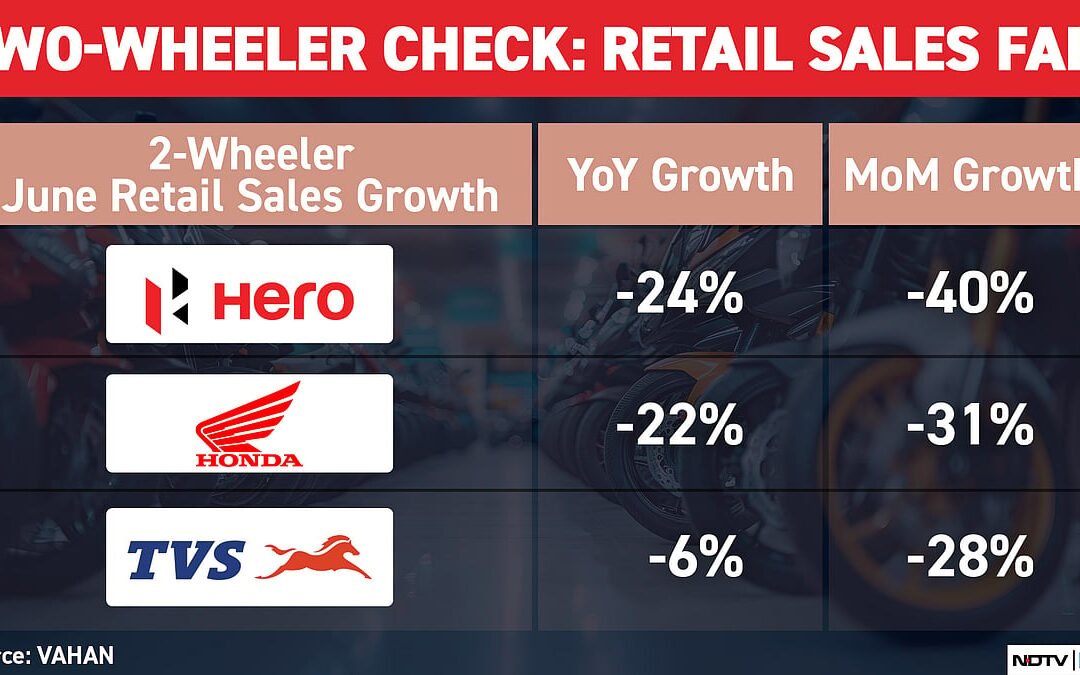

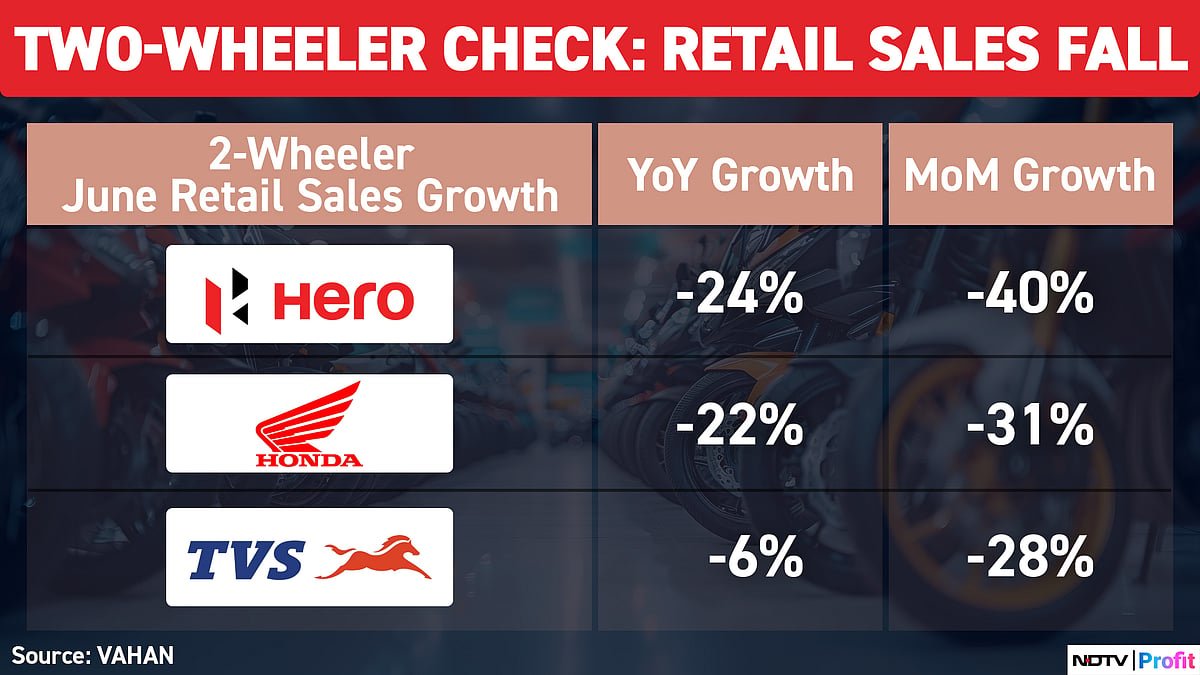

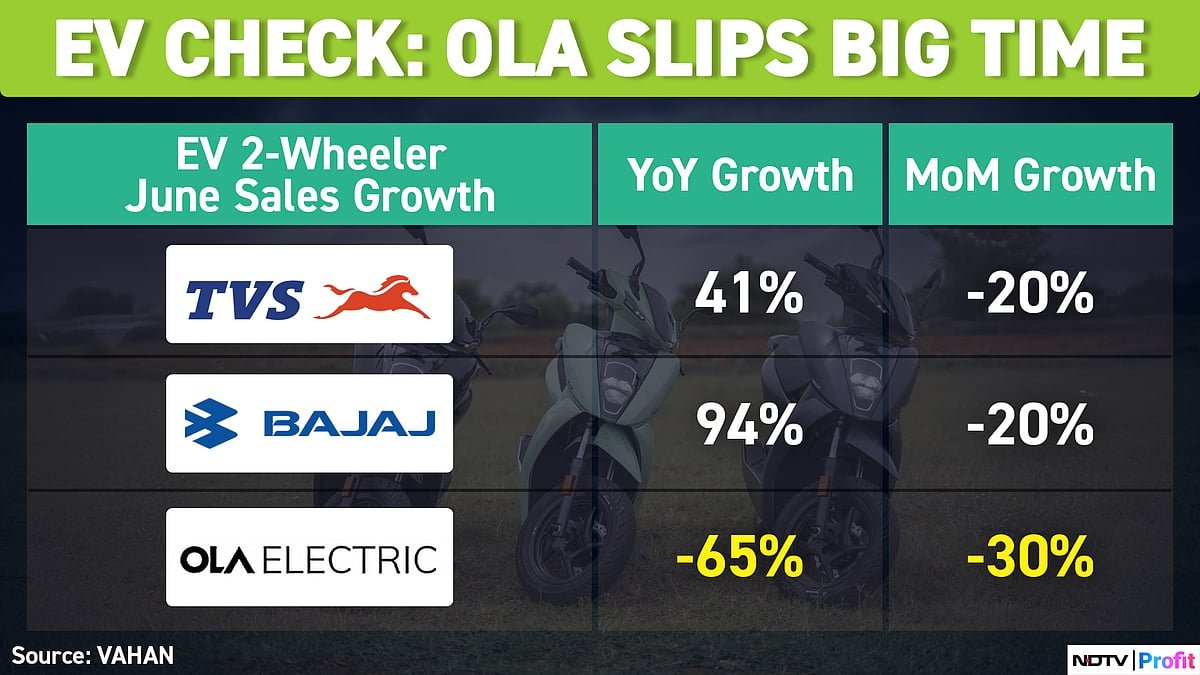

The month of June is a seasonally weaker for auto sales, given April and May lead to higher sales on the back of wedding season. But this time, data from government portal VAHAN suggests an even weaker picture both in two wheeler and car sales.

There are three key trends visible from this data, which includes the ‘Scooterization’ of the economy. This means there was higher growth in sales of scooters compared to motorcycles. Two out of three units of two wheelers sold currently are motorcycles.

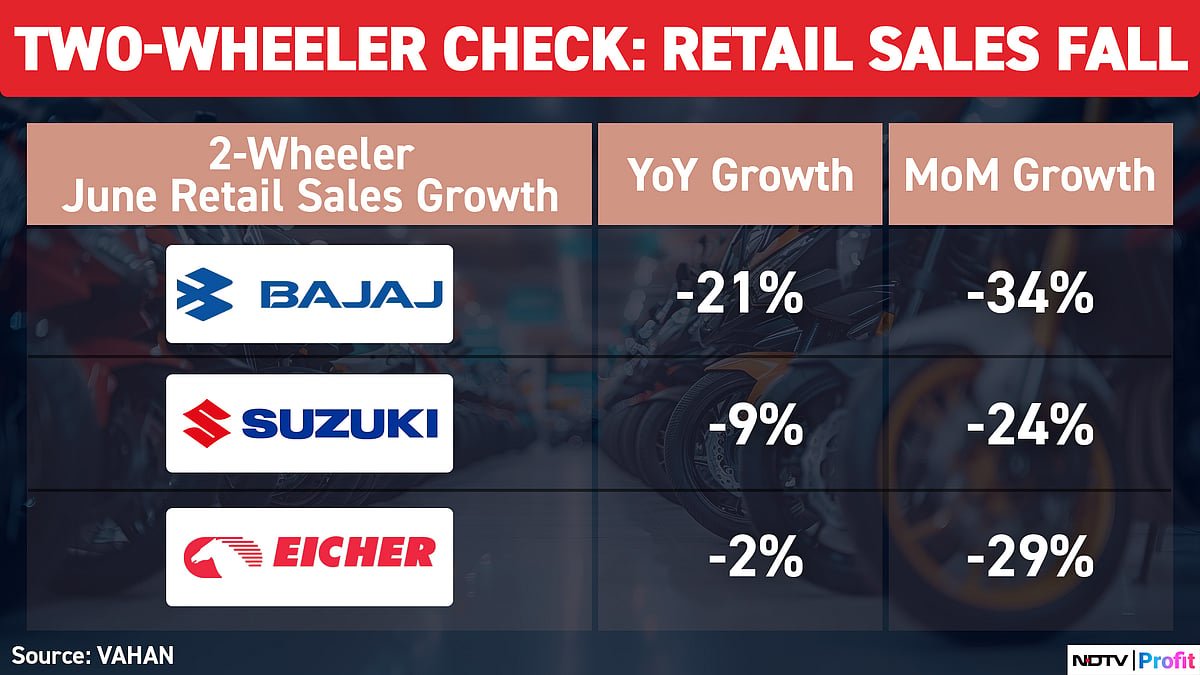

Data also looks bad for Ola Electric, showing a 65% fall in sales compared to June 2024 and slipping to no. 3 position in overall market share. Car sales have also been disappointing, including that of growth player Mahindra & Mahindra Ltd.

Let’s take a look at findings from the data.

‘Scooterization’ Shows Change In Buyer Preference

All two-wheeler companies have reported a fall in sales, both compared to June 2024 and the previous month as well. But the least fall was seen in scooter sales, compared to motorbikes. Within motorcycles as well, the share of entry level bikes has fallen more, compared to premium bikes of over 350cc. Companies like Hero MotoCorp and Bajaj Auto have seen the maximum fall among listed players, led by their higher exposure to motorbike segment.

Eicher Motors saw the least fall of just 2%, led by buyers’ preference for premium bikes. Companies like TVS Motor got almost one-third sales from scooters, and also has premium bikes under Apache brand.

EV Two-Wheeler June Sales Growth: Ola Electric’s Fall Continues

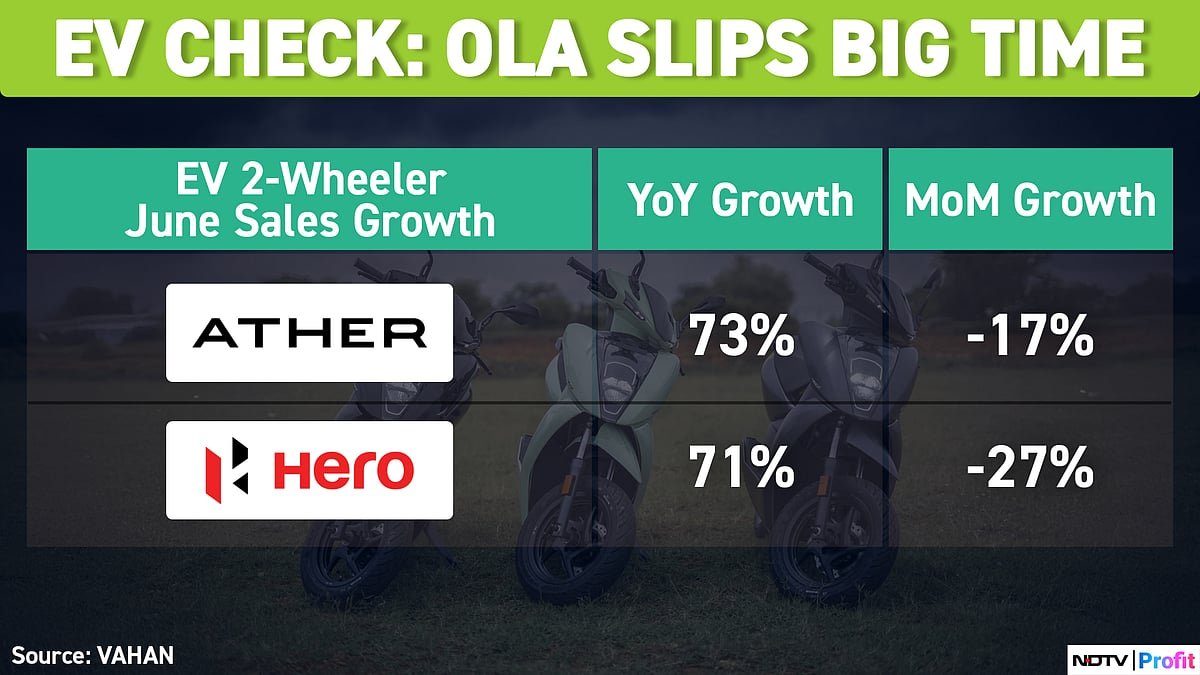

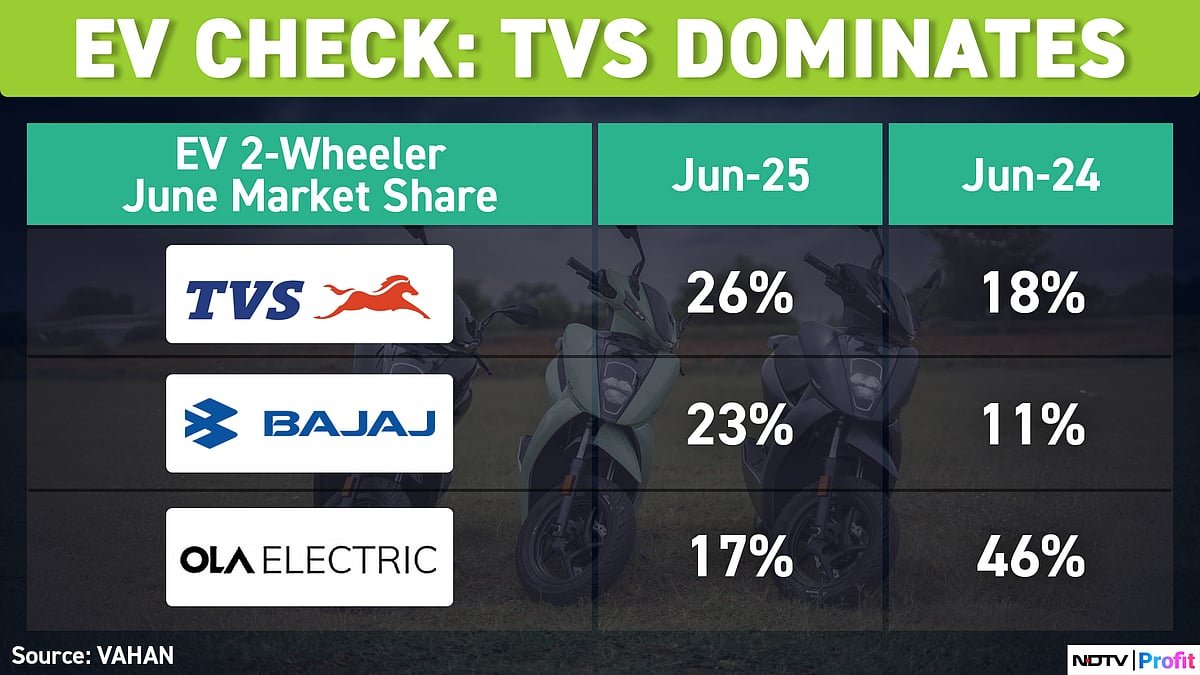

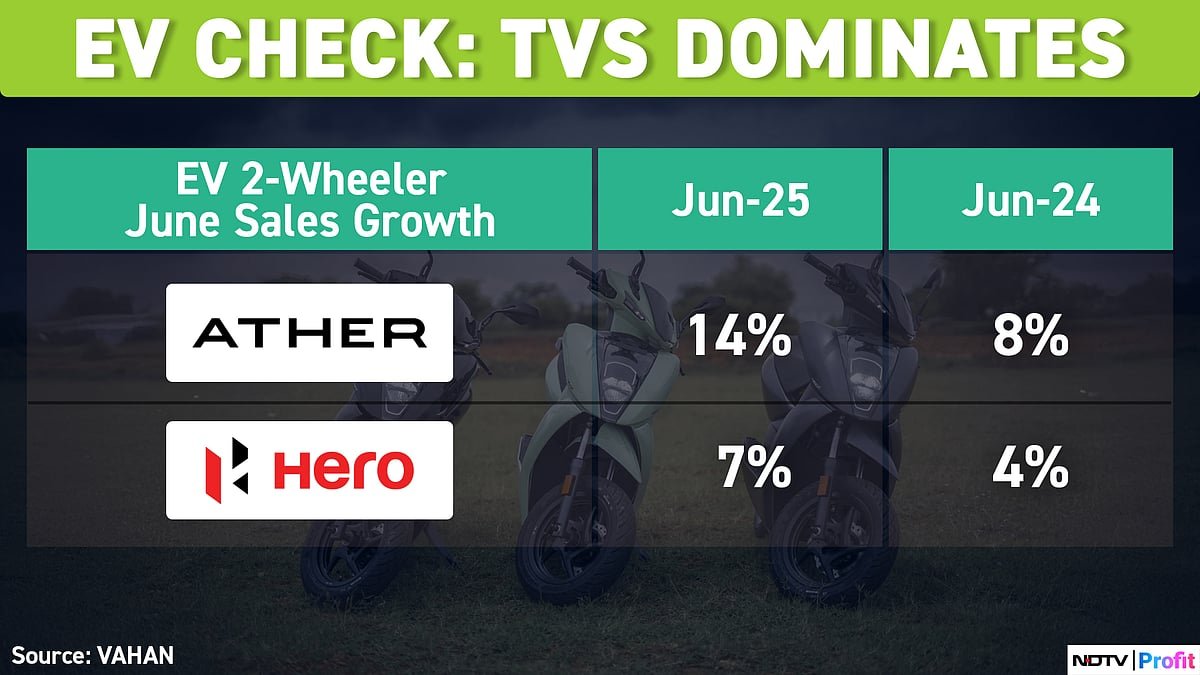

Electric two-wheeler sales have been the cornerstone of cleaner fuel within automobiles at a time when electric car sales have been languishing. While most players like TVS, Bajaj Auto and Ather Energy have shown over 40-70% consistent growth over last few months, Ola Electric has reported over 65% fall in sales in June.

The Bhavish Aggarwal-led firm has been in news for consistent fall in sales over last few months, buoyed by service issues and increased costs impacting both sales and its financials. The company’s market share has fallen from almost 50% to below 20% now and slipped to the no. 3 position in terms of market share. The company has almost tripled its stores and introduced newer models in an attempt to show growth, but that will be something to watchout for.

TVS has become the undisputed market leader and now commands 26% market share. Its brand iQube has now launched newer models with smaller battery size and price points to increase penetration further. A similar strategy has been deployed by Bajaj Auto as well with its Chetak brand. This is visible in their market share doubling to 23% and becoming no. 2.

Ather Energy is also looking like it could overtake Ola Electric, with hopes of showing growth from increased store count in newer geographies.

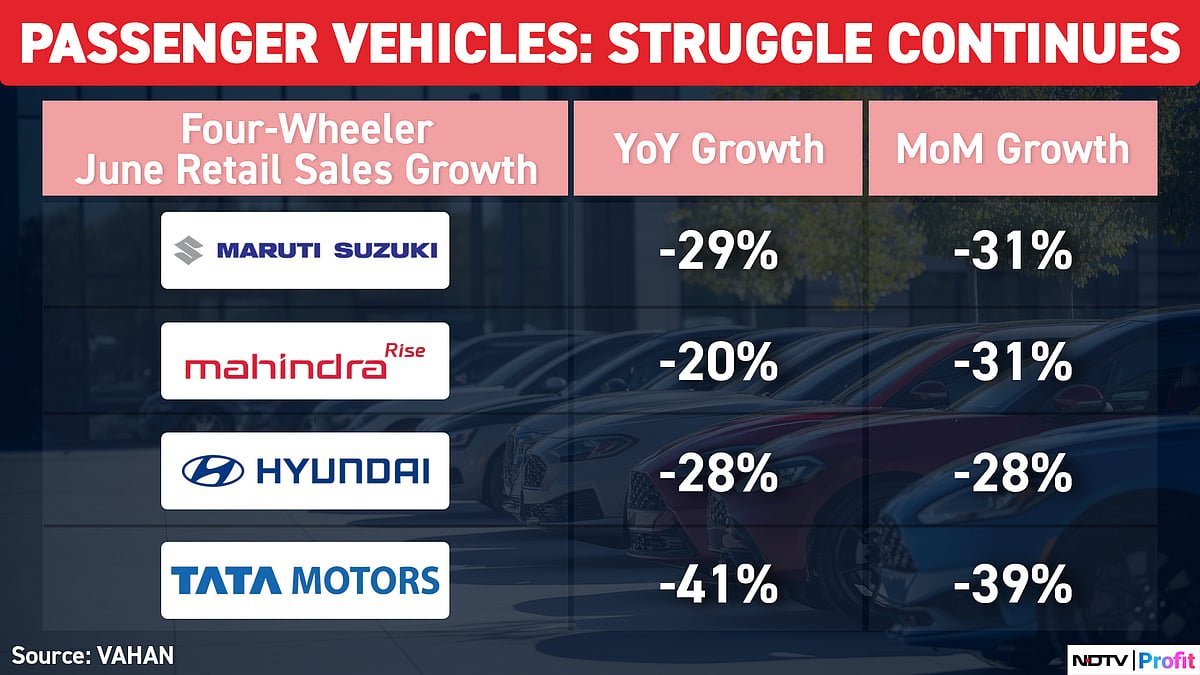

Car Sales Continue To Remain Weak

It’s been another tough month for carmakers, notwithstanding M&M. FY25 was a tough year for carmakers with low single digit growth. This year also, auto bodies like SIAM anticipate similar growth.

Car makers showed 20-41% fall in sales compared to June 2024, with Tata Motors showing the highest fall of 41%. Tata Motors is planning new launches to help boost growth in second half of fiscal 2026. They have launched new refreshed models of Altroz and Tiago in hatchback segment and recently introduced Harrier EV as well. Other new models like Sierra are also expected to be launched soon.

M&M, Maruti, Eicher Remain BofA’s Top Picks

Bank of America echoed the ‘Scooterization’ trend. The brokerage in its latest note highlighted that it remains prominent and drives growth for TVS. Royal Enfield growth momentum sustained despite fall in motorbike sales.

Within cars, though, they did highlight the increased discounting trends seen at 2.9%, compared to 2.4% as a percentage of average selling price for cars. New launches by Maruti, Hyundai and Tata Motors are expected in second half of the year and will be a key monitorable. However, resolution of rare earth magnet imports is key to monitor in near term.

M&M, Maruti Suzuki India Ltd. and Eicher are BofA’s preferred picks in two wheeler and carmakers.

. Read more on Auto by NDTV Profit.