, whilst the Southern Goldfields were stable. The election to process higher volumes of softer, higher-grade oxide in the Murchison allowed us to significantly increase milling throughput at Meekatharra and accelerated cash generation, even though this third‑party ore carries a higher unit cost.

Looking ahead, our 3‑Year Outlook (3YO) clearly maps a pathway to structurally lower our cost base.

The ramp up of our Bluebird–South Junction mine at Meekatharra, Great Fingall at Cue and increasing outputs from Beta Hunt in Kambalda will underpin higher grade ore replacing the low‑grade stockpiles milled to maintain processing throughputs at our largest processing hubs. In parallel we are actively advancing a range of Westgold owned open pit targets to bring value forward in the 3YO.

As we enter the second half of FY26 our focus remains on more consistent operational delivery. Our key growth projects are advancing to plan and alongside a non-core divestment programme, the planned demerger and IPO of Valiant Gold during H2, FY26 can create additional ore supply for our Murchison processing hubs and unlock latent value for our shareholders.

Westgold’s momentum continues to build. The business has scale, is debt free, unhedged and with a clear plan to reduce our cost structure, this team is committed to unlocking greater value from our portfolio.”

Executive Summary

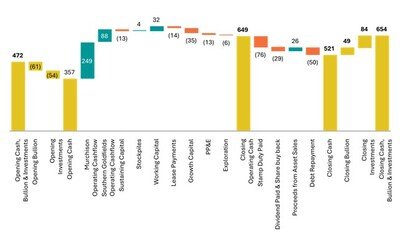

Cash Position as of 31 December 2025

Westgold closed Q2, FY26 with cash, bullion and liquid investments of $654M – representing a build of $182M in total cash, bullion and liquid investments.

Underlying cash build was $365M before one off payments (stamp duty ($76M), debt repayments ($50M), dividends and share buy backs ($29M), growth and exploration spend (invested $48M on non-sustaining capital and $6M on exploration), and one off cash inflows of $26M (proceeds from asset sales).

This result was driven by a substantial increase in Group gold production and an increase in realised gold price to $6,356/oz.

Notes for Q2 Cash, Bullion and Liquid Investment Movements

- Proceeds from Asset Sales of $26M – relating to the Lakewood Sale and Alicanto deposit received in the quarter.

- The FY25 dividend payment to shareholders (3cps) of $28M was declared during Q1 FY26.

- Stamp duty of $76M paid for the Karora transaction.

- Debt repayment of $50M – resulting in Westgold being debt free.

- Closing Q2, FY26 investments include 1.7B NMG shares – but exclude 19.8M shares in Blackcat Syndicate Limited (ASX: BC8 – under escrow until 31/03/2026) and 31.8M shares in Kali Metals Limited (ASX:KM1 – under escrow until 8/01/2026).

- Westgold remains unhedged and fully exposed to the spot gold price.

Group Production Highlights – Q2, FY26

Westgold is pleased to report a record quarterly Group gold production for Q2, FY26 of 111,418oz (Q1 FY26: 83,937oz). The Murchison produced 80,934oz (Q1 FY26: 53,140oz) and the Southern Goldfields produced 30,484oz (Q1 FY26: 30,797oz).

Q2, FY26 production was significantly higher than Q1, FY26 driven by improving output in the Murchison, largely as a result of higher grades at Fortnum and higher grade and production sourced from Westgold’s Ore Purchase Agreement (OPA) with New Murchison Gold (ASX:NMG) at Meekatharra.

All-In Sustaining Cost (AISC) for Q2, FY26 was $390M (Q1 FY26: $240M), and on a per ounce basis was $3,500/oz (Q1 FY26: $2,861/oz). The higher quarter-on-quarter costs primarily reflect the decision to maximise cash generation. In particular, the election to purchase a higher volume of high grade oxide ore under the OPA provided an opportunity to increase milled grade at Meekatharra, which, while carrying a higher unit cost to Westgold, delivered stronger Group cash flow.

The OPA added $14M to the cash build in Q2 FY26.

The softer OPA ore also served to increase milling throughputs at our Meekatharra processing hub – lifting the run rates to over 2Mtpa. With short-term ventilation constraints at Cue restricting ore flow from Big Bell, the expanded capacity of the Meekatharra Hub was supplemented with additional low margin stockpile ore. While these factors elevated AISC for Q2, FY26 – they were deliberate, value-accretive choices that further strengthened the Group’s cash flow.

Westgold’s 3-Year Outlook outlines a clear pathway to structurally lower costs as lower-grade stockpile feed is progressively replaced with higher-grade sources across the portfolio. Westgold is also actively advancing organic opportunities to bring value forward in the 3YO and this includes a range of Westgold owned open pit targets.

Excluding gold production from ore purchased under the OPA, Group AISC was $2,945/oz with higher royalty payments linked to gold price contributing to the increased cost.

For the first half of FY26, Westgold produced 195Koz of gold at an AISC of $3,225/oz inclusive of the OPA.

Westgold maintains its production guidance for FY26 of 345 – 385koz.

Production from Westgold’s assets was in line with expectations over the half and while the Company continues to expect progressive efficiency improvement across its portfolio in H2 FY26, Q3 FY26 will see increased planned maintenance at all four (4) processing hubs. Despite production from the OPA having outperformed in Q2 FY26, Westgold maintains a conservative outlook on OPA production for the remainder of the year.

Westgold maintains its cost guidance of $2,600 – $2,900/oz, exclusive of the gold price linked OPA costs.

While Westgold maintains its margin, the OPA costs have dramatically increased in conjunction with the rising gold price, driving the ASIC inclusive of the OPA higher. Westgold’s OPA margin will increase in Q3 FY26 in accordance with the OPA terms.

Across the gold industry, the rising gold price is also increasing the impact of royalty cost in AISC. Year to date this has added $12M to Westgold’s AISC expectations.

The Company sold 115,200oz of gold for the quarter achieving a record price of $6,356/oz, generating $732M in revenue. With Westgold hedge free, operations generated $319M of mine operating cashflows and a strong AISC margin of $2,856/oz.

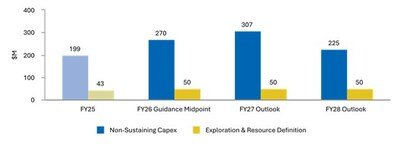

Total non-sustaining capital expenditure during Q2 FY26 of $48M (Q1 FY26: $60M) includes $35M of investment in growth projects (Bluebird-South Junction and Great Fingall development) and $13M in plant and equipment (processing facilities, ventilation, water, power and paste infrastructure across the Group).

Investment in exploration and resource development of $6M (Q1 FY26: $12M) for the quarter continued focusing on Bluebird-South Junction and Starlight in the Murchison, and the Fletcher Zone at Beta Hunt in the Southern Goldfields. Westgold remains on track to invest the FY26 exploration guidance of $50M with a ramp up in exploration activity focused on Bluebird South Junction and the Fletcher Zone in H2 FY26.

The net mine cash inflow for Q2 FY26 was $265M (refer Table 1 under Group Performance Metrics).

3-Year Outlook

Building on the FY26 guidance, Westgold released a detailed 3-Year Outlook (3YO) on 1 October 2025 that presents a high-confidence, executable plan to increase the Group’s annual gold production to ~470,000oz per annum by FY28, while reducing AISC to around $2,500/oz from FY27 onwards.

This organic growth plan is modelled on Westgold’s existing portfolio of operating assets, 2025 Ore Reserves (56Mt at 1.93g/t for 3.5Moz of gold), and four processing hubs with a combined current processing capacity of approximately 6Mtpa.

Importantly, the 3YO excludes tangible opportunities which, if realised, represent further upside to the plan.

These opportunities are being actively advanced to bring value forward into the 3YO.

For more information, refer to “Westgold Provides 3-Year Outlook” lodged on the ASX on 1 October 2025.

Group Performance Metrics

Westgold’s quarterly physical and financial outputs for Q2 FY26 are summarised below.

Table 1: Westgold Q2 FY26 Performance

|

Physical Summary |

Units |

Murchison |

Southern |

Group |

|

ROM – Ore Mined |

t |

706,987 |

481,127 |

1,188,114 |

|

Grade Mined |

g/t |

2.5 |

2.4 |

2.4 |

|

Ore Processed |

t |

1,084,704¹ |

444,722 |

1,529,426 |

|

Head Grade |

g/t |

2.5¹ |

2.3 |

2.4 |

|

Recovery |

% |

92 |

94 |

93 |

|

Gold Produced |

oz |

80,934¹ |

30,484 |

111,418 |

|

Gold Sold |

oz |

84,077 |

31,123 |

115,200 |

|

Achieved Gold Price |

A$/oz |

6,356 |

6,356 |

6,356 |

|

Cost Summary |

Units |

Murchison |

Southern Goldfields |

Group |

|

Mining |

A$’M |

203¹ |

60 |

263 |

|

Processing |

A$’M |

40¹ |

18 |

58 |

|

Admin |

A$’M |

8 |

9 |

17 |

|

Stockpile Movements |

A$’M |

2 |

2 |

4 |

|

Royalties |

A$’M |

16 |

19 |

35 |

|

Sustaining Capital |

A$’M |

11 |

2 |

13 |

|

All-in Sustaining Costs |

A$M |

280 |

110 |

390 |

|

All-in Sustaining Costs |

A$/oz |

3,457 |

3,614 |

3,500 |

|

All-in Sustaining Costs – Excluding OPA |

A$’M |

152 |

110 |

262 |

|

All-in Sustaining Costs – Excluding OPA |

A$/oz |

2,597 |

3,614 |

2,945 |

|

Notional Cashflow Summary |

Units |

Murchison |

Southern Goldfields |

Group |

|

Notional Revenue (produced oz) |

A$’M |

515 |

194 |

709 |

|

All-in Sustaining Costs |

A$’M |

280 |

110 |

390 |

|

Mine Operating Cashflow |

A$’M |

235 |

84 |

319 |

|

Growth Capital |

A$’M |

(29) |

(6) |

(35) |

|

Plant and Equipment |

A$’M |

(8) |

(5) |

(13) |

|

Exploration Spend |

A$’M |

(2) |

(4) |

(6) |

|

Net Mine Cashflow |

A$’M |

196 |

69 |

265 |

|

Net Mine Cashflow |

A$/oz |

2,421 |

2,247 |

2,373 |

|

1. Includes 181kt of OPA ore processed at 4.0g/t for 22,317oz. The OPA added $128M to Westgold’s group AISC. |

Q2 FY26 Group Performance Overview

Westgold processed 1,529 kt (Q1 FY26: 1,355kt) of ore in total at an average grade of 2.4g/t Au (Q1 FY26: 2.1g/t Au), producing 111,418oz of gold (Q1 FY26: 83,937oz). Processing improvements were driven predominantly by the exceptional performance at the Meekatharra hub influenced by the higher percentages of soft oxide material in the blend and incremental improvements in throughput rates at other operations driven by systematic work to optimise productivity.

Group AISC in Q2 FY26 was $390M, higher than the previous quarter (Q1 FY26: $240M).

Westgold mined a total of 1,188kt at 2.4g/t Au (Q1 FY26: 1,225kt at 2.2g/t Au) declining slightly quarter on quarter as expected, driven by the completion of Lake Cowan open pits (~73kt lower quarter on quarter) and scheduled slower mining rates at Fender (~24kt lower quarter on quarter). All other mines were steady or slightly improved compared to the prior quarter.

MURCHISON

The Murchison hubs produced 80,934oz of gold (Q1 FY26: 53,140oz). Quarterly production increased significantly due to improved throughput and grade at the three Murchison processing hubs.

The Fortnum Hub contributed to the production improvement with strong production from higher grade stoping areas at the Starlight mine. The Meekatharra Hub also significantly improved, with Bluebird UG performing to plan and OPA oxide material outperforming. The blending of soft oxide ore from the OPA enabled the Meekatharra Hub to process at rates well above historical averages, unlocking capacity to purchase and process extra OPA ore, whilst also continuing to feed fresh UG ore from Bluebird UG and low grade stockpiles.

The Cue Hub also lifted quarter on quarter with fewer planned shutdowns in Q2 and grade increasing with the addition of Great Fingall main reef ore.

Total AISC of $280M (Q1 FY26: $163M) was higher than the prior quarter, mainly due to the gold price linked OPA ($128M). While OPA ore carries a higher unit cost, Westgold consciously elected to process increased volumes given the opportunity it provided to maximise cash flow.

AISC per ounce of $3,457/oz (Q1 FY26: $3,061/oz) increased primarily due to the OPA purchases. Excluding the OPA, the Murchison AISC per ounce was $2,597/oz.

Total Non-Sustaining Capital Expenditure of $37M, includes Growth Capital ($29M) and Plant and Equipment ($8M) across the Murchison. Growth Capital mainly related to the continuation of Great Fingall development and expansions to the Bluebird UG.

SOUTHERN GOLDFIELDS

The Southern Goldfields hub produced 30,484oz of gold in Q2 FY26 (Q1 FY26: 30,797oz).

Higginsville throughput was in line with expectations for the quarter with the small Two Boys underground outperforming on both grade and ounce production.

Beta Hunt also delivered steady mining outputs in line with expectations. With major ventilation and pumping infrastructure completed in Q1, mine development rates improved in Q2, positioning Beta Hunt to increase mining rates from Q3, FY26 onwards.

The total AISC in the Southern Goldfields increased quarter on quarter (Q2 FY26 AISC: $110M vs Q1 FY26 AISC: $77M). On a per ounce basis, AISC was higher at $3,614/oz in Q2 FY26 (Q1 FY26: $2,516/oz). This is due predominantly to gold price linked royalties, and increased development positioning the operation for a ramp up in production in Q3.

Total Non-Sustaining Capital Expenditure of $11M, includes Growth Capital ($6M) and Plant and Equipment ($5M) across the Southern Goldfields Operations mainly relating to water management, primary ventilation and underground infrastructure at the Beta Hunt mine.

.Table 2: Q2 FY26 Group Mining Physicals

|

Ore Mined (‘000 t) |

Mined Grade (g/t) |

Contained ounces (Oz) |

|

|

Murchison |

707 |

2.5 |

56,688 |

|

Bluebird |

171 |

2.5 |

13,827 |

|

Fender |

34 |

2.7 |

2,989 |

|

Big Bell |

280 |

1.8 |

16,379 |

|

Great Fingall |

10 |

2.4 |

749 |

|

Starlight |

212 |

3.3 |

22,744 |

|

Southern Goldfields |

481 |

2.3 |

35,219 |

|

Beta Hunt |

396 |

2.2 |

27,603 |

|

Two Boys |

36 |

4.3 |

5,029 |

|

Lake Cowan OP |

49 |

1.7 |

2,587 |

|

GROUP TOTAL |

1,188 |

2.4 |

91,907 |

Table 3: Q2 FY26 Group Processing Physicals

|

Ore Milled (‘000 t) |

Head Grade (g/t) |

Recovery (%) |

Gold Production (Oz) |

|

|

Murchison |

1,085 |

2.5 |

92 |

80,934 |

|

Bluebird |

180 |

2.5 |

95 |

13,840 |

|

Fender |

3 |

2.2 |

88 |

182 |

|

Ore Purchase |

181 |

4.0 |

96 |

22,317 |

|

Open Pit & Low Grade |

151 |

1.0 |

89 |

4,391 |

|

Meekatharra Hub |

515 |

2.6 |

95 |

40,730 |

|

Big Bell |

271 |

1.8 |

86 |

13,775 |

|

Fender |

58 |

2.4 |

86 |

3,909 |

|

Great Fingall |

10 |

2.2 |

86 |

625 |

|

Open Pit & Low Grade |

3 |

0.6 |

85 |

55 |

|

Cue Hub |

342 |

1.9 |

86 |

18,364 |

|

Starlight |

199 |

3.5 |

95 |

21,063 |

|

Open Pit & Low Grade |

29 |

0.9 |

97 |

777 |

|

Fortnum Hub |

228 |

3.1 |

95 |

21,840 |