Bulgaria will officially adopt the euro, becoming the 21st member of the Eurozone on January 1 after meeting all the criteria required for joining the European Monetary Union.

“I warmly welcome the positive conclusions of the Convergence Reports published today by the European Commission and the European Central Bank,” Eurogroup President Paschal Donohoe said. “These reports confirm that Bulgaria has now met all the necessary criteria for euro area membership — a pivotal milestone on its path to adopting the euro.”

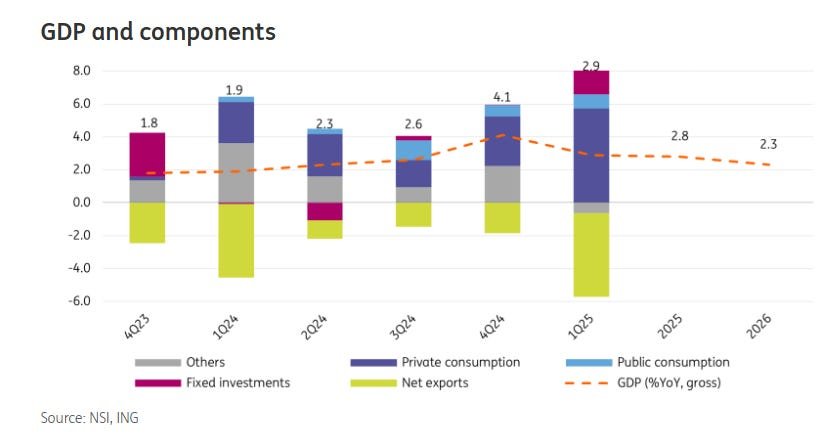

Despite public concerns about adopting the Euro, Bulgaria’s economy is expected to benefit from the move. GDP growth will remain at a constant 2.8% in 2025, ING Think said on July 3. Wages are expected to continue finding support in the tight labour market, benefiting private consumption to some extent, it added.

“With the new fiscal stimulus in Germany underway, there are prospects of some tailwinds for the Bulgarian export-oriented industry in the medium term,” ING Think said. “In the short run, however, some small palpable gains could be more visible from the Schengen ascension, the euro adoption and regional infrastructure developments more broadly”

Joining the Eurozone and securing oversight from the ECB could boost Bulgaria’s economic stability and growth prospects, Jasmin Groeschl, senior economist for Europe at Allianz SE, told CNBC. Foreign investment could, for example, increase, she suggested, and the country’s gross domestic product would be expected to be boosted by Eurozone membership.

EU Introduces Euro to Create Stable, Integrated Monetary Union

The EU introduced the euro in 1999 as a virtual accounting currency by 11 EU countries and became a physical currency in 2002. The economic bloc sought to establish a stable and integrated monetary union that would facilitate cross-border trade.

Furthermore, the euro aimed to reduce currency exchange risks and give the EU a stronger voice on the global economic stage. The creation of the European Central Bank (ECB) established a stable monetary policy, interest rates, and financial stability within the European Union.

However, a blanket policy approach can be problematic in uncertain periods.

In a paper published last month, the Economic Governance and EMU Scrutiny Unit found that the ECB would benefit from enhancing transparency. The unit added that the ECB needed more clarity from its communication channels, particularly regarding the central bankers’ speeches.

Seven EU Nations Opt Out of Euro

Despite the …