India’s business landscape is undergoing a generational shift. A new league of young billionaires is taking the reins of legacy corporations — names that have dominated the Indian economy for decades. But as the spotlight turns to the next-gen leaders, one question lingers: Will they take the legacy forward or fumble the fortune?

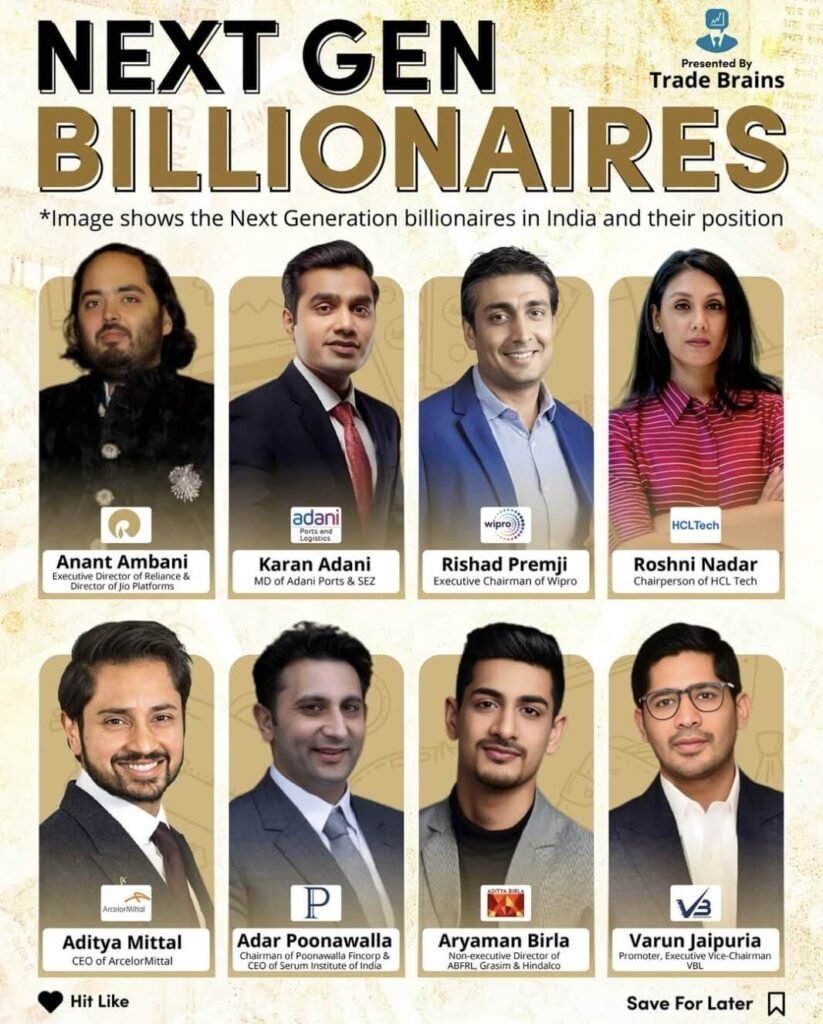

An image recently shared by Trade Brains has gone viral for showcasing some of India’s most prominent next-generation billionaires — heirs to empires in oil, steel, IT, pharma, and more. The list features names like Anant Ambani, Roshni Nadar, Karan Adani, Adar Poonawalla, Aryaman Birla, and others, each already holding significant roles in their respective family businesses.

From Anant Ambani, the Executive Director of Reliance and Director at Jio Platforms, to Roshni Nadar, the Chairperson of HCLTech and one of the most powerful women in tech globally — these individuals are no longer just heirs, they are decision-makers. Karan Adani leads Adani Ports & SEZ as Managing Director, while Rishad Premjiserves as Executive Chairman of Wipro. The list also includes Aditya Mittal (CEO of ArcelorMittal), Varun Jaipuria(Vice-Chairman, Varun Beverages), and Aryaman Birla, who is slowly carving a name beyond his father’s towering legacy.

But inheriting a title is far easier than keeping the empire intact.

India has already witnessed high-profile examples where inherited fortunes have spiraled downward. Anil Ambani, once richer than his brother Mukesh, saw his net worth plummet to near zero. Vijay Mallya, once the flamboyant face of Kingfisher and Indian liquor baron, is now a cautionary tale of mismanagement and debt. These cases serve as reminders that inherited wealth doesn’t guarantee sustained success.

As these next-gen billionaires step into power, they face a double-edged sword: the privilege of a head start and the pressure of living up to sky-high expectations. In today’s fast-changing world, innovation, leadership, and agility are just as important as legacy and brand value.

The new generation has resources, reach, and recognition. But will they have the resilience, vision, and grit to build on what their parents and grandparents created?

Only time will tell if these young leaders will evolve into visionary entrepreneurs or become another page in the “what could’ve been” chapter of Indian business history.

What’s your take — is a strong legacy more valuable than strong leadership?

Let us know your thoughts in the comments!

The post Born Billionaires or Future Leaders? Meet the Next Gen Tycoons of India Taking Over Legacy Empires appeared first on Trade Brains.