Bitcoin’s Emergence on Mainstream Platforms

I’ll start by saying that I recently noticed something on Finviz, a website I often use to find information about American companies traded on U.S. stock exchanges. There is a section on futures that displays the main assets traded on the U.S. market. I don’t know exactly when this happened, but just recently noticed it. Bitcoin appeared in the lower right corner of the currency section. Along with the dollar, euro, British pound, Australian dollar, Swiss franc, and Japanese yen. About 15 years ago, we didn’t even know it existed. Now, it stands alongside currencies with a history of hundreds of years, some of them even more.

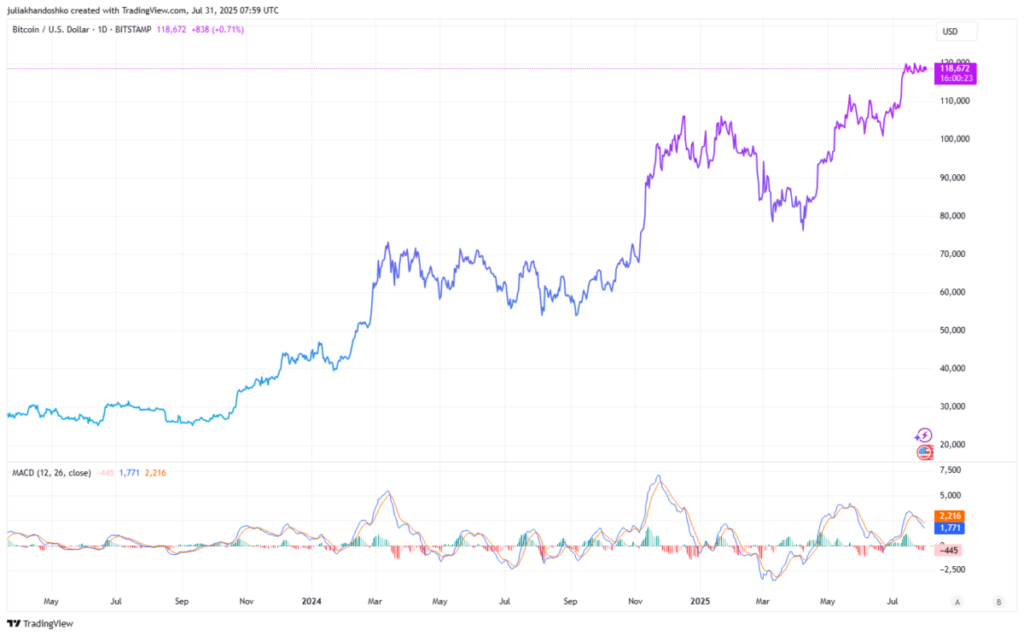

Bitcoin’s Strong Upward Trend

I’m also sharing the dynamics of Bitcoin over the past two years. In fact, it has grown steadily, with only minor corrections. Nevertheless, the pronounced upward trend is attracting attention. It is not only private investors who are investing in Bitcoin, but also large ETF funds and even global central banks. For example, Kazakhstan is contemplating investing some of its gold and foreign exchange reserves in Bitcoin.

Institutional Investment In Bitcoin

While Kazakhstan is considering this, there are already funds that actively invest in Bitcoin. For example, there is the iBit fund (ticker symbol IBIT.US). This is an ETF fund from BlackRock that allows you to access Bitcoin by purchasing standard shares that are traded on the exchange, helping to eliminate the operational, tax, and depository complexities …