Andersons (NASDAQ:ANDE) is preparing to release its quarterly earnings on Monday, 2025-08-04. Here’s a brief overview of what investors should keep in mind before the announcement.

Analysts expect Andersons to report an earnings per share (EPS) of $0.51.

Andersons bulls will hope to hear the company announce they’ve not only beaten that estimate, but also to provide positive guidance, or forecasted growth, for the next quarter.

New investors should note that it is sometimes not an earnings beat or miss that most affects the price of a stock, but the guidance (or forecast).

Earnings Track Record

The company’s EPS beat by $0.21 in the last quarter, leading to a 9.82% drop in the share price on the following day.

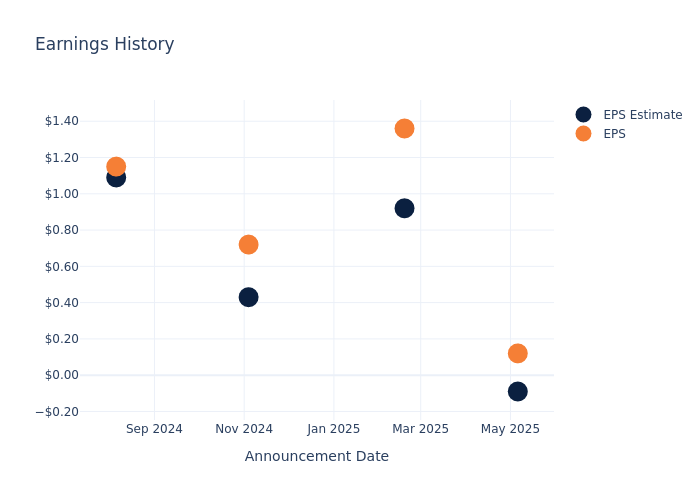

Here’s a look at Andersons’s past performance and the resulting price change:

| Quarter | Q1 2025 | Q4 2024 | Q3 2024 | Q2 2024 |

|---|---|---|---|---|

| EPS Estimate | -0.09 | 0.92 | 0.43 | 1.09 |

| EPS Actual | 0.12 | 1.36 | 0.72 | 1.15 |

| Price Change % | -10.0% | 17.0% | -5.0% | -1.0% |

Tracking Andersons’s Stock Performance

Shares of Andersons were trading at $35.92 as of July 31. Over the last 52-week period, shares are down 26.78%. Given that these returns are generally negative, long-term shareholders are likely bearish going into this earnings release.

Analysts’ Perspectives on Andersons

Understanding market sentiments and expectations within the industry is crucial for investors. This analysis delves into the latest insights on Andersons.

The consensus rating for Andersons is Buy, based on 2 analyst ratings. With an average one-year price target of $50.0, there’s a potential 39.2% …