A sharp decline in the U.S. dollar is reigniting investor interest in emerging markets, prompting billions to flow into investment products tracking equities, despite Wall Street dominating headlines with new all-time highs.

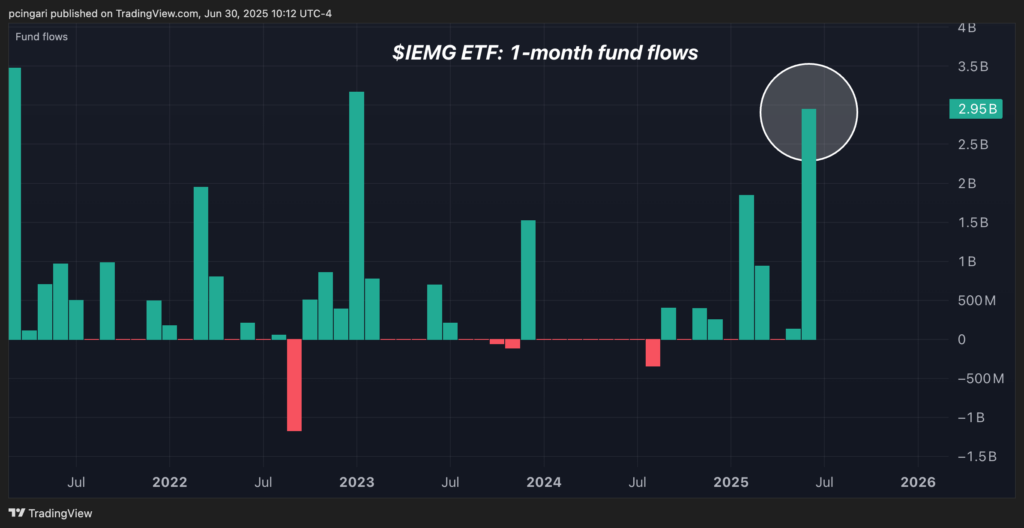

The iShares Core MSCI Emerging Markets ETF (NYSE:IEMG)—the top vehicle for U.S. investors seeking exposure to EM equities—registered $2.95 billion in inflows in June, its strongest monthly influx since January 2023.

Emerging market stocks are on track for a 5% monthly gain in both May and June, setting up the strongest two-month performance since late 2022.

The surge marks a significant shift in global positioning, particularly as investors seek relative value and macro tailwinds beyond U.S. assets, with the U.S. Dollar Index (DXY) dropping to its lowest level in over three years.

Weaker Dollar Reshapes Emerging Markets

Bank of America’s chief investment strategist Michael Hartnett sees a powerful confluence of global forces working in favor …