GST Rate Cut Live: Madhusudan Kela Says GST Overhaul To Boost Demand

Madhusudan Kela, founder MK Ventures said on GST 2.0:

-

This is a landmark move for the country

-

This has a significant impact for boosting demand

-

Government seem to be in a determined mood to do a lot more

-

Government has been very proactive in tackling difficult situations like tariffs and take measures to spur growth

-

If government continues the path of deregulation and ease of business this will lead to even higher growth

-

FPI Flows base is very high of almost $800 billion and a $5 billion sale by FPI investors should not concern us

-

If dollar weakens and tariff issue gets resolved, expect the flows to increase in India

GST News Live: Going For An IPL Match Just Got More Expensive

As part of the government’s sweeping changes to Goods and Services tax rates, sporting events such as the Indian Premier League and Pro Kabaddi League is set to attract tax slab of 40%, up from 28% earlier.

This puts IPL in the highest GST slab, on par with sin goods including tobacco products like cigarettes, pan masala as well as casino, race clubs and other luxury events.

This means watching an IPL game at a stadium is set to get significantly more expensive for cricketing fans across the country.

GST Rate Cut Live: Consumer Durbale Stocks See Uptick

Shares of consumption sector companies such as Hindustan Unilever Ltd., Colgate Palmolve India Ltd. and Dabur India Ltd. after the Goods and Services Tax Council slashed rates on an array of food items, including packaged namkeens, instant noodles, chocolates, and coffee, from either 12% or 18% to a uniform 5%.

Read more about it here

GST Rate Cut Live: Cement Stock Buzz

ACC Ltd., Ambuja Cement Ltd., and UltraTech Cement Ltd. share prices jumped in Thursday’s session as the Goods and Services Tax on cement fell to 18% from 28%. The latest rate revision was part of the GST reforms which will come into effect from Sept 22.

Read more about it here

GST Rate Cut Live: GST Rate Cut Is Long Term In Nature

GST 2.0 is a fundamental shift for the auto sector, stated Rajesh Jejurikar, Executive Director and CEO (Auto and Farm Sector) at Mahindra & Mahindra Ltd. He emphasised that electric vehicles now account for 8% of all models sold by the company, and that the new GST on EVs, without any caveats, is a major positive for the sector. Jejurikar added that this move is more long-term in nature, suggesting a lasting impact on the industry.

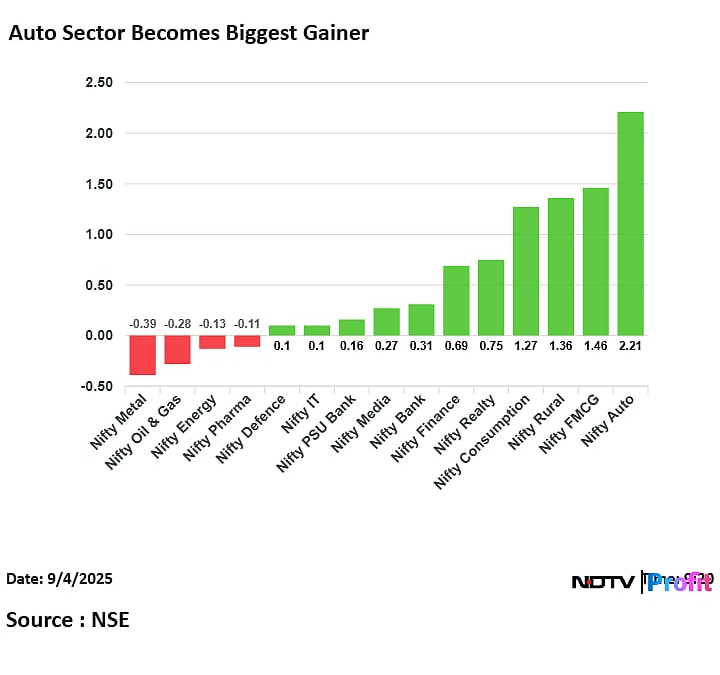

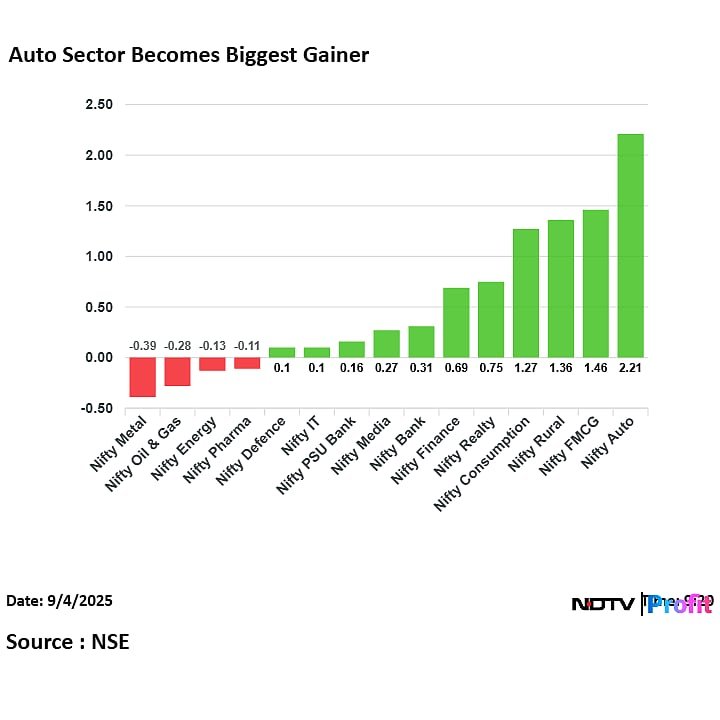

GST Rate Cut Live: Auto Stocks Zoom Post GST Overhaul

Most auto stocks rallied on Sept. 4, led by Escorts Kubota Ltd., Mahindra And Mahindra Ltd. and Eicher Motors Ltd., after the Goods and Services Tax Council, chaired by Finance Minister Nirmala Sitharaman on Wednesday declared a new tax scheme.

Read more about it here

GST Rate : ACs Top Selling Category During Festive Season

B. Thiagarajan, Managing Director of Blue Star said the air conditioning industry had been campaigning to bring the GST rate for 5-star ACs down to 18%.

While he noted that ACs are a top-selling category during the festive season, he also stated that the industry was not expecting the rate reduction to apply to all AC models.

However he noted that, the current GST rate cut slash from 28% to 18% on air conditioners will likley bring in a demand uptick in terms of value in as well as volume.

GST Rate Cut Live: Tractor Prices To Come Down To Rs 40k-60k

Escorts Kubota’s Whole-Time Director, CFO Bharat Madan said that GST rate cut from 12% to 5% on tractors will bring down the cost per vehicle between Rs 40,000 to Rs 60,000

The sector will likely see some disruption due to Input tax credit benefit amongst others but very positive overall and the entire benefit will get passed on to the consumers, he added.

Madan also said that the rural market has done well over past few months and this move will boost demand further, he added.

GST Rate Cut Live: GST Cut Likely To Lower Construction Cost

Government is going to be very strict on profiteering and it is expected from all players to pass on GST Cut impact to consumer starting September 22, says Sandip Ghose, MD, Birla Corporation.

GST Rate Cut Live: GST 2.0 To Cost This Much To Governemnt

The sweeping changes to GST rates will only lead to a Rs 18,000 crore fiscal burden for the centre, as per Bernstein’s analysis. This number amounts to only 0.05% of India’s FY26 GDP value.

Read more about it here

GST Rate Cut Live: India Inc Welcomes The GST Overhaul

The GST Council on Wednesday approved limiting slabs to 5% and 18%, effective from Sept. 22. India Inc reacted positively to this change with Anand Mahindra, Chairman, Mahindra Group saying, “We have now joined the battle. More and faster reforms are the surest way to unleash consumption and investment.”

Read how other have reacted it here

GST Rate Cut Live: Insurance Sector Soars

Shares of life and health insurance companies soared von Thursday after the Goods and Services Tax Council exempted insurance premiums from levies. The insurance services are currently under 18% rate.

Read more about it here

GST Rate Cut: Nifty, Sensex Open Over 1% Higher

Benchmark indices have opened higher driven by massive reforms in GST 2.0. Both Sensex and Nifty 50 opened over 1% higher at 81,456.67 and 24, 980.75 respectively.

GST Rate Cut Live: Consumer Durables Set To Become Cheaper

GST has been reduced from 28% to 18% on air conditioners, TVs of 32 inch and dishwashing machines.

GST Rate Cut Live: ‘No Free Lunch’ For Anyone Says Pranjul Bhandari

While GST tax cuts may seem like a free lunch for consumers ahead of festivities, Pranjul Bhandari the chief India economist at HSBC, has flagged uncertainties. According to her, the true impact hinges on manufacturers passing on benefits and the government compensating revenue losses.

She said that “there is no free lunch here, somebody benefits and somebody loses. I think we have to be mindful of that at this point of time.” This encapsulates her view, that while ”a festive-season tax cut is great, but there are factors to be cautious about”.

GST Rate Cut Live: Household Confidence To Drive Tax Benefit

With GST cuts, the implicit assumption is that money in the hands of the households has more multiplier effect (on the economy) than government spending, Samiran Chakraborty, chief economist – India at Citibank, told NDTV Profit.

“Out of this tax benefit, how much will be saved and spent. This will based on houselold confidence in saving versus spending,” he said.

GST Rate Cut Live: NIL GST On Roti, Paratha

“Reduction of GST from 5% to NIL for ultra high temperature milk, chhena और paneer. All the Indian breads will see a nil rate. So roti or paratha or whatever it is, they all come to nil.”

— @nsitharaman, Union Minister for Finance & Corporate Affairs, on outcomes of 56th GST… pic.twitter.com/gjgzf9S1pt

— Ministry of Information and Broadcasting (@MIB_India) September 3, 2025

GST Rate Cut Live: GST Increased To 18% On Coal

Coal, which previously attracted 5%, will now be taxed at 18%, raising costs for coal-based industries.

GST Rate Cut Live: Experts React To GST 2.0

The positive impact of reduction in Goods and Services Tax announced by the government on the Indian economy will be guided by household confidence and which way the consumer leans in the ‘save versus spend’ pole, experts said.

Read more about it here

GST Rate Cut Live: What GST Exemption On Insurance Means

Complete GST exemption on health and life insurance as opposed to earlier it was 18% GST on life & health insurance premiums for individuals.

But a full exemption means insurance companies will have to bear GST on input services they receive.

Apart from that insurance companies also avail various services like commission payments etc, for these they could earlier use GST paid for input services against GST to be paid to Governemnt.

Now, this entire amount will now be a cost.

GST Rate Cut Live: 5% GST On All Medicines And Drugs

Apart from complete GST exemption on 33 essential drugs, GST has been reduced from 12% to 5% on all other drugs and medicines.

GST Rate Cut Live: New Rates To Come Into Effect From This Date

GST Council recommends GST rates on services will be implemented with effect from 22nd September 2025.

GST Rate Cut Live: Top 10 FAQs On Tax Cuts Answered

GST Council on Wednesday decided on proposals including restructuring tax slabs from four at present to only two — 5% and 18%.The Ministry of Finance has released a list of frequently asked questions following the 56th GST Council meeting.

Read on them here

GST Rate Cut Live: Pay Less For Gym, Yoga Centres

GST has been reduced from 18% to 5% on beauty and physical well-being services used by common man including services of gyms, salons, barbers, yoga centres, etc.

GST Rate Cut Live: Boost For Consumtpion Sector

GST rate cut from 12%-18% to 5% on dairy, packaged foods, Loose paneer/ pizza bread, Confectionery, Bakery Products, Toothpaste, Frozen Desserts, Breakfast Cereals will give a boost to consumtion.

Positive for Britannia, Heritage Foods, Dodla Dairy, Nestle, Parag Milk, Tata Consumer, Bikaji, Gopal Snacks, HUL, Dabur, Colgate

GST Rate Cut Live: 40% Tax On Aerated Drinks, Biddi, Zarda, Etc

-

The highest GST slab of 40% will be applied to sin goods and premium items, such as luxury vehicles including yacht and helicopter.

-

Sitharaman clarified that the 40% rate will specifically apply to pan masala, cigarettes, gutka, chewing tobacco products like zarda, unmanufactured tobacco, and bidis.

-

Additionally, aerated drinks containing added sugar or sweeteners, flavoured or caffeinated beverages, carbonated fruit drinks, and similar non-alcoholic beverages (except those taxed at lower rates) will also fall under this 40% slab.

GST Rate Cut Live: List Of Medicine Exempt From GST

The healthcare sector benefits from zero GST on 33 essential medicines, alongside reduced rates of 5% on a wide range of medical equipment, diagnostic kits, and surgical devices.

-

Onasemnogene abeparvovec – SMA

-

Asciminib – Blood Cancer

-

Mepolizumab – Asthma

-

Pegylated Liposomal Irinotecan – Pancreatic Cancer

-

Daratumumab – Cancer

-

Daratumumab subcutaneous – Cancer

-

Teclistamab – Blood Cancer

-

Amivantamab – Lung Cancer

-

Alectinib – Lung Cancer

-

Risdiplam – SMA

-

Obinutuzumab – Blood Cancer

-

Polatuzumab vedotin – Blood Cancer

-

Entrectinib – Cancer

-

Atezolizumab – Cancer

-

Spesolimab – GPP flares

-

Velaglucerase Alpha – Gaucher

-

Agalsidase Alfa – Fabry disease

-

Rurioctocog Alpha Pegol – Hemophilia

-

Idursulphatase – Type II Mucopolysaccharidosis

-

Alglucosidase Alfa – Pompe

-

Laronidase – Type I Mucopolysaccharidosis

-

Olipudase Alfa – ASMD

-

Tepotinib – Lung Cancer

-

Avelumab – Cancer

-

Emicizumab – Hemophilia

-

Belumosudil – cGVHD

-

Miglustat – Gaucher

-

Velmanase Alfa – Alpha-mannosidosis

-

Alirocumab – Cholesterol lowering drug

-

Evolocumab – Cholesterol lowering drug

-

Cystamine Bitartrate – Cystagon

-

CI-Inhibitor injection – Hereditary Angioedema

-

Inclisiran – Cholesterol lowering drug

-

Agalsidase Beta – Fabry disease

-

Imiglucerase – Gaucher

-

Eptacog alfa activated recombinant coagulation factor VIIa – Hemophilia

GST Rate Cut Live: GST Slashed On Small Cars To 18%

-

In the automobile sector, GST on small cars and motorcycles under 350cc has been cut from 28% to 18%.

-

Three-wheelers and auto parts will now be uniformly taxed at 18%, while buses, ambulances, and trucks will also benefit from lower rates.

-

Electric vehicles (EVs) will continue to enjoy the existing concessional GST rate of 5%, with no changes announced.

GST Rate Cut Live: Insurance Now GST Free

As the outcome of GST Council meet, Finance Minister in a major win for the middle class announced GST exemption on individual life and health insurance policies—including ULIPs, term life, and family floater plans. This move is expected to ease household expenses and boost insurance penetration nationwide

GST Rate Cut Live: Changes On Cement Sector

GST rate on cement sector has been brought down from 28% to 18%.

GST Rate Cut Live: From Four Slabs To Two Slabs

The GST council has also approved a two-tier rate structure of 5% and 18%, replacing the existing four major slabs — 5%, 12%, 18%, and 28%.

“We are simplifying registration, return filing and refunds. We are making reforms with a focus on the common man,” said Sitharaman during the press briefing.

Read more about it here

GST Rate Cut Live: Slashes Made Across Segments

In a major pre-festive bonanza, taxes on a wide array of goods from household staples and life-saving medicines to small cars and consumer appliances will be significantly reduced starting September 22.

Read more on it here

. Read more on Economy & Finance by NDTV Profit.