BRC (NYSE:BRCC) is set to give its latest quarterly earnings report on Monday, 2025-08-04. Here’s what investors need to know before the announcement.

Analysts estimate that BRC will report an earnings per share (EPS) of $-0.03.

Anticipation surrounds BRC’s announcement, with investors hoping to hear about both surpassing estimates and receiving positive guidance for the next quarter.

New investors should understand that while earnings performance is important, market reactions are often driven by guidance.

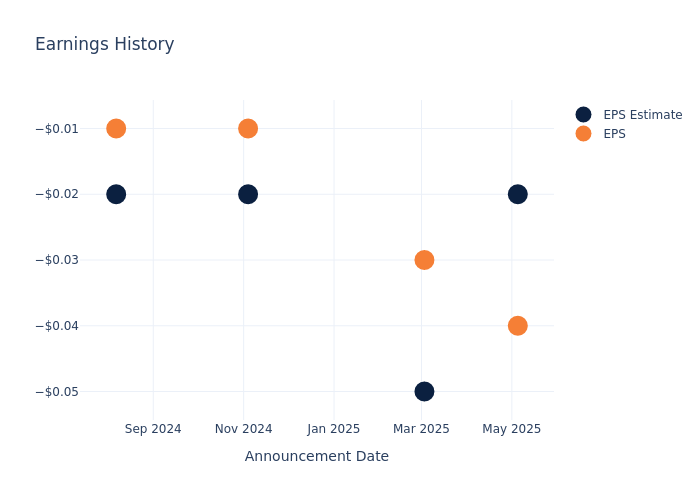

Performance in Previous Earnings

In the previous earnings release, the company missed EPS by $0.02, leading to a 25.74% drop in the share price the following trading session.

Here’s a look at BRC’s past performance and the resulting price change:

| Quarter | Q1 2025 | Q4 2024 | Q3 2024 | Q2 2024 |

|---|---|---|---|---|

| EPS Estimate | -0.02 | -0.05 | -0.02 | -0.02 |

| EPS Actual | -0.04 | -0.03 | -0.01 | -0.01 |

| Price Change % | -26.0% | -16.0% | 4.0% | -38.0% |

Market Performance of BRC’s Stock

Shares of BRC were trading at $1.7 as of July 31. Over the last 52-week period, shares are down 67.65%. Given that these returns are generally negative, long-term shareholders are likely a little upset going into this earnings release.

Analyst Observations about BRC

For investors, grasping market sentiments and expectations in the industry is vital. This analysis explores the latest insights regarding BRC.

Analysts have given BRC a total of 3 ratings, with the consensus rating being Outperform. The average one-year price target is $4.0, indicating a potential 135.29% upside.

Analyzing Analyst Ratings Among Peers

The analysis below examines the analyst ratings and average 1-year …